Get the free IRS Issues New Proposed Section 125 Cafeteria Plan ...

Get, Create, Make and Sign irs issues new proposed

Editing irs issues new proposed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs issues new proposed

How to fill out irs issues new proposed

Who needs irs issues new proposed?

IRS Issues New Proposed Form: Comprehensive Guide

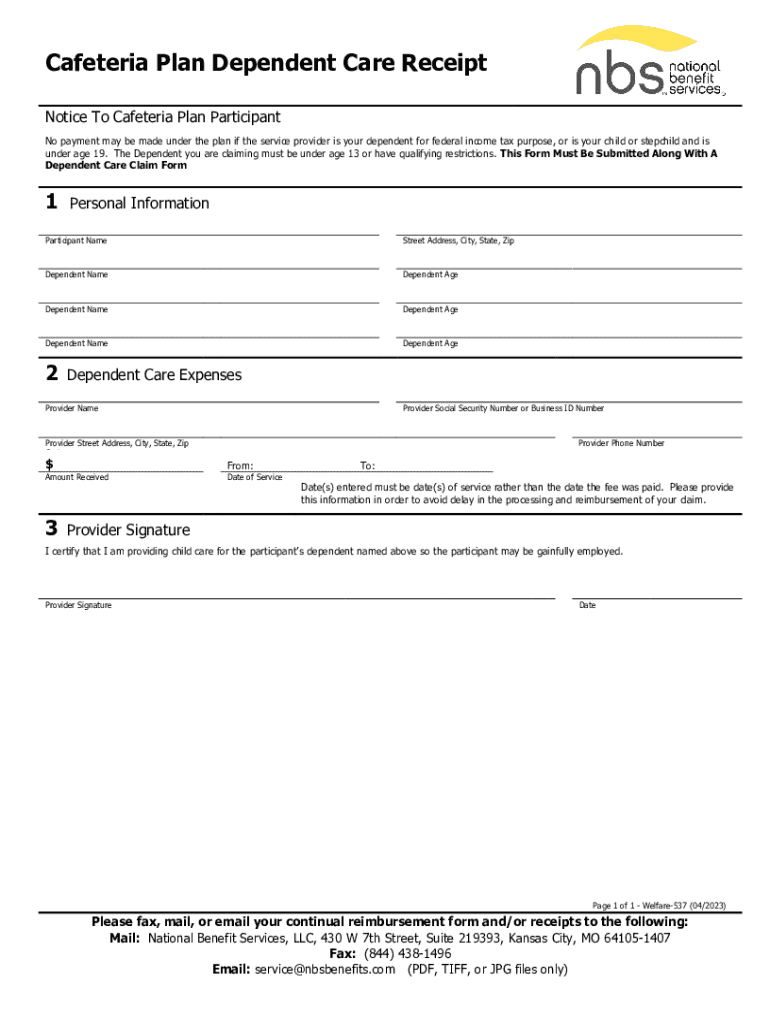

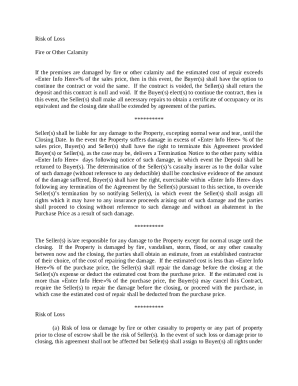

Overview of the new proposed form

The IRS has introduced a new proposed form designed to streamline specific tax reporting processes while ensuring compliance with the latest tax regulations. This form targets individuals, freelancers, small business owners, and tax professionals who encounter distinct reporting requirements within their financial practices. The purpose of this form is to collect accurate information effectively, thereby aiding in tax compliance and potentially reducing audit risks.

Historically, IRS forms undergo periodic updates to align with changing tax laws and improve user experience. The introduction of this proposed form reflects the IRS's commitment to simplifying tax documentation and enhancing taxpayer support.

Key features of the new proposed form

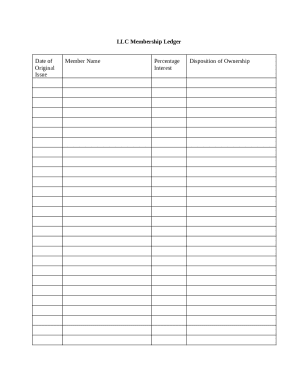

The new proposed form is divided into distinct sections, each requiring specific information based on the taxpayer's profile. For example, the first section may require personal identification details, while subsequent sections assess income sources, deductions, and credits. This structured approach aims to prevent common errors and ensure comprehensive data collection.

Comparing this new form to previous versions highlights multiple enhancements. While older forms may have lacked certain prompts to clarify taxpayer obligations, the proposed form introduces new entries designed to capture more detailed financial information. This evolution in design aims to support accurate reporting and reduce misunderstandings.

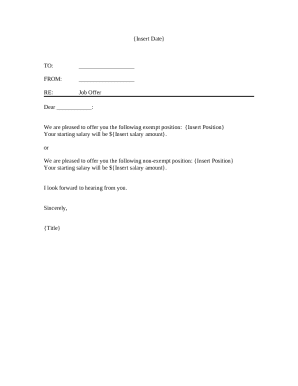

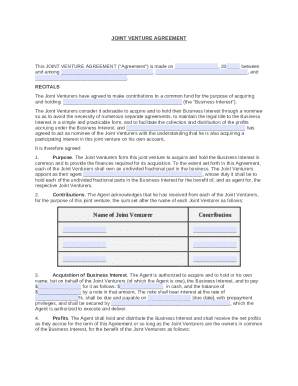

Who should use the new proposed form?

The new proposed form caters primarily to individuals, freelancers, and small business owners who face unique tax reporting challenges. For instance, freelancers offering multiple services may need to provide granular details regarding their earnings and applicable expenses, while small businesses may navigate complex deductions and credits. Specific scenarios where this form is particularly applicable include reporting income from gig economy work, claiming self-employment deductions, or strategizing business-related tax credits.

Utilizing the new proposed form is crucial for maintaining tax compliance. Filing using outdated forms can result in inaccuracies, which might lead to audits or additional tax liabilities.

Step-by-step instructions for completion

Prior to filling out the new proposed form, preparation is key. Gather all necessary documents, including income statements (such as 1099s or W-2s), previous tax returns, and relevant receipts. Organizing these records will significantly ease the filling process and enhance accuracy.

When filling out the form, proceed carefully through each section. Start with your personal information, followed by income details, and proceed to deductions. Many taxpayers commonly overlook entries, especially in sections requiring specifics on self-employment expenses or credits. Hence, a meticulous approach is fundamental.

Before submission, perform a final review to confirm that all information is accurate and complete. Errors can lead to delays or even audits, so taking the time to ensure everything is correct is essential.

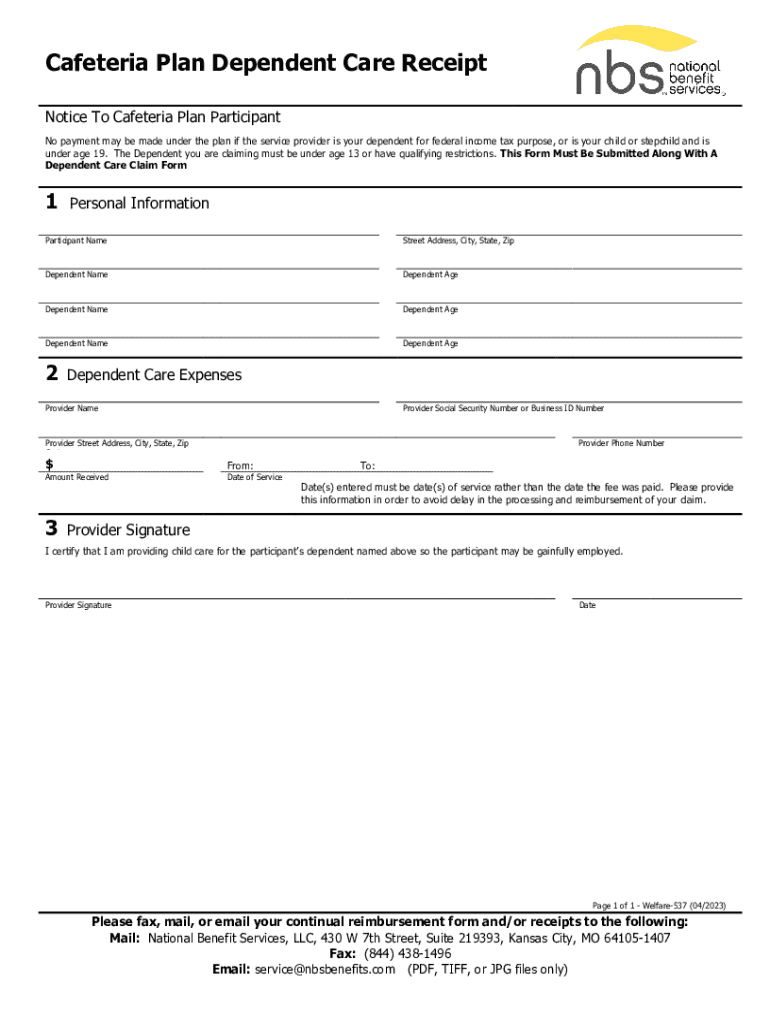

Utilizing pdfFiller to manage the new proposed form

pdfFiller offers an efficient solution for managing the new proposed form. With its robust editing and e-signing features, users can easily upload the form, fill it out, and save their progress. This cloud-based platform allows for convenient access from anywhere, providing a user-friendly interface that simplifies document management.

The platform also supports team collaboration. Users can share forms with colleagues for collective input or review, streamlining the workflow for teams working on tax documentation. This collaborative capability ensures that everyone is on the same page regarding tax compliance and documentation.

FAQs regarding the new proposed form

Frequent inquiries arise surrounding the new proposed form, particularly concerning its completion and submission process. Many users wish to understand submission timelines and whether electronic submissions are viable. Additionally, taxpayers often seek clarity on what to do if they encounter issues while filling out the form.

For common issues, staying organized and clearly understanding each section is vital. Those facing technical difficulties with pdfFiller or related tools can typically find solutions through user support or instructional content.

Featured insights and resources

As the IRS continually updates its forms and processes, staying informed is essential. A curated list of recent articles from tax professionals offers insights into the implications of the new proposed form, alongside expert opinions to aid better understanding.

Additionally, educational resources, including links to IRS announcements and tax advice, provide comprehensive support for taxpayers. Instructional webinars delve deeper into changes and best practices, serving as valuable tools for ensuring compliance.

Staying updated on IRS regulations

Tax regulations can shift rapidly, making it critical for individuals and businesses alike to monitor IRS updates actively. Failure to stay informed may lead to compliance issues or missed opportunities for tax savings. Subscribers to IRS newsletters and alerts can receive timely information directly relevant to their tax obligations.

Implementing tools for tracking changes, such as online subscription services, can empower taxpayers to embrace their responsibilities effectively. Proactive engagement not only fosters compliance but also enhances overall financial accuracy.

We're here to help

At pdfFiller, customer support is dedicated to assisting users in navigating the new proposed form and addressing any inquiries. Our knowledgeable team is available to provide personalized assistance, ensuring users feel confident and supported throughout their tax documentation processes.

For direct help or specific questions, users can quickly reach out via our contact channels to obtain expert guidance tailored to their needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in irs issues new proposed?

Can I create an electronic signature for the irs issues new proposed in Chrome?

How do I fill out the irs issues new proposed form on my smartphone?

What is irs issues new proposed?

Who is required to file irs issues new proposed?

How to fill out irs issues new proposed?

What is the purpose of irs issues new proposed?

What information must be reported on irs issues new proposed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.