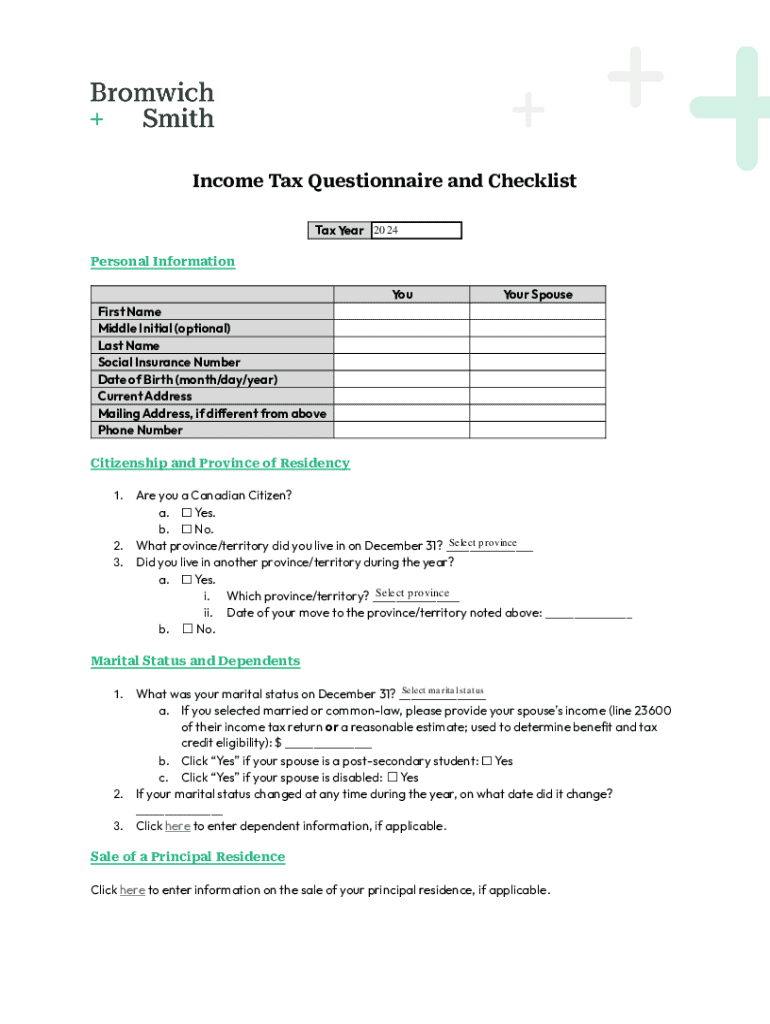

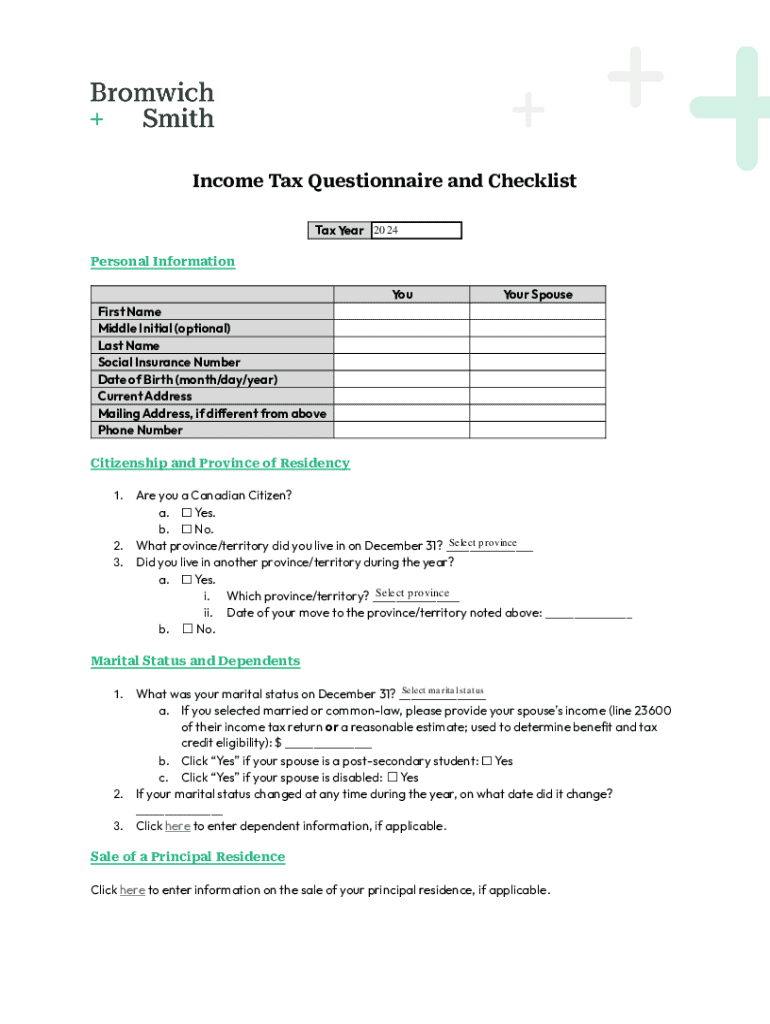

Get the free Income Tax Questionnaire and Checklist

Get, Create, Make and Sign income tax questionnaire and

How to edit income tax questionnaire and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax questionnaire and

How to fill out income tax questionnaire and

Who needs income tax questionnaire and?

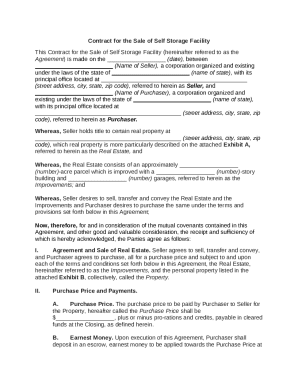

Income Tax Questionnaire and Form: A Comprehensive Guide

Understanding income tax forms

Income tax forms are essential documents required by the IRS for individuals and businesses to report their income, calculate taxes owed, and ensure compliance with tax laws. Understanding these forms is critical for accurate tax filing and maximizing potential tax benefits.

Various forms categorize the types of income and the applicable data for tax calculation. Familiarizing yourself with these forms can streamline the tax preparation process and avoid potential pitfalls.

The income tax questionnaire complements these forms by gathering specific information necessary for accurate returns, helping to identify potential deductions and credits that could reduce tax liabilities.

The income tax questionnaire: What you need to know

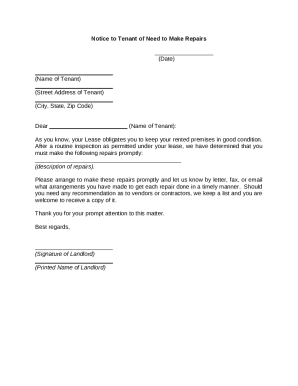

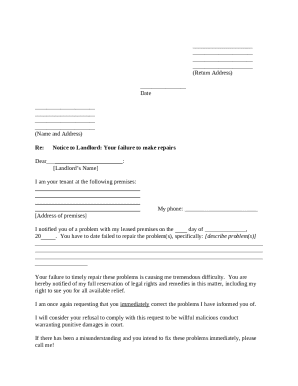

An income tax questionnaire serves as a preparatory step in the tax filing process, designed to collect relevant details to streamline the submission of tax forms. Completing this questionnaire accurately ensures that your income tax returns are precise and reflective of your financial situation.

By identifying deductions and credits, this tool can potentially save you money on your tax bill or increase your refund, making it an invaluable part of your tax preparation.

Step-by-step guide to completing the income tax questionnaire

Before diving into the income tax questionnaire, preparation is key. This means gathering all necessary documentation to ensure nothing is overlooked during the process.

Start by collecting W-2 forms from your employers, 1099s for freelance work, and receipts related to tax-deductible expenses. Organizing your financial information beforehand will make filling out the questionnaire much clearer and quicker.

As you begin filling out the questionnaire, pay special attention to each section, starting with personal information. Ensure all details are current and accurate.

Moving to the income section, report wages and any freelance income accurately. Deductions and credits should be thoroughly documented, allowing for itemized deductions or the claiming of common credits that apply to your circumstances.

Finally, review your answers for accuracy. Double-check all figures and verify that you have included all necessary supporting documents. This step can prevent costly mistakes when you submit your tax forms.

The income tax form: Completing and submitting

Once the questionnaire is complete, the next step is transferring the information to the actual income tax form. Aligning your questionnaire responses with the tax form requirements ensures a seamless filing process.

Be diligent in entering your data accurately on the tax form. After filling in all necessary information, don't forget to sign and date the form. Digital signatures are becoming increasingly popular, and using tools like pdfFiller, you can efficiently eSign your documents.

Submitting your income tax form can be done through various methods. E-filing is often the quickest and most efficient way, while mail-in procedures are still available for those who prefer traditional filing.

Interactive tools for managing your income tax documents

Having an effective system in place for managing your income tax documents is essential. Using interactive tools like pdfFiller allows you to edit and manage your tax forms effortlessly.

With pdfFiller, you can upload existing documents, collaborate with tax professionals, and securely store vital information for future reference. This not only enhances efficiency but also ensures that your documentation remains organized.

Common mistakes to avoid when filling out tax forms

When preparing your income tax forms, being aware of common mistakes can save you time and prevent future complications. One common issue is misreporting income sources. Always ensure that you provide complete and accurate income information to avoid discrepancies.

Another frequent error is missing out on eligible deductions. Many taxpayers overlook specific deductions that could significantly reduce their tax liabilities. It's essential to familiarize yourself with all possibilities.

FAQ section

Mistakes on your tax form can lead to delays and complications. If you find an error after submission, don’t panic. The IRS allows taxpayers to amend their returns, which involves filing Form 1040-X to correct inaccuracies.

For those wondering about tracking the status of their submitted tax forms, the IRS provides tools where you can check your payment status online, ensuring you're always kept in the loop regarding your filing.

Next steps after filing your taxes

Once your income tax forms have been successfully submitted, understanding the aftermath is crucial. Tax refunds may vary in timing and amount, and being prepared for this can help you plan your finances accordingly. Utilize tools like pdfFiller to organize future document needs efficiently.

Beyond the current tax year, consider saving templates for repeated processes and record keeping. This preparation can streamline next year's filing, making the process smoother and less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the income tax questionnaire and electronically in Chrome?

How can I edit income tax questionnaire and on a smartphone?

How do I fill out income tax questionnaire and on an Android device?

What is income tax questionnaire and?

Who is required to file income tax questionnaire and?

How to fill out income tax questionnaire and?

What is the purpose of income tax questionnaire and?

What information must be reported on income tax questionnaire and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.