Get the free AS CORRECTED

Get, Create, Make and Sign as corrected

How to edit as corrected online

Uncompromising security for your PDF editing and eSignature needs

How to fill out as corrected

How to fill out as corrected

Who needs as corrected?

How to issue a corrected 1099

Understanding the importance of corrected 1099 forms

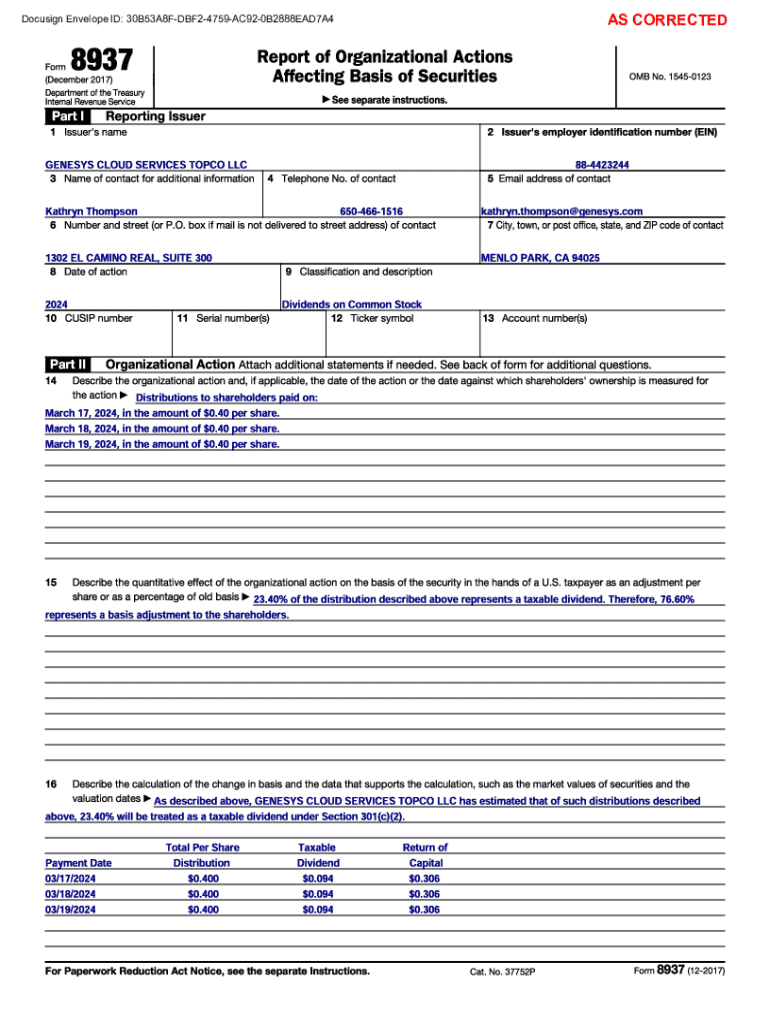

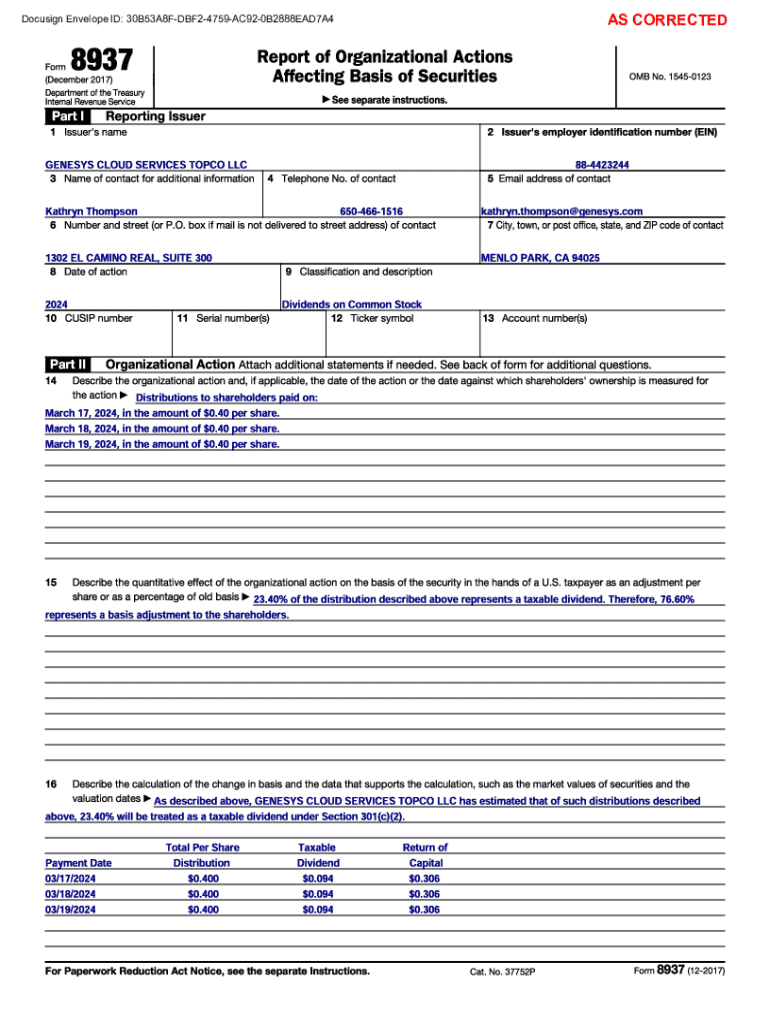

A corrected 1099 form is essential for ensuring accurate reporting of income for tax purposes. When filing taxes, it's crucial that all information is correct to avoid potential penalties from the IRS and to keep your financial records clean. This form allows businesses to rectify any mistakes made in the original 1099 submission, which could otherwise lead to discrepancies during the tax year.

Types of 1099 forms that can be corrected

There are several different types of 1099 forms, but two of the most common are the 1099-MISC and the 1099-NEC. Each has distinct purposes and situations where corrections frequently occur. Understanding these forms is critical in ensuring accurate reporting.

Common scenarios for corrections may involve payments to independent contractors or mistakes in dividend payments. For instance, if you paid a freelancer more than reported due to oversight, filing a corrected 1099-NEC ensures their total income is accurately reflected.

Identifying common errors that require a correction

Recognizing common errors is crucial in the process of issuing a corrected 1099 form. Missteps can occur at various stages in the documentation and reporting process, leading to potential complications and penalties.

Penalties associated with incorrect filings can escalate quickly, making it imperative to correct mistakes as soon as they are identified. Addressing these corrections proactively helps maintain compliance and avoids potentially costly fines.

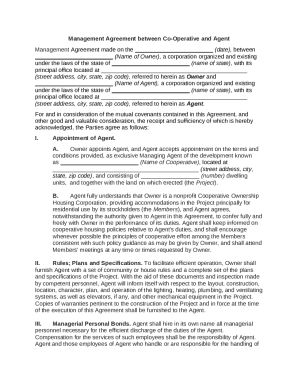

Step-by-step guide to issuing a corrected 1099

Issuing a corrected 1099 form involves multiple steps that require careful attention to detail. The following guide will walk you through the process to ensure accuracy in your submissions.

Filing corrected 1099s paper vs. online

When it comes to submitting corrected 1099 forms, there are two primary methods: paper filing and online e-filing. Each method has its benefits and considerations that may affect your choice.

Using pdfFiller to file a corrected 1099 online simplifies the process further. By accessing 1099 templates and following specific instructions, you can efficiently manage your tax forms, saving time and reducing stress.

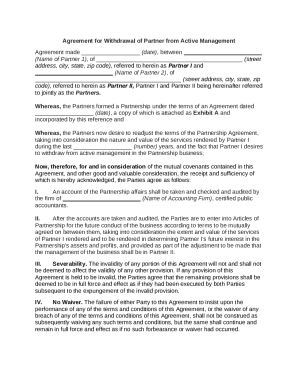

Special considerations for voiding a 1099

In some instances, it may be more appropriate to void a 1099 rather than issue a correction. It's essential to understand when to take this action and the implications it may have on your tax responsibilities.

Addressing mistakes after submission

If you realize a mistake has been made after submitting a 1099 form, swift action is critical. How you address this error can influence your reporting accuracy and minimize issues with the IRS.

Taking these steps ensures that you uphold proper communication with both the IRS and your financial counterpart, mitigating any potential fallout from the mistake.

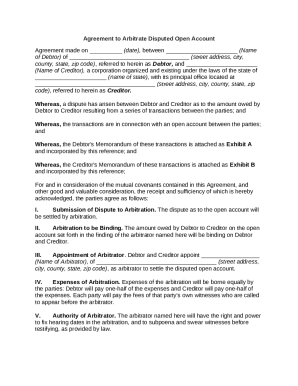

FAQs about corrected 1099 forms

Navigating the world of corrected 1099 forms can raise many questions. Addressing common queries about this process can empower individuals and teams with the knowledge they need.

Utilizing pdfFiller for document management

Choosing the right tools for managing 1099 forms can streamline your workflow significantly. pdfFiller offers a robust solution for creating, editing, and managing various documents.

Tips for preventing future errors with 1099 forms

Preventing future errors when filing 1099 forms is achievable with a few strategic approaches. By implementing best practices, you can enhance your record-keeping and reporting accuracy.

By employing these tips, you can safeguard against issues that may arise during the tax season, allowing for a more seamless experience when filing your forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my as corrected in Gmail?

How do I fill out as corrected using my mobile device?

How do I fill out as corrected on an Android device?

What is as corrected?

Who is required to file as corrected?

How to fill out as corrected?

What is the purpose of as corrected?

What information must be reported on as corrected?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.