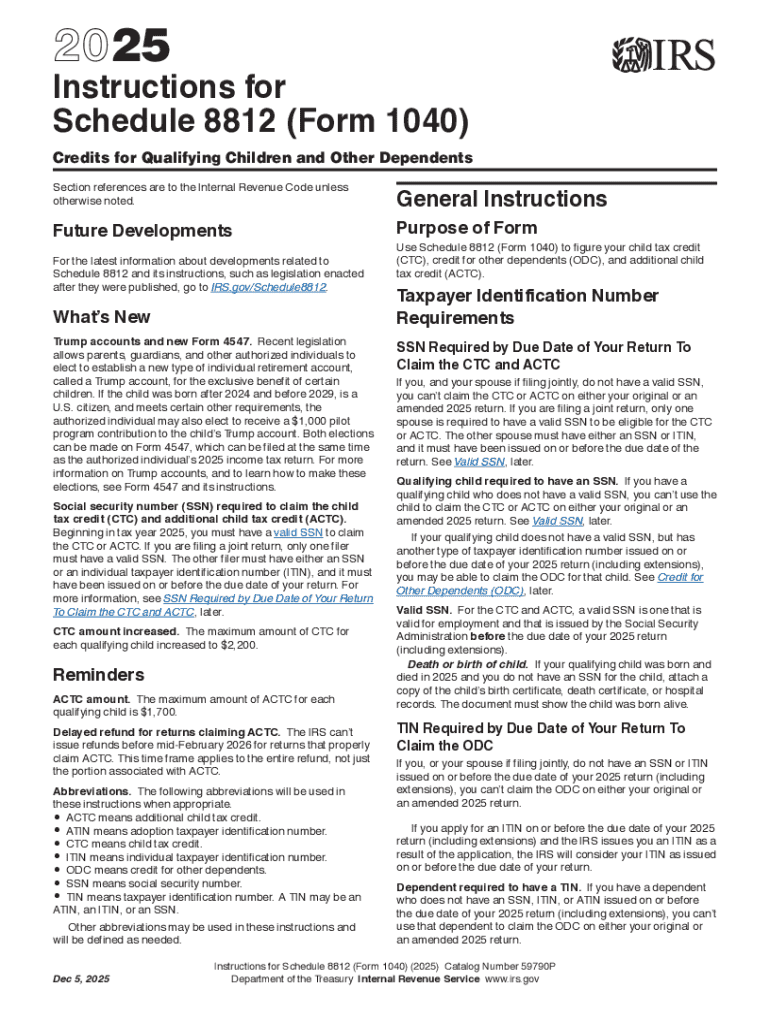

IRS 1040 Schedule 8812 Instructions 2025-2026 free printable template

Get, Create, Make and Sign IRS 1040 Schedule 8812 Instructions

Editing IRS 1040 Schedule 8812 Instructions online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040 Schedule 8812 Instructions Form Versions

How to fill out IRS 1040 Schedule 8812 Instructions

How to fill out 2025 instructions for schedule

Who needs 2025 instructions for schedule?

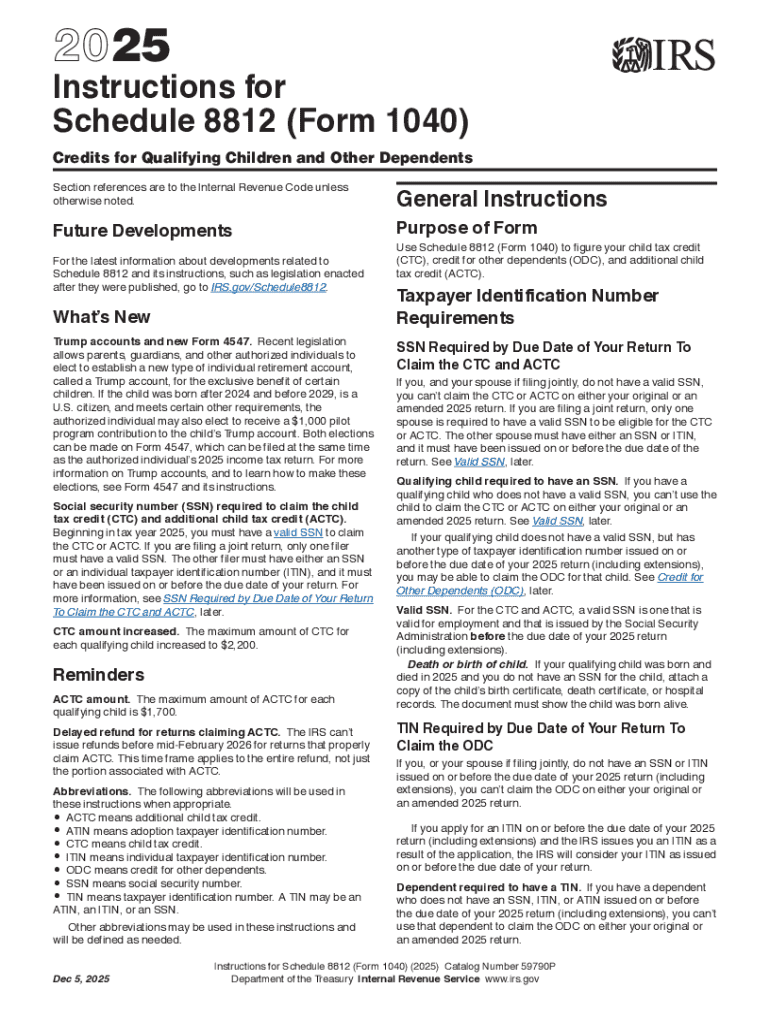

2025 Instructions for Schedule Form

Overview of the 2025 Schedule Form

The 2025 Schedule Form is a crucial document required for individuals and entities to report their income, deductions, and adjustments accurately for tax purposes. This form serves as part of a broader tax return process, enabling users to outline their financial status clearly. Its primary purpose lies in capturing a comprehensive view of a taxpayer's financial dealings for the tax year, ensuring compliance with IRS regulations.

Accurate filing of the schedule form is essential not only to avoid penalties but also to identify available tax credits and deductions that can significantly reduce overall tax liabilities. Correctly reporting information promotes transparency and allows for smooth processing of returns by the IRS.

For 2025, several key changes have been implemented in the Schedule Form, including adjustments in deduction limits, updates to income thresholds, and new fields that necessitate particular attention. Understanding these changes will help taxpayers optimize their submissions effectively.

Who should use the 2025 Schedule Form?

The Schedule Form for 2025 is targeted at individuals, limited liability companies (LLCs), and small business owners who need to report various sources of income and applicable deductions. Eligibility criteria can include income thresholds that determine filing requirements, particularly for those with self-employment income or specific investments that fall under IRS scrutiny.

Common scenarios for using the form involve freelancers reporting their freelance earnings, small business owners capturing revenue from their business activities, and those claiming specific itemized deductions. By utilizing the 2025 Schedule Form, users can benefit from increasing their tax efficiency, ensuring they claim all entitled benefits.

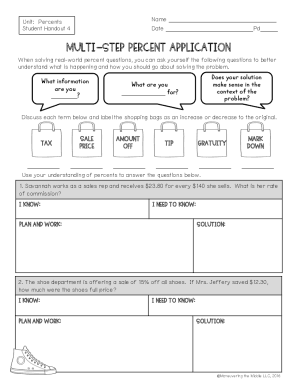

Step-by-step instructions for completing the 2025 Schedule Form

Completing the Schedule Form requires careful preparation and an organized approach to ensure accuracy and compliance. Understanding the required information beforehand will significantly streamline the process.

Preparation: What you need before starting

Before filling out the 2025 Schedule Form, gather all necessary documents, including previous tax returns, W-2 forms, 1099 forms, and any receipts related to deductible expenses. It may also be beneficial to have a tax calculator on hand for accurate income and deduction estimates.

Step 1: Filling out basic information

Begin by entering your personal information, including your full name, address, and Social Security Number. Make sure to double-check these details for accuracy, as any discrepancies can lead to delays or issues with your tax return.

Step 2: Income reporting

Accurately report all income received for the year, including salaries, freelance income, investment earnings, and rental income. Calculate total income by summing each source. Common sources include W-2, 1099-MISC, and 1099-NEC forms.

Step 3: Deductions overview

Identify eligible deductions that can reduce your tax bill. Common deductions include business expenses, healthcare costs, and education-related expenses. Ensure you have supporting documents ready to substantiate these deductions.

Step 4: Adjusting for California-specific conditions

For residents of California, it is vital to be aware of the special adjustments that apply. This may include certain state-specific deductions or credits. Examples such as maintaining detailed records for contractor payments, and understanding potential local tax obligations are crucial.

Step 5: Final review and submission process

Once the form is completed, conduct a final review. Cross-reference validation with a checklist to ensure all fields are accurately filled. When ready, decide between e-filing and paper filing; e-filing is often faster and more efficient, while paper filing provides tangible proof of submission.

Common mistakes to avoid

Taxpayers often encounter errors when completing the Schedule Form. Common mistakes include misreporting income figures, omitting essential deductions, or providing incorrect personal information. Additionally, misunderstanding the line instructions can lead to incorrectly filled forms.

To ensure accuracy, it is advisable to take your time completing the form and cross-check all entries with valid documentation. If you realize you’ve submitted an inaccurate form, there are procedures for correcting errors, such as filing an amended return.

Interactive tools for using the 2025 Schedule Form

Utilizing interactive tools can significantly ease the burden of filling out the 2025 Schedule Form. pdfFiller offers a variety of features designed for efficient document management which makes the process more intuitive.

How to use the interactive PDF editor

The interactive PDF editor allows users to edit, sign, and collaborate directly within the document. You can easily fill in fields, add digital signatures, and annotate where needed—all from a cloud-based platform. This flexibility is particularly beneficial for teams working collaboratively on tax submissions or individuals seeking to ensure compliance with complex requirements.

Utilizing pdfFiller’s cloud-based options

With pdfFiller’s cloud technology, users can access their documents anytime and anywhere, making it easy to manage and track changes. Version control becomes a breeze, allowing seamless revision tracking that supports accuracy and reduces miscommunication.

Understanding the implications of your submission

Once the 2025 Schedule Form is filed, it enters a processing phase where the IRS reviews the submission against their records. Understanding what happens post-filing is crucial, as this can determine the timeline for any potential refunds or additional actions required.

Typically, taxpayers should expect to wait a few weeks to receive notifications. Be prepared for potential follow-up actions, like additional information requests, especially in complicated cases. Keeping meticulous records will assist in any clarity needed during follow-ups.

Related forms and resources

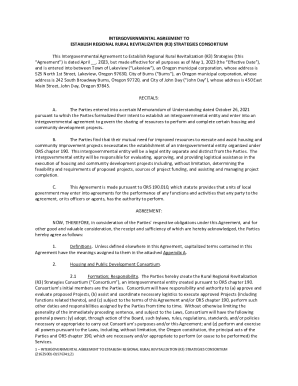

Navigating tax forms can often involve more than just the Schedule Form. Other relevant forms, like Schedule A and Schedule B, may also be necessary for establishing complete income and deduction reports. Familiarizing yourself with these documents can help in comprehensive tax preparation.

Several resources exist for the 2025 tax preparation period, including IRS publications and guides on specific deductions. Awareness of these resources aids taxpayers in making informed declarations and optimizing their submissions.

Exploring additional assistance options

Finding help while managing the 2025 Schedule Form isn’t challenging. Tax professionals can offer significant insights, especially for complex financial scenarios. Consulting a tax professional can ensure that you adequately navigate state and federal tax laws without missing critical deductions.

Additionally, engaging with online support forums and tutorials can offer peer assistance. pdfFiller also offers guidance on utilizing its tools, making it easier to understand the full functionality of the platform for efficient form management.

Success stories: Individuals who have mastered their 2025 Schedule Form

Many individuals have successfully navigated the complexities of the 2025 Schedule Form through a combination of diligence and effective tools. Users often report that the features of pdfFiller have significantly facilitated document management, allowing them to focus more on analytic aspects of their financial reporting.

Real-life experiences emphasize staying organized and using available technology to streamline processes. Factors such as collaboration and ease of access contribute to successful outcomes, showcasing how proper resources can empower taxpayers to master their submissions.

People Also Ask about

Where can I get a hard copy of 1040 instructions?

How do I get tax forms and instructions?

Where do I enter the stimulus check on my taxes?

How do I find my income tax on 1040?

How do I prepare a 1040?

How do I fill out a Schedule I?

What is schedule a form?

What do I put on line 30 for recovery rebate credit?

Can I file 1040 by myself?

What are the instructions for line 30 on Form 1040?

What is the easiest 1040 form?

What is the difference between 1040 A and 1040?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 1040 Schedule 8812 Instructions from Google Drive?

How can I edit IRS 1040 Schedule 8812 Instructions on a smartphone?

How do I edit IRS 1040 Schedule 8812 Instructions on an Android device?

What is 2025 instructions for schedule?

Who is required to file 2025 instructions for schedule?

How to fill out 2025 instructions for schedule?

What is the purpose of 2025 instructions for schedule?

What information must be reported on 2025 instructions for schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.