Get the free MB Actuary Signature

Get, Create, Make and Sign mb actuary signature

Editing mb actuary signature online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mb actuary signature

How to fill out mb actuary signature

Who needs mb actuary signature?

Comprehensive Guide to the MB Actuary Signature Form

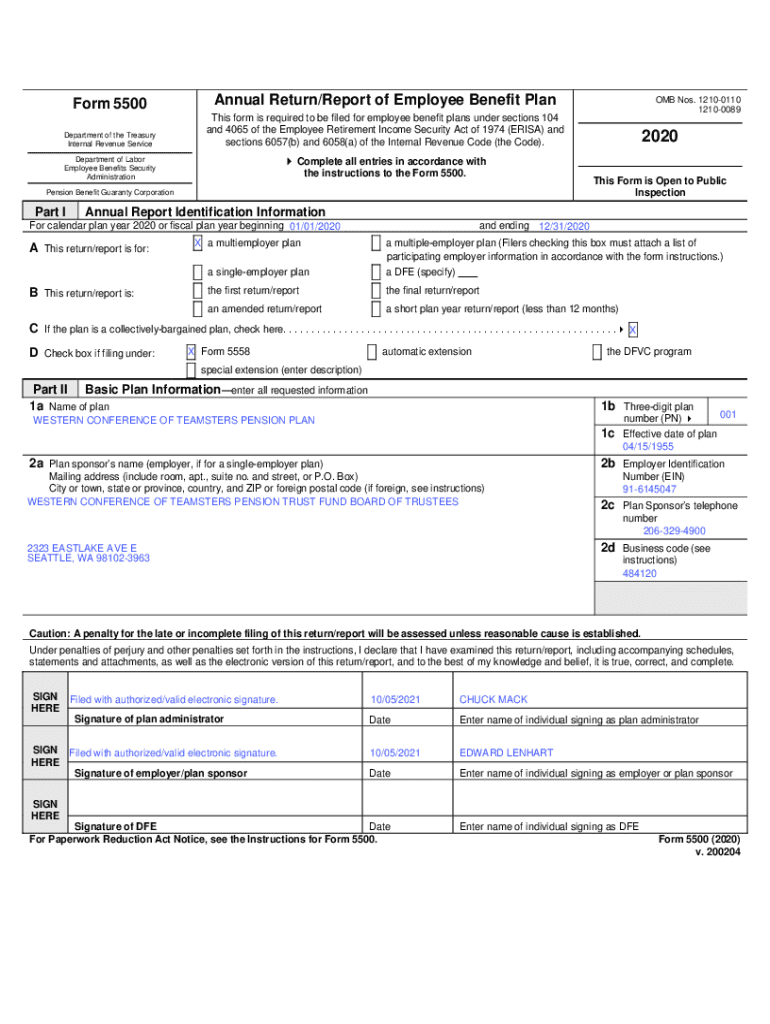

Understanding the MB actuary signature form

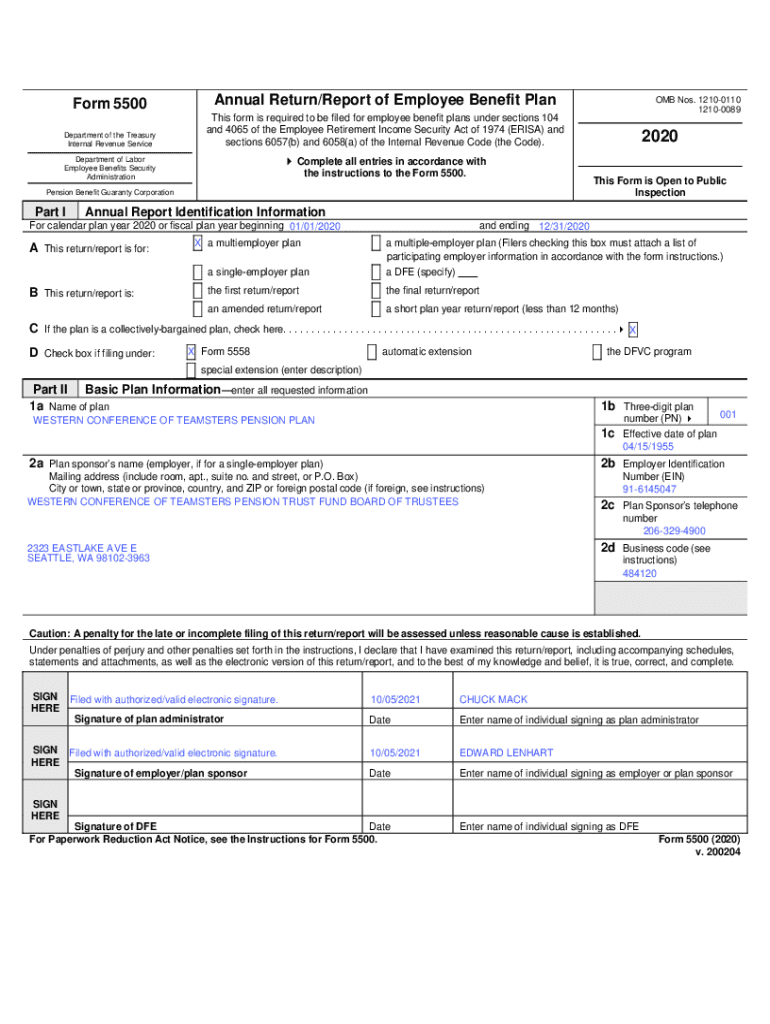

The MB actuary signature form is a fundamental document in the context of multiemployer pension plans. Its primary purpose is to certify that the actuarial valuations and assumptions made in the preparation of pension funding reports are accurate and comply with the regulatory standards set forth by the Employee Retirement Income Security Act (ERISA) and the Pension Protection Act (PPA). The form embodies the responsibility that enrolled actuaries hold in ensuring the financial health and legal compliance of pension plans.

Accurate completion and timely submission of the MB actuary signature form are critical. Delays or errors in submission can lead to significant consequences, including penalties or compliance issues that can affect the pension plan's funding status and the financial security of its beneficiaries.

Key definitions and terminology

Understanding terms related to the MB actuary signature form is essential for anyone involved in pension plan management. An 'actuary' is a professional trained in the mathematics of insurance, pensions, and finance, who assess risk and uncertainty in financial terms. The 'signature' indicates the official approval of the actuary, affirming that their work complies with the required standards. Other relevant terms include 'multiemployer pension plans,' which are arrangements where multiple employers participate in a single pension fund, and 'regulatory' which pertains to the adherence to applicable laws governing pension plans.

Who needs to complete the MB actuary signature form?

Eligibility to complete the MB actuary signature form generally revolves around the status of the actuary involved. Specifically, the form must be filed by an enrolled actuary, a professional who has met the rigorous standards set by the American Academy of Actuaries and has been approved by the Joint Board for the Enrollment of Actuaries. This typically applies to actuaries engaged in multiemployer pension plans, ensuring they are qualified to certify the plan's financial health.

Enrolled actuaries have the extensive experience and training necessary to assess various demographic and economic factors impacting pension plans. Their responsibilities not only include completing the MB actuary signature form but also preparing detailed actuarial valuations that inform employers and stakeholders of a plan’s funded status and any corrective actions that may be necessary to maintain compliance with funding requirements.

Overview of the form structure

The MB actuary signature form consists of several key sections that serve distinct functions. The main sections typically include:

In addition, any required attachments must be specified, which may include actuarial reports or additional documentation validating the assumptions made in the actuarial reports. Complete submissions are imperative for ensuring that the form fulfills its intended role within regulatory scrutiny.

Detailed instructions for completing the MB actuary signature form

Filling out the MB actuary signature form requires precision. Here is a step-by-step guide to ensure clarity and completeness.

Step 1: Header Information

In the header section, provide accurate details of the pension plan, ensuring that the name, plan number, and effective date align with official documentation. This information verifies the identity of the plan for regulatory purposes.

Step 2: Actuary Information

Actuaries must neatly present their qualifications. This includes the lost enrollment number, professional designation, and contact information. Ensuring that this data is correct helps maintain the integrity of the submitting actuary’s professional standing.

Step 3: Signature and Date

The final requirement is the actual signature of the actuary, confirming that the information contained within the form is truthful and reflective of their professional opinions. Effective dating indicates when the actuary completed the review and submission, further solidifying the document's legitimacy.

Common pitfalls and how to avoid them

Mistakes can often occur during the completion process. Common pitfalls include neglecting to fill in necessary sections, inaccuracies in the actuarial qualifications, or failing to sign the form. To prevent such errors, it's prudent to double-check all information for accuracy and to consider a review by another team member for clarity.

Managing the submission process

Once the MB actuary signature form is completed, managing the submission process is the next critical step. It’s essential to choose the correct submission method. Options typically include electronic submission via a secure portal or mailing a hard copy to the appropriate regulatory authority. When opting for electronic submission, ensure that you receive a confirmation receipt as proof of submission.

For mail-in submissions, consider using a service that provides tracking capabilities to confirm when your form arrives at its destination. Having a documented trail ensures accountability and reduces anxiety related to whether your submission was properly received.

Practical tips for efficient document management

Utilizing tools like pdfFiller can dramatically streamline the process of completing the MB actuary signature form. This user-friendly platform allows you to fill out the form online seamlessly, reducing the chances for errors prevalent in traditional pen-and-paper methods.

Using pdfFiller for form completion and management

To use pdfFiller effectively, simply upload the MB actuary signature form to the platform. From there, you can complete each section, insert your signature electronically, and easily save your work. You can also access templates to ensure all necessary sections are completed adequately.

Collaboration features

With pdfFiller’s cloud-based platform, team collaboration is facilitated. Multiple users can work on the document simultaneously, allowing for input from different actuaries or administrative staff. This feature not only enhances productivity but also ensures that all perspectives are incorporated into the final submission.

FAQs about the MB actuary signature form

Many questions arise concerning the MB actuary signature form. One common concern is who can delegate the responsibility of filing the form. Typically, it is the enrolled actuary’s duty to ensure proper submission; however, the actuary can work with a supporting team if necessary.

It’s also essential to clarify misconceptions regarding document confidentiality. The information on the form is typically shared with regulatory bodies but maintained for compliance purposes within the organization's records. Understanding these nuances aids in easing concerns related to data privacy.

Additional considerations for actuarial documentation

Staying informed on regulatory changes is vital for anyone involved in pension documentation. Recent legislative updates can significantly impact how the MB actuary signature form is processed and the requirements for accompanying documentation. Hence, actively monitoring these changes ensures compliance.

Furthermore, best practices for maintaining compliance encompass routinely reviewing internal policies, providing training for new actuaries, and ensuring that all documentation is archived correctly. Adopting a compliance-first mentality within your organization ensures the longevity and reliability of your pension plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mb actuary signature without leaving Google Drive?

Can I create an eSignature for the mb actuary signature in Gmail?

How do I complete mb actuary signature on an Android device?

What is mb actuary signature?

Who is required to file mb actuary signature?

How to fill out mb actuary signature?

What is the purpose of mb actuary signature?

What information must be reported on mb actuary signature?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.