Get the free non-profit organizations (NPOs) described in paragraph 149(1)(l) of the Income Tax Act

Get, Create, Make and Sign non-profit organizations npos described

Editing non-profit organizations npos described online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-profit organizations npos described

How to fill out non-profit organizations npos described

Who needs non-profit organizations npos described?

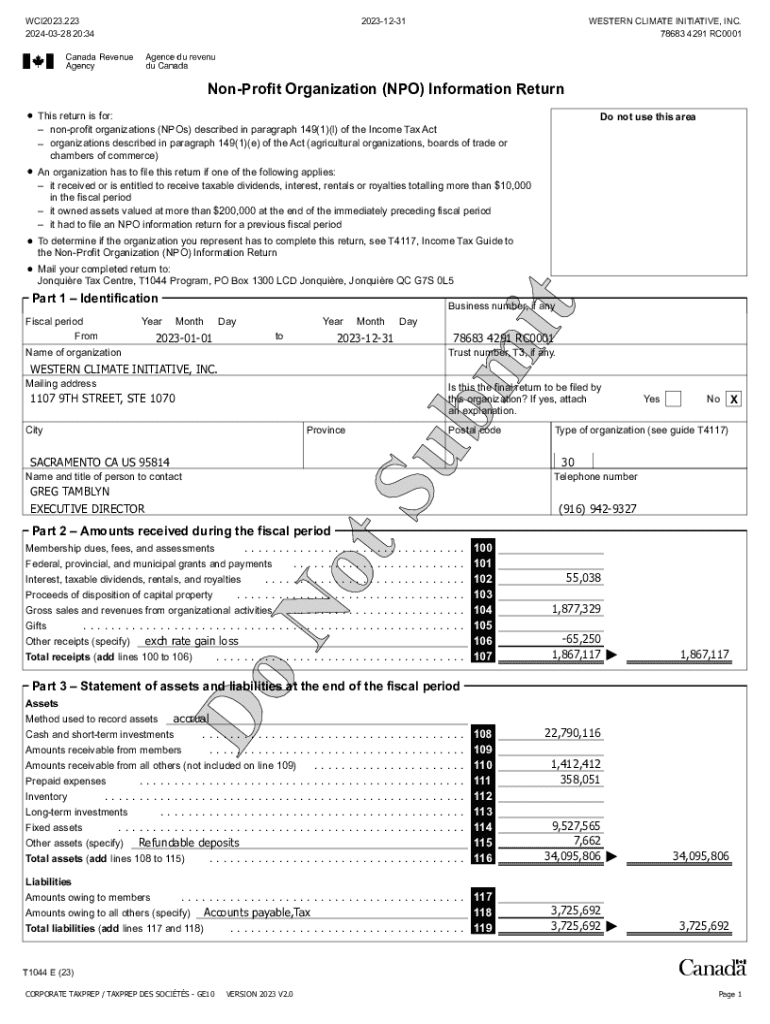

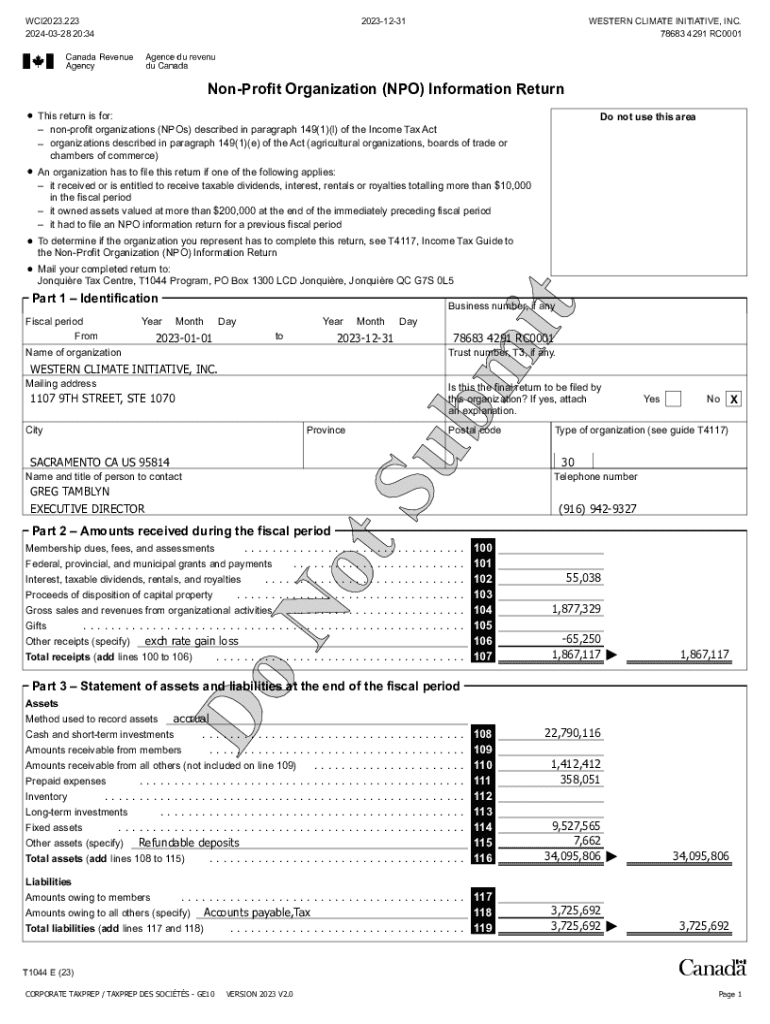

Non-Profit Organizations (NPOs) Described Form

Understanding non-profit organizations (NPOs)

Non-profit organizations, commonly known as NPOs, are entities structured to fulfill a specific mission beyond generating profit. Their primary purpose is to provide public benefit, through services or advocacy, in fields such as education, health, social services, and the arts. Unlike traditional businesses, NPOs reinvest any surplus revenues into their mission rather than distributing them to shareholders.

Key characteristics of NPOs include a commitment to a charitable mission, philanthropic efforts, and reliance on donations and grants. They are often run by a board that guides their direction and ensures they abide by their mission, allowing for community engagement. The importance of organizational structure within NPOs cannot be overstated; a clear system promotes accountability, enhances efficiency, and ultimately supports stronger outreach efforts to their target audiences.

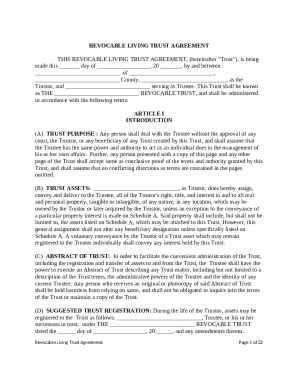

Overview of the non-profit organizations form

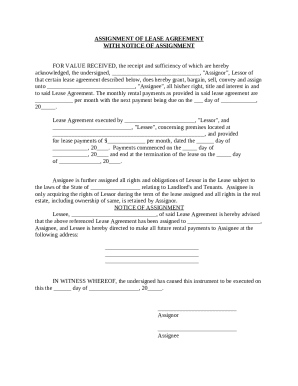

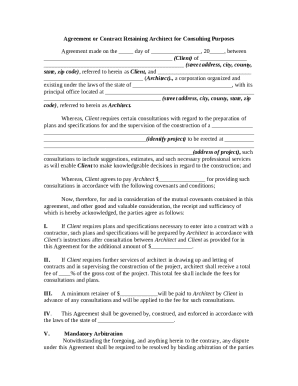

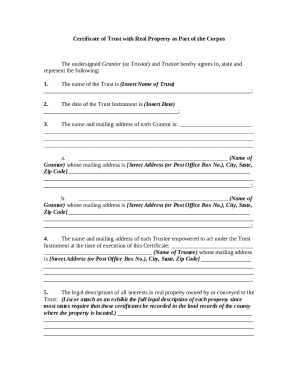

The non-profit organizations form, often referred to as the NPO form, serves as the foundational document for establishing a non-profit entity. This form is critical because it legally defines the organization's structure, mission, and operational strategies. Completion and submission of this form is a prerequisite for receiving tax-exempt status, which can significantly increase an NPO's capacity to attract donations and grants.

In the context of the larger non-profit landscape, the NPO form is part of a series of documentation that underpins regulatory compliance and operational legitimacy. By correctly filling out and submitting this form, organizations ensure they are formally recognized and can function efficiently within the framework of charitable work.

Types of forms required for NPO registration

Registering a non-profit often requires navigating a variety of forms—both at the federal and state levels. Understanding these documents is essential to maintaining compliance and operating lawfully.

Step-by-step guide to completing the NPO form

Completing the NPO form is a critical step that requires careful preparation and attention to detail. The process begins with collecting all necessary information about the organization’s purpose, structure, and finances.

Using resources such as interactive checklists and visual aids can simplify the completion process. A sample completed NPO form can serve as a vital reference point during your preparation.

Common challenges in completing NPO forms

Completing NPO forms can be intricate, leading to a range of common challenges. One prevalent issue is misinterpreting key terms or categories within the form, which can create ambiguity in the organization’s intent or operational scope.

Another significant challenge arises from incomplete information. Omitting necessary details can lead to delays in processing or even denials of application. Additionally, many organizations struggle with developing accurate financial projections, which are crucial for demonstrating sustainability and transparency to funding sources.

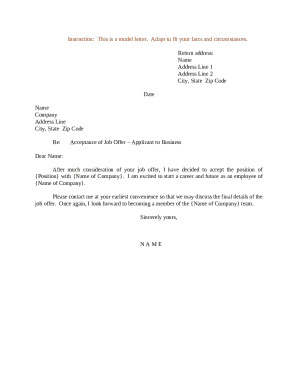

Tips for editing and reviewing the NPO form

A comprehensive review of the NPO form before submission is vital. Ensuring that all sections are thoroughly completed can prevent issues from arising once the form is in the hands of regulatory bodies.

Signing and submitting the NPO form

Once the NPO form is completed, it requires a formal signature before submission. Organizations may have the option for eSigning, which simplifies the signature process and can expedite submission.

Tracking your submission is essential to ensure that your application is received and processed in a timely manner. After submission, organizations should take steps to remain compliant, understanding that ongoing communication with state or federal entities may be required.

Ongoing management and updates post-form submission

Post-submission, NPOs must continue to manage their organizational information diligently. Regular updates about leadership changes, structural adjustments, or mission amendments are essential to maintain legal and functional integrity.

Compliance requirements also evolve over time, necessitating the NPOs to actively monitor laws and regulations that affect their operations. This diligence not only protects the organization but also fosters trust with donors and the community.

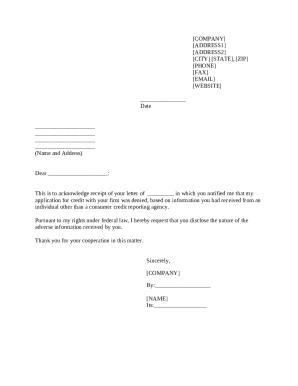

Utilizing pdfFiller for NPO documentation

pdfFiller serves as an invaluable tool for non-profit organizations navigating the complexities of documentation. With cloud-based document creation and management, NPOs can easily edit, collaborate, and store their forms securely.

Employing these features allows NPOs to work more efficiently and effectively, positioning them for success in their missions.

Real-life case studies and testimonials

Success stories demonstrate the effectiveness of utilizing the NPO form properly. For instance, an early-stage NPO that effectively navigated the registration process reported a significant increase in grant funding due to their clear alignment with regulatory expectations and financial transparency.

Conversely, a case where missteps occurred highlights the importance of thoroughness. A non-profit that submitted an incomplete NPO form faced challenges that delayed its launch and detracted potential supporters. These examples showcase not only successful paths but essential lessons learned from missteps, offering encouragement to others in the non-profit sector.

FAQ section for non-profit organizations form

The journey of forming a non-profit can raise numerous questions. Common queries about the NPO form include how to interpret specific sections, the timeline for approval, and the implications of various designations—like 501(c)(3)—on fundraising capabilities.

Clarifications on misunderstandings frequently encountered during form completion can help guide future applicants. It's essential for organizations to know where to seek further guidance and support, whether through regulatory bodies or online platforms such as pdfFiller.

Legal navigational insights

Understanding the legal implications of the NPO form is crucial for non-profit organizations. Compliance across both state and federal levels is necessary to function without legal pitfalls. Each jurisdiction has its regulations governing non-profit operations, making it essential for NPOs to keep abreast of any changes.

Consulting with legal counsel can provide critical insights, particularly during registration or if an NPO faces challenges regarding compliance. As regulations evolve, having access to legal expertise can ensure an organization remains aligned with best practices.

Interactive tools and resources

Various interactive tools are available to assist organizations throughout the documentation process. pdfFiller offers embedded tools that simplify document creation and management, providing templates and intuitive features to enhance user experience.

Moreover, linking to relevant external resources aids in building knowledge, while sign-up options for webinars or workshops focusing on NPO compliance add value to the learning journey. These resources empower visitors to stay informed and engaged as they navigate the complexities of the non-profit sector.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non-profit organizations npos described to be eSigned by others?

How can I get non-profit organizations npos described?

How do I complete non-profit organizations npos described on an iOS device?

What is non-profit organizations npos described?

Who is required to file non-profit organizations npos described?

How to fill out non-profit organizations npos described?

What is the purpose of non-profit organizations npos described?

What information must be reported on non-profit organizations npos described?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.