Get the free How to Amend a 990 Form: Everything Tax-Exempt ...

Get, Create, Make and Sign how to amend a

How to edit how to amend a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to amend a

How to fill out how to amend a

Who needs how to amend a?

How to amend a form: A comprehensive guide

Understanding the need for amendments

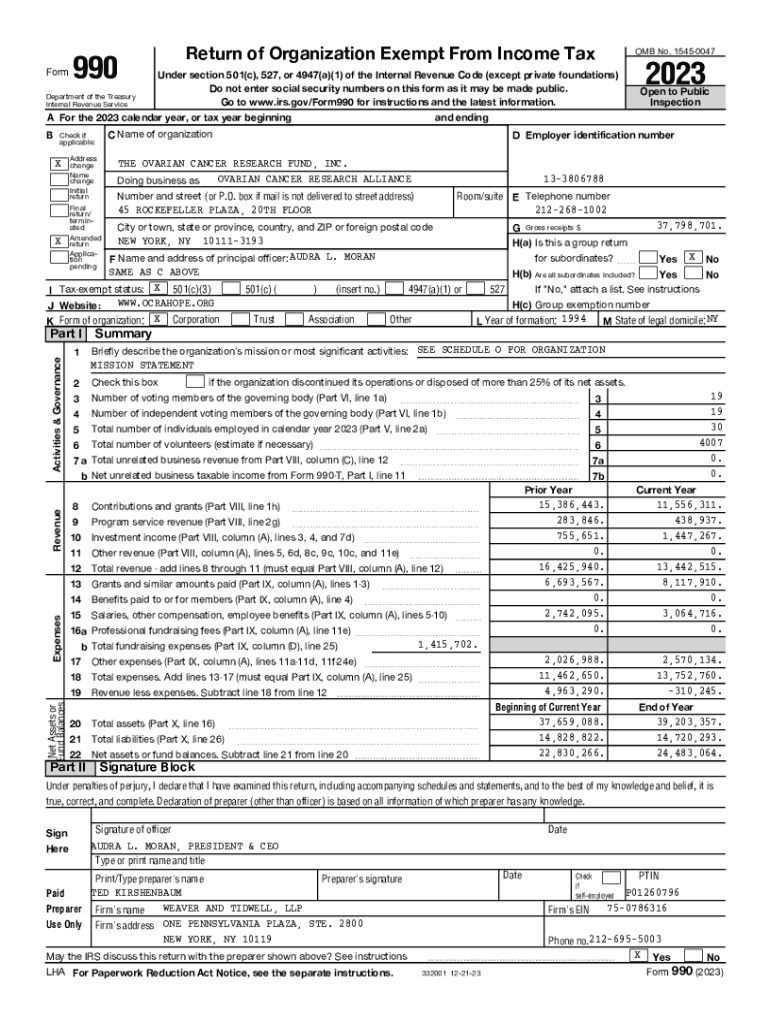

Whether you’re filing taxes or updating important personal information, understanding when and why to amend a form is crucial. Forms often require amendments due to simple mistakes like typos, or more significant issues like changes in your circumstances. Not addressing inaccuracies can render the form invalid, potentially leading to legal repercussions or financial penalties.

Common reasons for amending forms include incorrect data entries, adding missing information, or reflecting a change in personal status. For example, if you recently got married and filed taxes under your maiden name, amending your tax return ensures everything aligns correctly with your IRS records. Legal documents and contracts also warrant amendments, especially when terms change or parties involved need updating.

It is essential to understand that different forms will have unique amendment processes, and some may require specific information or formats to maintain their validity.

Steps to identify required amendments

Before amending a form, the first step is to review the original document thoroughly. Carefully check for spelling errors, incorrect information, or missing signatures that may jeopardize its validity. This can be crucial for forms such as tax returns, where errors could affect your tax filing and result in financial discrepancies with the IRS.

It’s also crucial to gather supporting documentation. Collect the necessary papers and documents that justify the amendments. For instance, if you are correcting income reported on your tax return, you'll need pay stubs or W-2 forms as evidence of the correct amounts. Assess each amendment's importance: prioritize changes based on their potential impact on legality or necessary timelines.

The amendment process

Now that you’ve identified the amendments needed, it’s time to execute them correctly. If you're working with paper forms, making manual corrections can be straightforward. Use ink to strike out errors and write in the correct information clearly. Avoid correction fluid, as it may raise questions about the validity of the document. Ensure that each correction is initialed and dated to show the form has been altered officially.

For digital forms, utilizing tools like pdfFiller streamlines the amendment process significantly. You can easily edit PDFs, make necessary corrections, and add new information without compromising the form's integrity. Features such as eSign allow you to securely sign documents online, and collaboration tools let you share with teammates for second opinions or necessary approvals.

Essential guidelines for digital amendments

Navigating pdfFiller’s platform can greatly enhance your ability to amend forms efficiently. Start by logging into the platform, where you can access a variety of templates for different types of forms. The user-friendly interface allows you to easily locate and select the specific form you need to amend. Understanding how to use interactive tools such as highlighting text and adding comments can be invaluable during the amendment process.

Next, ensure to save your edited forms and back them up to maintain version control. After making your amendments, always save a copy of the original to compare against. Regularly backing up your documents helps safeguard against data loss. Using cloud storage options provided by pdfFiller ensures that your documents are accessible from anywhere, mitigating the risks associated with losing your work.

Submitting amended forms

After amending your form, understanding the submission methods is crucial. You can choose digital submission options like e-filing via the IRS websites, especially beneficial for tax forms where deadlines are crucial. Alternatively, mailing the amended form could be required for some legal documents or contracts. Familiarize yourself with the specific deadlines for each type of submission to avoid late fees or penalties.

Confirmation of receipt from the relevant authority is essential. Whether submitting online or via mail, tracking your submission ensures that it was received. Systems such as e-filing typically provide immediate confirmation when your forms are accepted. For mailed submissions, consider using certified mail or another service that requires a signature upon delivery, giving you proof of submission.

What to do if your amendment is rejected

In some cases, your amended form may be rejected, which can be frustrating and confusing. Common reasons for rejection include mistakes during the amendment process, such as failing to provide supporting documents or not following the specific format requested. It's imperative to read the rejection notice carefully; it usually outlines the exact reasons for the rejection.

To resolve a rejection, contact the relevant organization immediately for clarification. Don't hesitate to ask for specific instructions on how to correct the issues they identified. Re-submitting your amendment might require a clear understanding of the corrections needed to prevent further rejections.

Frequently asked questions (FAQs)

What happens if I don’t amend my form? Not addressing errors in your forms can lead to serious penalties, especially concerning tax returns where inaccuracies can trigger audits by the IRS. Ensuring all information is correct helps maintain compliance and protect against any legal ramifications.

Can I use pdfFiller for all types of forms? The platform is robust and versatile, supporting various types of documents. Whether you're handling tax forms, contracts, or legal affidavits, pdfFiller provides tools that help streamline the amendment process across a wide array of form types.

How secure is my information when using pdfFiller? pdfFiller takes data privacy seriously, employing strong security measures including encryption and secure cloud storage to protect your personal information during the amendment process. This ensures that you can edit and share sensitive documents without concern.

Leveraging pdfFiller for future form management

Using pdfFiller not only simplifies amending forms but also enhances your future document management. Consider creating templates for commonly used forms to optimize your workflow. This allows you to fill in necessary details quickly without recreating forms from scratch each time you have new information to submit.

Collaboration is easier with pdfFiller’s tools that enable real-time editing among team members. This feature is especially beneficial for businesses or organizations looking to finalize documents efficiently. Whether you’re making amendments based on team feedback or keeping up with compliance requirements, the platform keeps you updated with necessary changes.

Enhancing your skills in document amendment

Improving your ability to amend documents can significantly benefit your efficiency in managing forms. Engage with pdfFiller’s educational materials, which provide workshops and resources that delve deeper into document management. These materials help users gain a better understanding of the best practices for amending key forms.

Additionally, community forums and support groups offer an opportunity for users to connect with peers and experts. Sharing experiences and tips on effective document amendment can provide valuable insights that enhance your skills. Engaging with a community is an excellent way to learn from others’ successes and challenges in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in how to amend a?

How do I fill out how to amend a using my mobile device?

How do I edit how to amend a on an iOS device?

What is how to amend a?

Who is required to file how to amend a?

How to fill out how to amend a?

What is the purpose of how to amend a?

What information must be reported on how to amend a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.