Get the free HUB Electronic furnishing 1095 Form - For Client to Edit.docx

Get, Create, Make and Sign hub electronic furnishing 1095

Editing hub electronic furnishing 1095 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hub electronic furnishing 1095

How to fill out hub electronic furnishing 1095

Who needs hub electronic furnishing 1095?

Understanding the Hub Electronic Furnishing 1095 Form

Understanding the 1095 form

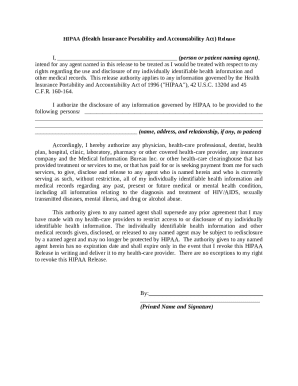

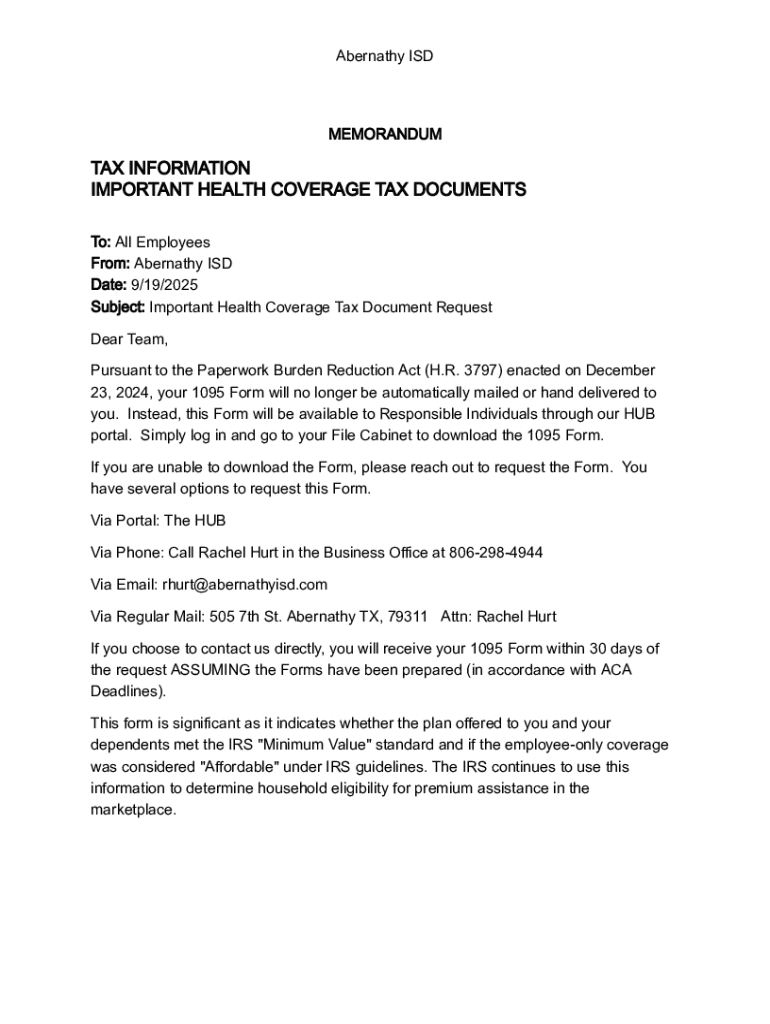

The 1095 form is crucial for reporting health coverage provided to individuals. This form, mandated by the Affordable Care Act (ACA), ensures that the individual reporting their health insurance coverage meets the criteria necessary to avoid penalties when filing taxes. There are three specific versions of this form: 1095-A, 1095-B, and 1095-C. The 1095-A is utilized by individuals who purchased coverage through the Health Insurance Marketplace, while the 1095-B is issued by health insurance providers to report minimum essential coverage. The 1095-C is given to employees of large employers that are compliant with the employer mandate under the ACA.

Each variation of the 1095 form serves a distinct purpose in ensuring that individuals have the proper documentation to confirm their health coverage during tax season. Particularly, employers who provide coverage must furnish the 1095-C to their employees to reflect the offered health plans, which is critical for both compliance and tax reporting purposes.

Importance of the 1095 form in tax filing

The 1095 form plays a significant role in tax filing as it provides necessary information that supports an individual's tax return. When filing taxes, individuals must report any health coverage that meets ACA standards. Not possessing a 1095 form when required can lead to complications, including penalties for failing to report coverage accurately. It is annual practice that recipients receive their form from health insurers or employers to substantiate their health insurance status.

Moreover, the form assists the IRS in verifying that individuals comply with the Affordable Care Act's mandates. The data included in this form—such as the months of coverage and the type of plan—helps streamline tax audits and ensures transparency between taxpayers and the IRS.

Who needs the 1095 form?

The primary audience for the 1095 form includes individuals who are enrolled in a health plan. This encompasses not only employees receiving coverage through their employer but also those who opt for individual plans purchased through the marketplace. Employers, particularly those meeting the criteria of having 50 or more full-time employees, are required to provide Forms 1095-C to demonstrate compliance with ACA mandates.

Certain exceptions exist whereby short-term health insurance or gap coverage may not necessitate a 1095 form. Individuals in these circumstances should consult healthcare compliance professionals to confirm whether they are required to furnish this documentation for tax purposes.

Step-by-step guide for obtaining your 1095 form

To obtain your 1095 form, begin by contacting your health insurance provider or your employer's HR department. If you are an employee, ensure that you clarify whether you need the 1095-C or any other variant. It's wise to have identifying information handy, such as your Social Security Number, policy number, and the name of the covered individual.

Generally, the official deadlines for distributing the 1095 form are set for March 2 of the following year. Expect to receive your document promptly to prepare effectively for tax season.

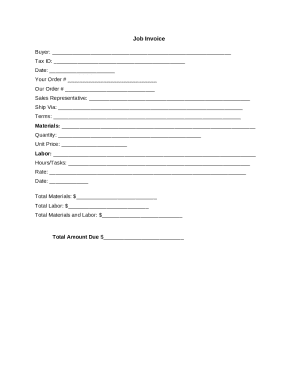

How to fill out the 1095 form

Filling out the 1095 form requires attention to detail across its various sections. Part I captures the Responsible Individual's information—typically the person covered. Ensure that names are spelled accurately, Social Security Numbers are correct, and addresses are updated to avoid processing delays.

Part II delves into the Coverage Information. Here, it's crucial to report the correct months and types of health coverage received. For Part III, which involves reporting information about covered individuals, verify that each person's data, including names and Social Security Numbers, is correctly listed. Accuracy is vital since these details will be scrutinized when filing your tax return.

Common mistakes to avoid when completing the form

When completing the 1095 form, awareness of common mistakes can save time and headaches. Misinterpreting the required information, such as not listing all covered individuals, might lead to incorrect submissions. Another frequent error involves confusion about the coverage months, which can happen if coverage switches mid-year.

Failing to file accurately could result in receiving penalties from the IRS. Utilize electronic tools such as pdfFiller to reduce these errors. Features like form verification can alert users to missing information and potential inaccuracies before submission.

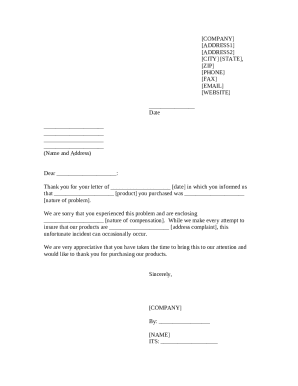

Editing and managing your 1095 form with pdfFiller

pdfFiller offers tools tailored for efficiently managing your 1095 form. Users can easily upload their forms to the pdfFiller cloud-based platform, which allows seamless editing. Features include filling out fields, annotating, and saving your document securely, all from an intuitive dashboard.

Additionally, pdfFiller enables collaborative work by sharing the form with tax professionals or co-workers. The ability to track changes and specify comments leads to a more organized and transparent document handling process. This feature is particularly beneficial for professionals in larger organizations like Lockwood STT Ahoka or educational institutions such as Tahoka ISD 2300, which encompasses the Tahoka Elementary School, Tahoka Middle School, and Tahoka High School.

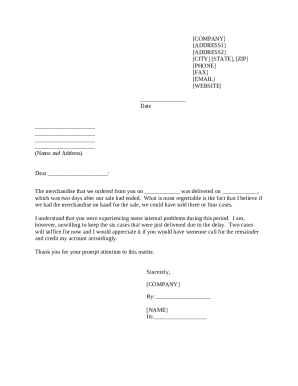

E-signing your 1095 form

E-signing the 1095 form through pdfFiller streamlines the finalization process. The platform allows users to create a legally binding eSignature quickly and efficiently. Simply follow the step-by-step instructions on pdfFiller to ensure each section of the form is completed and sealed with your signature.

The legal standing of eSignatures is recognized by the IRS and most authorities, making this a standard practice in modern document management. This means you can submit your 1095 form without concern about its validity, reducing turns in document processing times.

FAQs about the 1095 form

A common concern among taxpayers is: what happens if I don’t receive my 1095 form? If your insurer or employer does not provide you with a 1095, it’s important to contact them directly. You may also still file your taxes using other supporting documentation, but consult a tax professional for guidance on how to accurately represent your health coverage.

Another frequently asked question is whether someone can file their taxes without a 1095 form. The answer is yes, you can file using alternative documentation, but it’s advisable to maintain records that validate your health coverage throughout the year.

In the event of mistakes on your 1095 form, it's vital to address these errors promptly. Contact the issuer of the form to request an amended copy, and be sure to keep records of the communication for future reference.

Additional tools and resources on pdfFiller

pdfFiller is replete with interactive features for document management, aiding users in controlling their file workflow effectively. The platform supports collaborative tools that allow multiple users to engage with the 1095 form simultaneously, streamlining the process further.

In addition to the 1095 forms, pdfFiller also provides access to other relevant documents such as 1099 forms and various tax-related templates, factoring in the diverse needs of its users. With its comprehensive functionality, pdfFiller continues to empower individuals and organizations in managing their documentation seamlessly.

User testimonials and success stories

Many users have shared their positive experiences after utilizing pdfFiller for their 1095 forms. They cite the ease of use of the platform, efficiency in completing forms, and how it significantly reduced their tax filing stress. By providing collaborative features, teams have successfully integrated pdfFiller into their document management processes, enhancing compliance and efficiency across departments.

For instance, institutions like Tahoka ISD have adopted pdfFiller to streamline their reporting processes for various forms, including the 1095-C. Case studies reveal how these organizations have improved their document processes, reducing turnaround times and increasing accuracy—factors vital to maintaining compliance with tax mandates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit hub electronic furnishing 1095 in Chrome?

How do I edit hub electronic furnishing 1095 straight from my smartphone?

How do I edit hub electronic furnishing 1095 on an Android device?

What is hub electronic furnishing 1095?

Who is required to file hub electronic furnishing 1095?

How to fill out hub electronic furnishing 1095?

What is the purpose of hub electronic furnishing 1095?

What information must be reported on hub electronic furnishing 1095?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.