Get the free Providing Low-Income Fare Discounts at Public Transit Agencies

Get, Create, Make and Sign providing low-income fare discounts

Editing providing low-income fare discounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out providing low-income fare discounts

How to fill out providing low-income fare discounts

Who needs providing low-income fare discounts?

Providing Low-Income Fare Discounts Form: A Comprehensive Guide

Understanding low-income fare discounts

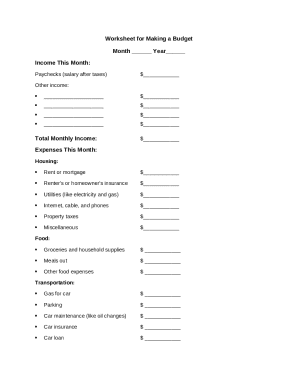

Low-income fare discounts are specially designed rates that enable individuals or families living on limited incomes to access transportation services at a reduced cost. This approach acknowledges the financial burdens that many residents face, particularly in urban areas where transportation is essential for employment, education, and healthcare access.

These discounts matter significantly for affordable mobility as they promote equity in public transportation systems, ensuring that lower-income riders can access essential services without exorbitant costs. Various regions implement these fare discounts differently, with some offering significant reductions on bus passes and other transit options. Understanding the local fare discount programs is crucial for low-income individuals to maximize their transportation options.

Eligibility criteria for low-income fare discounts

Eligibility for low-income fare discounts typically depends on specific income requirements. Many programs require that applicants demonstrate their family income is at or below a certain percentage of the federal poverty level. This percentage can vary based on the area and individual circumstances.

Documentation needed to verify eligibility generally includes pay stubs, tax returns, or other income verification forms. Residents may also need to provide proof of residency to ensure they qualify for local fare discounts. Additionally, many regions implement specific programs targeting different demographics, including seniors, students, and individuals with disabilities.

How to access the low-income fare discounts form

Accessing the low-income fare discounts form is most straightforward when using online resources provided by your local transit department. Typically, these forms are located in a designated section of your city’s public transportation website, often under fare discounts or assistance programs.

For individuals who prefer mobile access, many transit services now offer apps where users can conveniently find and fill out the low-income fare discounts form. Additionally, local offices may have physical copies of the form available for applicants who prefer in-person assistance.

Filling out the low-income fare discounts form

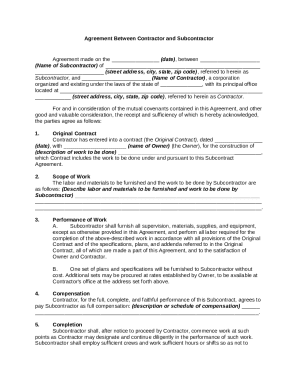

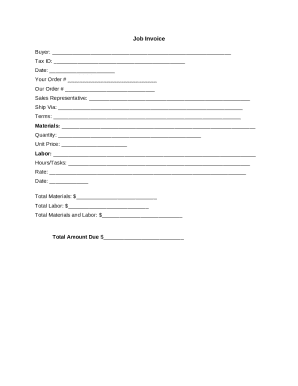

Navigating the form can be straightforward if you understand its layout. Typically, forms are divided into several sections that ask for personal information, income details, and the specific discount you're applying for. Key information needed may include your name, address, income sources, and proof of residency.

To ensure accuracy when completing the form, consider these tips: Verify your income details against the requirements, and ensure all provided information is accurate and matches your supporting documents. Additionally, common mistakes to avoid include leaving sections blank or misrepresenting your income. Providing clear and legible information will help prevent delays in processing your application.

Submitting your low-income fare discounts form

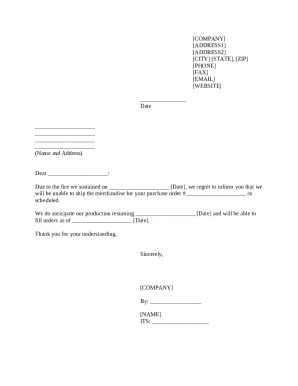

Once you've completed your low-income fare discounts form, the next step is submission. There are various submission methods available depending on your preference. Many online platforms allow you to electronically submit your application, which can expedite processing times.

For mail-in submissions, ensure that you send your application to the correct address provided on the form, and consider using a trackable mailing option. If you prefer in-person submissions, many local transit offices will accept applications directly. After submission, you should receive a confirmation of your application — it’s important to follow up if you do not hear back in a reasonable amount of time.

Managing your low-income fare discounts account

After your low-income fare discounts account is created, it’s essential to manage it effectively. You can usually track the status of your application through the transit department's website or via the app you used to apply. Keeping your contact details updated helps prevent communication issues.

If your financial situation changes, be proactive and update your account information accordingly. Failing to do so could affect your eligibility for fare discounts. Additionally, many programs will require annual renewal to maintain your benefits, so be sure to note renewal dates to avoid lapsing.

Frequently asked questions (FAQs)

Processing times for the low-income fare discounts form can vary by region, but expect to hear back within a few weeks. If your application is denied, it’s important to read the reasoning given and consider whether you can provide additional documentation to support your case.

Many programs offer an appeal process for denied applications, allowing you to present your case again. Additionally, applying for multiple discounts across different services is often permitted, provided you meet the eligibility requirements for each program.

Helpful links and resources

Various official websites provide extensive resources for low-income fare discount programs. These sites typically include detailed eligibility criteria, application forms, and contact information for local agencies that can provide additional assistance. Engage with community organizations that focus on transportation solutions as they may offer resources tailored to your area.

By exploring these resources, individuals can gain valuable insights into navigating the system and utilizing available assistance effectively. Check if your local transit providers have dedicated sections on their websites for preferred access.

Using pdfFiller for your document needs

Utilizing pdfFiller streamlines the process of handling the low-income fare discounts form and other essential documents. This powerful platform allows users to edit, eSign, and collaborate on forms easily from any device, enhancing document management and reducing time spent on paperwork.

With pdfFiller, you can fill out state-specific forms effortlessly, ensuring that you are always using the correct version. The platform provides interactive tools that facilitate easy document management, offering reminders for renewals and detailed tracking of submission status.

Community stories and testimonials

Numerous users have shared their experiences with low-income fare discounts, illustrating the significant impact these programs have on community mobility. Many stories highlight how access to affordable transportation has transformed lives, allowing individuals to attend jobs, school, or medical appointments with ease.

The importance of accessible transportation for low-income households cannot be overstated, as these programs not only save money but also enable families to thrive in their everyday lives. By hearing real-life testimonials, potential applicants can better understand the benefits of applying for low-income fare discounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out providing low-income fare discounts using my mobile device?

Can I edit providing low-income fare discounts on an iOS device?

How do I complete providing low-income fare discounts on an Android device?

What is providing low-income fare discounts?

Who is required to file providing low-income fare discounts?

How to fill out providing low-income fare discounts?

What is the purpose of providing low-income fare discounts?

What information must be reported on providing low-income fare discounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.