Get the free AN ACT concerning business. - hfs illinois

Get, Create, Make and Sign an act concerning business

How to edit an act concerning business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out an act concerning business

How to fill out an act concerning business

Who needs an act concerning business?

An Act Concerning Business Form: A Comprehensive Guide

Understanding business forms

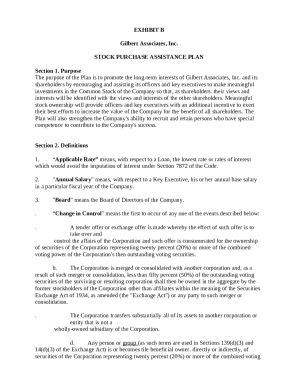

Business forms represent the legal structure that defines how a business operates and is perceived under law. They determine the legal rights of the business, its liabilities, and its decision-making processes. Choosing the appropriate business form is crucial as it can influence factors such as taxation, liability, and funding opportunities.

The primary types of business forms include Limited Liability Company (LLC), Corporation, Partnership, and Sole Proprietorship, each with its distinct characteristics. An LLC offers flexibility and protection from personal liability, while corporations provide extensive liability shielding but involve more regulatory requirements. Partnerships allow for shared ownership and management but can expose individuals to certain liabilities, whereas sole proprietorships are straightforward but expose the owner to personal liability.

When selecting a business form, important factors include the number of owners, the level of acceptable risk, funding needs, tax implications, and how you wish to manage the business.

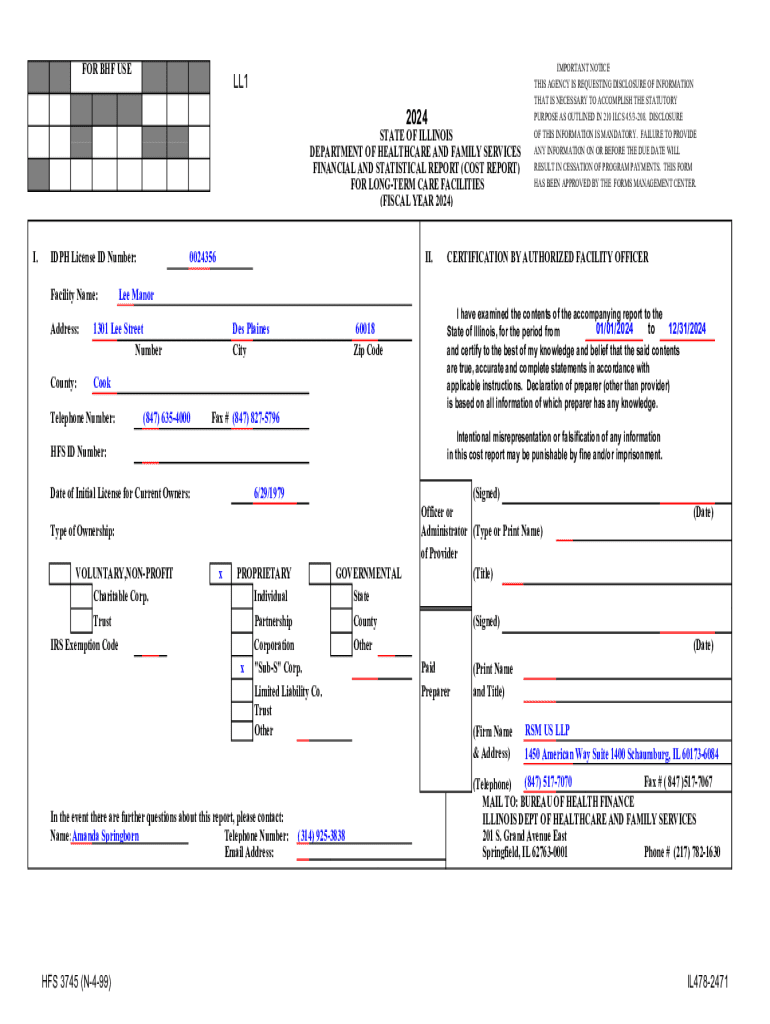

Overview of the act concerning business form

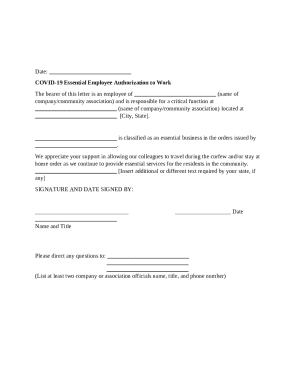

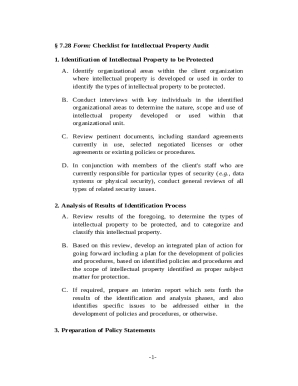

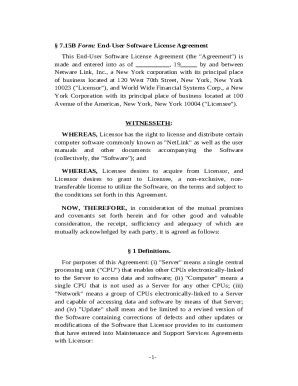

The Act Concerning Business Form has evolved through various legislative frameworks aimed at facilitating the establishment and operation of businesses. Its purpose is to clarify the requirements for selecting and filing different business forms, ensuring that entrepreneurs have a clear understanding of their legal obligations.

Key provisions of the act mandate compliance with specific documentation and filing procedures relevant to each business form. By holding business owners accountable, the act helps maintain transparency and accountability in business operations.

For business owners, the implications of the act are significant. It affects how they select their business structure, with each form carrying its own legal responsibilities and benefits. Understanding the act also aids in navigating potential liabilities and compliance issues associated with different forms of business.

The act influences business form selection by imposing certain requirements that must be met, including registration and adherence to state regulations. It drives entrepreneurs to consider their options thoroughly before committing to a specific business form.

Step-by-step process for completing a business form

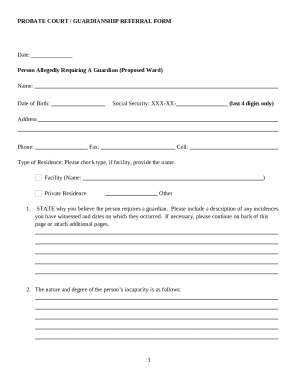

Completing a business form involves careful attention to detail. Essential information required includes the business's name and address, ownership structure, and a clear statement of the business purpose. This information lays the foundation for your business's legal identity.

When filling out the form, follow these structured steps:

Common mistakes to avoid include inaccurate business names, omitting essential ownership or management details, and miscalculating financial contributions. Double-checking for accuracy can prevent setbacks during the submission process.

Interactive tools for business form management

pdfFiller provides an array of features optimized for document creation and management, making it an essential tool for individuals looking to navigate the complexities of business forms effectively.

Key features include:

With these tools, managing your business documents becomes a seamless process, allowing for greater efficiency in both the completion and filing stages.

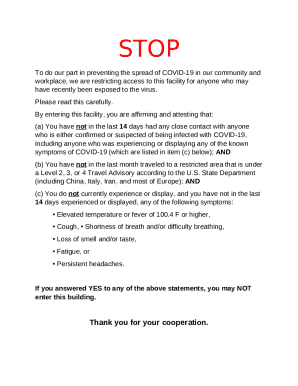

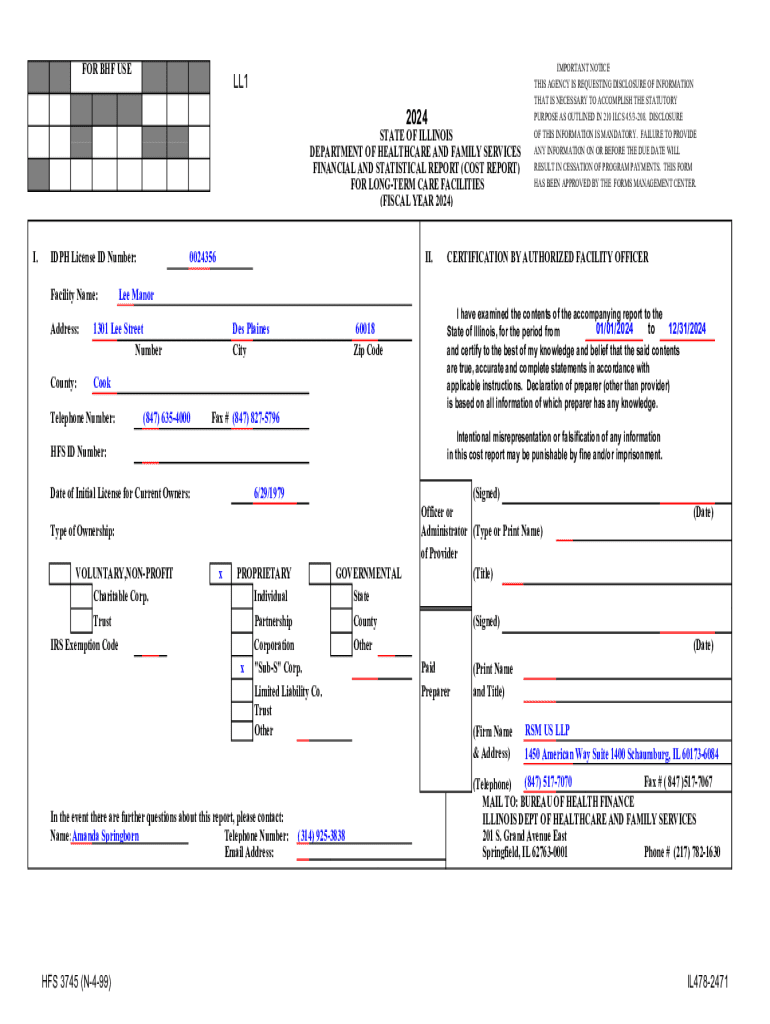

Filing and submitting your business form

Once your business form is prepared, understanding where to file is crucial. Depending on your entity type, submission may be required at either the state or federal level.

Filing methods differ significantly. While some states allow for online submissions, others may require mailing or faxing the documents, which necessitates a clear understanding of the process.

As you submit your form, be sure to keep track of any confirmation status provided, as this helps in ensuring your documents are processed correctly and timely.

After form submission: what’s next?

After successfully submitting your business form, post-submission responsibilities come into play. Owners must keep abreast of the legal requirements pertinent to their chosen business structure to remain compliant.

This includes keeping essential documents organized and updated, such as:

Additionally, maintaining a clear understanding of tax obligations based on the business form you choose is crucial. Resources for ongoing management can aid in navigating these responsibilities.

FAQs about business forms and the act

As you explore the intricacies of business forms and the Act Concerning Business Form, several common misconceptions and questions arise that can cause confusion.

Expert insights and best practices

Navigating the complexities of selecting a business form often requires legal and professional insights. It’s vital to understand the nuances of each form and the corresponding legal considerations.

Business experts recommend that entrepreneurs engage in thorough research, considering not only their business needs but also future growth plans. Key best practices include:

Real-life scenarios illustrate how different business forms address unique challenges, showcasing how timely decisions can lead to lasting success and stability.

Community and professional support

Engaging with local business associations is invaluable for entrepreneurs navigating the diverse landscape of business forms. These networks offer resources, insights, and opportunities for collaboration among business owners.

In addition, seeking legal assistance can provide clarity on regulatory requirements, while networking opportunities allow for shared experiences and strategies. Ultimately, a supportive community enhances the entrepreneurial journey, providing crucial tools and support for success.

Utilizing resources offered through events, workshops, and networking sessions will solidify your grasp of the act concerning business form and empower you as a business owner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit an act concerning business on an iOS device?

How do I complete an act concerning business on an iOS device?

How do I fill out an act concerning business on an Android device?

What is an act concerning business?

Who is required to file an act concerning business?

How to fill out an act concerning business?

What is the purpose of an act concerning business?

What information must be reported on an act concerning business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.