Get the free Susquehanna County Tax Bureau in Montrose, PA

Get, Create, Make and Sign susquehanna county tax bureau

Editing susquehanna county tax bureau online

Uncompromising security for your PDF editing and eSignature needs

How to fill out susquehanna county tax bureau

How to fill out susquehanna county tax bureau

Who needs susquehanna county tax bureau?

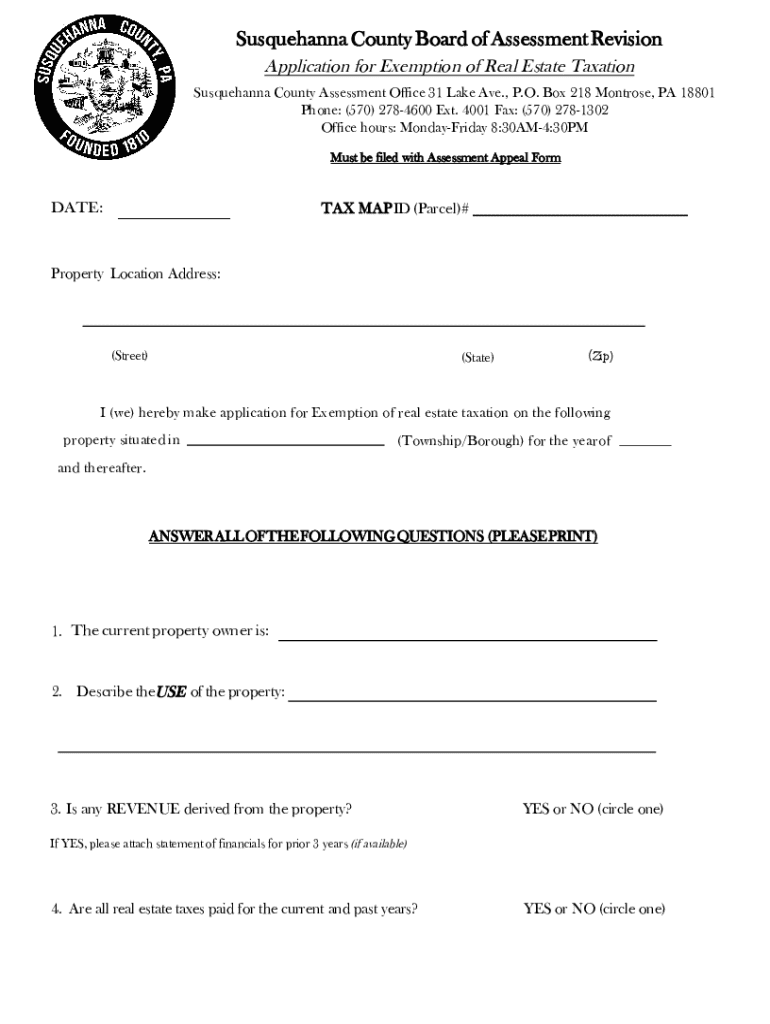

Understanding the Susquehanna County Tax Bureau Form: A Comprehensive Guide

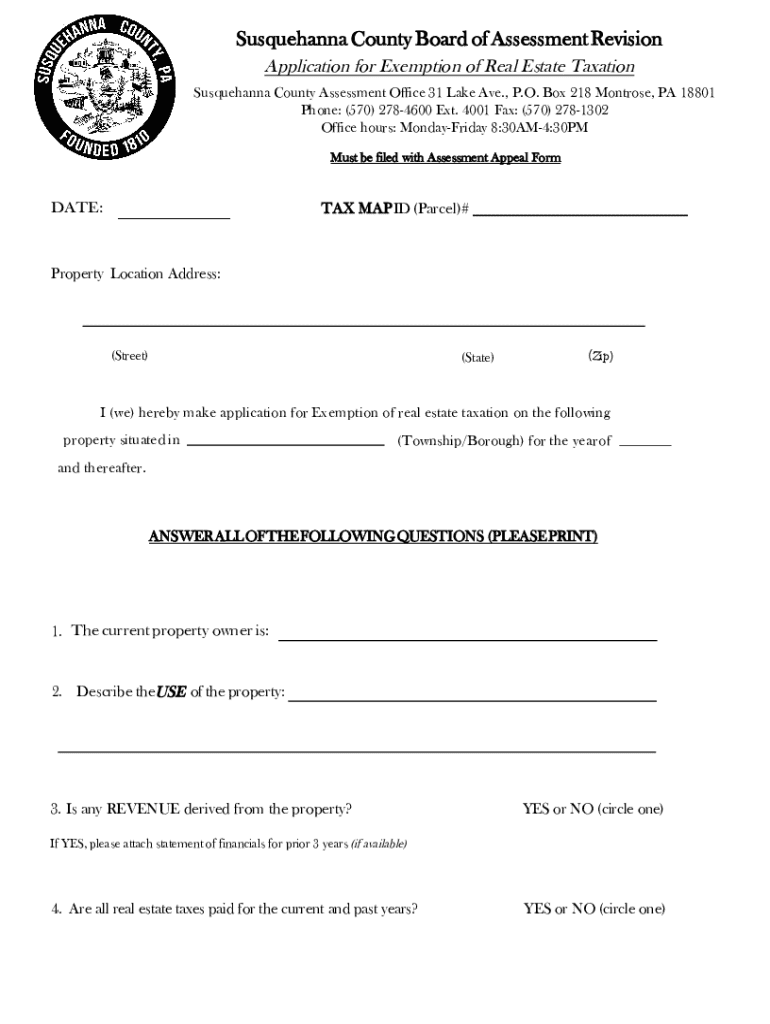

Overview of Susquehanna County Tax Bureau

The Susquehanna County Tax Bureau plays a crucial role in the financial management of the county by overseeing the administration of various taxes. Its primary objective is to ensure that tax collections are efficient, accurate, and complete, contributing to the overall funding of local services. For residents, tax forms are not merely bureaucratic paperwork; they are vital for maintaining property responsibilities and ensuring proper funding for essential amenities like schools and public safety.

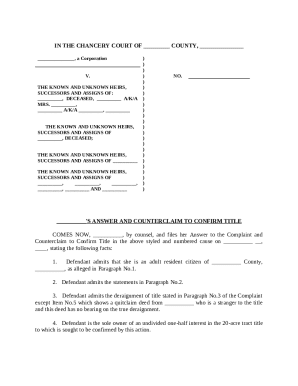

Understanding the types of taxes administered by the Susquehanna County Tax Bureau is important. The Tax Bureau primarily handles local property taxes, which are essential for funding school districts and local government operations. Additionally, real estate transfer taxes are collected when properties change hands, contributing to the county’s revenue. Other local taxes may also apply depending on specific circumstances, making it essential for residents to stay informed about their tax obligations.

Understanding the Susquehanna County Tax Bureau Form

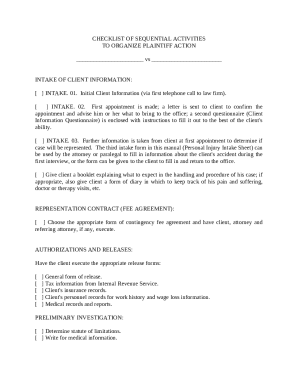

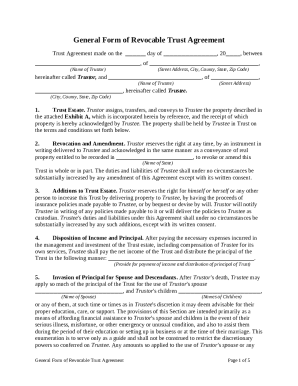

The Susquehanna County Tax Bureau Form is the official documentation required for various tax-related processes within the county. This form is integral for property owners and local businesses, serving multiple functions, such as filing for tax claims or applying for tax exemptions. Completing this form accurately helps ensure compliance with local tax laws and can significantly affect financial responsibilities.

Who's required to use the Susquehanna County Tax Bureau Form? The primary audience includes property owners and tenants, along with local businesses navigating tax-related procedures. Situations that specifically demand this form may include disputes over property valuations, applying for exemptions on property tax, or complications surrounding real estate transactions. Understanding when and how to use this form can save taxpayers time and potential financial liabilities.

How to access the Susquehanna County Tax Bureau Form

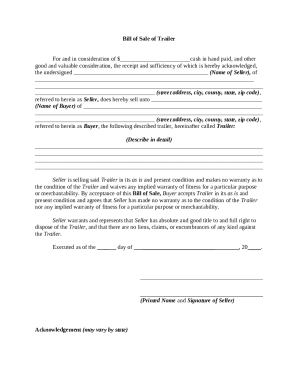

Accessing the Susquehanna County Tax Bureau Form is straightforward and can be completed in a few steps. One popular method is downloading the form directly from pdfFiller, where users can easily find the necessary documents. To retrieve the form, simply visit the pdfFiller homepage, use the search bar to find 'Susquehanna County Tax Bureau Form', and follow the provided link for direct access to the downloadable PDF.

For those who prefer in-person assistance, the Tax Bureau offers alternative access points. Residents can visit local government offices or the Tax Bureau location to obtain physical copies of tax forms. Additionally, the official Susquehanna County website houses various online resources, making it easier for individuals to locate necessary paperwork and information regarding local tax laws.

Filling out the Susquehanna County Tax Bureau Form

Filling out the Susquehanna County Tax Bureau Form necessitates careful attention, as completing the form incorrectly can lead to delays or complications in tax processing. Each section of the form serves a unique purpose, often requiring property identification, owner information, and specifics related to the type of tax claim or exemption being filed. It is crucial to approach each section methodically, ensuring no fields are left blank or filled in inaccurately.

To avoid common pitfalls, it’s advisable to double-check all information before submission. Having relevant documents on hand—such as property deeds, identification numbers, or previous tax assessment notices—can streamline the process and help ensure accuracy. By following these detailed instructions and guidelines, taxpayers will not only enhance their understanding of the process but also minimize the chances of encountering issues.

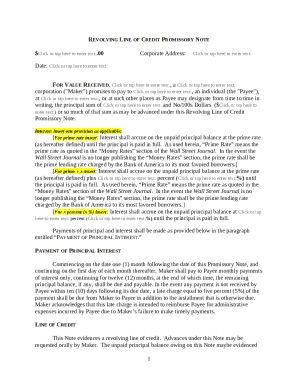

Editing and customizing using pdfFiller

pdfFiller offers a range of interactive tools that allow users to edit and customize the Susquehanna County Tax Bureau Form seamlessly. Whether adding additional notes, removing unnecessary sections, or updating information as required, the platform enables users to modify the form easily. This flexibility provides an advantage for individuals who might need to adjust details before finalizing their submission.

Compliance is crucial when it comes to tax forms, and pdfFiller helps users ensure that their completed Susquehanna County Tax Bureau Form meets all county standards. The platform includes features designed to highlight common errors and flag incomplete sections, thus allowing users to rectify any issues before submitting their form. With these tools, maintaining accuracy and compliance becomes a more manageable task.

Signing and submitting your form

The signing process for the Susquehanna County Tax Bureau Form requires specific signatures from individuals or entities involved. If the form is being submitted by a representative, it’s essential to ensure that the proper authorization is provided to avoid complications. Utilizing electronic signatures through pdfFiller streamlines this process, allowing users to sign documents from anywhere without the need for physical paperwork.

Once the form is completed and signed, knowing where and how to submit it is critical. Forms can often be mailed to the appropriate county office or submitted in-person at designated locations. Additionally, being aware of key deadlines is essential to avoid penalties or delays in processing. Users should review submission guidelines thoroughly to ensure their forms are submitted correctly and on time.

Tracking your submission

Confirming the receipt of your Susquehanna County Tax Bureau Form is an essential step after submission. Residents can generally verify their submissions through the county’s official website or by contacting the Tax Bureau directly. This confirmation can alleviate concerns regarding whether the forms have been properly processed, providing peace of mind to taxpayers.

In the event of issues arising with the submitted form, knowing how to troubleshoot is vital. Common issues may include missing information or discrepancies in submitted data. By having the right contact information for the Tax Bureau, users can quickly reach out for assistance to resolve any complications that might surface during the processing of their form.

Frequently asked questions

Navigating the ins and outs of the Susquehanna County Tax Bureau Form can lead to common queries regarding its completion and submission. Residents frequently ask about the timeline for processing submitted forms, potential exemptions, or the criteria for tax assessments. Having clear answers to these FAQs can help demystify the process and empower residents to handle their taxes confidently.

Moreover, it’s beneficial for taxpayers to familiarize themselves with frequent challenges they might face during the filing process, such as encountering forms with mixed instructions or changes in tax laws. Solutions to these issues are usually available directly from Tax Bureau resources or through local government assistance services.

Contacting the Susquehanna County Tax Bureau

For those seeking assistance, reaching out to the Susquehanna County Tax Bureau can be done through multiple channels. Interested individuals can contact the bureau via phone or email; their office hours are typically posted on the official website. This accessibility ensures that residents can obtain answers to critical questions and clarifications regarding their tax forms.

Additionally, the online support section provides useful FAQs and resources, making it a good starting point for users who prefer to seek answers independently. Direct links to these resources on pdfFiller can guide users in finding valuable information and enhancing their understanding of the taxation process, further simplifying interactions with the Tax Bureau.

Additional tools and resources

There are a variety of related forms available for tax management that can be accessed through pdfFiller. These forms are essential for maintaining compliance with local tax obligations. Quick links to other necessary forms simplify the process, allowing residents to organize their tax documentation effectively.

Moreover, educational resources regarding tax responsibilities and guidelines specific to Susquehanna County can provide further insights. Such materials are invaluable for residents seeking to expand their knowledge and ensure they meet their tax responsibilities adequately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send susquehanna county tax bureau to be eSigned by others?

How do I make edits in susquehanna county tax bureau without leaving Chrome?

Can I create an eSignature for the susquehanna county tax bureau in Gmail?

What is susquehanna county tax bureau?

Who is required to file susquehanna county tax bureau?

How to fill out susquehanna county tax bureau?

What is the purpose of susquehanna county tax bureau?

What information must be reported on susquehanna county tax bureau?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.