Get the free DEPARTMENT - WVU Tax Services - West Virginia University

Get, Create, Make and Sign department - wvu tax

How to edit department - wvu tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out department - wvu tax

How to fill out department - wvu tax

Who needs department - wvu tax?

Department - WVU Tax Form: A Comprehensive Guide

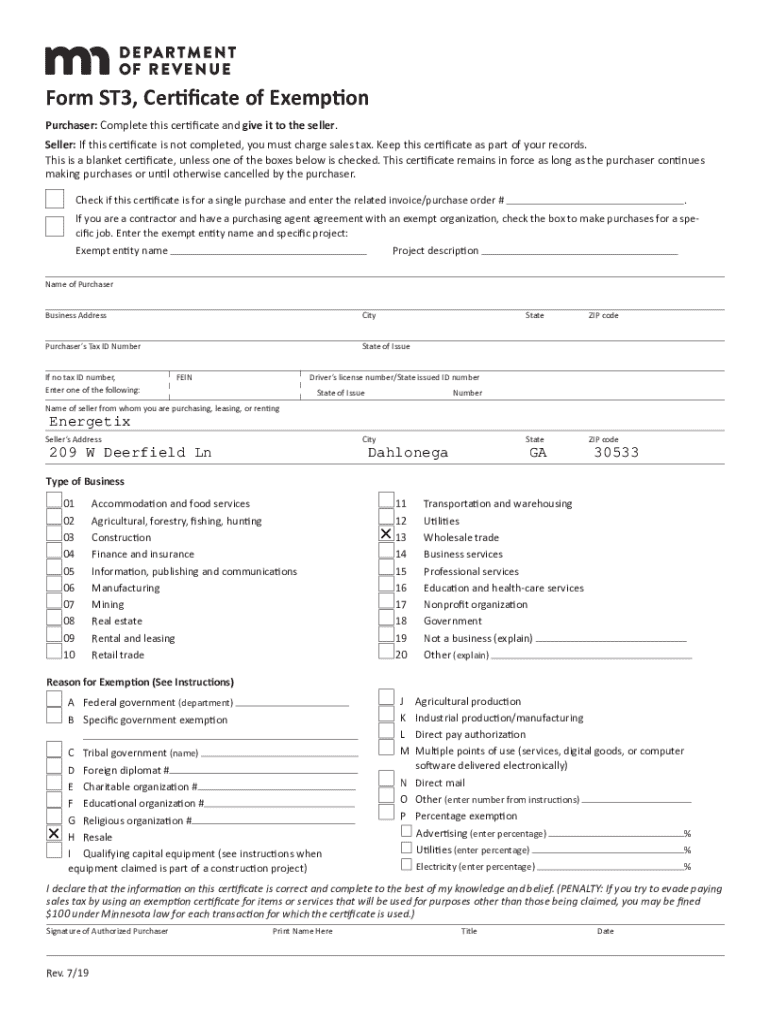

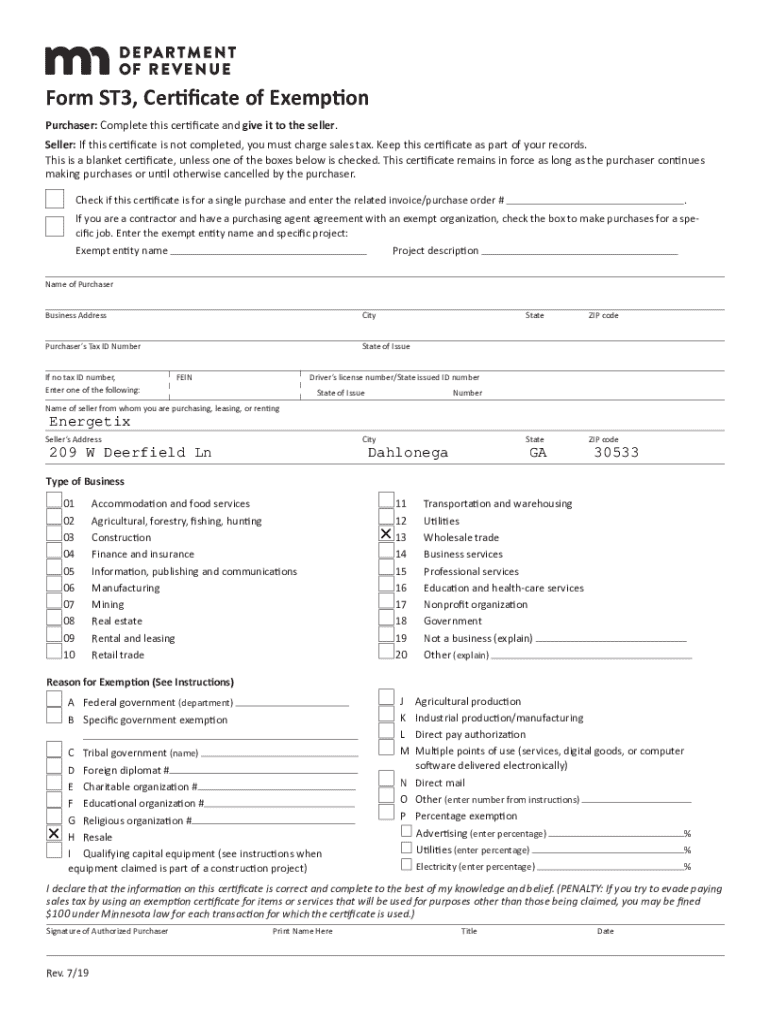

Understanding the WVU Tax Form

The WVU Tax Form plays a significant role for both students and employees at West Virginia University. This form is designed to capture key financial details that determine an individual's tax obligations and potential refunds. Accurately completing this form ensures compliance with federal tax laws and can unlock various benefits for those eligible.

Understanding who must file the WVU Tax Form is crucial. Generally, all students who earned income over a certain threshold during the fiscal year must complete this form. Faculty and staff must also submit it if they receive compensation in any form, whether it’s through wages, stipends, or fellowships.

Preparing to fill out the WVU Tax Form

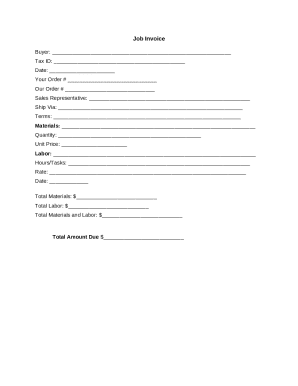

Before you start filling out your WVU Tax Form, it's important to gather all necessary information. This includes your Social Security number, previous year’s tax returns, W-2 forms, and any 1099 statements received. Having these documents ready can significantly streamline the process and ensure accuracy.

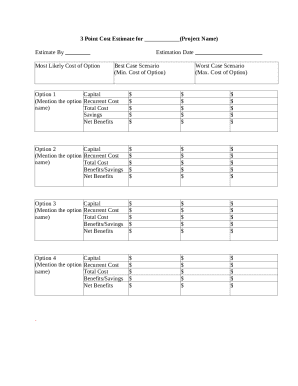

Additionally, certain tax reliefs and deductions may be available to students and employees at WVU. For instance, education-related deductions can help ease the financial burden. It’s beneficial to check eligibility for state or federal benefits, as they can lead to reduced taxable income or even refunds.

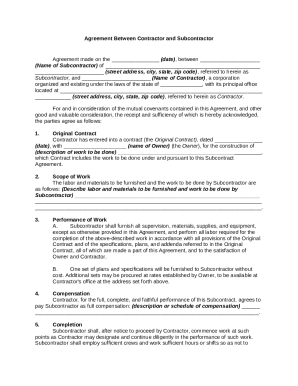

Step-by-step guide to completing the WVU Tax Form

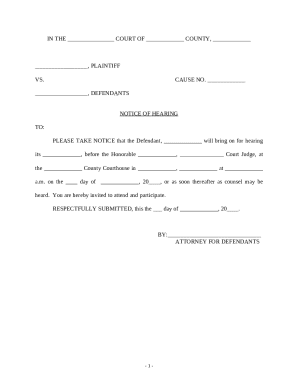

Completing the WVU Tax Form can be straightforward if you follow a step-by-step approach. Start by filling out your personal information accurately in the designated fields. Then, proceed to report your earnings. Each section of the form is structured to capture specific data about your financial situation.

Be sure to avoid common mistakes such as entering incorrect figures or neglecting to sign your form. Each field has its significance, and understanding terms like 'adjusted gross income' or 'taxable income' will greatly improve the accuracy of your submission.

Editing and saving your WVU Tax Form

Editing your WVU Tax Form is simple using tools like pdfFiller. This platform allows you to make necessary corrections directly on the PDF format. You can add or remove text with ease, ensuring your form reflects your accurate details before submission.

When saving your completed form, there are various options. You can save it in PDF format, ensuring it retains its formatting, or export it to other file types as needed. This flexibility assists in storing your documents securely and retrieving them for future reference.

Signing the WVU Tax Form

Electronically signing your WVU Tax Form is a vital step in the submission process. The e-signature process with pdfFiller is straightforward. After completing the form, you can create your signature and insert it into the designated field.

It's crucial to remember that electronic signatures must adhere to legal standards. Ensure that your signature matches the name and identity on the form, as this can affect the authenticity of your submission.

Submitting the WVU Tax Form

Once your WVU Tax Form is filled out and signed, the next step is submission. You can submit your completed form online through the designated WVU portal or mail it to the appropriate department. For those who prefer in-person submission, visiting the financial aid office is an option.

After submission, it’s important to track your form to ensure it has been processed. You can do this by accessing your account on the WVU portal or contacting the designated tax department.

Managing your WVU Tax Form files

Organizing your tax documents effectively is essential for ease of access in future tax seasons. Use file folders or cloud storage to categorize your WVU Tax Form alongside related documents like W-2s and past tax returns. This systematic approach alleviates stress when it’s time to file your taxes.

Utilizing tools like pdfFiller can further improve document management. Features such as cloud storage and organization tools allow for easy retrieval and management of all tax-related documents, enabling you to keep everything in one convenient place.

Troubleshooting common issues with the WVU Tax Form

If you face difficulties while filling out your WVU Tax Form, it's vital to know what to do next. Common issues may arise from entering incorrect information or not knowing where to submit. Resolving such problems often requires carefully reviewing your entries and referring to the WVU tax guidelines for clarification.

When in doubt, don't hesitate to seek help. The WVU financial aid office provides resources and assistance for students and staff needing additional guidance, ensuring that everyone can navigate the process successfully.

Enhancing your document workflow with pdfFiller

pdfFiller offers a multitude of benefits for managing your WVU Tax Form and overall document workflow. With its intuitive editing features, collaborative tools, and robust document management system, users can streamline their tax preparation process. These benefits contribute to an organized approach, reducing the time and stress typically associated with tax filing.

Incorporating pdfFiller into your routine means taking advantage of its cloud-based capabilities. This allows you to access your documents from anywhere at any time, making it easier to work on your WVU Tax Form or any other document as needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my department - wvu tax directly from Gmail?

How can I edit department - wvu tax from Google Drive?

How do I fill out department - wvu tax using my mobile device?

What is department - wvu tax?

Who is required to file department - wvu tax?

How to fill out department - wvu tax?

What is the purpose of department - wvu tax?

What information must be reported on department - wvu tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.