Get the free Questionnaire - Kenney Tax & Accounting .LLC

Get, Create, Make and Sign questionnaire - kenney tax

How to edit questionnaire - kenney tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out questionnaire - kenney tax

How to fill out questionnaire - kenney tax

Who needs questionnaire - kenney tax?

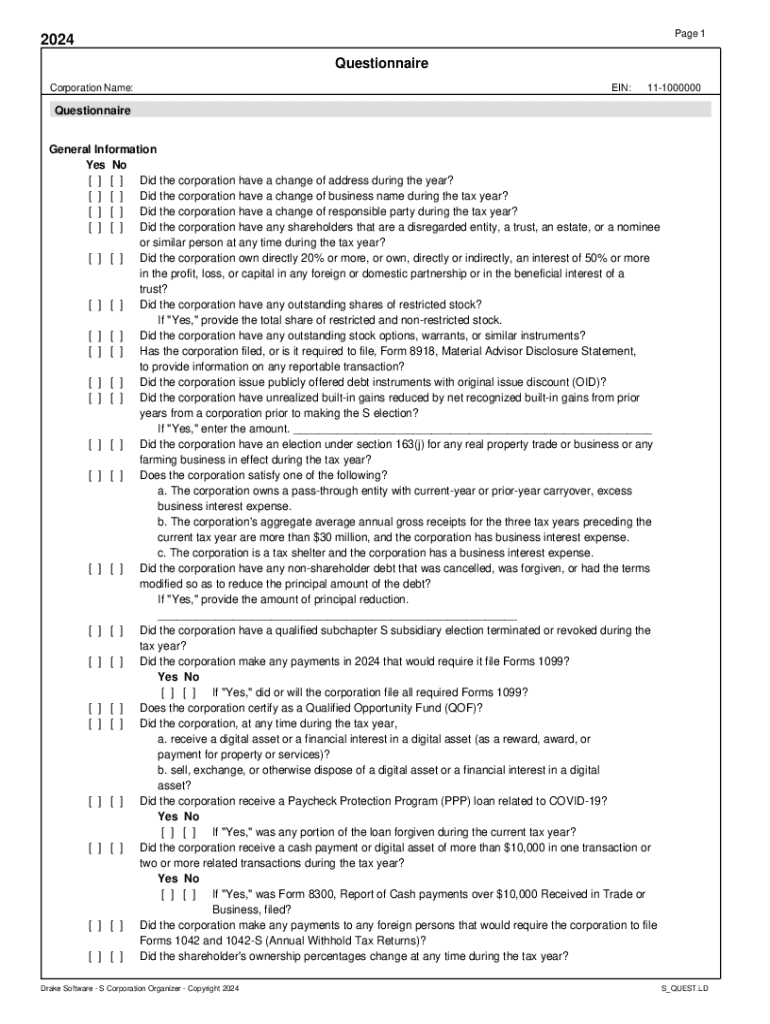

Comprehensive Guide to the Questionnaire - Kenney Tax Form

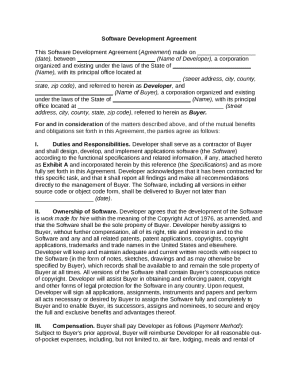

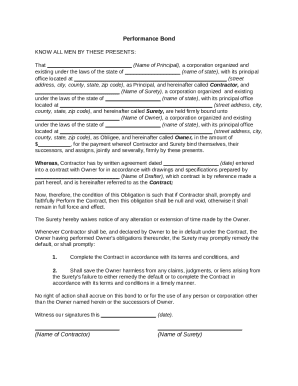

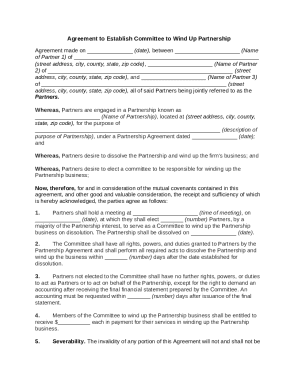

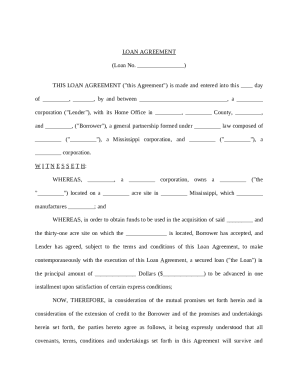

Overview of the Kenney Tax Form

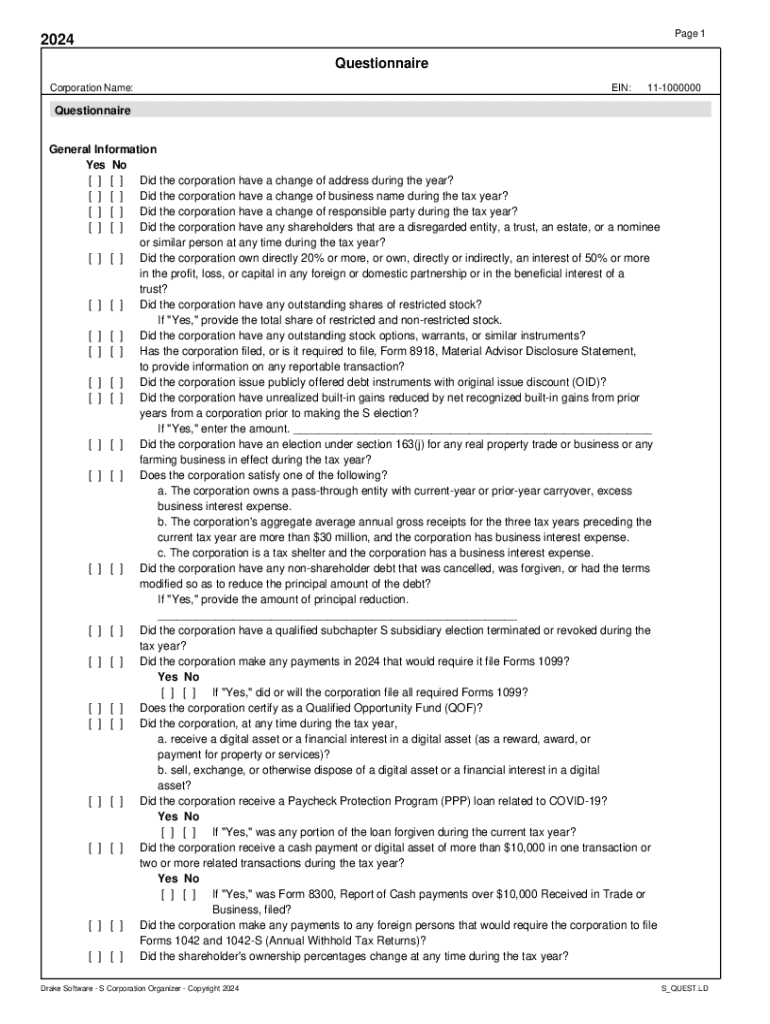

The Kenney Tax Form is a specialized document intended for reporting essential financial information for tax purposes. It is designed to simplify the tax filing process for individuals and businesses alike, ensuring that all relevant financial data is captured systematically. This form is particularly significant in aiding users to claim eligible deductions and credits, ultimately impacting their tax liabilities.

Understanding the importance of the Kenney Tax Form is crucial. For businesses, it's not just about compliance; it's a strategic tool that can optimize tax obligations. Individuals benefit by ensuring they maximize potential refunds or minimize owed amounts through accurate representations of financial situations.

The Kenney Tax Form is aimed at a wide audience. This includes self-employed individuals, small business owners, and employees with complex financial situations. Common scenarios for usage include filing for tax credits, reporting multiple income streams, or managing self-employment tax responsibilities.

Understanding the components of the Kenney Tax Form

To fill out the Kenney Tax Form effectively, one must understand its components. The required information spans several categories, beginning with identification details such as name, address, and Social Security number, which are essential for accurate tax record-keeping. The form also requires an overview of financial information, including income sources, expenses, and any applicable deductions.

Each section of the form plays a pivotal role. For instance, the Personal Information section captures fundamental identifiers, while the Income Reporting section breaks down various income streams like wages, rental income, and self-employment earnings. Additionally, the Deductions and Credits section allows users to claim eligible expenses and credits that can significantly reduce taxable income. Lastly, the Payment Information segment outlines how payments should be made if taxes are owed.

Unique elements in the Kenney Tax Form include features that prompt specific analyses and requests for data which streamline the reporting process. This can help taxpayers identify overlooked credits or deductions, ensuring comprehensive reporting.

Step-by-step guide to filling out the Kenney Tax Form

Filling out the Kenney Tax Form requires careful preparation. Begin by gathering necessary documents such as W-2s, 1099 forms, and receipts for deductible expenses. Utilizing digital tools available through pdfFiller can significantly ease this process, providing a seamless experience for document management.

Once you've prepared, the completion process consists of several straightforward steps. First, logging into pdfFiller is essential. Setting up an account is quick and offers robust security features to protect sensitive information.

Common mistakes to avoid include overlooking required fields and neglecting to double-check numerical values. Many users struggle with these details, leading to potential filing issues. To enhance accuracy, utilize tools provided by pdfFiller for validation, ensuring that every field is correctly filled out before submission.

Editing and modifying your Kenney Tax Form

Once the Kenney Tax Form is filled out, editing tools available through pdfFiller offer comprehensive options for adjustment. Whether it’s correcting a misentered figure or updating personal information, these features allow for seamless revisions. Moreover, you can add comments or notes throughout the document for clarity or reminders.

Collaboration options enhance teamwork. Sharing the form with team members enables real-time editing, ensuring that feedback can be incorporated immediately. This is especially valuable for small businesses that need input from multiple stakeholders during tax season.

Saving and storing your form efficiently involves choosing cloud storage solutions that pdfFiller offers, ensuring that your document is accessible from anywhere. Implementing best practices for document management reduces the risk of lost files and simplifies retrieval during audits or follow-ups.

eSigning and finalizing your Kenney Tax Form

The eSignature is a vital part of the Kenney Tax Form submission process. eSigning verifies the authenticity and acknowledgment of the document, serving as a critical legal requirement for tax filings. The implications of failing to include an eSignature can lead to processing delays or complications with tax authorities.

Using pdfFiller, eSigning the Kenney Tax Form is straightforward. First, follow the prompt to insert your signature. If multiple signers are required, you can designate the order of signing, making the process efficient even for collaborative submissions.

After signing, ensuring correct submission is pivotal. Utilize pdfFiller’s tracking options to monitor the status of your form submission, ensuring acknowledgment from tax authorities for peace of mind.

Managing your Kenney Tax Form post-submission

After submitting the Kenney Tax Form, the next steps revolve around effective record-keeping. It's advisable to employ digital storage solutions enabled by pdfFiller, ensuring that copies of the submitted form are easily retrievable. Keeping copies is not only vital for personal records but also essential if there are disputes or audits by tax authorities.

In some instances, you may need to update or resubmit your form, particularly if new information comes to light post-filing. Knowing how to navigate amendments is crucial. pdfFiller offers guidance on these processes to ensure compliance with tax regulations and timely updates.

Resources for follow-up actions include FAQs available via pdfFiller, ensuring you have access to common inquiries and tax assistance articles that can provide further clarity on tax-related challenges.

Frequently asked questions (FAQs) about the Kenney Tax Form

When navigating the Kenney Tax Form, users often have common inquiries. For instance, what to do if you need assistance during the filling process or how to resolve discrepancies when they arise. Addressing these concerns with clarity is crucial for a smooth filing experience.

Expert insights can provide valuable guidance. Tax professionals often recommend starting the process early to allow ample time for review and correction. Another tip is to utilize available resources thoroughly, minimizing the risks of oversight that could lead to penalties.

Community insights and feedback

Community feedback is often invaluable when assessing the effectiveness of tax forms. Users frequently share their experiences with the Kenney Tax Form on forums and social platforms, discussing both successes and challenges encountered during filing.

Testimonials reflect the diverse experiences individuals and businesses have while using the Kenney Tax Form. Engaging in discussions can provide additional insights and tips, creating a shared knowledge base that enhances everyone’s filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my questionnaire - kenney tax in Gmail?

Can I create an electronic signature for signing my questionnaire - kenney tax in Gmail?

How do I edit questionnaire - kenney tax straight from my smartphone?

What is questionnaire - kenney tax?

Who is required to file questionnaire - kenney tax?

How to fill out questionnaire - kenney tax?

What is the purpose of questionnaire - kenney tax?

What information must be reported on questionnaire - kenney tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.