Get the free I IZ 56

Get, Create, Make and Sign i iz 56

How to edit i iz 56 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i iz 56

How to fill out i iz 56

Who needs i iz 56?

A Comprehensive Guide to the iz 56 Form

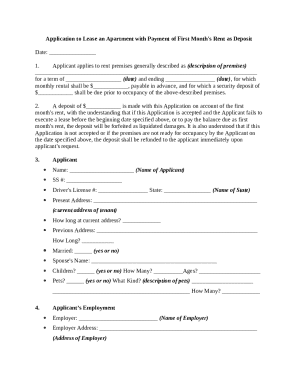

Understanding the iz 56 form

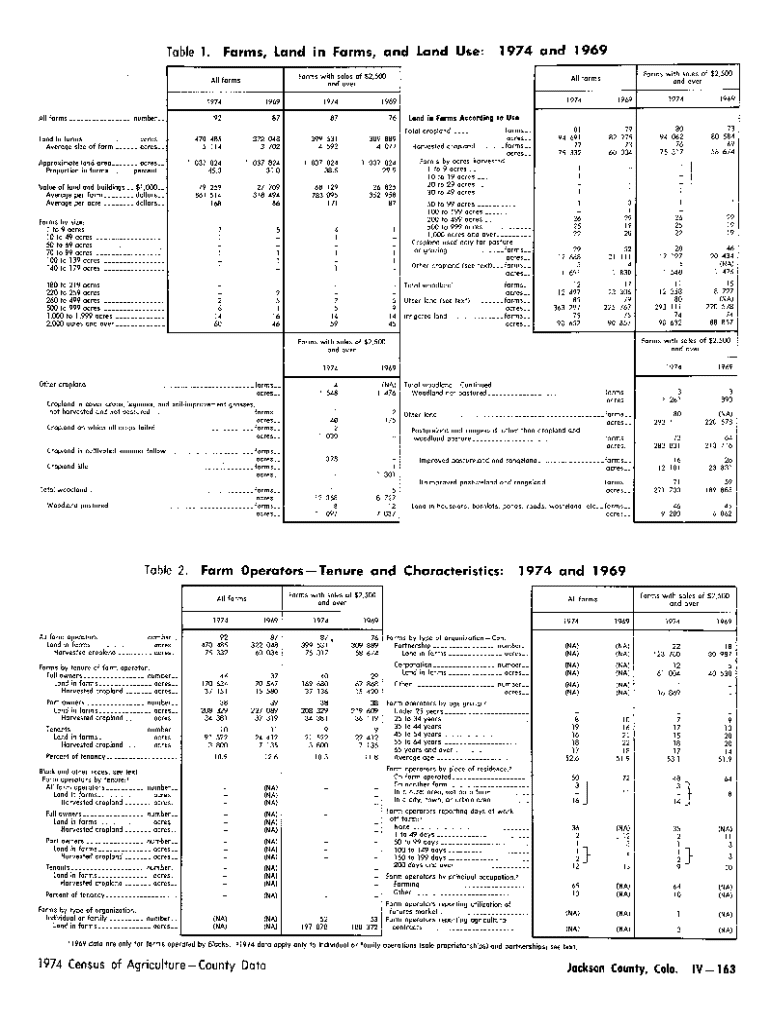

The i iz 56 form serves as a vital document in various scenarios, primarily addressing specific procedural needs within both personal and professional environments. Its purpose revolves around facilitating necessary reporting and compliance, ensuring that individuals and entities can meet the required obligations with clarity and precision.

The significance of the i iz 56 form extends across various applications, from tax submissions to compliance certifications. For example, businesses may use it to report specific operational data to state or local governments, while individuals may rely on it for personal disclosures or financial evaluations.

Who needs the iz 56 form?

The i iz 56 form is essential for a diverse range of users, including individuals, businesses, and organizations that encounter specific situations requiring formal reporting. Individuals may need this form when applying for loans or grants, where detailed financial information is mandatory. Meanwhile, businesses are required to submit this form to fulfill legal obligations related to operational compliance.

For instance, a small business owner seeking state funding may have to provide an i iz 56 form as part of their application package, ensuring transparency and adherence to financial protocols. Similarly, non-profit organizations can use this form in various grant applications, emphasizing the need for financial accountability.

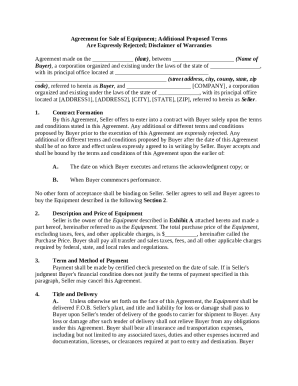

Key features of the iz 56 form

The i iz 56 form boasts several key features tailored to enhance user experience and ensure accurate submissions. Each section within the form serves a distinct purpose, from personal identification to financial disclosures, making it crucial to understand what each part entails. Accuracy and completeness are paramount, as any discrepancies can lead to delays or issues with processing.

Specifically, the form is structured to include sections for personal details, financial information, and supporting documentation. Users are encouraged to provide precise data, as this will facilitate smoother evaluation processes for whatever purpose the form is being utilized.

Step-by-step guide to filling out the iz 56 form

Completing the i iz 56 form requires careful preparation and systematic fulfillment of each section. Start by gathering all necessary information and documents, such as identification and financial statements. By organizing these details in advance, you can streamline the process and reduce potential errors.

Next, follow these detailed instructions for each section of the i iz 56 form:

Avoid common pitfalls, such as overlooking required sections or providing incorrect financial data, which can delay processing. By staying attentive to detail and regularly reviewing your entries, you will enhance the likelihood of a successful submission.

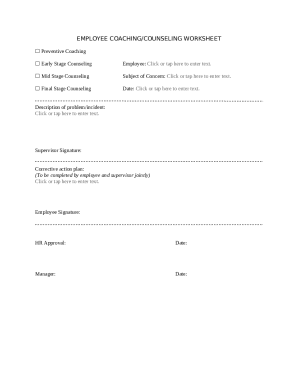

Editing and customizing the iz 56 form

Editing the i iz 56 form can be efficiently accomplished using pdfFiller, which provides an array of editing tools designed for user convenience. The platform allows you to modify fields, add new information, or even update existing data without hassle. With pdfFiller’s user-friendly interface, you can quickly navigate through the form.

For collaborative efforts, pdfFiller offers features that enable teams to work together effectively. This includes the option to invite others for review and signature, enhancing communication and facilitating workflow enhancements.

Signing the iz 56 form

The signing of the i iz 56 form is a critical step that validates the information provided and confirms consent. E-signatures have gained legal acceptance, making them a secure method of signing documents. By using pdfFiller’s eSignature feature, users can quickly and conveniently add their signatures without the need for printing.

The process for signing the form electronically is straightforward: simply follow these steps:

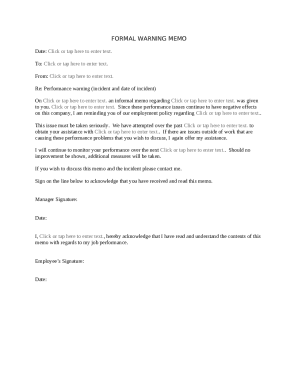

Managing and storing the iz 56 form

After completing the i iz 56 form, proper management and storage are essential for future access. Digital storage offers flexibility, enabling easy retrieval and sharing of the document as needed. Best practices suggest using secure cloud storage options to safeguard sensitive information.

pdfFiller provides a suite of security features that ensure your documents are stored safely, such as encryption and access controls, which prevent unauthorized access.

FAQs about the iz 56 form

Understanding the common questions surrounding the i iz 56 form helps users navigate its complexities effectively. Frequently asked questions typically revolve around filling out the form, necessary documentation, and the signing process.

For instance, users often inquire about the specific supporting documents required for submission or what to do in case of an error in their entries. Addressing these concerns enables smoother interactions with the form.

Additional tools for working with the iz 56 form

To maximize the utility of the i iz 56 form, integrating it with other software tools can be beneficial. For example, using accounting software in tandem can streamline data entry and enhance reporting accuracy on financial aspects.

pdfFiller also offers additional enhancements, such as built-in templates and advanced editing features, which simplify document management tasks. Leveraging these tools allows users to work more efficiently with their forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify i iz 56 without leaving Google Drive?

How do I fill out i iz 56 using my mobile device?

How can I fill out i iz 56 on an iOS device?

What is i iz 56?

Who is required to file i iz 56?

How to fill out i iz 56?

What is the purpose of i iz 56?

What information must be reported on i iz 56?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.