Get the free implementation of taxpayer education in kenya

Get, Create, Make and Sign implementation of taxpayer education

Editing implementation of taxpayer education online

Uncompromising security for your PDF editing and eSignature needs

How to fill out implementation of taxpayer education

How to fill out implementation of taxpayer education

Who needs implementation of taxpayer education?

Implementation of Taxpayer Education Form

Understanding the taxpayer education form

The taxpayer education form is a structured document designed to inform and educate taxpayers about their obligations, rights, and available resources in managing their taxes effectively. This tool not only serves as a means of compliance but also fosters a better understanding of the tax system, ensuring taxpayers make informed decisions. The importance of taxpayer education cannot be overstated; with growing complexities in tax law, providing clarity through education helps reduce errors, promotes timely compliance, and encourages proactive engagement with the tax system.

Beyond just compliance, the taxpayer education form plays a critical role in raising awareness about various tax regulations, deductions, and credits that individuals may not otherwise know. This initiative also directly contributes to a more equitable tax system, where taxpayers understand their responsibilities and rights, potentially reducing tax-related disputes and fostering a collaborative relationship between taxpayers and tax authorities.

Key features of the form

The taxpayer education form consists of several key components that facilitate effective communication and engagement. Key features typically include:

Preparing to implement the taxpayer education form

Implementing a taxpayer education form starts with a foundational understanding of your audience. Identifying your audience is crucial in tailoring the content effectively. Consideration should be given to who will benefit most from such an educational tool. This could range from first-time filers to experienced professionals. Additionally, segments may include individuals or teams within organizations. Recognizing these groups will help focus educational efforts and ensure that the content is both relevant and impactful.

Assessing educational needs is the next step in this implementation process. Conducting a needs assessment can involve surveys, interviews, or focus groups to identify common misconceptions and knowledge gaps among the audience. Understand what the specific challenges they face are in relation to their tax responsibilities. This insight will allow you to address those areas directly, fostering a more informed tax culture.

Step-by-step instructions for filling out the form

Accessing the taxpayer education form is straightforward. It's typically available online through government tax websites or can be accessed through platforms like pdfFiller. Users should familiarize themselves with the navigation paths to ensure they can find the form quickly. Options for downloading or printing the document should also be highlighted on the hosting platform for easy access.

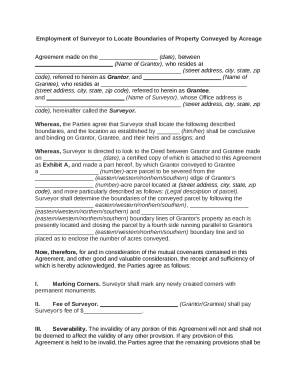

When filling out the taxpayer education form, it’s important to follow a structured process. Each section is designed to capture essential information, and users should take their time to ensure accuracy. Here’s a detailed walkthrough of each section:

While filling out the form, users should be aware of common pitfalls. For instance, overlooking sections or providing incorrect information could lead to compliance issues. It's advisable to check FAQs provided alongside the form for additional guidance.

Tools for editing and managing the taxpayer education form

Once the taxpayer education form is accessed, users can utilize various features to enhance their experience, notably through tools like pdfFiller. Editing capabilities allow users to modify the document easily, ensuring that all information is accurate and current. A simple step-by-step process guides users through editing, from adding text to modifying existing details.

Furthermore, incorporating interactive elements, such as checkboxes and multiple-choice questions, can enhance user engagement. These tools not only make it easier for users to fill out the form but also facilitate better understanding through interactive learning.

Collaboration is another essential aspect of form management. Users can easily share the form with team members to gather feedback. Utilizing cloud features offered by pdfFiller ensures that documents are accessible anywhere, which is particularly helpful for teams working remotely.

eSigning the taxpayer education form

Incorporating an eSignature capability into the taxpayer education form adds a layer of legal assurance that is increasingly vital in today’s digital transactions. eSigning not only streamlines the process but also offers benefits such as reducing paper usage and improving security. It confirms the authenticity of the signer and aligns with various legal standards for electronic documents.

Complete the eSignature process on pdfFiller by following a simple set of steps. Start by reviewing the document for accuracy. Next, select the eSignature option, which will prompt you to draw, upload, or use a pre-saved signature. This digital action solidifies your commitment to the information presented in the taxpayer education form.

Managing completed forms

Once a taxpayer education form is completed, saving and organizing the document efficiently is crucial. Users should adopt best practices for document organization, such as using clear naming conventions and designated folders. Keeping track of completed forms helps maintain readiness for any inquiries or audits that may arise.

Tracking form history is another benefit offered by platforms like pdfFiller. Users can easily find previous submissions and revisions, facilitating a clear understanding of past interactions and allowing for timely updates or corrections if required.

Leveraging educational outcomes

Evaluating the effectiveness of your taxpayer education form is necessary to ensure it meets its educational goals. Consider implementing metrics that assess user understanding and compliance. Gathering feedback from users will not only highlight successful learning outcomes but also indicate areas needing improvement. Surveys or feedback forms can be instrumental in collecting this data.

Strategies for continuous improvement should be adopted to refine the form steadily. Updating the content based on user feedback helps ensure that the taxpayer education form remains relevant and effective. Furthermore, as tax laws evolve, ongoing adaptation of the educational content will keep users informed of their responsibilities.

Getting help and support

For users who may encounter challenges, accessing customer support is essential. The pdfFiller support team offers assistance through various channels, including live chat, email, and help documentation. Engaging with customer support can provide immediate solutions to any questions regarding the form's usage.

Engaging with community insights is also beneficial. User forums and groups can serve as platforms for best practices and shared experiences. These communities might offer practical advice or tips from other users who have successfully navigated similar challenges.

Case studies and success stories

Real-world examples illustrate the tangible benefits of implementing the taxpayer education form. Organizations that have effectively utilized this tool report enhanced compliance rates and increased taxpayer satisfaction. Case studies can show specific scenarios where education forms led to a significant reduction in errors and misunderstandings.

Learning from these implementations allows others to identify effective strategies and potential pitfalls. Key takeaways often include the importance of tailored content relevant to specific audiences and the need for ongoing feedback and updates to the educational materials.

Future trends in taxpayer education

Looking ahead, innovations in document education are likely to significantly impact how taxpayer education forms will evolve. Upcoming features in platforms like pdfFiller may include advanced analytics that track user engagement and comprehension more effectively.

Additionally, legislative changes frequently affect tax laws, which means that taxpayer education forms must adapt accordingly. Keeping up with these changes will ensure that the information provided remains up-to-date and relevant, fostering a culture of continuous learning and awareness among taxpayers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find implementation of taxpayer education?

Can I create an electronic signature for the implementation of taxpayer education in Chrome?

How do I fill out implementation of taxpayer education using my mobile device?

What is implementation of taxpayer education?

Who is required to file implementation of taxpayer education?

How to fill out implementation of taxpayer education?

What is the purpose of implementation of taxpayer education?

What information must be reported on implementation of taxpayer education?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.