Get the Understanding Tax-Free Childcare: A Guide for Parents

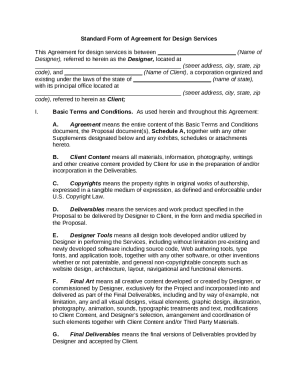

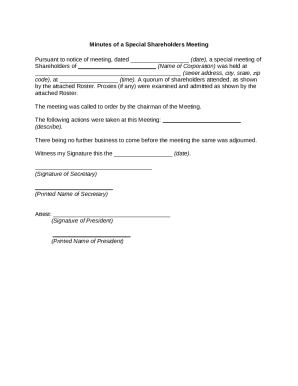

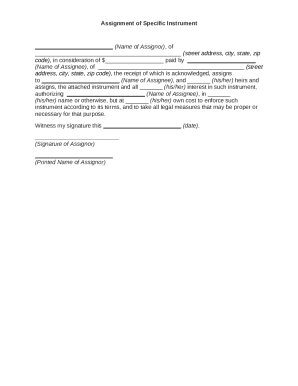

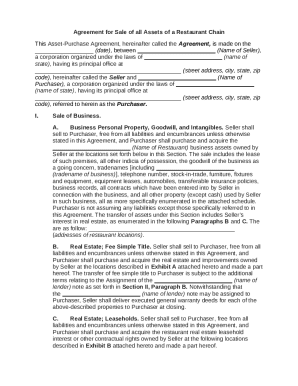

Get, Create, Make and Sign understanding tax- childcare a

Editing understanding tax- childcare a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding tax- childcare a

How to fill out understanding tax- childcare a

Who needs understanding tax- childcare a?

Understanding Tax - Childcare A Form

Overview of childcare tax credits

Childcare tax credits are valuable financial incentives offered by the government to support working families. These credits help reduce your tax liability, thus providing much-needed financial relief amid rising childcare costs. Understanding childcare tax forms is essential for maximizing these benefits. Without a clear grasp of the forms and credits available, you could potentially leave money on the table that could ease your family’s financial burden.

Types of childcare tax credits

Several types of childcare tax credits exist, each designed to accommodate the varying needs of families. The most recognized include:

Choosing the right credit depends on your personal financial situation and childcare needs. A comparison of the credits can help determine the most beneficial option for your family.

Qualifying expenses for childcare tax credits

Specific expenses qualify for childcare tax credits, ensuring that the benefit truly addresses your family's needs. Qualifying services generally include:

However, some expenses are non-qualifying, such as educational expenses, and activities not solely related to childcare, like extracurricular classes. Understanding what expenses count is vital for accurate tax reporting.

Essential documentation for filing childcare tax forms

Proper documentation is critical when filing childcare tax forms. Key documentation includes:

Organizing these documents throughout the year can significantly simplify the filing process. Consider creating a dedicated folder or digital space to keep important papers.

Step-by-step guide to filling out childcare tax forms

Filing your childcare tax form doesn’t have to be overwhelming. Here’s a systematic way to approach it:

Following these steps methodically ensures a smoother filing experience and maximizes your potential credits.

Interactive tools for managing your childcare tax forms

Utilizing interactive tools can greatly enhance the experience of managing your childcare tax forms. pdfFiller offers a streamlined process that makes tax preparation simpler than ever.

These features make pdfFiller an ideal solution for individuals and teams managing their childcare tax documentation effectively.

Additional considerations for filing taxes related to childcare

Your household structure plays a crucial role in the tax implications of childcare credits. For example, single parents often face different challenges and opportunities compared to married couples when filing tax returns.

Furthermore, being aware of any changes in tax policy that may affect childcare credits is vital. Changes like updates in income thresholds can impact how much credit you can claim, so staying informed is essential.

Annually reviewing childcare tax credits and applicable forms ensures you are leveraging all potential financial support available to you.

FAQs about childcare tax credits

Clarifying common doubts can ease the anxiety surrounding tax filing. Here are frequently asked questions regarding childcare tax credits:

Being informed about these aspects can make the filing process smoother, ensuring you receive deserved credits.

Tips for maximizing your childcare tax benefits

Strategic planning can significantly enhance your childcare tax benefits. Start with comprehensive record-keeping throughout the year. This proactive approach allows you to capture each qualifying expense without searching for receipts in tax season.

Additionally, consider consulting with a tax professional to navigate complex situations or take full advantage of available credits tailored to your circumstances.

By planning ahead and staying organized, you can maximize your tax benefits related to childcare expenses, easing your financial stress.

How pdfFiller simplifies tax preparation for childcare

Navigating tax forms can be cumbersome, but pdfFiller transforms this process into a streamlined experience. With its seamless document editing capabilities, users can fill out and manage their forms effortlessly.

eSigning options enable quick submissions, significantly accelerating processing times. Additionally, the platform boasts an all-in-one solution for managing various tax documents, ensuring all your needs are met in a single, convenient location.

Choosing pdfFiller means opting for a robust solution that empowers families and individuals to tackle tax preparation confidently and efficiently, maximizing benefits associated with childcare tax credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the understanding tax- childcare a electronically in Chrome?

How do I fill out understanding tax- childcare a using my mobile device?

Can I edit understanding tax- childcare a on an iOS device?

What is understanding tax- childcare a?

Who is required to file understanding tax- childcare a?

How to fill out understanding tax- childcare a?

What is the purpose of understanding tax- childcare a?

What information must be reported on understanding tax- childcare a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.