Get the free ACA 1095-C Codes Cheat Sheet: Guide for Employers

Get, Create, Make and Sign aca 1095-c codes cheat

How to edit aca 1095-c codes cheat online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aca 1095-c codes cheat

How to fill out aca 1095-c codes cheat

Who needs aca 1095-c codes cheat?

ACA 1095- codes cheat form: A comprehensive guide

Understanding ACA Form 1095- and its importance

Form 1095-C is a critical component of the Affordable Care Act (ACA), serving as documentation for employers regarding the health coverage offered to their employees. The form not only reports essential information about health coverage but also reassures the IRS that employers are complying with ACA mandates. Employers must outline the coverage they provide, which helps employees understand their healthcare options and obligations.

By accurately filling out Form 1095-C, employers ensure compliance with ACA requirements, avoiding penalties that could arise from incorrect reporting. The primary benefits of using this form include clarifying healthcare benefits to employees, confirming adherence to federal regulations, and supporting the calculation of potential tax credits for employees who require assistance in purchasing health insurance through the marketplace.

Decoding ACA 1095- codes: A comprehensive guide

Every entry on Form 1095-C includes specific codes that indicate the type of coverage offered by employers. Accurate code reporting is crucial for validating compliance with ACA regulations. Each code provides insight into the employer's health plan offerings and the employee's options, which are monitored by the IRS. Misreporting these codes could lead to discrepancies and potential financial penalties.

Detailed breakdown of Line 14 codes

Line 14 codes are crucial for indicating the offer of coverage. Codes range from 1A to 1I, each representing different scenarios of health insurance offers made to employees. For instance, Code 1A indicates that the employer offered minimum essential coverage to at least 95% of full-time employees and their dependents. Understanding these codes is important not just for compliance but for ensuring that employees receive the right benefits.

Common pitfalls in reporting Line 14 codes often include incorrectly identifying the coverage level offered or neglecting to account for dependent coverage. Every employer situation is unique, requiring a careful assessment of employee offerings to select the correct Line 14 code.

Understanding Line 16 codes

Line 16 codes provide crucial context for determining whether an employer is eligible for safe harbor provisions as outlined under Section 4980H. These codes signal to the IRS whether an employee has been given an offer of minimum essential coverage under ACA guidelines. Accurately choosing the right Line 16 code is key to avoiding potential penalties associated with misreporting.

Misreporting risks related to Line 16 codes could lead to erroneous IRS penalty assessments. Therefore, determining the right code for your situation fosters compliance and accurately reflects your employees' coverage statuses.

Common questions and issues with ACA Form 1095- codes

Numerous queries frequently arise regarding Line 14 and Line 16 codes, including the situations in which each code should be applied. Employers often grapple with documentation related to employee eligibility, which could inevitably lead to mistakes on the ACA Form 1095-C. As most employers are quite familiar with the complexities of health coverage, they are diligent about reviewing their forms before submission.

To troubleshoot common errors in coding, employers should ensure accurate record-keeping practices are in place. This includes keeping a close eye on which employees have been offered coverage, as well as the start and end dates of employment, to understand what codes apply in different scenarios. For additional assistance, consulting IRS guidelines and expert resources on coding is recommended.

Interactive tools and resources for better compliance

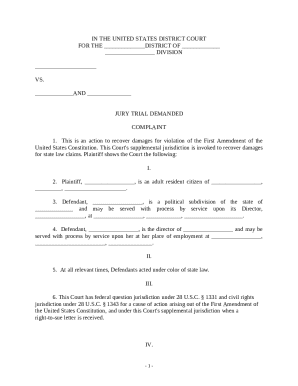

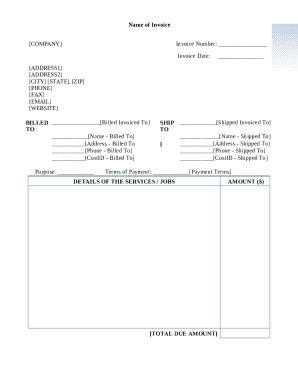

pdfFiller offers innovative tools to simplify the process of filling and editing Form 1095-C. With intuitive features designed for easy navigation, users can quickly input necessary information and accurately report essential codes. The platform provides a composite workspace from which users can fill out, sign, and manage their ACA-related documentation.

Step-by-step instructions for utilizing pdfFiller's editing tools involve starting from the homepage, locating the Form 1095-C template, and utilizing the easy-fill fields to enter information. The platform’s ability to electronically sign documents enhances compliance efforts while streamlining the reporting process.

Compliance best practices for reporting using Form 1095-

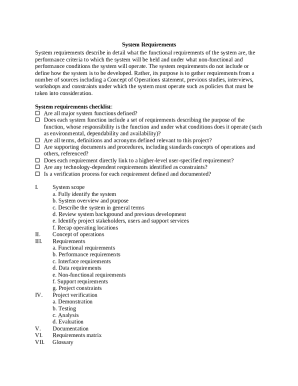

To enhance accuracy in reporting, employers should review their obligations under the ACA consistently. This includes familiarizing themselves with coverage types and conditions that clarify employee eligibility. A best practice involves meticulously organizing all documentation related to employee coverage, which can aid in maintaining accurate codes when completing Form 1095-C.

Regular audits of documentation ensure that coding remains compliant with ACA requirements. Maintaining organized employee records not only simplifies filing Form 1095-C but also prepares employers for any IRS inquiries regarding health coverage reporting.

Case studies: Real-world applications of Form 1095- coding

Examining real-world scenarios can illuminate how issues with Form 1095-C coding can arise. In one instance, a mid-sized employer incorrectly reported the Line 14 code by not accounting for dependent coverage, leading to IRS scrutiny and resulting in unnecessary penalties. Correcting the code and maintaining thorough documentation helped the employer re-establish their compliance standing.

Conversely, another employer utilized a clear understanding of Line 16 codes to navigate their reporting responsibilities successfully. By accurately documenting changes in employee status and ensuring records were up-to-date, they demonstrated compliance efficiently during an IRS audit without any issues.

Conclusion: The path to efficient ACA compliance

Accurate coding on Form 1095-C is paramount for employers looking to comply with ACA regulations. Misreporting can lead to significant repercussions, emphasizing the importance of understanding each code's context and applications. Navigating future updates to ACA reporting requirements will necessitate vigilance and clarity in reporting to not only fulfill employer obligations but also to support employees' healthcare access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get aca 1095-c codes cheat?

How do I edit aca 1095-c codes cheat online?

How do I fill out aca 1095-c codes cheat on an Android device?

What is aca 1095-c codes cheat?

Who is required to file aca 1095-c codes cheat?

How to fill out aca 1095-c codes cheat?

What is the purpose of aca 1095-c codes cheat?

What information must be reported on aca 1095-c codes cheat?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.