Get the free Beneficiarys Instructions for Schedule K-1 (Form 38)

Get, Create, Make and Sign beneficiarys instructions for schedule

How to edit beneficiarys instructions for schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiarys instructions for schedule

How to fill out beneficiarys instructions for schedule

Who needs beneficiarys instructions for schedule?

Beneficiary’s Instructions for Schedule Form: A Comprehensive Guide

Overview of beneficiary’s instructions for schedule form

The beneficiary's instructions for schedule form is a pivotal document that serves to guide beneficiaries through the often-complex process of reporting income or distributions for tax purposes. This form is particularly crucial for those involved in trusts or inheritances, as it delineates specific instructions that allow for accurate completion of tax filings. Understanding these instructions is essential to avoid errors that can lead to financial penalties or delays.

The pdfFiller platform plays a significant role in this process, providing user-friendly tools that simplify the completion of the schedule form. Through its cloud-based services, individuals can easily access, fill out, and submit their forms from any location, streamlining tax preparation and making compliance much more manageable.

General information

Who qualifies as a beneficiary? Generally, beneficiaries are individuals or entities entitled to receive assets from a trust, will, or retirement account. Taxpayers, like Californian residents, should be aware that the rules can vary significantly depending on state laws and the nature of the assets involved. Beneficiary instructions should be carefully considered when preparing tax documents, especially when dealing with forms such as Schedule K-1, as they ensure the correct reporting of income received.

Document relevance becomes particularly pronounced when discussing tax preparation and financial planning. Many common scenarios necessitate the use of the beneficiary schedule form, including estate distributions, income received from trust activities, and payments derived from life insurance policies. Therefore, having a thorough understanding of how to fill out this documentation is vital.

Purpose of beneficiary instructions

Beneficiary instructions serve as an essential roadmap for filling out the schedule form accurately. These guidelines not only ensure that the beneficiary records the correct amounts but also help maintain compliance with federal and state tax regulations. Inaccuracies in reporting can result in audits or taxes owed, making familiarity with these instructions paramount.

Common pitfalls during the form-filling process include misinterpreting line items, failing to report all potential income sources, or overlooking deadlines. To mitigate these risks, beneficiaries are encouraged to refer closely to the provided instructions, double-check their entries, and seek clarification on any sections that may be unclear. The assistance of platforms like pdfFiller can greatly aid in this process, offering guidance and tools that reduce the likelihood of errors.

Step-by-step guide to filling out the beneficiary schedule form

Filling out the beneficiary schedule form involves several coherent steps. Below is a structured approach to help beneficiaries navigate this process effectively.

Specific line instructions

Offering specific guidance on each key line of the beneficiary schedule form is crucial for accurate completion. Each line often comes with its set of terminology and abbreviations; thus, clarity is essential. Here are detailed insights into the terms and examples that illustrate how to fill in these lines correctly.

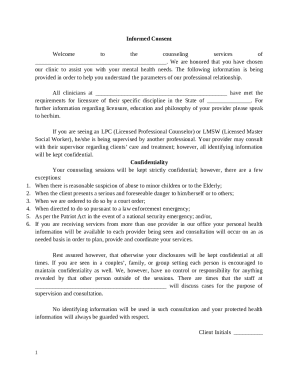

Privacy and compliance considerations

When dealing with sensitive financial documents like the beneficiary's instructions for schedule form, privacy and compliance take center stage. pdfFiller implements stringent measures to protect user data, ensuring that all information entered into the platform is encrypted and securely stored.

Compliance guidelines are not to be overlooked. Users need to ensure they are adhering to federal and state laws surrounding the reporting of income. Consulting with a tax professional or legal advisor can aid in navigating complex regulations, especially for residents in states like California, where tax laws can be intricate and nuanced.

FAQs regarding the beneficiary's schedule form

Beneficiaries often have numerous questions regarding the schedule form and the instructions provided. Clarifying these queries not only enhances understanding but also aids in the smooth completion of the form. Here are some frequently asked questions:

Related forms and documentation

When completing the beneficiary's schedule form, you may need other related forms for a comprehensive tax filing. For instance, Schedule K-1 is often used to report income, deductions, and credits received from partnerships or S corporations. Familiarity with these documents ensures you're well-prepared.

Translating beneficiary instructions

As many beneficiaries may not speak English fluently, the importance of translation services cannot be overstated. Clear instructions in the native language facilitate comprehension and reduce errors in filing the schedule form.

pdfFiller offers translation features that help make tax-related documents accessible to everyone, ensuring that language barriers do not hinder compliance and accurate reporting.

Additional support and live help options

Navigating the intricacies of the beneficiary's instructions for schedule form can be daunting. pdfFiller provides robust customer service that includes live help options, enabling users to seek assistance for complex queries or issues that arise while completing their forms.

Accessing live help ensures that users can address any concerns in real time, making the document management process far less stressful and much more efficient. Whether you need assistance drafting your instructions or understanding specific line items, the help is readily available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beneficiarys instructions for schedule directly from Gmail?

How do I complete beneficiarys instructions for schedule online?

How can I fill out beneficiarys instructions for schedule on an iOS device?

What is beneficiary's instructions for schedule?

Who is required to file beneficiary's instructions for schedule?

How to fill out beneficiary's instructions for schedule?

What is the purpose of beneficiary's instructions for schedule?

What information must be reported on beneficiary's instructions for schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.