Get the free 2024 Individual Tax Questionnaire v1.docx

Get, Create, Make and Sign 2024 individual tax questionnaire

Editing 2024 individual tax questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 individual tax questionnaire

How to fill out 2024 individual tax questionnaire

Who needs 2024 individual tax questionnaire?

Navigating the 2024 Individual Tax Questionnaire Form: A Comprehensive Guide

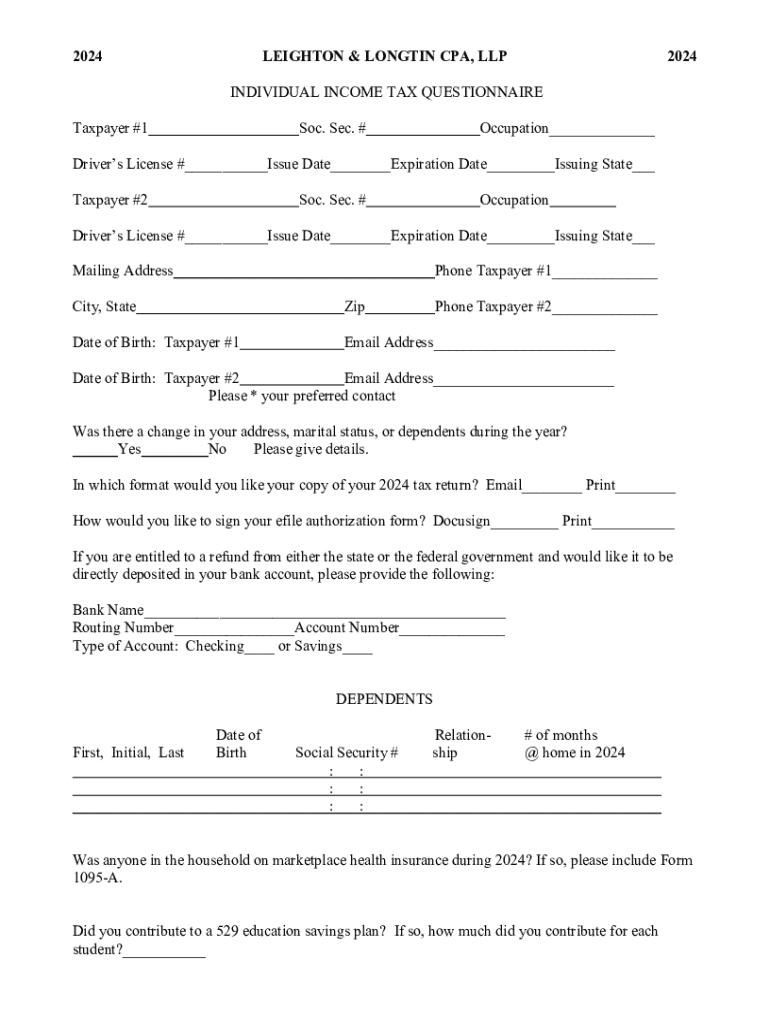

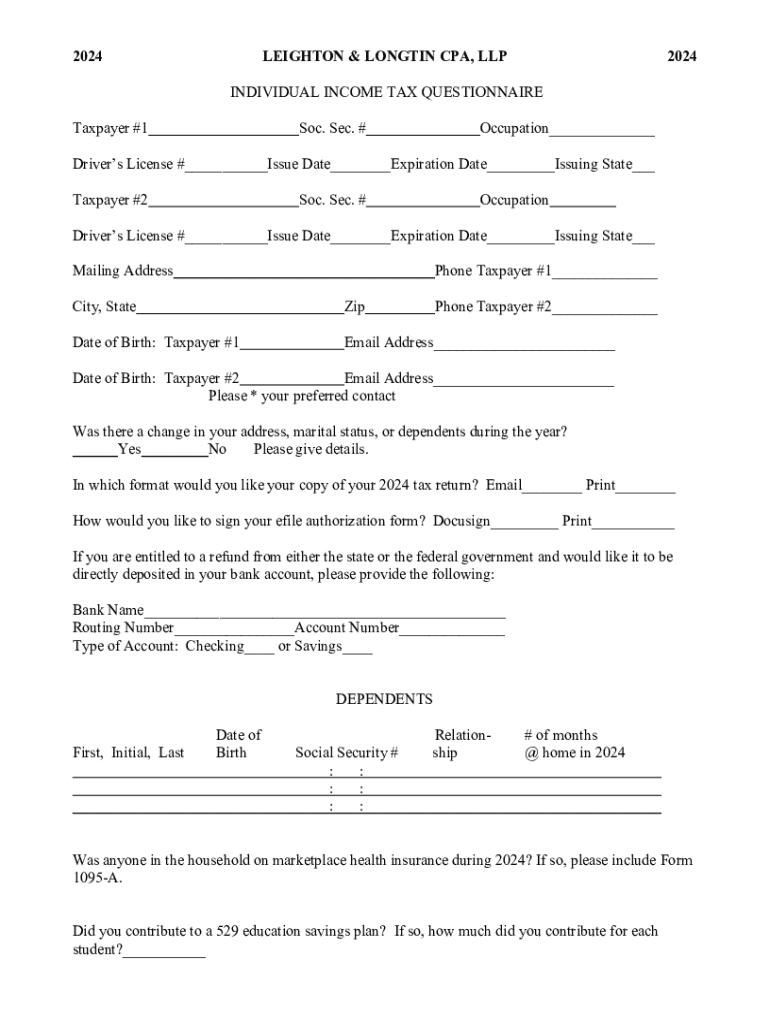

Overview of the 2024 individual tax questionnaire

The 2024 individual tax questionnaire form serves as a critical tool for taxpayers, enabling a thorough assessment of your financial situation for the year. This form is not just a bureaucratic hurdle; it clarifies your tax standing and is essential in maximizing potential deductions and credits that could significantly reduce your tax liability.

With the advent of new tax laws and regulations this year, you'll want to stay updated to ensure compliance and take advantage of any favorable changes. Understanding the modifications introduced for 2024 can provide insights into how best to structure your finances and file your taxes effectively.

Detailed instructions for completing the form

Completing the 2024 individual tax questionnaire form requires careful attention to detail. The form is divided into several sections, each aimed at capturing essential information that informs your tax situation.

Section-by-section breakdown

The first section requests your personal information, including your name, address, and Social Security number. Be meticulous when filling this out, as errors here can lead to significant processing delays.

The next section focuses on income reporting. It's crucial to report all types of income received during the year, which may include wages, freelance earnings, dividends, and rental income. Gather supporting documents such as W-2s and 1099s to back up your reported income.

Following income, the form delves into deductions and credits. Here you can choose between taking the standard deduction or itemizing your deductions—whichever is more beneficial. Itemization could involve deductions for mortgage interest, charitable contributions, and qualified medical expenses.

To ensure accurate fill-out, avoid common errors such as providing mismatched information or overlooking additional income sources. Best practices involve double-checking all entries and keeping a systematic record of all financial documents until the filing process is completed.

Interactive tools for filling out the 2024 questionnaire

With technological advancements, filling out the 2024 individual tax questionnaire form has never been easier. Utilizing fillable PDF forms allows for a more user-friendly experience, eliminating the risk of hand-written errors.

pdfFiller offers fillable options, which streamline the completion process and provide integrated error-checking features. Additionally, the auto-calculation capabilities are invaluable for estimating your deductions and credits, providing a suggested amount based on your entries.

Transitioning to eSignatures is another modern advantage; it simplifies the submission process, allowing you to securely sign and send your completed form digitally. This not only speeds up the process but also enhances security.

Managing your tax documents

Staying organized is a crucial aspect of effective tax management. Keeping an orderly collection of your financial records simplifies the preparation of your questionnaire. Methods like utilizing spreadsheets or document categorization can enhance your efficiency during tax season.

pdfFiller provides an excellent platform for managing documents, enabling you to store, access, and organize your tax-related files all in one place. This level of organization is essential, especially when it comes time to submit your questionnaire.

When it's time to submit, be aware of filing deadlines to avoid costly penalties. Generally, the deadline for submission is mid-April, but it's wise to confirm any changes for 2024. Submitting your questionnaire through pdfFiller ensures that your documents are filed securely and with proper format.

Collaborating with tax professionals

If your tax situation is complex—perhaps involving multiple income sources or unique deductions—consulting a tax professional can provide significant benefits. They can help ensure you comply with all regulations while maximizing your potential refunds.

Once your questionnaire is completed, sharing it securely is vital. pdfFiller enables you to share documents seamlessly through their platform, offering a sense of security and collaboration. When working with professionals, provide clear instructions and communicate any specific concerns you may have.

Identifying scenarios that warrant professional advice, such as recent life changes (marriage, new dependents) or business income, can save you time and potentially a lot of money in the long run.

Frequently asked questions

It's common for taxpayers to have questions throughout the process. One common query is, 'What if I made errors on my questionnaire?' If you've realized an error after submission, you may need to file an amendment. This can be done promptly through both paper forms or electronically via pdfFiller, which provides a straightforward workflow for corrections.

Another frequent concern entails 'What if my financial situation changes after I submit?' In and of itself, this does not prevent you from amending your tax submission; however, the nature of the changes may warrant professional advice to determine how best to proceed.

Testimonials and user experiences

Real-life stories from pdfFiller users illuminate the efficiency of this platform. Many have found that using pdfFiller has significantly reduced their stress levels during tax season, streamlining everything from document creation to submission.

The intuitive nature of pdfFiller's tools allows users to generate documents quickly, avoiding the common pitfalls of traditional tax preparation methods. Many have highlighted the ease of collaboration with tax professionals while using these tools.

Stay updated and informed

Staying ahead of the curve regarding tax news and updates can make a significant difference in your financial strategies. By subscribing to our newsletter, you access timely information on tax changes, important deadlines, and tips for optimizing your filings.

Engagement with the pdfFiller community provides further enrichment. By connecting with us on social media platforms, you’re not only receiving valuable information but also joining discussions that can enhance your understanding of tax preparation.

Contact us for support

Navigating tax preparations can be daunting, but you don’t have to do it alone. If you require assistance with filling out the 2024 individual tax questionnaire form, our customer service team at pdfFiller is ready to help. You can reach out through various channels, ensuring you find the support you need conveniently.

Our resources are readily available through the pdfFiller platform, providing users access to various educational materials and guidelines to enhance their experience and comprehension of tax preparation.

Client forms and additional tools

pdfFiller not only offers the 2024 individual tax questionnaire form but also provides a marketplace of other relevant tax forms. Accessing these documents from one platform simplifies the entire process and reduces the hassle of maintaining physical copies.

Integrating your workflow with pdfFiller’s document management tools can further enhance your efficiency. The ability to access, edit, and manage various forms from a single location saves time and effort, making tax filing a more manageable task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2024 individual tax questionnaire online?

How do I make changes in 2024 individual tax questionnaire?

How can I edit 2024 individual tax questionnaire on a smartphone?

What is 2024 individual tax questionnaire?

Who is required to file 2024 individual tax questionnaire?

How to fill out 2024 individual tax questionnaire?

What is the purpose of 2024 individual tax questionnaire?

What information must be reported on 2024 individual tax questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.