Get the free Ke Accounting & Tax Services LLC

Get, Create, Make and Sign ke accounting amp tax

How to edit ke accounting amp tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ke accounting amp tax

How to fill out ke accounting amp tax

Who needs ke accounting amp tax?

A comprehensive guide to KE accounting and tax forms

Understanding the role of accounting in tax preparation

Accurate accounting is crucial for effective tax preparation. It ensures that all financial records reflect the realities of business operations, enabling taxpayers to report their income correctly and avoid potential penalties. Poor accounting practices can lead to overreported or underreported income, which can invite scrutiny from tax authorities.

One of the common mistakes in tax accounting is the failure to keep meticulous records throughout the year. Many individuals wait until the tax season to compile their financial data, which can result in errors or missed deductions. Understanding key terms such as gross income, deductions, and tax credits is also essential for completing forms accurately.

Introduction to tax forms

Tax forms are essential documents that report income, expenses, deductions, and credits to the tax authorities. The significance of choosing the right form cannot be understated, as using the wrong form can lead to misreporting and delays in processing. Each form is designed for specific types of income, deductions, and taxpayer situations.

Some of the frequently used accounting tax forms include the 1040 for individual income tax, the 1099 for reporting various types of income other than wages, and the W-2 for reporting wages paid to employees. Familiarizing yourself with the purpose and requirements of these forms will equip you to select the right one for your tax situation.

Step-by-step guide to completing the accounting tax form

Completing a tax form can seem intimidating, but breaking it down into manageable steps can simplify the process. Start by gathering all necessary documentation related to your finances for the tax year.

Step 1: Gather necessary documentation

Ensure you have essential documents such as W-2s, 1099s, bank statements, and receipts for deductible expenses. Organizing these documents will make the process smoother.

Step 2: Understanding the form layout

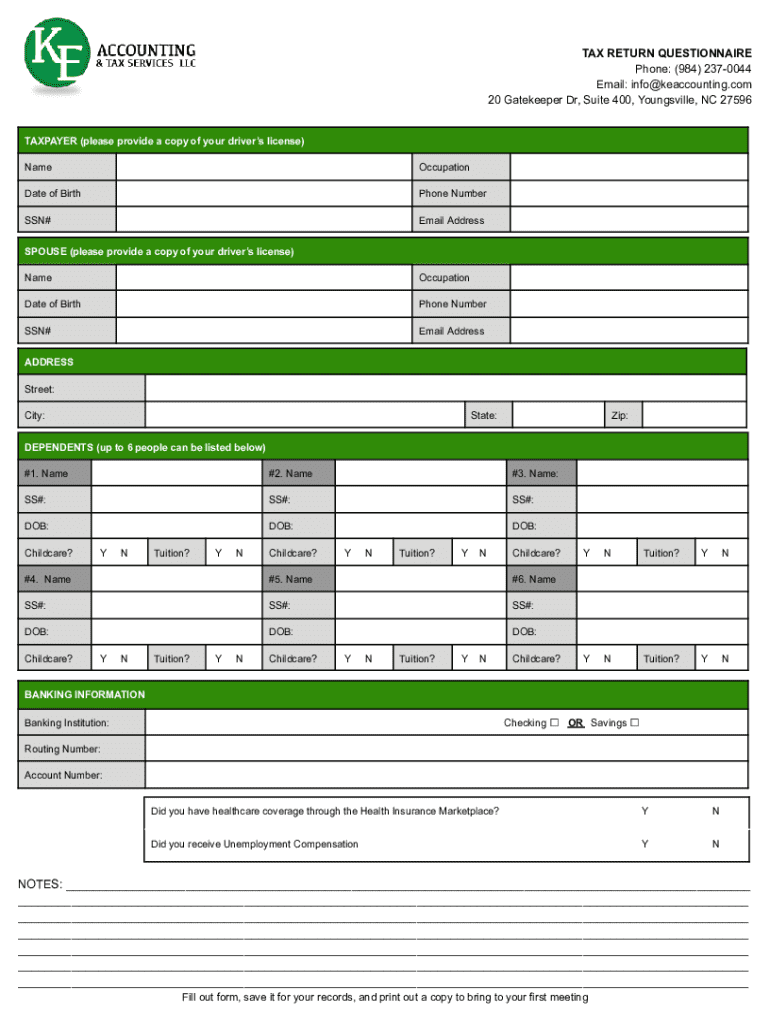

Each form consists of several sections that need careful attention. Familiarizing yourself with the form's layout enables you to locate fields quickly and reduces the chances of mistakes. Key sections often include personal information, income reporting, deductions, and signatures.

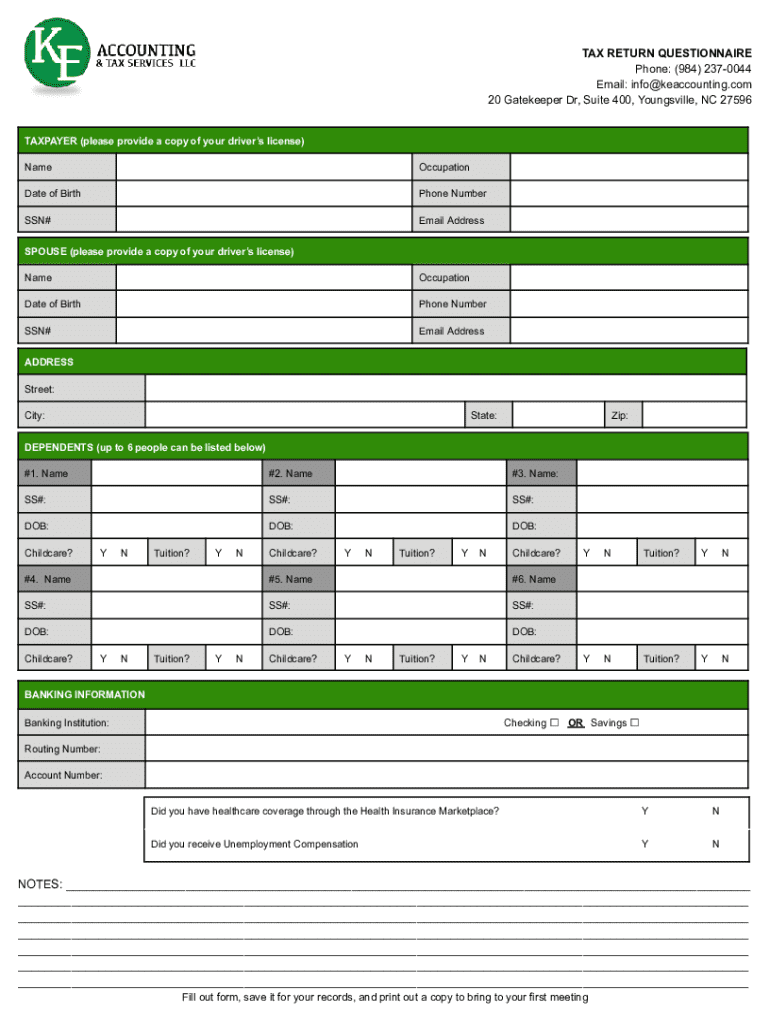

Step 3: Filling out personal information

Entering your personal information accurately is crucial. Any mistakes in your Social Security number or name can cause processing delays. Always double-check that names match exactly with records the IRS has on file.

Step 4: Reporting income

Accurately reporting your income is essential. Be thorough in including all sources of income, such as wages, freelance income, interest, and dividends. Ensure all amounts match the documentation provided.

Step 5: Deductions and credits

Maximizing your deductions can significantly enhance your tax return. Key deductions may include mortgage interest, student loan interest, and medical expenses. Be aware of any tax credits for which you may qualify, as these can directly reduce the amount owed.

Step 6: Review and validate the information

Before submitting, take the time to review your form carefully. Utilize tools like tax software to verify calculations and check for common errors. A checklist can also help ensure that you've completed all necessary sections accurately.

Leveraging technology for smooth form submission

Using cloud-based solutions like pdfFiller can transform how you complete your tax forms. These tools facilitate easy editing, signing, and management of documents.

The unique features of pdfFiller include interactive editing tools that allow for efficient adjustments and streamlined document management, ensuring you can access your tax forms from anywhere at any time. This is especially beneficial for individuals juggling multiple income sources or who work remotely.

Best practices for managing accounting and tax forms

Maintaining an organized approach to your accounting and tax documentation can save a considerable amount of time. Develop a consistent system for both digital and paper records, regularly updating and storing materials in a secure manner.

Conduct periodic reviews of your financial records to ensure accuracy and compliance. This practice not only minimizes errors but also prepares you for any audits that may arise.

Common challenges in tax form submission and how to overcome them

Tax form submission can present several challenges, including common errors like miscalculations, incorrect entries, or missing forms. It's critical to cross-check all entries and remain aware of deadlines to avoid penalties.

If you receive an IRS notification or request for more information, don’t panic. Respond promptly and provide the required documentation. Familiarizing yourself with resources, both online and offline, can provide crucial guidance when these challenges arise.

Best tools and resources for accounting and tax support

Numerous software applications can enhance your accounting and tax documentation experience. Tools like QuickBooks and TurboTax offer features specifically designed for maximizing tax efficiency.

Online communities and forums can also be valuable resources for users looking for specific answers or advice. Platforms such as Reddit or accounting-focused forums can provide insights and suggestions from fellow taxpayers and accounting professionals.

Future trends in accounting and taxation

Technology continues to revolutionize the field of tax preparation. Automation and artificial intelligence are increasingly being used to streamline and enhance the accuracy of accounting practices.

Anticipating changes in tax laws and regulations can change how taxpayers prepare their forms. Staying adaptable is key as new requirements emerge, including updates to digital submission processes.

Engaging with the pdfFiller community

The pdfFiller platform not only allows you to handle forms efficiently but also encourages users to connect with each other for shared learning. Engaging with the community can provide insights on best practices and personal experiences in tax form handling.

Utilizing community feedback can enhance your own document management strategies. Continuous learning and interaction within the community foster a more knowledgeable approach to accounting and tax preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ke accounting amp tax for eSignature?

How can I get ke accounting amp tax?

How do I edit ke accounting amp tax in Chrome?

What is ke accounting amp tax?

Who is required to file ke accounting amp tax?

How to fill out ke accounting amp tax?

What is the purpose of ke accounting amp tax?

What information must be reported on ke accounting amp tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.