Get the free Dispute Credit Report Sample Letter with Explanation

Get, Create, Make and Sign dispute credit report sample

Editing dispute credit report sample online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dispute credit report sample

How to fill out dispute credit report sample

Who needs dispute credit report sample?

Dispute Credit Report Sample Form: A Comprehensive Guide

Understanding the importance of disputing errors on your credit report

A credit report is a detailed record of an individual’s credit history, which lenders use to assess creditworthiness. Each bureau collects and compiles data on your financial behaviors, such as payment history and accounts settled. However, inaccuracies often appear in these reports, jeopardizing your credit score and potential borrowing opportunities.

Common errors found in credit reports include incorrect personal information like misspelled names or wrong addresses, unfamiliar accounts that you did not open, or duplicate entries for the same account appearing twice. These inaccuracies can severely impact your credit score, affecting your ability to secure loans, mortgages, or even housing.

The significance of regularly reviewing your credit report cannot be understated, as each error can lead to a significant dip in your overall score, affecting your financial stability and future arrangements.

When should you dispute your credit report?

Identifying when to dispute a credit report is crucial for maintaining an accurate financial image. Look for signs such as unfamiliar accounts that you do not recognize, incorrect personal information like misspelled names or incorrect addresses, and duplicate entries of the same accounts.

A good rule of thumb is to review your credit report at least once a year. If you notice discrepancies, timely addressing them is essential. The sooner you dispute inaccuracies, the quicker you can remedy potential damage to your credit score.

Preparing to dispute your credit report

Preparation is key when disputing entries on your credit report. Begin by thoroughly gathering necessary information, which includes copies of documentation supporting your claim, such as past bills, payment receipts, and correspondence with creditors.

Understanding your rights under the Fair Credit Reporting Act (FCRA) is crucial for consumers. You have the right to dispute inaccuracies, with the credit bureaus required to investigate the claims. This knowledge helps in evaluating the potential impact of addressing errors on your credit report.

Overview of the dispute process

The dispute process can be broken down into a simple step-by-step guide that makes it easier to navigate. First, identify the errors on your report. Then, document everything meticulously, ensuring that you capture relevant information in a clear format.

Next, determine how you wish to file your dispute: online, via mail, or by phone. Each method has its benefits, but online disputes are often quicker and easier. Finally, submit your dispute while keeping an organized record of all correspondences and filings. Tracking your actions will facilitate any future follow-up necessary.

Utilizing the dispute credit report sample form

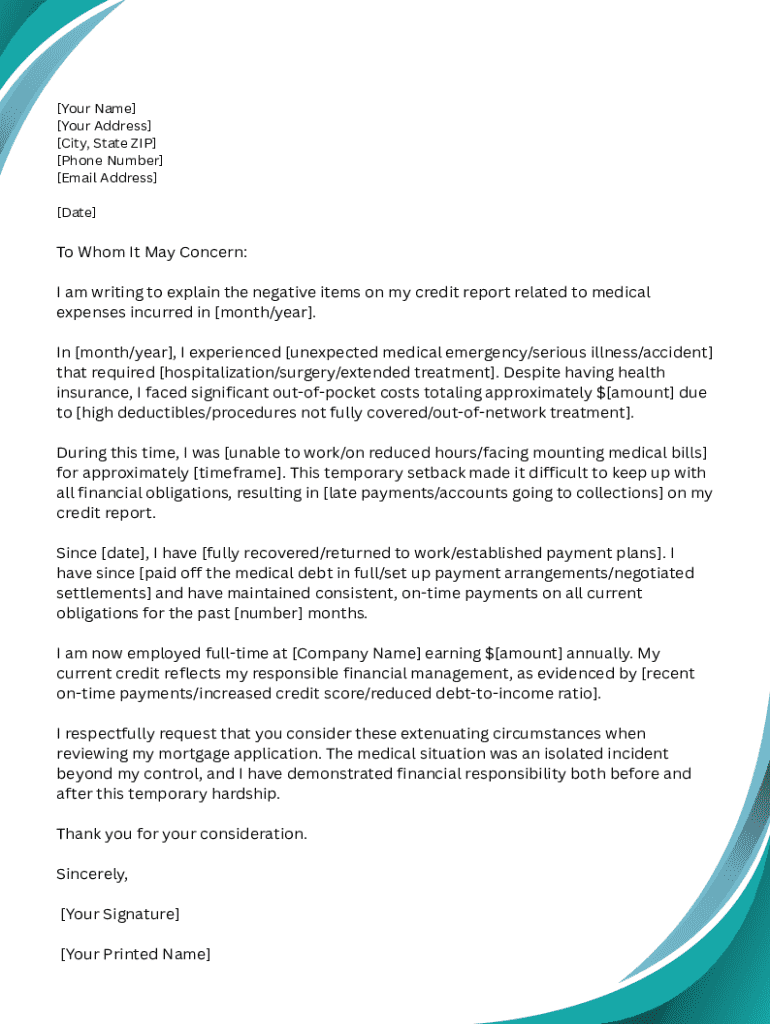

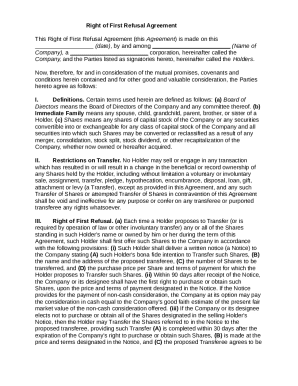

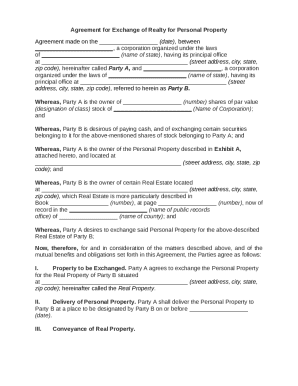

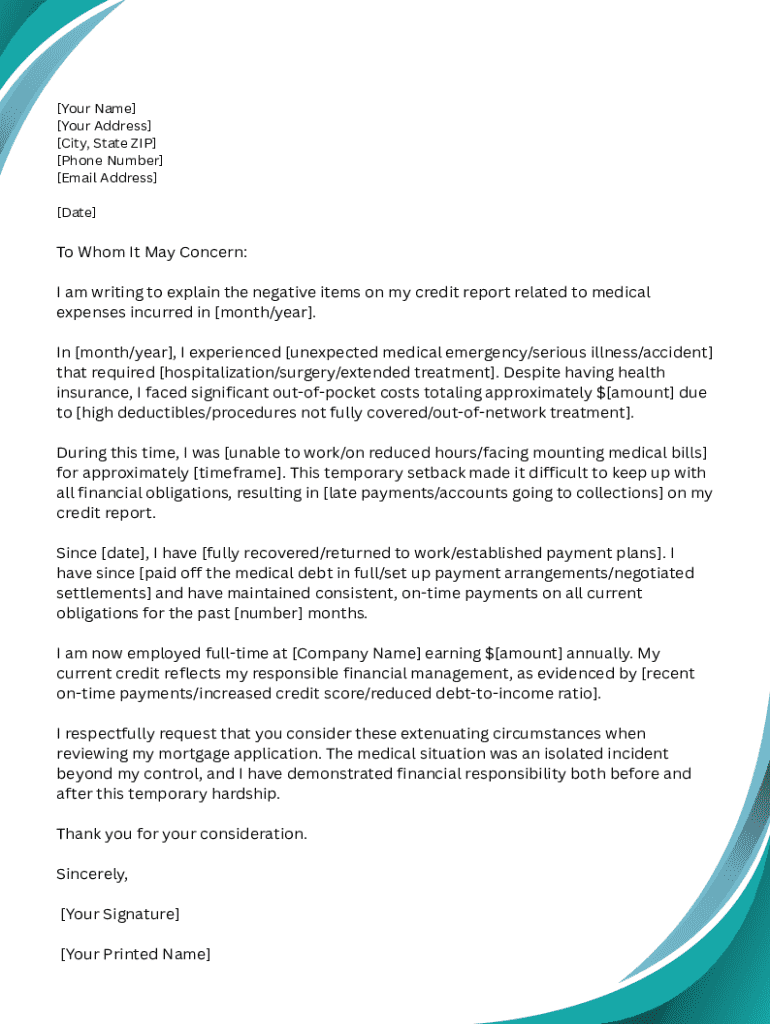

A dispute credit report sample form serves as a critical tool in organizing your information for submission. The form should begin with your personal information, including your full name, address, and Social Security number.

Next, detail the account in question, including the creditor's name and the nature of the dispute. Clearly explain why you believe the information is inaccurate, and ensure to date and sign the form before submission. Accessing a sample form is readily available online, especially on platforms like pdfFiller, which provide templates and guidance.

Strategies for effective dispute submission

Completing the form with precision goes a long way in the dispute process. Take the time to be thorough and articulate your concerns clearly. Use objective language, avoiding emotional tones, to maintain professionalism and clarity in your point.

When writing your dispute letter, focus on the facts. Include supporting evidence, like account statements or documents from the creditor. Ensure to follow any specific guidelines set forth by the credit bureau to prevent any unnecessary delays in processing.

Tracking progress of your dispute

Keep the lines of communication open with credit bureaus following your initial submission. They will typically respond within 30 days upon receiving your dispute. Understanding their timeline helps set attainable expectations.

After submission, expect to hear back not only from the credit bureaus but possibly from creditors as well, who may conduct their own investigations into the claim. Follow-ups are often necessary if no resolution occurs within the specified timeframe.

Post-dispute actions

If the dispute remains unresolved, pursue further steps, including contacting the creditor directly for better clarification. If needed, escalate your issue further with additional documentation and explanations to emphasize your case.

Regardless of the outcome, ensure to update your credit report accordingly and monitor it for any new discrepancies that might arise. Consistency in reviewing your report is vital for falling back into any previous disputes.

Avoiding future credit report issues

Preventative measures can help you maintain a clean credit report moving forward. Regularly monitoring your credit through various tools available can alert you to issues before they escalate. Many services offer credit alerts and updates when changes occur.

Invest time in understanding good credit practices, and stay informed. Simple actions such as timely bill payments, avoiding maxing out credit cards, and reaching out to creditors in times of trouble can help build a sustainable financial future.

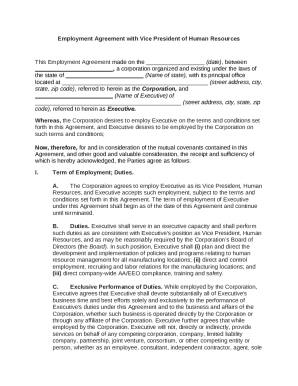

Why choose pdfFiller for document management

pdfFiller stands out as an exemplary tool for document management, especially when it comes to important forms like the dispute credit report sample form. Users can easily edit PDFs on-the-go, ensuring that accuracy is maintained without hassle.

With advanced eSigning features and tools that facilitate collaboration, the platform enhances the user's experience while ensuring document security. Utilizing a cloud-based solution, users benefit from the ability to access and manage their documents from anywhere, reducing stress and increasing efficiency.

FAQs about credit report disputes

Common questions often arise during the dispute process. Many users wonder about the timelines for investigation responses or whether they can dispute multiple errors at once. Understanding the basics can ease worries and streamline the process.

There are also prevalent myths surrounding credit disputes, such as believing that disputing will lower your credit score—this is untrue. Disputes highlight inaccuracies in your credit report and can actually help preserve or enhance your score. For further clarification, numerous resources are available online for deeper insights.

Real-life case studies

Drawing inspiration from real-life success stories can motivate individuals facing the dispute process. Learning how others navigated their disputes successfully—often by ensuring they understood their rights and documented their claims meticulously—can provide valuable lessons.

Some individuals have turned to platforms like pdfFiller to streamline their process, enabling them to manage their documents securely and effectively. By using the available tools, they have minimized errors in documenting disputes and expediting resolutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit dispute credit report sample from Google Drive?

How can I send dispute credit report sample to be eSigned by others?

How do I complete dispute credit report sample on an Android device?

What is dispute credit report sample?

Who is required to file dispute credit report sample?

How to fill out dispute credit report sample?

What is the purpose of dispute credit report sample?

What information must be reported on dispute credit report sample?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.