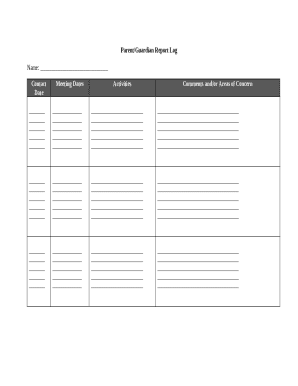

Get the free Evidence from Federal Lending Cutoffs during COVID-19

Get, Create, Make and Sign evidence from federal lending

Editing evidence from federal lending online

Uncompromising security for your PDF editing and eSignature needs

How to fill out evidence from federal lending

How to fill out evidence from federal lending

Who needs evidence from federal lending?

Evidence from Federal Lending Form: How-to Guide

Understanding federal lending forms

Federal lending forms are standardized documents utilized in the lending process to ensure clarity and compliance with federal regulations. These forms provide essential information regarding the terms and conditions of a loan, enabling borrowers to make informed decisions. Understanding the evidence contained in these forms is critical because it directly impacts financing transactions, including mortgages, personal loans, and credit applications.

The importance of these forms cannot be overstated. They serve to protect consumers by providing transparency around loan terms and conditions, helping borrowers understand their rights and obligations. Federal regulations, such as the Truth in Lending Act (TILA), provide the framework governing these disclosures, mandating lenders to supply accurate information that reflects the true cost of borrowing.

Types of federal lending forms

Truth in lending act (TILA) disclosure form

The Truth in Lending Act (TILA) Disclosure Form is designed to provide borrowers with clear and concise information about the costs associated with borrowing. This form outlines key details such as interest rates, payment schedules, and total loan costs, ensuring that borrowers are fully informed before signing any agreements. Notably, this disclosure helps borrowers understand the implications of various loan products and can aid them in comparing offers from different lenders.

Lenders are required to provide TILA disclosures to any consumer seeking or receiving credit. This includes commercial banks, credit unions, and other lending institutions. Being aware of the requirement for TILA disclosures is fundamental for borrowers, as it signifies their right to receive pertinent information about the loan they are considering.

Loan estimate form

The Loan Estimate form is a crucial document provided during the mortgage application process. It offers a detailed breakdown of estimated loan costs, including interest rates, monthly payments, and fees associated with the loan transaction. This form empowers borrowers by allowing them to see the estimated monthly payment and closing costs on a clear and easy-to-understand page.

Key sections of the Loan Estimate to pay attention to include the Loan Terms section, which outlines the financing details, the projected payments, and the costs at closing. Typically, this form is shared with borrowers within three business days of applying for a loan, giving them time to review and compare offers before moving forward.

Closing disclosure form

The Closing Disclosure is a final loan document that must be provided to the borrower three days before the closing of the loan. This form details the final terms and costs of the loan, including the loan amount, interest rate, monthly payment, and closing costs. Reviewing this form is essential for borrowers, as it allows them to confirm that the terms they discussed with the lender have not changed, and that all estimated amounts reflect final costs.

Buyers often overlook the Closing Disclosure, which can lead to confusion or disputes on closing day. Common pitfalls include missing changes in costs compared to the Loan Estimate or not understanding the breakdown of fees. Being diligent in reviewing this document is crucial to ensure the transaction proceeds smoothly.

Key evidence requirements in federal lending forms

Understanding the necessary evidentiary components included in federal lending forms is vital for both borrowers and lenders. This ensures compliance with legal standards and helps prevent misunderstandings. The following are essential components typically required:

Best practices for utilizing federal lending forms

Proper preparation for completing federal lending forms can significantly ease the lending process. Below are important steps to consider to ensure accuracy:

Common mistakes to avoid

Even experienced borrowers can make mistakes when completing federal lending forms. Common errors include providing inaccurate personal information, overlooking specific disclosures, or misunderstanding loan terms. These mistakes can lead to delays in approval or implications for loan qualification. To mitigate these risks, borrowers should consistently double-check the information provided in every form.

Consequences of inaccuracies can be severe, ranging from denial of the loan to potential legal repercussions down the line. Ensuring that every detail is carefully considered in documents like the Loan Estimate and Closing Disclosure can save borrowers from future penalties and challenges.

Legal considerations and compliance

Compliance with federal regulations is essential in the lending process. The forms used are governed by laws such as TILA and the Real Estate Settlement Procedures Act (RESPA). Understanding these compliance requirements is crucial, as failure to adhere to them can result in significant penalties for lenders and denial or voiding of contracts for borrowers.

Borrowers have specific rights designed to protect them under federal law. These include the right to receive timely and accurate disclosures, the right to contest any discrepancies, and the right to legal recourse in the event of violations by lenders. Seeking legal advice when uncertain about rights or obligations regarding federal lending forms can be invaluable.

Leveraging technology for financial document management

pdfFiller stands out as a compelling solution for managing financial documents, including federal lending forms. This cloud-based platform allows users to access, edit, eSign, and share documents from anywhere, streamlining the entire lending process.

Its robust feature set includes collaborative tools that simplify workflows, reducing the hassle and delays often associated with traditional document management. Users have reported improved efficiency and accuracy, thanks to pdfFiller's user-friendly interface and powerful editing capabilities. This makes handling essential documents like the Truth in Lending Act disclosures, Loan Estimates, and Closing Disclosures far more straightforward.

Case studies highlight the success of teams leveraging pdfFiller in navigating the complexities associated with federal lending forms. By using the platform, they were able to minimize errors and enhance collaboration, resulting in smoother transactions.

Frequently asked questions (FAQs)

Many individuals have queries regarding timelines and process intricacies related to federal lending forms. Common questions include:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find evidence from federal lending?

How do I edit evidence from federal lending online?

How do I fill out evidence from federal lending on an Android device?

What is evidence from federal lending?

Who is required to file evidence from federal lending?

How to fill out evidence from federal lending?

What is the purpose of evidence from federal lending?

What information must be reported on evidence from federal lending?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.