Get the free Committed to your insurance protection Switch to Helsana and ...

Get, Create, Make and Sign committed to your insurance

How to edit committed to your insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out committed to your insurance

How to fill out committed to your insurance

Who needs committed to your insurance?

Committed to Your Insurance Form: A Comprehensive Guide

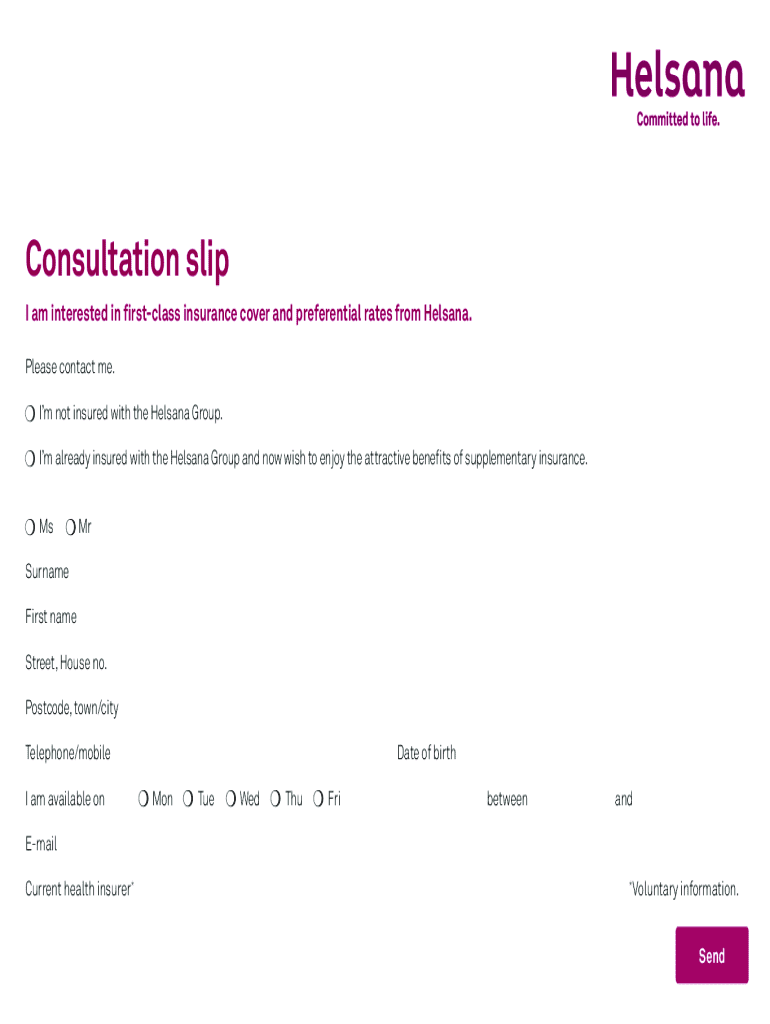

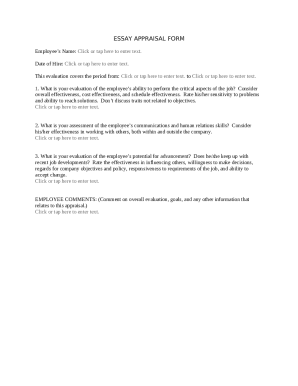

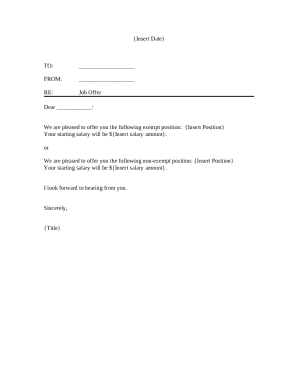

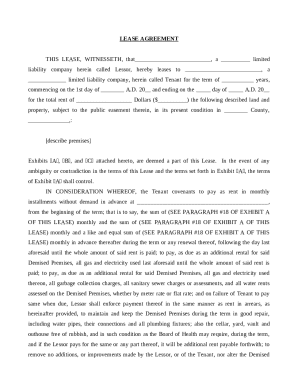

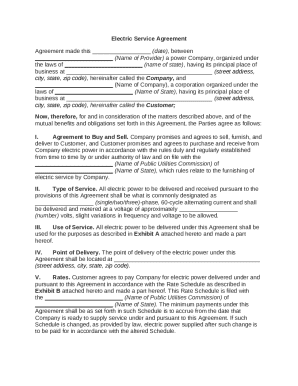

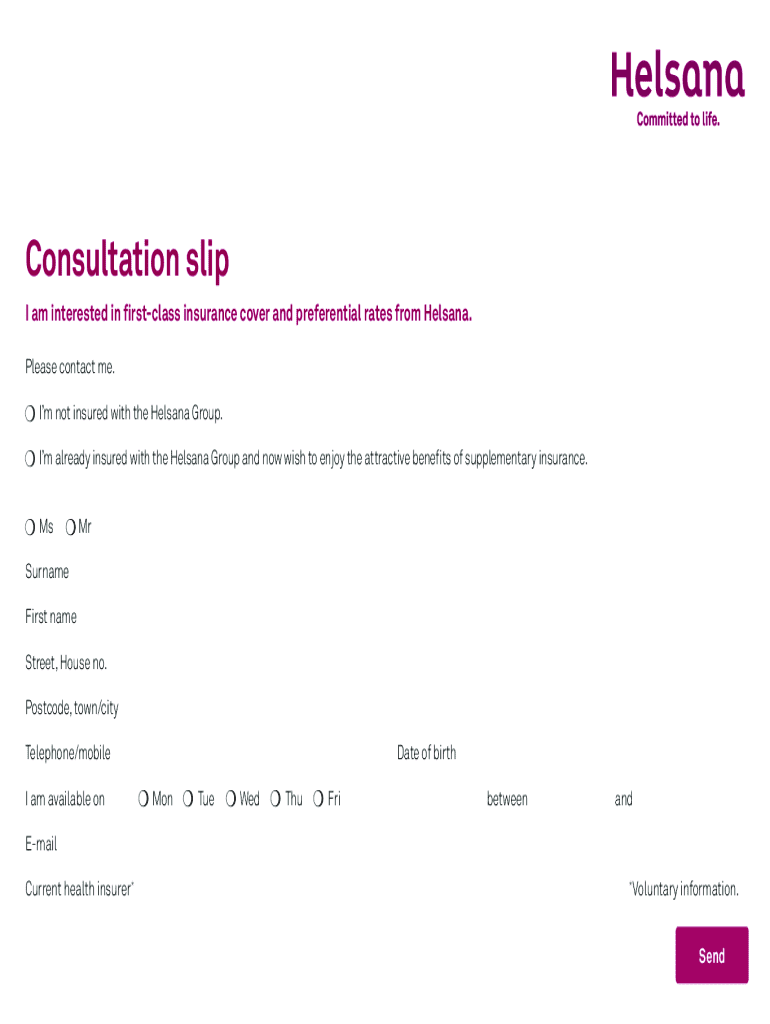

Understanding your insurance form

An insurance form is a fundamental document that outlines the agreement between you and your insurance provider. This document serves multiple purposes, from detailing your coverage options to collecting essential information necessary for claims. When filled out correctly, it ensures a smooth relationship with your insurer, allowing for peace of mind in emergencies.

However, inaccuracies on your insurance form can lead to significant issues, including claim denials or delays. For example, if you mistakenly input the wrong address or coverage type, your insurer may refuse to pay out a claim when you need it the most. Thus, being committed to your insurance form is not only about filling it out; it’s about ensuring every detail is precise.

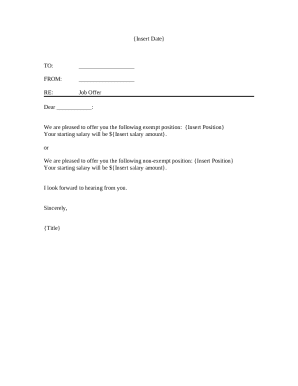

Types of insurance forms available

Insurance forms vary widely based on the type of insurance you are dealing with. Common types include health insurance forms, auto insurance applications, and various liability insurance agreements. Each type has specific requirements and nuances tailored to its particular coverage scenario, making understanding these differences pivotal.

Individuals often deal with personal insurance forms, while businesses regularly fill out commercial insurance forms. Knowing the distinctions between these forms ensures you supply the correct information relevant to your situation, which is critical in the decision-making process when securing insurance.

Key components of the insurance form

Filling out your insurance form accurately is crucial and involves a variety of key components. Personal details such as your name, address, and contact information form the basis of the document. Moreover, you need to include your policy information, detailing the type of coverage you intend to apply for and the insurance provider.

Common mistakes such as incomplete fields or misinterpreting coverage options can lead to considerable setbacks. For instance, if you overlook a coverage type that is critical for your needs, you might find yourself under-insured. Furthermore, when prepping your form, it’s wise to gather supporting documents like identification, previous policy copies, and any relevant medical records to ensure a comprehensive submission.

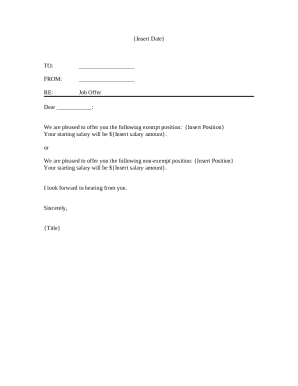

Step-by-step guide to filling out your insurance form

Before diving into filling out your insurance form, it's essential to prepare effectively. Start by gathering all necessary information and documents. Establishing a timeline can help you remain organized; for instance, setting a deadline for each section’s completion can prevent last-minute rushes.

As you fill out the form, go section by section, ensuring clarity and accuracy. For example, when filling out your coverage details, make sure to detail every type of coverage you're requesting. After completing your form, dedicate time to reviewing it thoroughly for any errors. Double-check not just for spelling or numeric mistakes but also ensure the intended coverage has been correctly represented.

Editing and signing your form with pdfFiller

Once your insurance form is completed, utilizing pdfFiller’s editing features provides an efficient way to make necessary adjustments. The platform’s editing tools enable you to modify text, add notes, or highlight significant sections seamlessly. An added advantage of this cloud-based platform is that you can access these tools from anywhere, making it incredibly convenient.

After making your edits, signing the form electronically is the next step. pdfFiller allows you to eSign your insurance form easily, ensuring your signature has legal validity. With the option to collaborate—by sharing the form with team members or agents—you can incorporate feedback and finalize the document with confidence.

Managing your insurance form post-submission

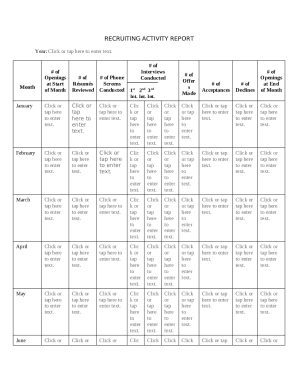

After submitting your insurance form, keeping track of its status becomes essential. Many insurance companies offer portals where you can check the current status of your submission. If you encounter issues, such as a rejection, knowing your next steps is necessary to address the problems promptly.

Additionally, understanding when and how to update or change your insurance form is vital. Factors such as a change in personal circumstances, like marriage or relocation, may necessitate an updated form. Knowing when a completely new form is required ensures that you remain compliant with insurance regulations.

Frequently asked questions (FAQs)

People often have questions regarding their insurance forms, especially regarding processing times and security. For example, many want to know how long it takes to process their submitted insurance form. While the timeframe can vary by insurer, most processing times are within a few weeks. It is also common to be concerned about what to do if your form is rejected; directly contacting your insurer is typically the best step.

Another frequent inquiry involves the security of submitted documents. Most reputable insurers implement robust security measures to ensure that your documents are protected. As a best practice, always ensure you access your submission through secure websites or applications.

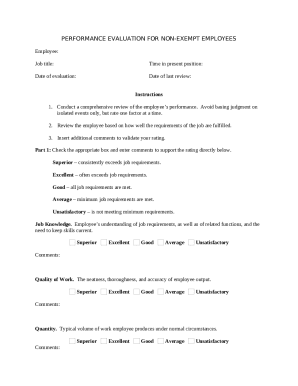

Case studies and user testimonials

Real-life stories and testimonials provide invaluable insights into the effectiveness of pdfFiller in simplifying the insurance process. For instance, one user shared how the platform enabled them to complete their auto insurance form and submit it in under ten minutes compared to the traditional method that typically took days. With lower turnaround times, users can secure insurance coverage efficiently without feeling overwhelmed.

Clients also appreciate the collaborative features of pdfFiller, allowing them to invite family members or colleagues to review forms, making the process less burdensome. These success stories highlight how committing to your insurance form has become easier than ever with the right tools.

Additional tools and resources

pdfFiller offers a variety of interactive tools designed to enhance the document creation and management experience. These tools allow users to create a complete insurance form from scratch or utilize templates to ensure all necessary sections are included. Moreover, users can find guidance on choosing the right insurance coverage tailored to their personal or business needs.

By conducting thorough comparisons of different insurance policies through provided resources, potential policyholders can make informed decisions. This approach to insurance acquisition further emphasizes the importance of being committed to your insurance form, as thorough research leads to optimized choices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute committed to your insurance online?

How can I fill out committed to your insurance on an iOS device?

How do I fill out committed to your insurance on an Android device?

What is committed to your insurance?

Who is required to file committed to your insurance?

How to fill out committed to your insurance?

What is the purpose of committed to your insurance?

What information must be reported on committed to your insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.