Get the free Forms 990 / 990-EZ Return Summary MASSACHUSETTS ...

Get, Create, Make and Sign forms 990 990-ez return

How to edit forms 990 990-ez return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out forms 990 990-ez return

How to fill out forms 990 990-ez return

Who needs forms 990 990-ez return?

Forms 990 and 990-EZ Return Form: A Comprehensive Guide

Understanding forms 990 and 990-EZ

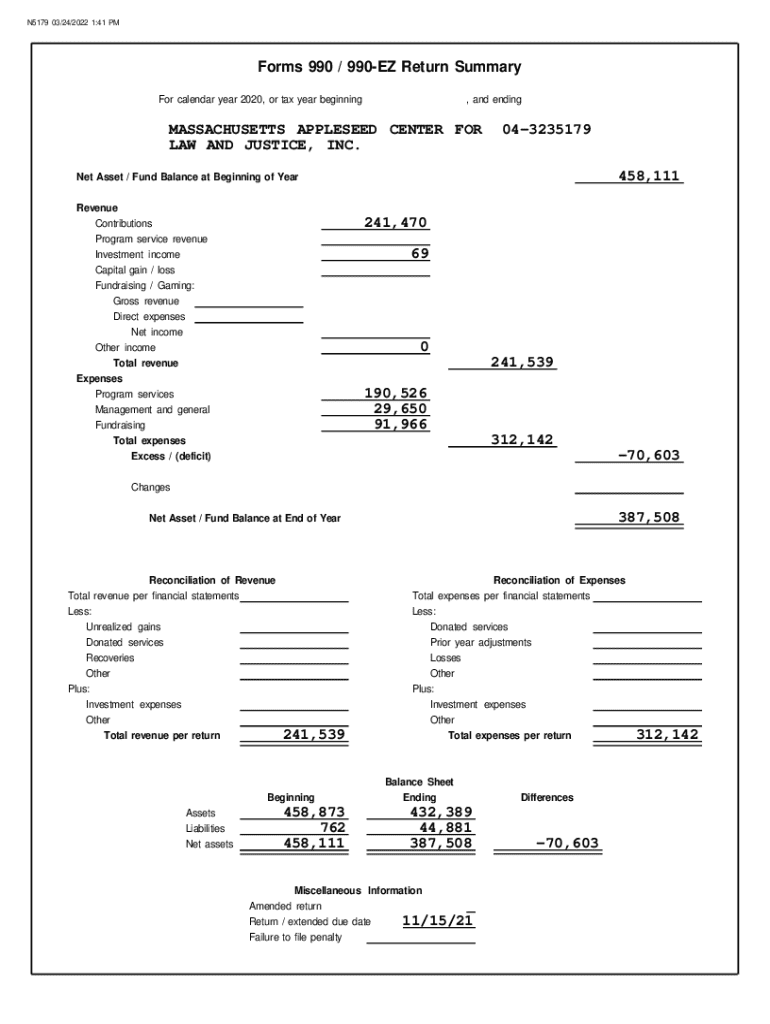

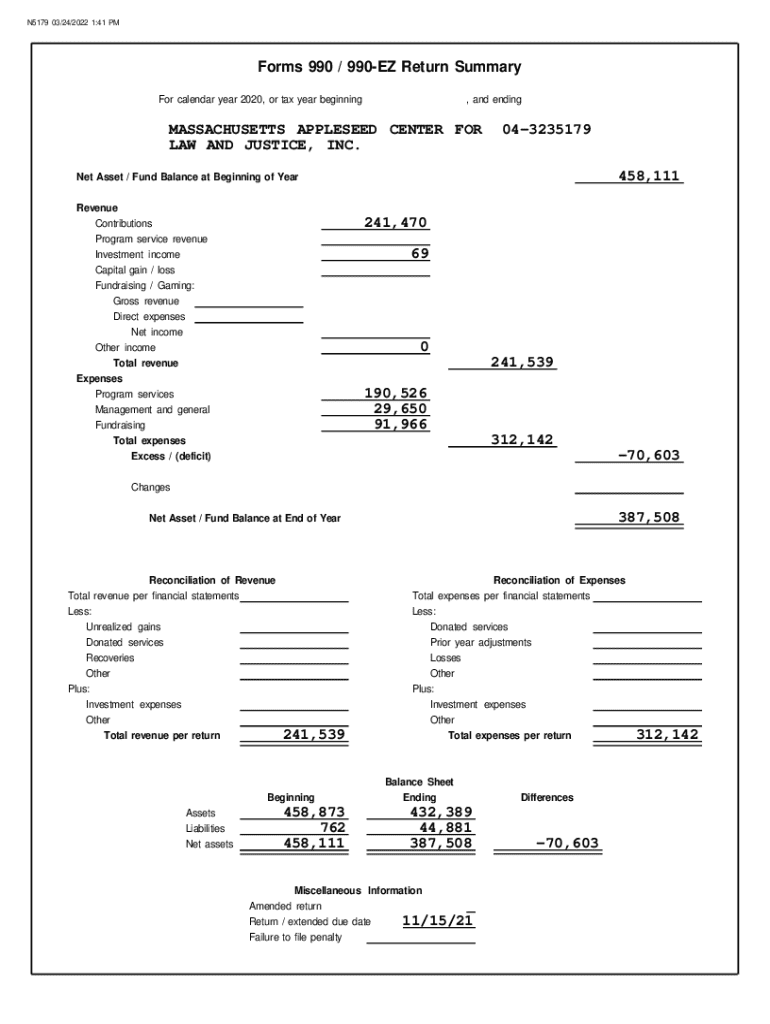

Forms 990 and 990-EZ are vital components of the tax filing process for tax-exempt organizations in the United States. They serve as annual information returns that provide the IRS and the public with crucial insights into a nonprofit's financial activities and overall health. Organizations use these forms to ensure compliance while adhering to transparency and accountability standards, which are essential for maintaining tax-exempt status.

The main purpose of Form 990 is to detail a nonprofit's finances comprehensively, including revenue, expenses, and program services. It requires detailed disclosures, allowing stakeholders to assess how effectively an organization operates. In contrast, Form 990-EZ is a shorter version designed for smaller organizations with less complex financial situations, offering a streamlined way to report necessary information.

Key components of Form 990 and 990-EZ

Each form requires a set of basic organizational details, including the nonprofit's name, address, and Employer Identification Number (EIN). Additionally, organizations must provide a clear description of their mission, major activities, and any significant changes during the fiscal year. These details help stakeholders understand the organization's goals and operational focus.

Financial statements are the cornerstone of both Forms 990 and 990-EZ, where organizations report vital figures related to their revenues, expenses, and net assets. Key financial sections include total revenue from all sources, direct and indirect expenses incurred in running programs, and any other significant financial activities that impacted the organization during the reporting period. Accurate reporting in these sections is crucial for maintaining compliance and public trust.

Filing requirements and deadlines

Nonprofits must adhere to specific filing deadlines for Forms 990 and 990-EZ. Generally, the forms are due on the 15th day of the 5th month after the end of the organization's fiscal year. Using a standard calendar year, this typically translates to a May 15 deadline. Organizations that fail to meet this deadline may face consequences, including penalties and, in extreme cases, loss of tax-exempt status.

Extensions are available for organizations needing extra time to complete their filings. To request an extension, nonprofits can file Form 8868, which can provide an additional six months for submitting the necessary documents. Special cases, such as new organizations or those with unique fiscal years, may have different requirements and should consult IRS guidelines to ensure compliance.

Step-by-step guide to completing Form 990-EZ

To effectively complete Form 990-EZ, organizations must first gather all necessary documentation. This includes financial records such as income statements, balance sheets, and any previous IRS filings. Having a comprehensive list of your financial activities will ensure that all relevant information is accurately reflected in the form.

Each section of Form 990-EZ has specific instructions to guide users through the completion process. For example, organizations must accurately report revenue from program services, investments, and fundraising efforts. Additionally, capturing expenses related to program operations, administrative costs, and fundraising efforts will provide a clear picture of the organization's financial health. It's crucial to double-check each section to avoid common mistakes, such as miscalculating totals or omitting crucial details.

Filing form 990 and 990-EZ electronically

Electronic filing (eFiling) of Forms 990 and 990-EZ has gained popularity due to its numerous advantages. eFiling enhances speed and accuracy, allowing nonprofits to submit their forms quickly while minimizing potential errors. Moreover, electronic submission provides a confirmation receipt, giving organizations peace of mind that their filings have been received by the IRS.

To file Form 990-EZ online, organizations can use approved eFile platforms that guide users through the process. These platforms often offer step-by-step instructions and automatically calculate figures, helping to streamline the filing process further. Familiarizing yourself with recommended eFile tools can significantly reduce the stress associated with tax filing.

Using pdfFiller to manage your form 990 and 990-EZ

pdfFiller provides a powerful platform for managing Forms 990 and 990-EZ, featuring extensive editing capabilities for PDFs. Organizations can easily customize templates, add necessary details, and collaborate with team members to ensure accurate submissions. This functionality streamlines the filing process and fosters teamwork, especially in larger organizations where multiple individuals may contribute to the completion of these forms.

One standout feature of pdfFiller is the ability to eSign documents electronically. Users can upload their completed forms, sign them digitally, and share them instantly, making the filing process even more efficient. Additionally, pdfFiller's integration with cloud storage solutions allows teams to access documents from anywhere, ensuring that important filings are always within reach.

Common FAQs about form 990 and 990-EZ

Nonprofit organizations often have questions regarding Forms 990 and 990-EZ. One common inquiry is what to do if a mistake is made on a submitted form. In such cases, organizations can file Form 990-X to correct errors and ensure compliance with IRS requirements. Understanding the public access and disclosure rules surrounding these forms is also crucial, as it allows organizations to manage their transparency effectively.

Ongoing compliance is another area of concern for nonprofits. Maintaining accurate records and setting up regular compliance checks can be beneficial. Organizations should keep meticulous documentation of financial transactions, board meeting minutes, and any changes in policies or programs to ensure they remain compliant with all necessary regulations.

Interactive tools and resources

pdfFiller offers interactive tools that can simplify the filing process for Forms 990 and 990-EZ. For instance, users can access an interactive checklist that guides them through the required steps in preparing their forms. Additionally, financial calculators are available to estimate potential tax liabilities and cash flow, making it easier for organizations to forecast their financial situations as they approach filing deadlines.

For those looking to simplify their outcomes, pdfFiller also provides templates for Forms 990 and 990-EZ. These downloadable templates enable organizations to tailor their filings according to their specific needs while ensuring compliance with IRS standards. Utilizing these resources can significantly enhance the efficiency and accuracy of the filing process.

Simplifying your documentation workflow

Efficient document management is key for nonprofit organizations, particularly when filing Forms 990 and 990-EZ. Establishing a systematic approach to collecting and filing the necessary documents can streamline the process tremendously. Nonprofits can create a timeline for document collection and set reminders leading up to filing deadlines to ensure that everything is in order when it's time to submit.

Collaboration tools are also essential, especially when teams work together to prepare these forms. Utilizing pdfFiller’s collaborative features enables multiple team members to access and edit the same document, ensuring everyone is on the same page. Adopting software integrations that facilitate real-time collaboration can significantly enhance the efficiency of the document preparation process, leading to more accurate and timely filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit forms 990 990-ez return from Google Drive?

How can I get forms 990 990-ez return?

Can I create an electronic signature for signing my forms 990 990-ez return in Gmail?

What is forms 990 990-ez return?

Who is required to file forms 990 990-ez return?

How to fill out forms 990 990-ez return?

What is the purpose of forms 990 990-ez return?

What information must be reported on forms 990 990-ez return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.