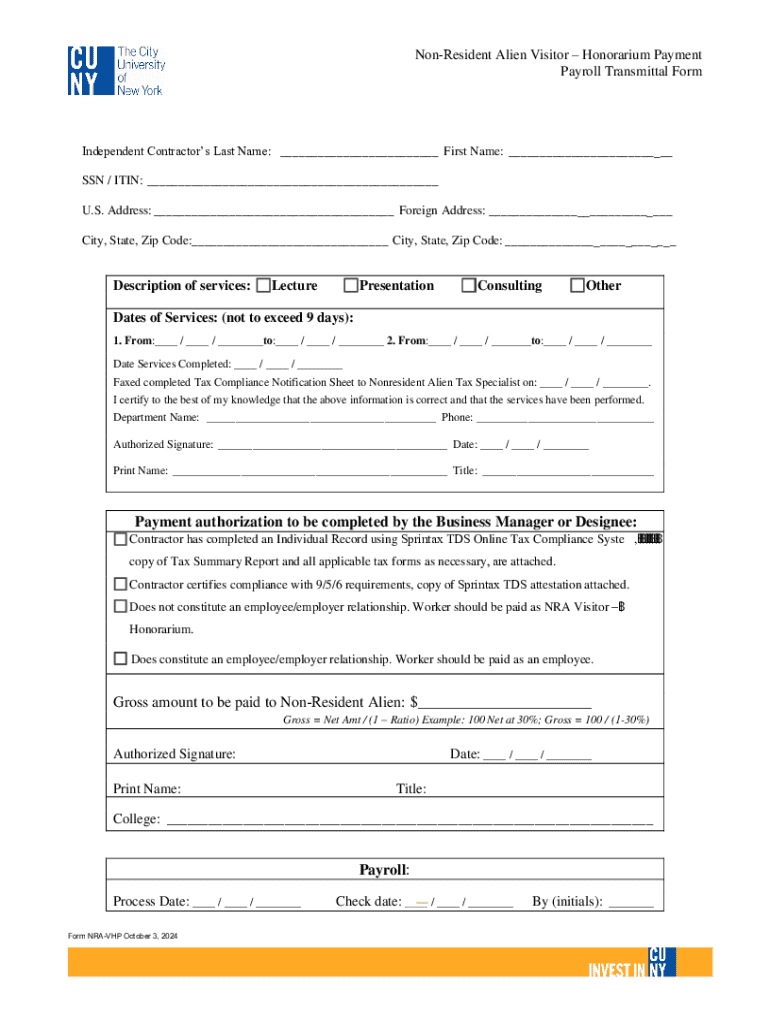

Get the free Honorarium Payment Payroll Transmittal Form

Get, Create, Make and Sign honorarium payment payroll transmittal

How to edit honorarium payment payroll transmittal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out honorarium payment payroll transmittal

How to fill out honorarium payment payroll transmittal

Who needs honorarium payment payroll transmittal?

Comprehensive Guide to the Honorarium Payment Payroll Transmittal Form

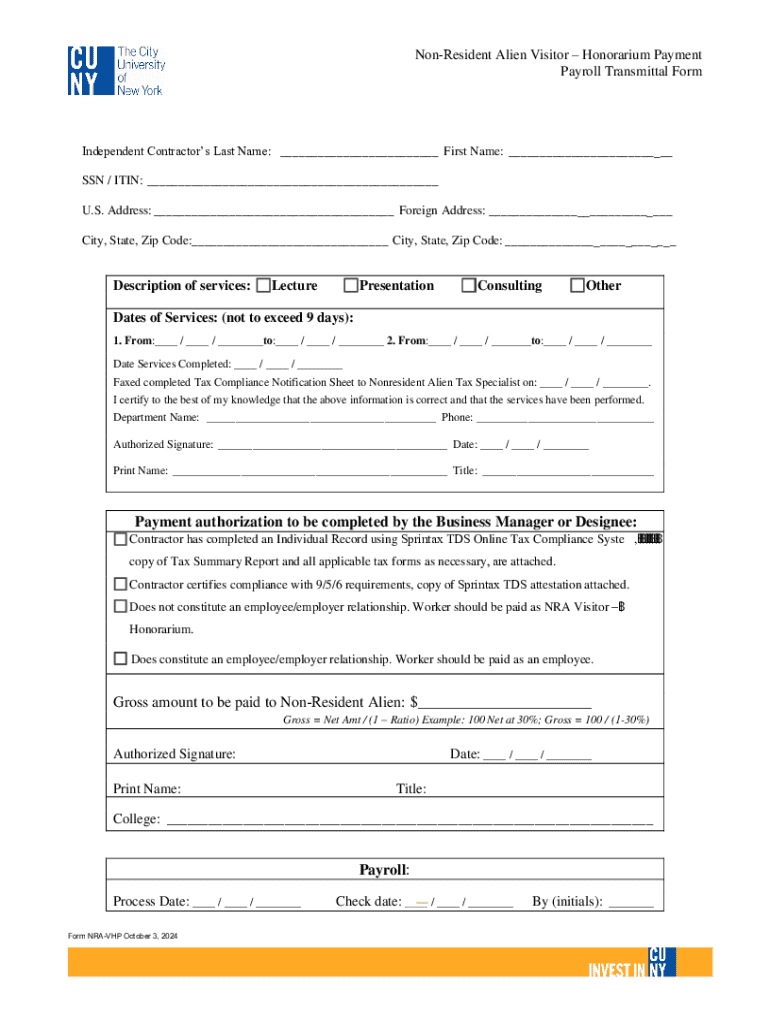

Understanding the honorarium payment payroll transmittal form

An honorarium payment payroll transmittal form is essential for documenting financial transactions, specifically for compensating individuals for services rendered voluntarily. While honorariums are typically awarded to speakers, consultants, or event participants, they often remain misunderstood due to their non-salary nature, leading to confusion regarding taxation and compliance.

The need for payroll transmittal forms arises across various settings, including academic institutions, nonprofit organizations, and professional associations, making understanding this form crucial for ensuring ease of payment processing. By providing a clear structure for honorarium payments, these forms facilitate accurate record-keeping and regulatory compliance.

Key components of the honorarium payment payroll transmittal form

Successfully completing an honorarium payment payroll transmittal form requires careful attention to several key components. First, it is essential to include personal identifying information about the recipients. This section typically includes the recipient's name, address, phone number, and possibly their Social Security number, depending on the organization’s requirements.

In addition to this basic information, the form should clearly state the payment amount and rationale for the honorarium. Understanding the payment's frequency, such as whether it is a one-time payment or recurring, is crucial for bookkeeping purposes. Lastly, the form usually requires a signature from authorized personnel and may include digital signature options for convenience.

Step-by-step process for filling out the form

To properly fill out the honorarium payment payroll transmittal form, it’s crucial to start by gathering necessary information. This includes having the recipient’s details at hand, knowing the agreed-upon payment amount, and any supporting documentation that validates the honorarium request.

Once you have all necessary information, begin filling out the form section by section. Here’s a detailed walkthrough:

Common mistakes to avoid include missing signatures, incorrect payment amounts, or failing to provide adequate descriptions for the payment's purpose. To simplify this entire process, using tools like pdfFiller can help streamline the experience by allowing users to import, fill, and edit their forms digitally.

Managing and submitting your honorarium payment payroll transmittal form

Before submitting your honorarium payment payroll transmittal form, a thorough review and finalization process is essential. Double-checking the accuracy of each piece of information can prevent processing delays. Miscommunication and errors can lead to significant administrative burdens, so ensuring clarity before submission is paramount.

In the current digital age, consider utilizing electronic submission options. Cloud-based platforms such as pdfFiller not only streamline the process but also enhance security and compliance measures. Leveraging these tools ensures that sensitive information is transmitted securely and that your honorarium payments are processed without unnecessary delays.

Tracking and following up on payments

Getting paid through an honorarium requires an understanding of the typical processing times that might be involved. Payments can often take several weeks to process, depending on the organization and its internal procedures. Understanding these timelines helps set appropriate expectations for recipients regarding when they can anticipate receiving their funds.

If payments appear delayed beyond expected timelines, it's essential for recipients to know how to query the status of their honorarium. Effective communication strategies with the payroll department can facilitate faster resolution of any issues. Here are some tips:

Best practices for handling honorarium payments

Implementing robust record-keeping strategies is essential for both organizations and recipients providing honorarium payments. Having a well-organized system for documenting these transactions helps manage any potential audits and ensures compliance with tax regulations.

At the same time, ensuring clear communication with payment recipients is key. Organizations should provide clarity regarding payment processes, timelines, and what recipients can expect in terms of documentation and reporting.

Leveraging pdfFiller’s tools for document management

pdfFiller offers several tools that can enhance the process of managing honorarium forms. Its cloud accessibility means users can access forms from anywhere, allowing for flexibility, particularly for remote teams or individuals. Furthermore, collaborative features enable team members to work together efficiently on document preparation and corrections.

Integrating pdfFiller into existing workflows maximizes efficiency, ensuring that all aspects of document management are unified. Customizable templates can significantly speed up the process of filling out honorarium payment payroll transmittal forms, allowing for quick adjustments according to specific needs.

Addressing common challenges and FAQs

Problems may arise during the completion or submission of honorarium payment payroll transmittal forms. Common issues include encountering error messages during online form submissions or difficulty with document compatibility across different software.

There are often frequently asked questions surrounding honorarium payments. Some common queries might pertain to the tax status of honoraria or issues around payment processing. Being prepared to address these questions can streamline communication with recipients and reduce delays in processing.

Update and maintenance of your templates

The importance of keeping your honorarium payment payroll transmittal forms current cannot be overstated. Regulatory changes can affect how honorarium payments are taxed or reported, which may require updates to your templates. Regularly reviewing and revising forms will ensure ongoing compliance with any shifts in legal requirements.

Users of pdfFiller can update forms easily within the platform. By utilizing the features that allow modification of templates, organizations can stay informed about necessary changes without creating significant downtime in their operations. Staying proactive will help navigate the complexities associated with honorarium payments smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify honorarium payment payroll transmittal without leaving Google Drive?

How do I complete honorarium payment payroll transmittal online?

How do I fill out honorarium payment payroll transmittal on an Android device?

What is honorarium payment payroll transmittal?

Who is required to file honorarium payment payroll transmittal?

How to fill out honorarium payment payroll transmittal?

What is the purpose of honorarium payment payroll transmittal?

What information must be reported on honorarium payment payroll transmittal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.