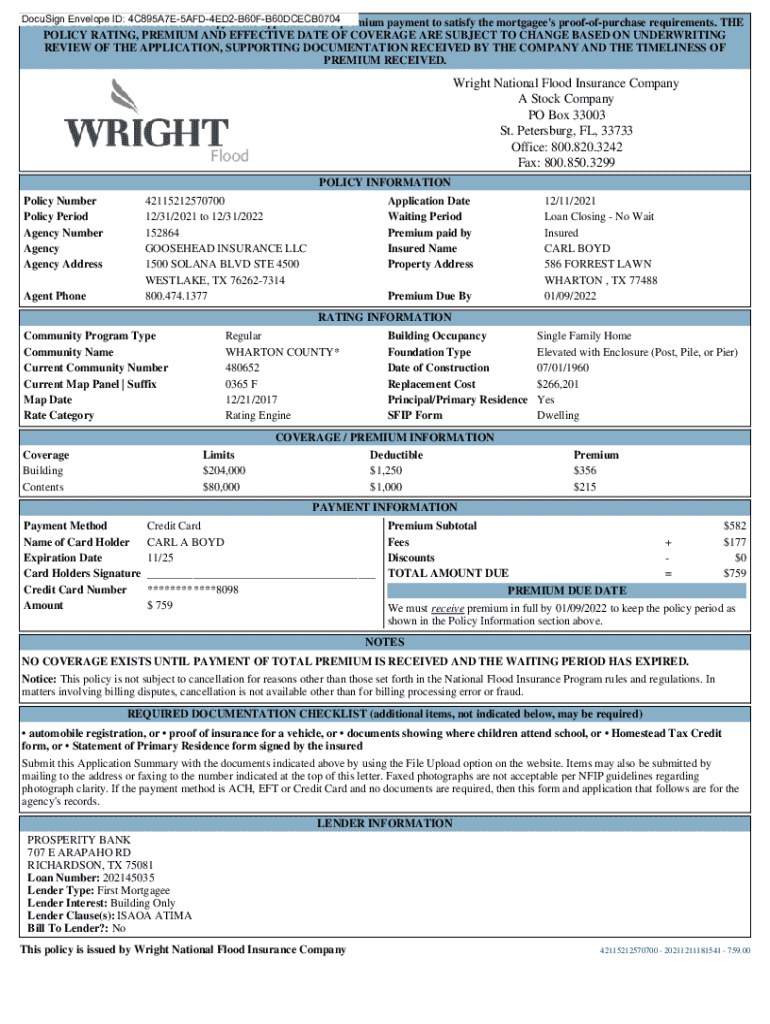

Get the free Wright National Flood Insurance Company A Stock Company PO ...

Get, Create, Make and Sign wright national flood insurance

How to edit wright national flood insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wright national flood insurance

How to fill out wright national flood insurance

Who needs wright national flood insurance?

Understanding the Wright National Flood Insurance Form: A Comprehensive Guide

Understanding the importance of the Wright National Flood Insurance Form

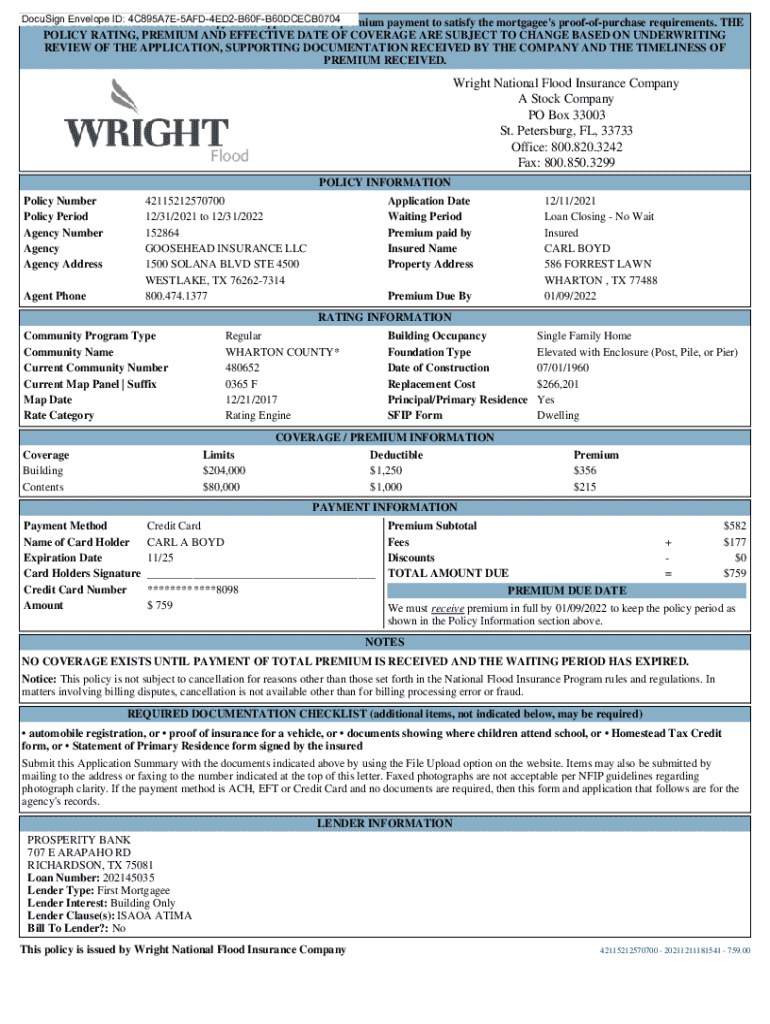

Flood insurance is crucial for homeowners, particularly those in flood-prone areas. It protects property against flood-related damages that conventional homeowners' insurance policies often exclude. The Wright National Flood Insurance Form plays a pivotal role in securing this essential coverage by capturing vital information required by insurers to assess risk and determine pricing. Completing this form correctly is the first step toward ensuring peace of mind for homeowners, safeguarding their most significant investment against potential flood disasters.

This form not only establishes eligibility for coverage but also delineates the specific terms of the policy. By understanding its relevance and requirements, prospective policyholders can navigate the sometimes overwhelming process of securing flood insurance effectively.

Key features of the Wright National Flood Insurance Form

The Wright National Flood Insurance Form consists of several elements that are critical for accurate completion. First, it requires detailed personal information including the applicant's name, contact information, and Social Security number. Property details follow, necessitating information about the home’s location, type, and any prior insurance history related to flood damage.

Moreover, applicants must specify coverage options and limits tailored to their unique situation, selecting between dwelling coverage and contents coverage. Understanding these options will aid in effective decision-making regarding how much protection is necessary.

Common pitfalls such as omitting personal information or misrepresenting property details can delay processing and may even lead to claim denials. It is essential to be diligent and thorough during this phase.

Step-by-step guide to completing the Wright National Flood Insurance Form

Completing the Wright National Flood Insurance Form can seem daunting, but with a systematic approach, you can tackle it efficiently. Here's a detailed, step-by-step guide to ensure you have everything in order.

1. Gather necessary documentation

Having all necessary documentation at hand will facilitate smoother completion of the form.

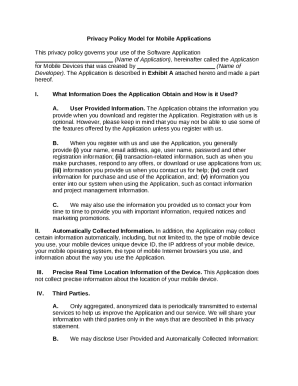

2. Accessing the Wright National Flood Insurance Form

The official form can be easily found on the FEMA or Wright National Flood Insurance websites. Additionally, pdfFiller makes it simple to access and download the form in a user-friendly format.

Utilizing pdfFiller’s platform not only allows for easy downloading but also provides various tools to fill out and edit the form directly in your browser, ensuring a seamless experience.

3. Filling out the form correctly

As you begin filling out the form, focus on accuracy and completeness. Each section has specific requirements that must be met for your application to be processing smoothly.

Consider leveraging interactive tools provided on pdfFiller, which can assist you in completing the form accurately.

4. Reviewing your form

Before submitting your form, it is vital to perform a thorough review of each entry. Taking the time for this final check can prevent many common mistakes that lead to application delays or complications.

Maintaining accuracy here not only aids in a smoother process but can also build trust with your insurance provider.

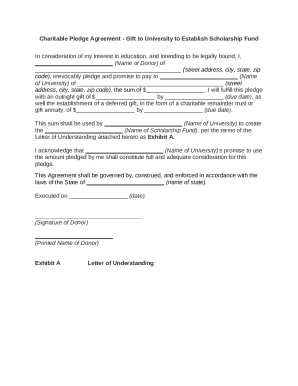

5. Submitting the form

Finally, when you are confident that your Wright National Flood Insurance Form is fully completed and accurate, it’s time to submit. Knowing your options for submission can simplify this process.

Taking careful note of these submission methods will ensure your form is processed in a timely manner.

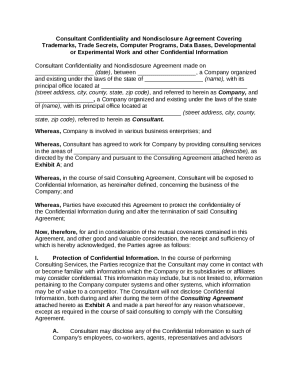

Managing your flood insurance policy

After submitting the Wright National Flood Insurance Form, it is essential to manage your flood insurance policy proactively. The form is just the beginning of your commitment to flood risk management.

Properly maintaining your policy includes understanding how to use it post-submission, modifying coverage as necessary, and ensuring your documentation remains current. With pdfFiller, managing your documents becomes hassle-free, allowing you to make updates and modifications easily.

Using tools available on the pdfFiller platform can aid you in keeping your policy relevant, especially in light of changes to your property or personal circumstances that may necessitate policy updates.

Frequently asked questions (FAQs)

Understanding the process surrounding the Wright National Flood Insurance Form can help ease common concerns. Here are some frequently asked questions that many policyholders grapple with.

Clarifying these facets of the process can reduce anxiety for applicants and help them engage more confidently with their chosen insurance provider.

Customer support options for Wright National Flood Insurance

If you're in need of immediate assistance with the Wright National Flood Insurance Form, accessing customer support is key. Solutions like pdfFiller not only offer guidance through interactive tools but provide direct customer service options for your queries.

Whether you have specific questions about the form, your application status, or flood policy terms, making use of these support channels can streamline your experience.

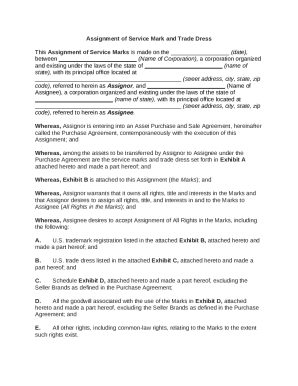

Extra tips for flood insurance policyholders

Maintaining your flood insurance policy effectively means remaining proactive and organized. Best practices include regularly reviewing your coverage, especially after significant property changes or natural disasters. Staying informed can help ensure you have the best possible protection.

Implementing these tips enables policyholders to navigate their coverage more effectively and ensures they are prepared in the face of potential flood disasters.

Recent updates and changes in flood insurance policies

Staying informed about recent regulatory and policy changes affecting the Wright National Flood Insurance is critical for current and prospective policyholders. Changes may impact premium rates, coverage options, and flood zone definitions.

These updates are implemented in response to shifting urban landscapes and increasing flood risk exposure due to climate change. Understanding these dynamics will help you make more informed decisions regarding the Wright National Flood Insurance Form and your overall flood coverage.

Exploring related topics

The importance of flood insurance extends beyond just policy completion. Individuals should consider their insurance as a vital part of comprehensive emergency preparedness. Resilience in the face of disaster is achievable when policyholders understand their rights and the processes around the Wright National Flood Insurance Form.

Case studies often highlight the need for effective documentation and the intricacies of the claims process, helping first-hand those navigating similar situations. Learning from others’ experiences can provide invaluable insights into effectively managing flood insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit wright national flood insurance from Google Drive?

How do I complete wright national flood insurance online?

How do I edit wright national flood insurance in Chrome?

What is wright national flood insurance?

Who is required to file wright national flood insurance?

How to fill out wright national flood insurance?

What is the purpose of wright national flood insurance?

What information must be reported on wright national flood insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.