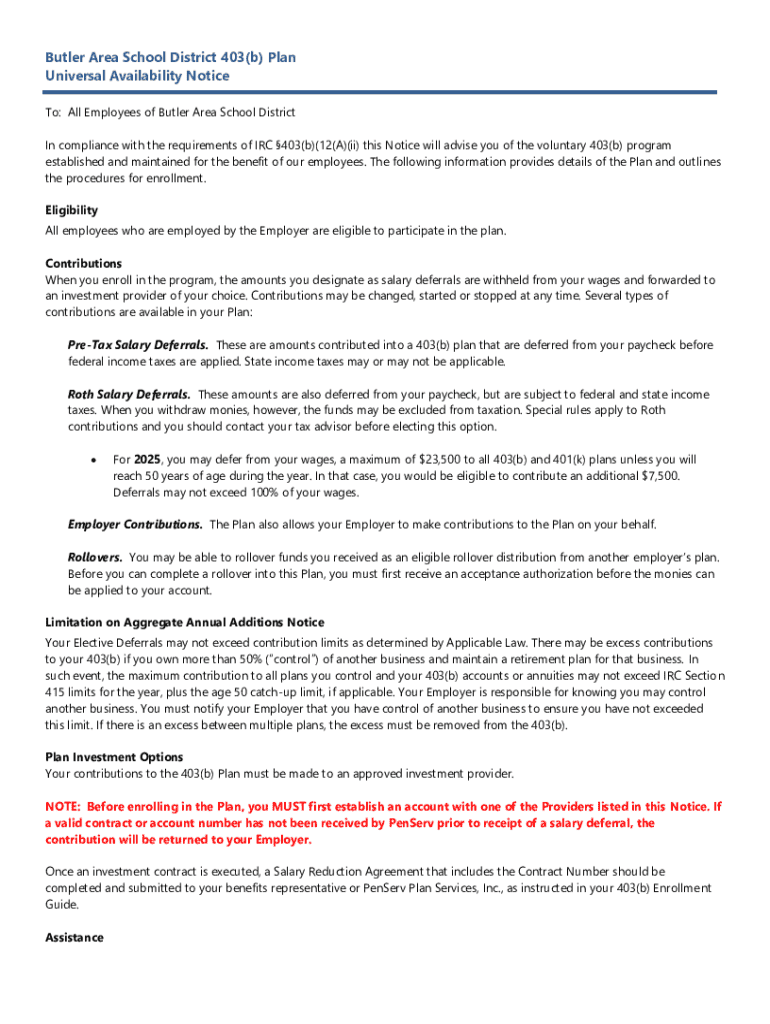

Get the free Form: 403(b) Plan Eligibility Notice

Get, Create, Make and Sign form 403b plan eligibility

Editing form 403b plan eligibility online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 403b plan eligibility

How to fill out form 403b plan eligibility

Who needs form 403b plan eligibility?

A comprehensive guide to the 403b plan eligibility form

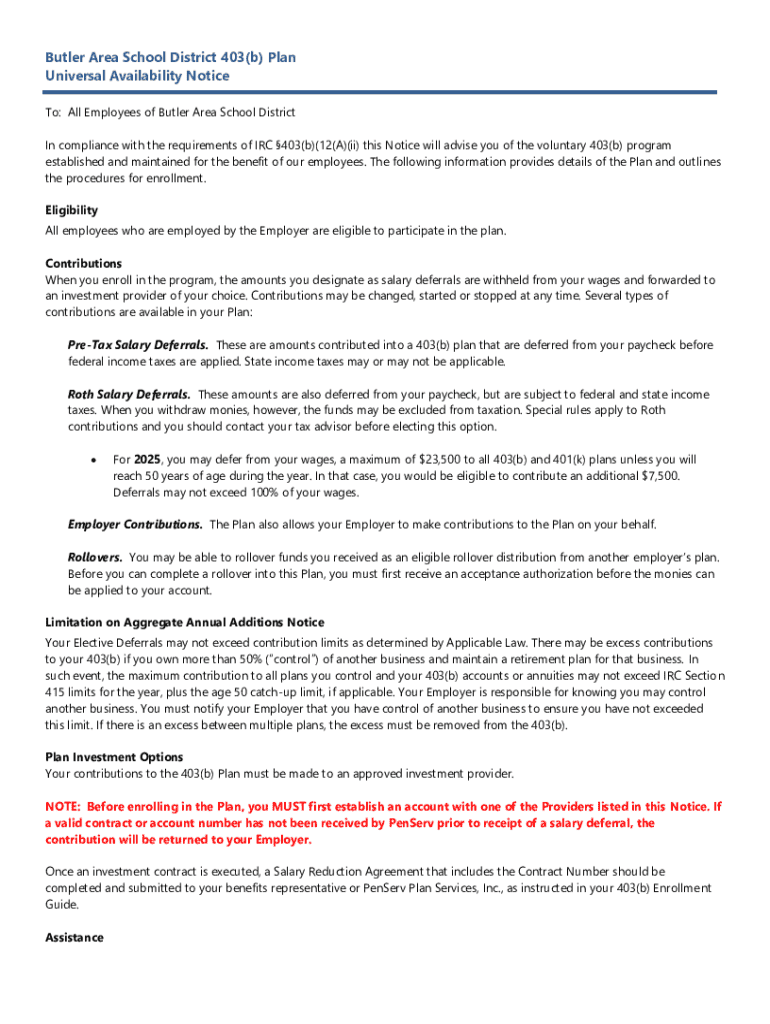

Understanding the 403b plan

A 403b plan is a tax-advantaged retirement savings plan designed specifically for employees of public schools and certain tax-exempt organizations. Unlike a 401k, which is typically offered by for-profit companies, the 403b plan serves a different demographic and provides unique benefits tailored for educators and nonprofit workers.

The purpose of the 403b plan is to encourage long-term savings for retirement. Participants can contribute a portion of their pre-tax income, enabling them to defer taxes on the funds until withdrawal, which typically occurs in retirement.

Benefits of participating in a 403b plan

Participating in a 403b plan comes with numerous advantages. Firstly, the tax benefits allow participants to contribute pre-tax income, lowering current taxable income, which can lead to significant tax savings. Secondly, many employers offer matching contributions, increasing the potential for a more robust retirement fund.

Moreover, participants in 403b plans enjoy flexibility regarding investment choices. Options often include various mutual funds and annuities, allowing individuals to tailor their investments according to their risk tolerance and retirement goals.

Determining your eligibility for a 403b plan

Eligibility for a 403b plan primarily depends on your employment status. Generally, employees of public schools and certain non-profit organizations are eligible to participate. Understanding who qualifies ensures that potential participants can take full advantage of the benefits offered by these plans.

Key employees, including highly compensated individuals, may face specific considerations regarding participation. It's crucial for employees to verify their eligibility status with HR professionals or the organization's financial planner.

Age and service requirements

Most 403b plans have specific age and service time requirements that individuals must meet to become eligible. Typically, you need to be at least 21 years old, but some plans may allow participation upon employment, regardless of age.

Service time considerations can also play a significant role in eligibility. Some plans may require you to be employed for a designated period, while others may allow immediate entry upon hire.

Special cases

While full-time employees often have clear eligibility criteria for 403b plans, part-time employees and adjunct faculty might find their status more complex. In many cases, part-time staff may still qualify for participation as long as their employers offer the plan.

Additionally, adjunct faculty at universities may also be eligible, depending on the institution's policies. Understanding these nuances can help more employees benefit from the advantages of 403b plans.

Navigating the 403b plan eligibility form

The 403b plan eligibility form is a critical document for individuals seeking to enroll in the plan. It not only enables enrollment but also plays a vital role in ensuring compliance with the applicable regulations. Filling out the form correctly can smooth the onboarding process, enabling timely access to retirement savings.

Being familiar with the key sections of the form is essential. Each segment usually asks for personal details, employment specifics, and selections concerning the investment plan. Completing these sections accurately reduces the likelihood of delays or issues.

Key sections of the form

When filling out the 403b plan eligibility form, several key sections need to be addressed. The first is personal information, which includes your full name, social security number, and contact information. This section is vital as it links you and your future contributions to the plan.

Another crucial part is employment information, where you'll indicate your position, employer, and service time. Lastly, plan selection requires you to choose the investment options you wish to pursue in the plan.

Step-by-step instructions for completing the form

Completing the 403b plan eligibility form requires careful attention to detail. Start by gathering necessary documentation, such as proof of employment and identification. Once you have everything on hand, you can fill out the personal and employment sections clearly and legibly.

Before submission, double-check the form for accuracy and compliance. Ensuring that all information is correct not only expedites the review process but also minimizes the risk of discrepancies that could impact your enrollment.

Common challenges and solutions

Eligibility verification can sometimes pose challenges, particularly if there are discrepancies in employment data. Employees may encounter issues related to inconsistent records; consulting with your HR department or using internal resources can help clarify your eligibility status.

Additionally, timely submission of the form is crucial to ensure that you don't miss out on benefits. Keeping track of deadlines and utilizing reminders can aid in managing the submission process efficiently.

Utilizing interactive tools for managing your 403b plan

Platforms like pdfFiller offer a seamless solution for editing, signing, and managing your 403b plan eligibility form. By leveraging online form management tools, individuals can enhance efficiency and simplify the paperwork process significantly.

Using such platforms not only allows for easy editing but also supports collaboration, making it easier to share forms with advisors or team members while ensuring compliance with necessary regulations.

How to use pdfFiller for form management

To effectively manage your 403b plan eligibility form using pdfFiller, start by uploading the form to the platform. You can then edit it easily and customize it based on your specific information and needs.

Once customized, the form can be shared securely with others for collaboration. The platform enables you to save your completed documents in a safe manner, ensuring that you have access whenever needed.

Resources for staying informed on 403b plans

Staying updated on regulatory changes impacting 403b plans is vital for participants. Regulations can shift, affecting contributions and plan management. Regularly checking official government websites can aid in staying informed about these developments.

Additionally, educational webinars and workshops can be invaluable resources, providing insights into complex topics surrounding retirement planning. Subscribing to resources or newsletters helps you stay connected to updates and community insights that are crucial for your financial planning.

Taking the next steps after form submission

Once you've submitted your 403b plan eligibility form, you can expect a confirmation of enrollment from your employer. This confirmation will provide details such as when your contributions will begin and any necessary steps to take moving forward.

Post-enrollment, it’s important to actively manage your 403b account. Regularly monitoring your investment performance and adjusting contributions or selections is essential to maximizing your retirement benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 403b plan eligibility online?

How can I edit form 403b plan eligibility on a smartphone?

How can I fill out form 403b plan eligibility on an iOS device?

What is form 403b plan eligibility?

Who is required to file form 403b plan eligibility?

How to fill out form 403b plan eligibility?

What is the purpose of form 403b plan eligibility?

What information must be reported on form 403b plan eligibility?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.