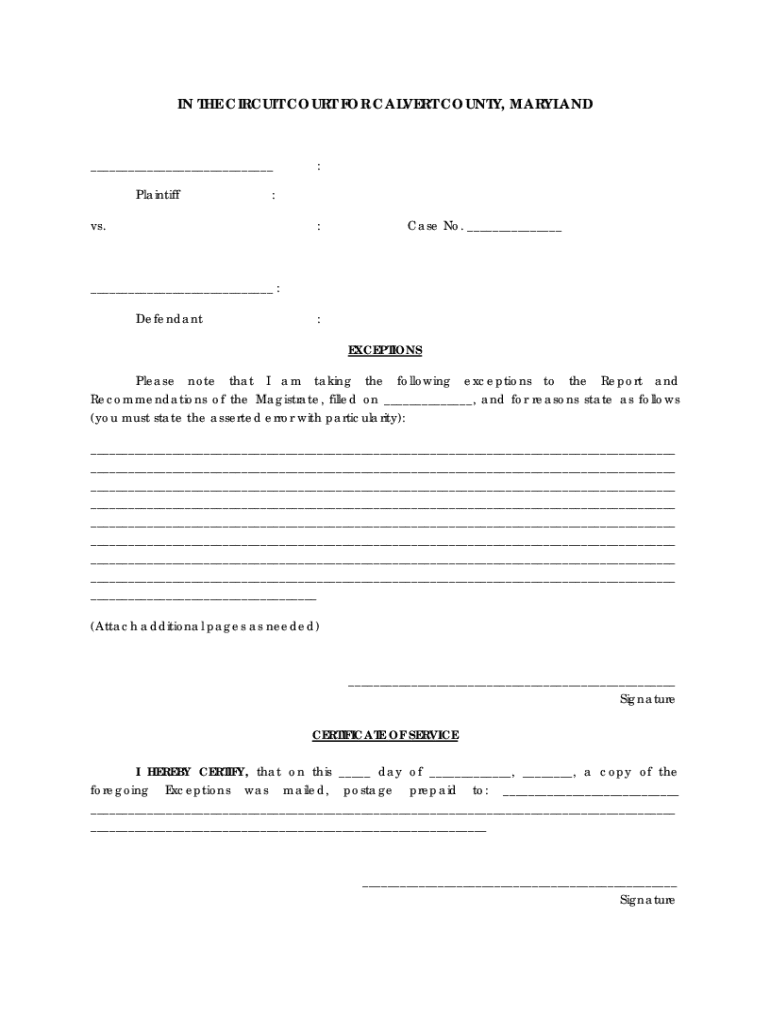

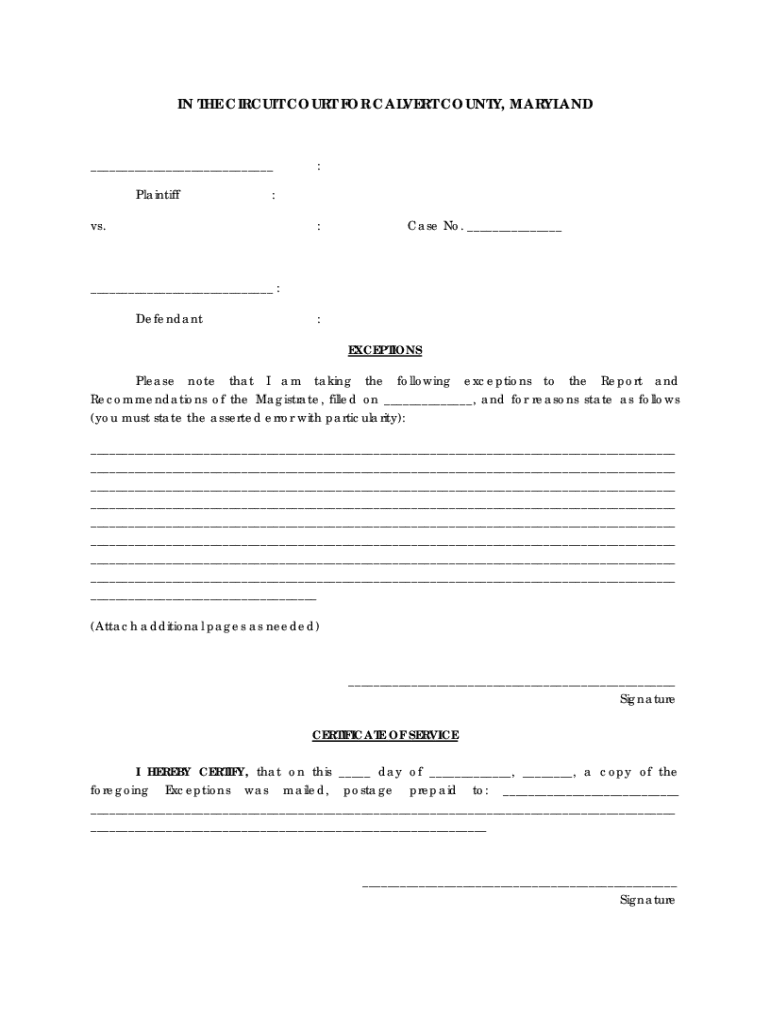

Get the free Filing Exceptions to the Magistrate's Report

Get, Create, Make and Sign filing exceptions to form

Editing filing exceptions to form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out filing exceptions to form

How to fill out filing exceptions to form

Who needs filing exceptions to form?

Filing Exceptions to Form: A Comprehensive Guide

Understanding filing exceptions to form

Filing exceptions to form refers to the process where individuals or companies apply for exemptions or alterations to the standard forms required by regulatory bodies. These exceptions might be necessary for various reasons, such as unique business circumstances or compliance challenges. The process is particularly important for ensuring that organizations meet their reporting obligations without facing undue hardship.

Understanding these exceptions is crucial as it helps stakeholders navigate the complexities of compliance requirements while adequately protecting their business interests. By familiarizing themselves with the exceptions available, applicants can seek appropriate adjustments to their filings, which can ultimately save time and resources.

Common types of filing exceptions

Filing exceptions are generally classified into two primary categories: automatic exceptions and requested exceptions. Understanding these distinctions is vital for businesses and individuals navigating their specific circumstances.

Automatic filing exceptions often apply based on predefined criteria, such as the size of the business or the revenue generated. For example, smaller entities may qualify for exceptions if their revenue falls below certain thresholds. Additionally, early submissions may sometimes qualify for automatic exceptions to avoid delays in compliance.

Conversely, requested filing exceptions require an application process where individuals or companies must submit a formal exception request. This process typically involves providing specific documentation to support the need for the exemption. Situations like natural disasters or personal hardship may also warrant special consideration for exceptions, demonstrating the flexible nature of the filing system.

Step-by-step guide to filing exceptions

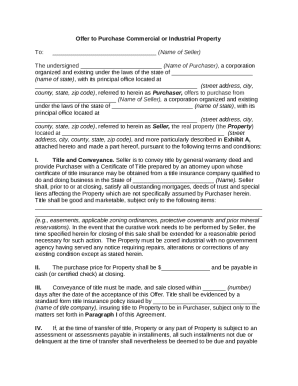

Navigating the filing exceptions process requires careful preparation and attention to detail. The first step is gathering all necessary information and documentation. This can include ownership information, business financials, and specific forms relevant to the exception request.

When completing the exception request form, ensure every section is filled out accurately. Each part of the form corresponds to aspects of your business or personal situation that justify the exception. It’s crucial to provide clear explanations and attach any necessary supporting documents to strengthen your request.

Submission can usually be done electronically or via traditional mail, depending on the specific requirements. Once submitted, be proactive about following up. A polite inquiry can help ascertain the status of your exception request and showcase your commitment to compliance.

Managing your exceptions efficiently

A vital aspect of successfully navigating filing exceptions to form involves effective document management. Leveraging pdfFiller allows businesses and individuals to create, edit, and manage the necessary documents seamlessly. With tools designed for easy e-signing and collaboration, users can streamline their documentation processes and improve team communication.

pdfFiller also offers features for tracking the status of your exception requests. Whether you need to monitor the approval process for a requested exception or keep tabs on multiple filings, using a digital platform can simplify tasks and enhance organizational control.

What to do if your exception is denied

Receiving a denial for a filing exception can be disheartening, but understanding the reasons behind such decisions is crucial. Common reasons for denial may include insufficient documentation, failure to meet specified criteria, or missed deadlines. Knowing these factors can help applicants prepare better for future requests.

Following a denial, the next steps should include a thorough review of the denial notice. This allows you to determine whether it's worth reapplying or adjusting your original request. If the situation proves complex, seeking professional advice could provide valuable insights and strategies for successfully obtaining an exception in subsequent attempts.

FAQs on filing exceptions

With complexities surrounding filing exceptions to forms, many individuals often have questions regarding the general process. Common inquiries include: What forms typically allow exceptions? Understanding the specific forms that enable exceptions can help applicants identify their eligibility points.

Another frequent question is about the duration of the exception process. Generally, the processing time can vary based on the form type and the office's workload. It's also common to ask whether a denied exception can be appealed. In most cases, there is a potential route for appeal, but this would require a clear understanding of the denial and adherence to outlined procedures.

Related articles and additional insights

Understanding filing exceptions to form is an ongoing learning journey. Many businesses have successfully navigated this complex terrain with the right strategy in hand. Exploring case studies of successful exception filings can provide valuable insight into effective application techniques.

Recent changes in tax laws may also impact how exceptions are handled, so staying informed is essential. Best practices for future filings can significantly reduce the likelihood of errors and improve compliance. pdfFiller also provides relevant template forms and tools that can assist in preparing such requests.

Interactive tools and resources

To support users in effectively navigating file exceptions to form, pdfFiller offers a range of interactive tools, including templates designed for exception filing. These templates can simplify the process significantly, ensuring that you present your information clearly and accurately.

Additionally, video tutorials are available to guide users step-by-step through filling out necessary forms, while interactive checklists can help ensure all required elements are included before submission. Utilizing these resources can greatly enhance the success rate of your exception requests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in filing exceptions to form without leaving Chrome?

How can I edit filing exceptions to form on a smartphone?

Can I edit filing exceptions to form on an iOS device?

What is filing exceptions to form?

Who is required to file filing exceptions to form?

How to fill out filing exceptions to form?

What is the purpose of filing exceptions to form?

What information must be reported on filing exceptions to form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.