Get the free Tax Return Questionnaire Form Template

Get, Create, Make and Sign tax return questionnaire form

Editing tax return questionnaire form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax return questionnaire form

How to fill out tax return questionnaire form

Who needs tax return questionnaire form?

Tax return questionnaire form: A comprehensive guide for efficient filing

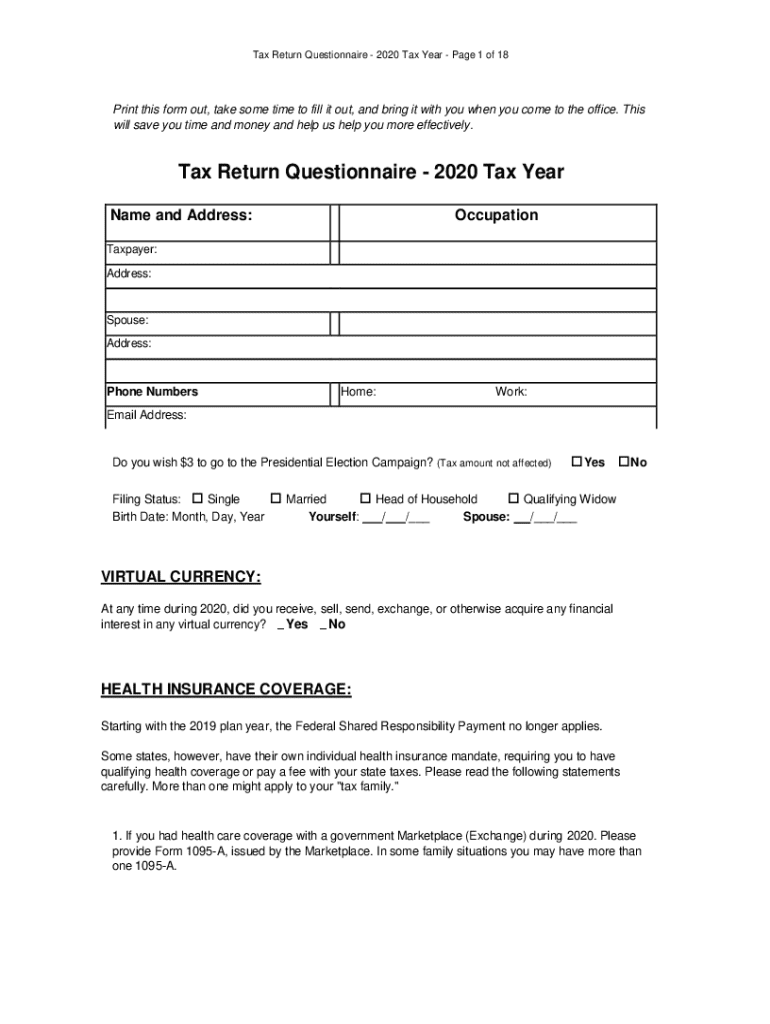

Understanding the tax return questionnaire form

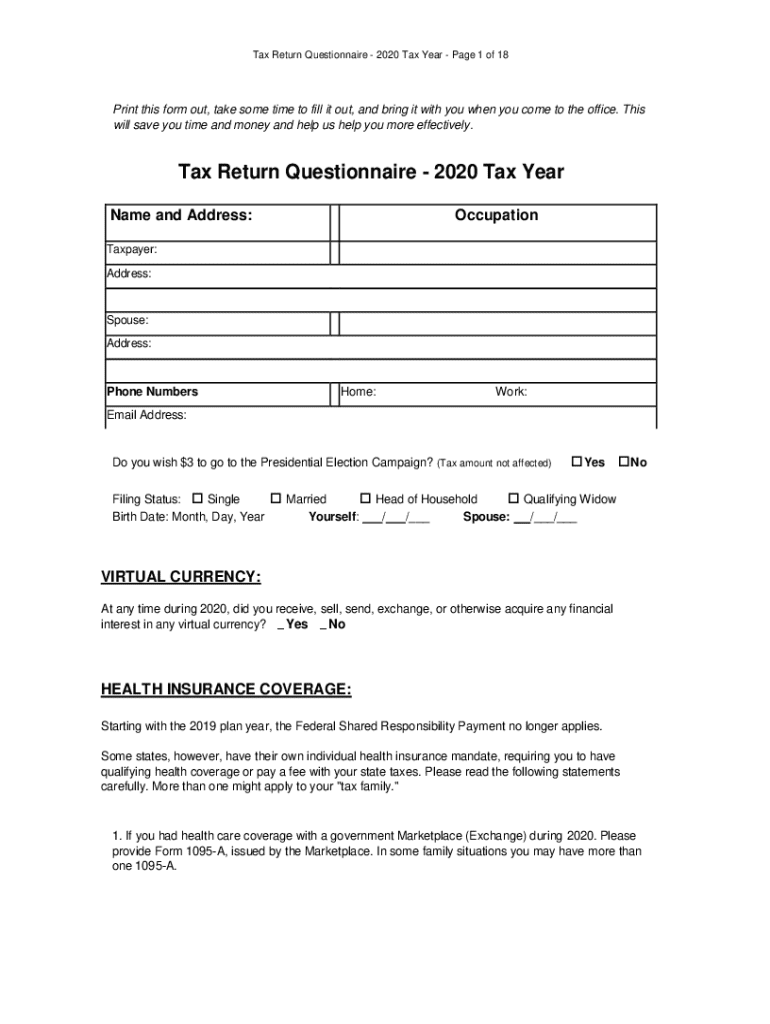

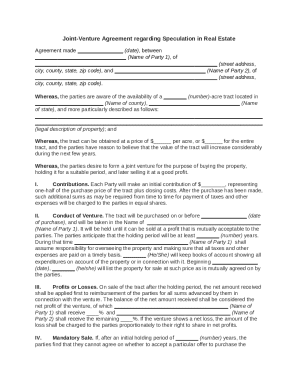

A tax return questionnaire form is a pivotal document utilized during the tax filing process. It serves as a comprehensive overview of your financial situation, collecting essential information that is necessary for accurate tax filing. By filling out this questionnaire, individuals and businesses can streamline their tax return preparation, ensuring no critical details are overlooked.

The importance of the tax return questionnaire form cannot be overstated. It acts as a guide, prompting users to provide necessary information regarding their income, deductions, and credits. This process not only facilitates seamless filing but also maximizes potential refunds or minimizes tax liabilities.

Anyone filing taxes—individuals, business owners, self-employed professionals—should use this form. It is applicable to both simple and complex financial situations, ensuring that all necessary details are accounted for.

Key components of the tax return questionnaire form

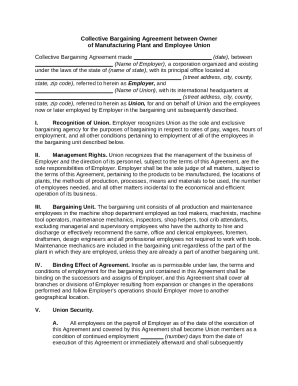

The tax return questionnaire form comprises several key components designed to gather pertinent information. The first section focuses on personal information, which includes vital details necessary for tax identification.

Next is the income information section. Here, taxpayers will list different sources of income such as employment earnings, income from a business, and investment income. Understanding how to document this income is vital for ensuring that everything is captured accurately.

Lastly, the deductions and credits section outlines possible tax benefits available to you. It’s crucial to know common deductions, such as medical expenses and mortgage interest, as well as the different types of tax credits you may qualify for. This information can dramatically affect your overall tax liability.

Step-by-step guide to completing the tax return questionnaire form

Completing the tax return questionnaire form can seem daunting, but breaking it down into manageable steps can simplify the process significantly.

Digital tools for easier form management

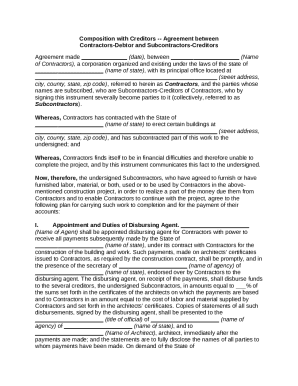

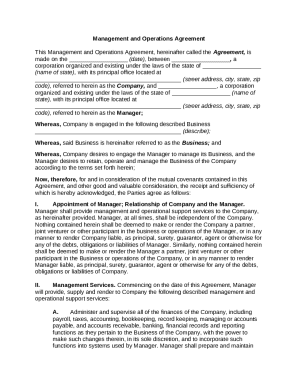

In the digital age, tax filing can be made easier with various online tools. Digital document solutions like pdfFiller provide an intuitive platform for managing your tax return questionnaire form.

Using pdfFiller enables users to edit PDFs with ease, ensuring that your tax questionnaire is up to date. The platform also supports e-signing capabilities, eliminating the need for physical signatures and expediting submissions.

Moreover, pdfFiller offers real-time collaboration features, allowing multiple parties—like business partners or tax preparers—to work on the document simultaneously, which is beneficial for larger teams.

Frequently asked questions (FAQ) about the tax return questionnaire form

Navigating the tax filing process often leads to common questions and concerns. Addressing these can alleviate anxiety and improve the filing experience.

Best practices for a smooth tax filing experience

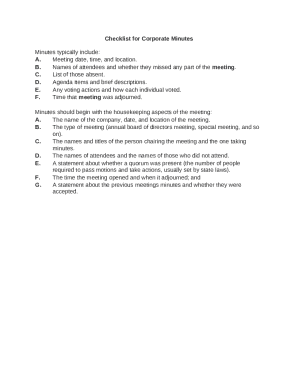

To ensure a stress-free tax filing experience, effective time management strategies come into play. Start preparing your documents well before the deadline.

Stay organized; create a checklist of forms and receipts needed for your tax return questionnaire form. Additionally, be aware of common pitfalls, such as overlooking income sources or neglecting to claim certain deductions, and aim to double-check your work to minimize errors.

Additional insights into tax season preparation

Preparing for tax season doesn't start and end in April. Proactive steps throughout the year can simplify future tax returns. Track your financial documents as they come in, and categorize them for easy access during tax time.

Staying informed about tax law changes is equally essential. New laws can affect deductions and credits, so subscribe to IRS newsletters or follow trusted financial blogs for updates.

Engaging with tax professionals: When and how

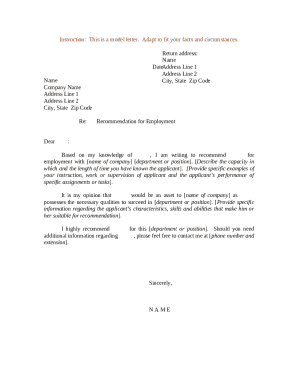

Recognizing when to consult a tax professional can save time and money, especially if your financial situation becomes complex. Look for signs that indicate the need for professional help, such as significant life changes like marriage, divorce, or starting a business.

When selecting a tax preparer, consider asking vital questions about their experience, fees, and approach to tax planning. Establish clear communication to ensure that your tax advisor efficiently understands your financial situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax return questionnaire form in Gmail?

How can I send tax return questionnaire form to be eSigned by others?

Can I sign the tax return questionnaire form electronically in Chrome?

What is tax return questionnaire form?

Who is required to file tax return questionnaire form?

How to fill out tax return questionnaire form?

What is the purpose of tax return questionnaire form?

What information must be reported on tax return questionnaire form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.