Get the free gLB I G81 -SBBSUL'rU B

Get, Create, Make and Sign glb i g81 -sbbsul039ru

How to edit glb i g81 -sbbsul039ru online

Uncompromising security for your PDF editing and eSignature needs

How to fill out glb i g81 -sbbsul039ru

How to fill out glb i g81 -sbbsul039ru

Who needs glb i g81 -sbbsul039ru?

A comprehensive guide to the GLB G81 -SBBSUL039RU Form

Understanding the GLB G81 -SBBSUL039RU form

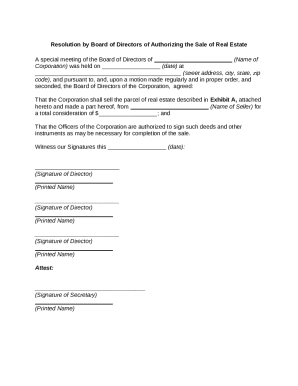

The GLB I G81 -SBBSUL039RU form is a critical document in various business and administrative settings. Typically designated for compliance-related processes, this form serves as a declaration or report that captures essential information relevant to a regulatory or corporate need. It is commonly used in scenarios involving audits, financial reporting, or regulatory submissions, where precise data is not just preferred but required.

Accurate completion of the GLB I G81 -SBBSUL039RU form is vital, as inaccuracies can lead to legal repercussions, financial penalties, or even delays in processing critical documents. Entities utilizing this form must understand not only its content but also the implications of errors, ensuring compliance with applicable laws and standards.

Essential features of the GLB G81 -SBBSUL039RU form

The GLB I G81 -SBBSUL039RU form comprises several key components designed for clarity and ease of use. The form is structured into clear sections that help guide the user through the information required. Each section is filled with critical fields that, when populated accurately, create a comprehensive overview of the necessary details.

In recent years, digital tools have transformed how we fill forms. pdfFiller offers interactive capabilities that enhance the user experience, including auto-fill options and guided prompts, which alleviate the complexity synonymous with traditional paper-based forms.

Step-by-step instructions for filling out the GLB G81 -SBBSUL039RU form

Before diving into the form, gathering all required documents and information is crucial. This includes financial records, identification documents, and any previous reports relevant to the current submission. By preparing diligently, you can simplify the filling-out process considerably.

Common mistakes include overlooking mandatory fields or providing outdated information. It is essential to verify details and cross-reference against original documents.

Editing the GLB G81 -SBBSUL039RU form

After filling out the GLB I G81 -SBBSUL039RU form, you may find the need to make changes. pdfFiller provides an array of editing tools that allow users to modify specific sections seamlessly. It is advisable to keep track of modifications as this ensures that the final version meets all compliance criteria.

Best practices for effective edits include maintaining clarity in language and ensuring that the revisions adhere to legal standards. Finalizing your document before submission will enhance its professionalism.

Signing the GLB G81 -SBBSUL039RU form

Signing the GLB I G81 -SBBSUL039RU form carries legal weight, and pdfFiller makes this process efficient through eSigning capabilities. With legally valid electronic signatures, users can affirm their agreement to the contents of the form without the hassle of printing or scanning.

Collaborative features enable team sign-offs, facilitating approval processes. You can invite multiple parties to review and sign off, enhancing visibility and accountability throughout the signing process.

Managing your GLB G81 -SBBSUL039RU form after completion

Once you have completed and signed the GLB I G81 -SBBSUL039RU form, effective management of the document is essential. pdfFiller provides storage solutions that allow you to organize forms in your account based on categories or date of completion. This organized approach facilitates easy retrieval when needed.

These management tools enhance your productivity while ensuring that sensitive documents remain secure.

Frequently asked questions about the GLB G81 -SBBSUL039RU form

Users often encounter common inquiries related to the GLB I G81 -SBBSUL039RU form. One frequent question revolves around how discrepancies in data should be handled. In situations where data mismatches occur, users are advised to double-check all entries against original documentation before resubmitting the form.

Expert users recommend regularly consulting user guides or reaching out to support to obtain clarity on any complex features.

User reviews and experiences

The reception of the GLB I G81 -SBBSUL039RU form among individuals and teams has largely been positive. Users appreciate the interface's intuitiveness, noting how easy it is to fill out and submit the form electronically. The functionality streamlines their workflow, allowing for rapid adaptation to the changing demands of document management.

Case studies illustrate successful navigation through complex document requirements, showcasing the GLB I G81 -SBBSUL039RU form's adaptability and effectiveness in diverse situations.

Related forms and templates

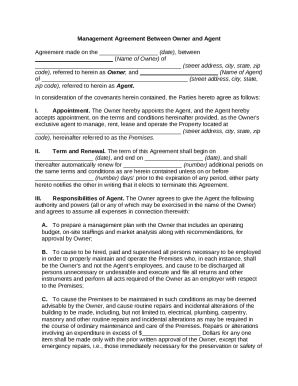

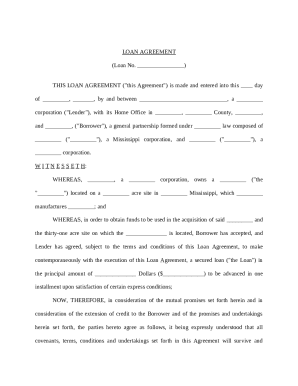

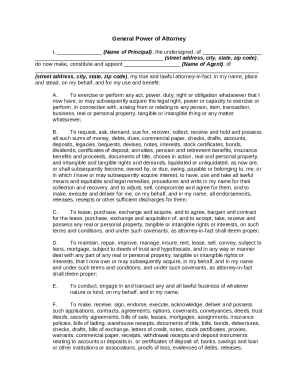

Several forms complement the GLB I G81 -SBBSUL039RU, serving similar functions or addressing associated organizational needs. Examples include forms for financial disclosures, compliance audits, and regulatory filings. Each of these forms presents specific structures and requirements tailored to its intended purpose.

To enhance document management further, pdfFiller offers additional tools that support users in organizing and accessing a variety of templates and forms efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send glb i g81 -sbbsul039ru to be eSigned by others?

How do I fill out the glb i g81 -sbbsul039ru form on my smartphone?

How do I fill out glb i g81 -sbbsul039ru on an Android device?

What is glb i g81 -sbbsul039ru?

Who is required to file glb i g81 -sbbsul039ru?

How to fill out glb i g81 -sbbsul039ru?

What is the purpose of glb i g81 -sbbsul039ru?

What information must be reported on glb i g81 -sbbsul039ru?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.