Get the free Business Tax ReceiptCity of Lauderhill

Get, Create, Make and Sign business tax receiptcity of

Editing business tax receiptcity of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax receiptcity of

How to fill out business tax receiptcity of

Who needs business tax receiptcity of?

Business Tax Receipt City of Form: A Complete How-to Guide

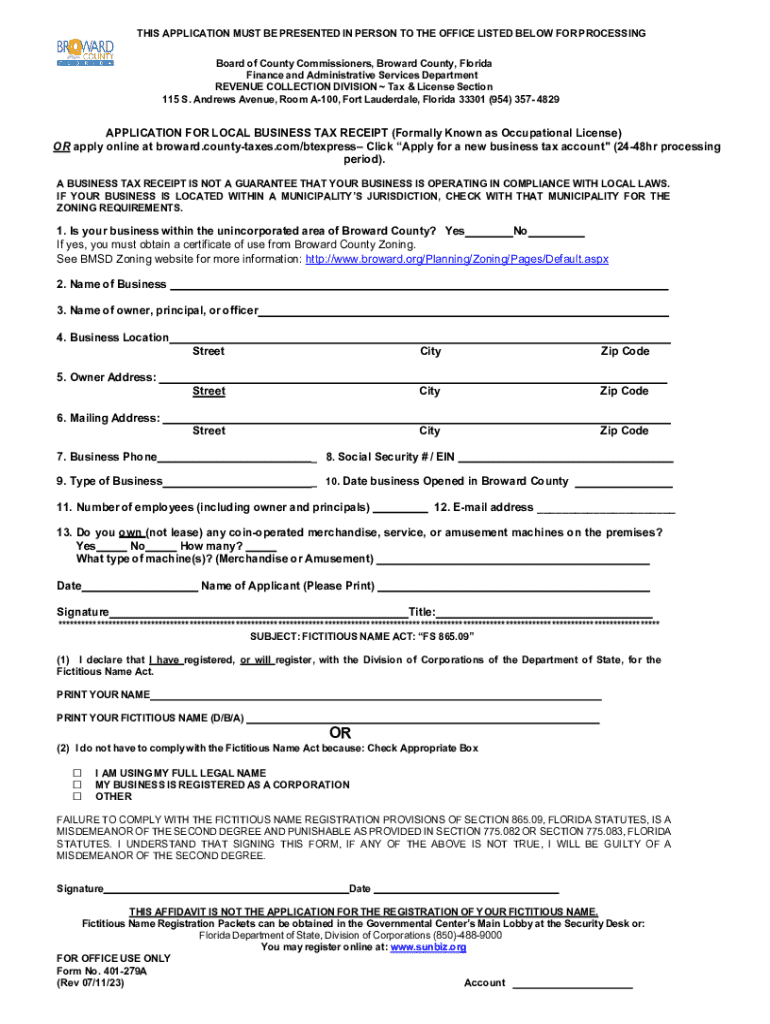

Understanding the business tax receipt

A Business Tax Receipt, commonly known as a BTR, is a crucial document that allows local governments to regulate businesses operating within their jurisdictions. Primarily, it serves as proof that a business has legally registered to conduct its operations in a specific city. Essential for ensuring compliance with local regulations, it also helps to fund public services and infrastructure that support business activities. Without a valid business tax receipt, companies may be subject to fines or other legal repercussions.

For businesses, obtaining a business tax receipt is not just a legal requirement; it's a badge of legitimacy. It assures customers and partners that the business complies with local laws, enhancing reputation and trustworthiness.

Who needs a business tax receipt?

Generally, any business entity that earns income through activities conducted in the city must obtain a Business Tax Receipt. This includes a variety of establishments such as retail shops, service providers, home-based businesses, and even freelancers providing professional services. However, certain exemptions may apply to non-profit organizations and governmental entities.

While most businesses need a BTR, various factors can determine the necessity for one. It is important to check specific local regulations, as cities may have distinct rules pertaining to different business categories.

Local regulations and compliance

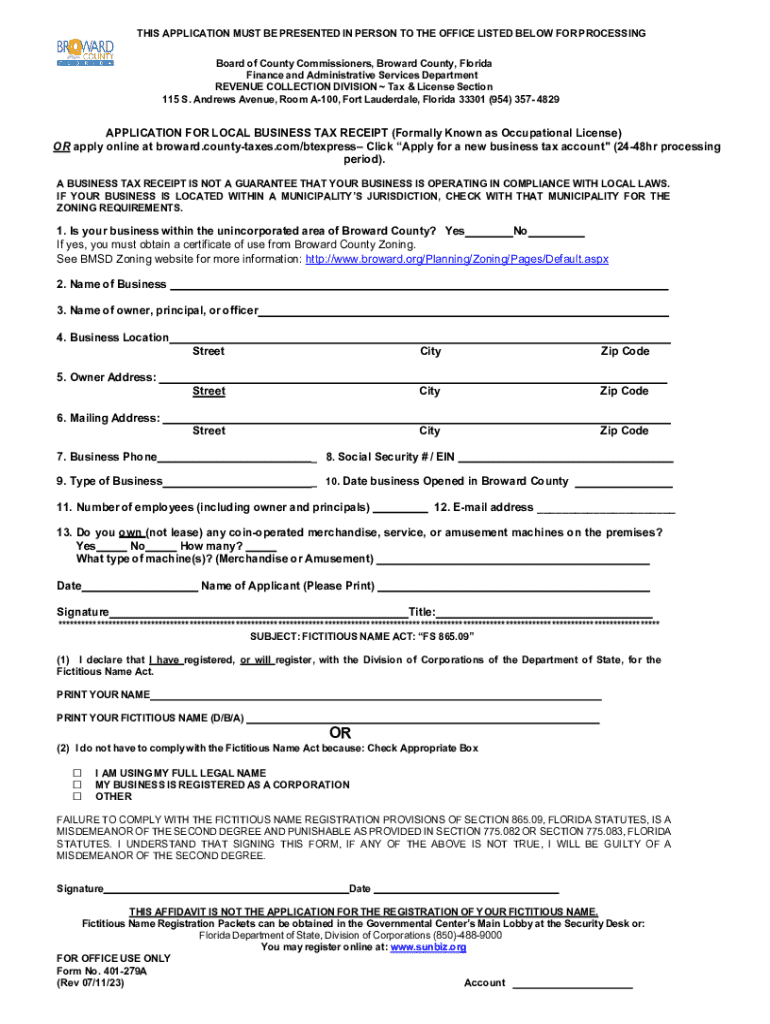

Each city has its specific requirements regarding the application for a business tax receipt. This typically involves completing an application form and submitting it along with necessary documentation such as proof of identity and residence. Non-compliance with these regulations can lead to severe consequences, including financial penalties, the potential closure of the business, and legal action. Consequently, staying abreast of local regulations and maintaining compliance is essential for business longevity.

Step-by-step guide to obtaining your business tax receipt

Embarking on the journey to secure your Business Tax Receipt necessitates careful preparation. Start by assembling necessary documents and information, which may include:

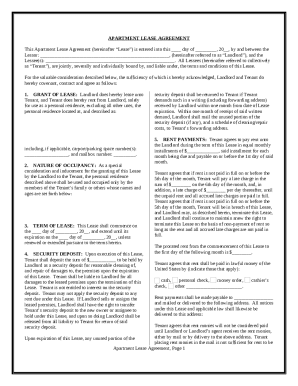

Filling out the application form is the next step. Choose the appropriate form corresponding to your business type, as there may be variations for different categories of operations. Your application will comprise several sections, including business details, owner information, and a description of activities. Accuracy is paramount here, as improper details could lead to application rejection or delays.

Common pitfalls include providing incomplete information or omitting necessary documents, which can prolong the process. After filling in the application, it's essential to review all entries for accuracy before submission.

Submitting your application

The submission of your application can occur either in person at designated city offices or online through platforms like pdfFiller. This online solution allows you to complete and submit your documents seamlessly from anywhere, ensuring convenience.

When submitting online, understanding the submission timeline is crucial. Check the estimated processing time, as it can vary based on local regulations and the volume of applications.

Paying the required fees

The associated fees for a Business Tax Receipt can vary significantly based on factors such as the business type and city location. Generally, you can expect to pay between $50 and several hundred dollars. Payment methods typically include credit cards, checks, and even online transactions. Ensure that you retain your payment confirmation, as it may be needed for verification or if issues arise.

Managing your business tax receipt

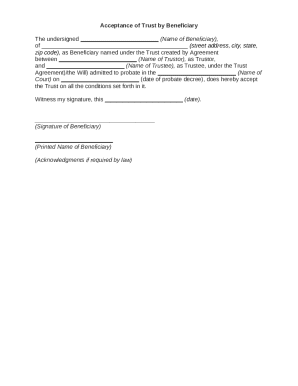

Once you have received your Business Tax Receipt, it's vital to store and organize it securely to protect against loss or damage. Digital storage solutions, such as cloud systems or document management services like pdfFiller, can ensure easy access to your important documents over time.

Renewal process

The renewal process varies by city but usually occurs annually. To renew, be sure to track renewal dates and any changes in your business that may require updates to the receipt. A common checklist for renewal includes:

Should you require an extension due to unforeseen circumstances, contact the city office promptly to initiate that process.

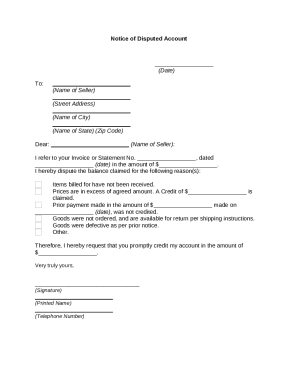

Updating your information

If your business information changes—for instance, a change in address, ownership structure, or business name—it is crucial that the city is notified immediately. Such updates typically require submitting an amendment form along with proof of the changes. This helps ensure that your business remains in compliance and minimizes the chances of facing sanctions.

Utilizing interactive tools on pdfFiller to enhance your experience

pdfFiller provides users with various interactive tools designed to simplify the process of creating and managing business documents. One of the key features includes document editing, which allows you to easily update your Business Tax Receipt and other important papers as needed. This feature offers a user-friendly interface that helps streamline your document management.

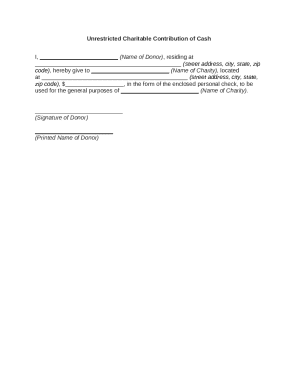

eSigning and collaborating on documents

Signing your Business Tax Receipt digitally is not only secure but also highly efficient. With pdfFiller, you can eSign documents with confidence and share them with team members or partners for collaboration. This convenience eradicates the need for physical meetings and uses valuable time more efficiently in managing your business affairs.

Resources for navigating business taxes

Addressing business tax queries can be daunting, but many resources are available. Consulting frequently asked questions regarding Business Tax Receipts can uncover valuable insights. Engaging with local government offices can also provide clarity on tax-related issues. Remember to keep updated on changes in tax regulations by subscribing for alerts from official sources.

Local business assistance programs can offer support and guidance tailored to your specific needs. These can include workshops, informational sessions, or even one-on-one consultations to help you navigate compliance effectively.

Staying updated on tax changes

Monitoring tax policy changes is vital for any business owner. Establish a habit of checking official city resources and news outlets regularly for updates. Continuous education on tax responsibilities will empower you and your business to thrive in a changing economic landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business tax receiptcity of in Gmail?

How can I edit business tax receiptcity of from Google Drive?

How do I fill out the business tax receiptcity of form on my smartphone?

What is business tax receiptcity of?

Who is required to file business tax receiptcity of?

How to fill out business tax receiptcity of?

What is the purpose of business tax receiptcity of?

What information must be reported on business tax receiptcity of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.