Get the free Commercial Invoice UAE: Guide to Requirements and Template

Get, Create, Make and Sign commercial invoice uae guide

Editing commercial invoice uae guide online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial invoice uae guide

How to fill out commercial invoice uae guide

Who needs commercial invoice uae guide?

Commercial Invoice UAE Guide Form: A Comprehensive Overview

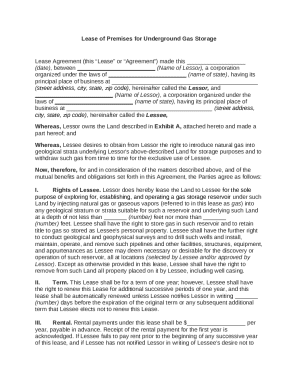

Understanding commercial invoices

A commercial invoice is a crucial document in international trade, serving as a bill for the goods and services supplied. It outlines the details of a transaction between a seller and a buyer and provides essential information needed for customs clearance. In the UAE, commercial invoices carry significant weight as they are used for customs valuation and are often required for tax purposes.

The importance of commercial invoices in facilitating smooth cross-border transactions cannot be overstated. They provide an official record of sales and entitle the buyer to claim credit or refunds where applicable. Essential components of a commercial invoice in the UAE include the invoice number, date of issue, seller and buyer details, product descriptions, quantities, prices, and payment terms.

Legal requirements for commercial invoices in UAE

Understanding the legal framework surrounding commercial invoices in the UAE is vital for compliance. The UAE authorities mandate certain information that must be included:

Falling short on these legal requirements can lead to delays and complications during the customs clearance process. Common pitfalls include incomplete information, incorrect pricing, or failing to properly format the invoice, which can hinder compliance with local and international regulations.

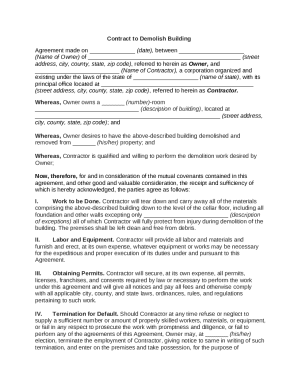

Step-by-step guide to completing a commercial invoice

Completing a commercial invoice involves meticulous attention to detail. Here’s a step-by-step guide:

Tools for preparing commercial invoices

Utilizing advanced document preparation tools can vastly improve the efficiency of creating commercial invoices. A cloud-based platform like pdfFiller offers unique advantages, allowing users to easily edit PDFs, eSign documents, and collaborate effectively with team members.

The ease of using pdfFiller includes:

Common mistakes when filing a commercial invoice

When filing a commercial invoice, some common mistakes can lead to significant issues in processing and legal recourse. Key mistakes to be aware of include:

To avoid these errors, always double-check all entries for accuracy, adhere to a consistent format, and seek assistance from professionals if needed.

Additional considerations for different audiences

Different users have varying needs when it comes to completing commercial invoices. Here are tailored considerations for distinct audiences:

Frequently asked questions (FAQs)

As users navigate the complexities of commercial invoicing in the UAE, several questions arise frequently regarding this process. Here are some answers to common inquiries:

Alternative documents related to commercial invoices

Alongside commercial invoices, several other documents play critical roles in international trade. Understanding their purposes can support smoother transactions:

Best practices for effective invoice management

Implementing best practices for managing commercial invoices is critical for achieving efficiency and compliance. Here are some effective strategies:

Interactive tools available for document handling

Digital transformation has led to numerous interactive tools available for handling commercial invoices effectively. pdfFiller offers specific features that support users in creating and managing their documents seamlessly.

Leveraging technology like pdfFiller transforms document management into a highly organized workflow, minimizing errors and saving time.

Real-life examples and case studies

Understanding the practical application of commercial invoicing can be enhanced by examining successful case studies. Several companies in the UAE have reported improved efficiency and reduced errors in their invoicing processes after employing systems like pdfFiller for managing their commercial documents.

User testimonials frequently highlight the benefits of clarity, accuracy, and ease of collaboration that arise from utilizing these platforms. Case studies have illustrated significant financial savings associated with avoiding compliance-related fines and expediting trade processes.

Upcoming changes and trends in commercial invoicing in UAE

Keeping an eye on changes and trends in the area of commercial invoicing in the UAE can equip businesses to adapt proactively. Technology advancements are leading to increased automation, which streamlines invoice management, potentially reducing human error and improving accuracy.

Regulatory changes may also arise as the UAE continues to align with international standards. Awareness of potential changes will be essential for businesses to remain compliant and ahead of competitors.

Engaging with a community of users

Connecting with other users for discussing experiences and best practices can enrich the invoicing process. Forums dedicated to commercial invoices allow businesses to share insights and strategies for ensuring compliance and efficiency.

Networking opportunities for businesses interested in optimizing their invoicing processes can also lead to partnerships that enhance overall service offerings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify commercial invoice uae guide without leaving Google Drive?

How do I fill out the commercial invoice uae guide form on my smartphone?

Can I edit commercial invoice uae guide on an Android device?

What is commercial invoice uae guide?

Who is required to file commercial invoice uae guide?

How to fill out commercial invoice uae guide?

What is the purpose of commercial invoice uae guide?

What information must be reported on commercial invoice uae guide?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.