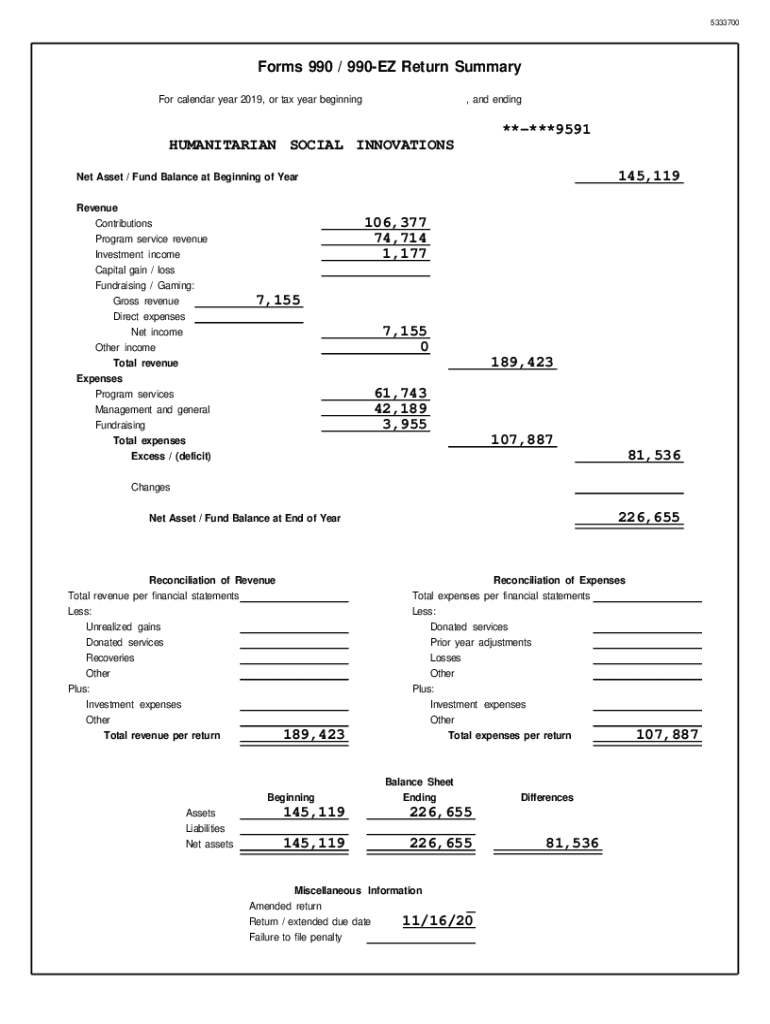

Get the free Forms 990 / 990-EZ Return Summary HUMANITARIAN SOCIAL ...

Get, Create, Make and Sign forms 990 990-ez return

Editing forms 990 990-ez return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out forms 990 990-ez return

How to fill out forms 990 990-ez return

Who needs forms 990 990-ez return?

Forms 990 and 990-EZ Return Form: A Complete Guide for Nonprofit Organizations

Understanding Form 990 & 990-EZ: What You Need to Know

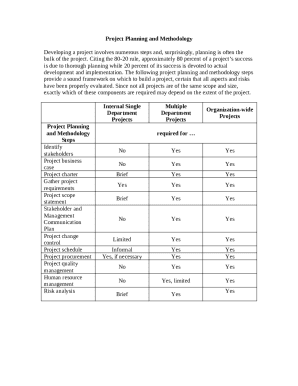

Form 990 and Form 990-EZ are essential tax forms for tax-exempt organizations in the United States. These returns provide the IRS with crucial information about an organization’s financial activities, governance, and compliance with tax-exempt regulations, helping maintain transparency within the nonprofit sector.

Form 990 caters to larger tax-exempt organizations, while Form 990-EZ is a streamlined version for smaller nonprofits. Understanding the differences between these two forms is vital for ensuring compliance and fulfilling tax obligations.

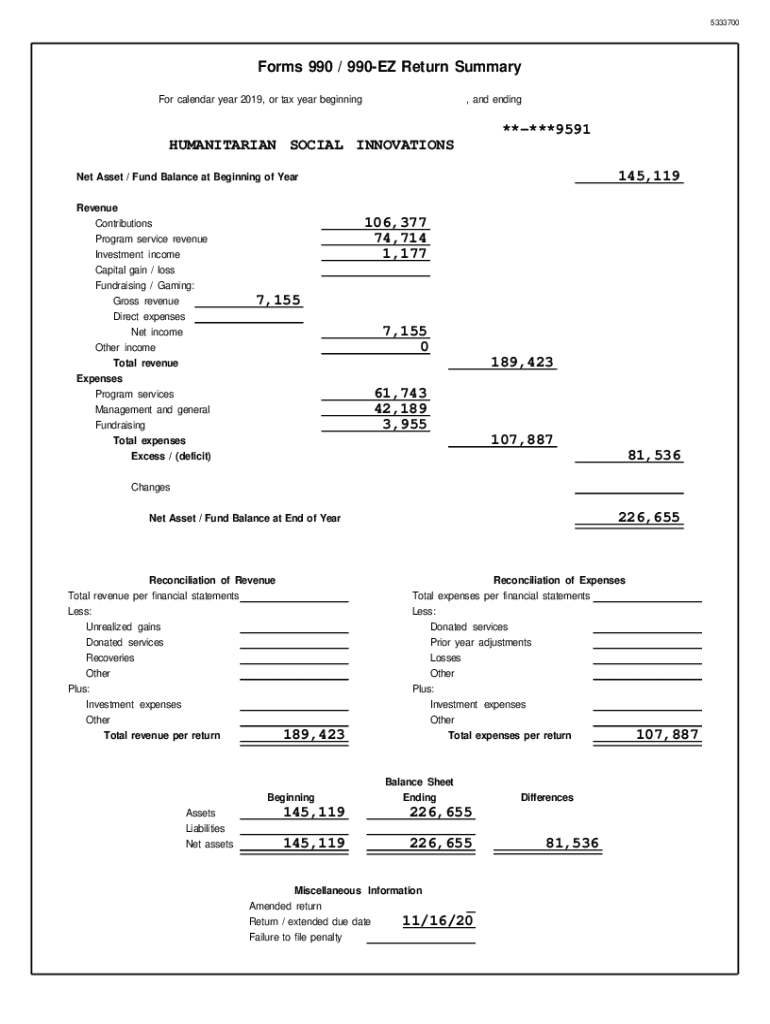

Preparing for Your Form 990/990-EZ Filing

Preparation is key when it comes to filing Forms 990 and 990-EZ. Start by gathering essential documents and information, including financial data, organizational details, and signatures from key officials such as the assistant treasurer. This ensures that you have a comprehensive overview of your financial activities and governance, which is crucial for accurate reporting.

Deadlines for filing these forms vary based on the organization’s fiscal year-end. Most organizations are required to file by the 15th day of the 5th month after their fiscal year ends. Knowing these dates can help avoid late filing penalties and complications with reporting.

Step-by-step guide to completing Form 990/EZ

Filling out Forms 990 and 990-EZ requires attention to detail. Start by clearly understanding the income reporting section. Report all income sources, including donations, grants, and earned income, accurately to reflect the organization's financial health.

Next, move on to the expense reporting section, where organizations must itemize their expenditures. By providing insights into how funds are utilized, these forms promote transparency and accountability.

Electronic filing options for Form 990/990-EZ

E-filing Forms 990 and 990-EZ offers various benefits, including faster processing, immediate confirmation, and reduced errors compared to paper filing. Nonprofit organizations are strongly encouraged to file electronically for efficiency and convenience.

The e-filing process can be streamlined using specialized software. Certain platforms, such as pdfFiller, provide user-friendly interfaces and templates specifically for nonprofit filings. This helps organizations to ensure compliance while making the filing process significantly easier.

Interactive tools for form management

Utilizing pdfFiller’s interactive features can greatly enhance your experience when managing Forms 990 and 990-EZ. With innovative tools like PDF editing capabilities, organizations can customize their forms to fit specific needs while maintaining compliance with IRS guidelines.

Additionally, eSignature functionality allows for seamless digital signatures to ensure that all necessary parties approve the documents quickly, eliminating unnecessary delays. Collaboration tools enable team members to work together, making the filing process smoother and more efficient.

Post-filing considerations

After submitting Forms 990 and 990-EZ, it’s important to confirm that your submission has been received. The IRS provides confirmation notifications, so be sure to keep an eye on communications. Keeping thorough records of your filings, along with all supporting documentation, will help in future filings and audits.

Organizations should also prepare for possible IRS inquiries, which may arise if there are discrepancies in the filings. Having detailed records and supporting documents can streamline responses to any inquiries, preserving the organization's reputation and tax-exempt status.

FAQs about filing Form 990/990-EZ

Many questions arise when nonprofits consider filing Forms 990 and 990-EZ. Common queries include when to file, which form to use, and what information is required. Addressing these frequently asked questions ensures nonprofits are well-prepared and mitigates common filing errors.

It’s also essential to clarify myths surrounding nonprofit tax returns, such as misconceptions that all nonprofits are exempt from filing. In reality, maintaining tax-exempt status requires consistent and accurate filings.

Final thoughts on managing your tax obligations

Staying organized throughout the year is critical for nonprofits. Regularly updating records and preparing for the filing season can alleviate last-minute stress and ensure accurate reporting. Leveraging tools such as pdfFiller can significantly aid in ongoing document management and compliance with IRS requirements, making tax preparation smoother.

By utilizing a reliable, cloud-based document solution, organizations can focus on their mission rather than worrying about paperwork. Remember, proactive management of your tax obligations reflects well on your nonprofit and strengthens your position within the community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify forms 990 990-ez return without leaving Google Drive?

How can I edit forms 990 990-ez return on a smartphone?

How do I fill out forms 990 990-ez return using my mobile device?

What is forms 990 990-ez return?

Who is required to file forms 990 990-ez return?

How to fill out forms 990 990-ez return?

What is the purpose of forms 990 990-ez return?

What information must be reported on forms 990 990-ez return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.