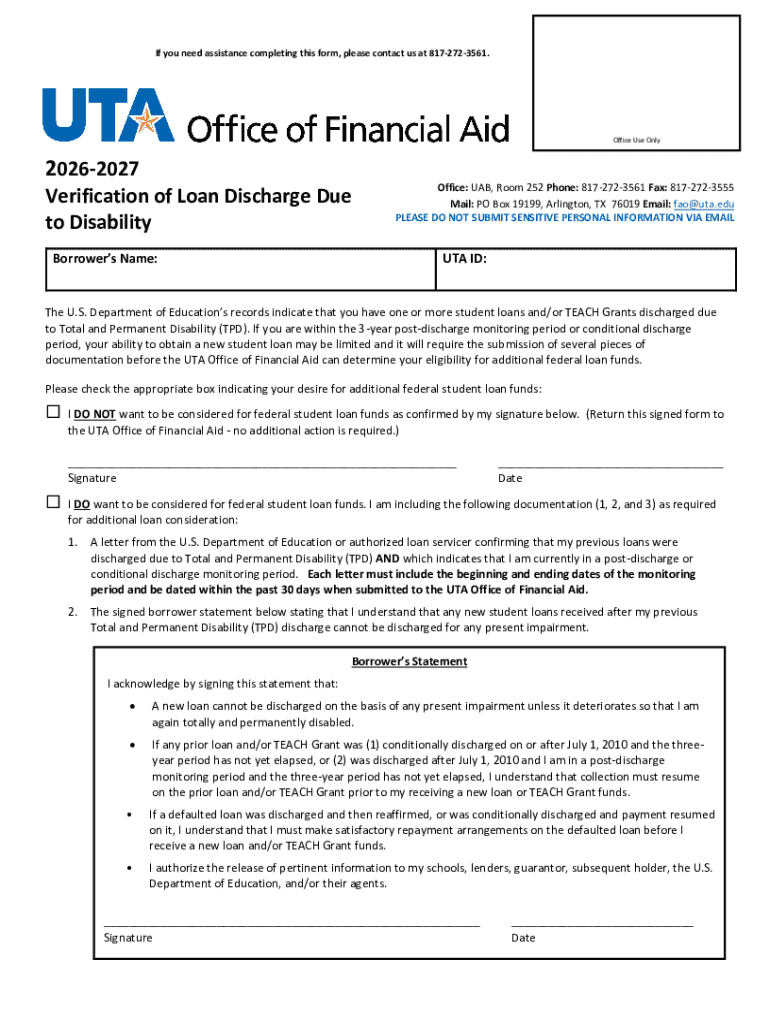

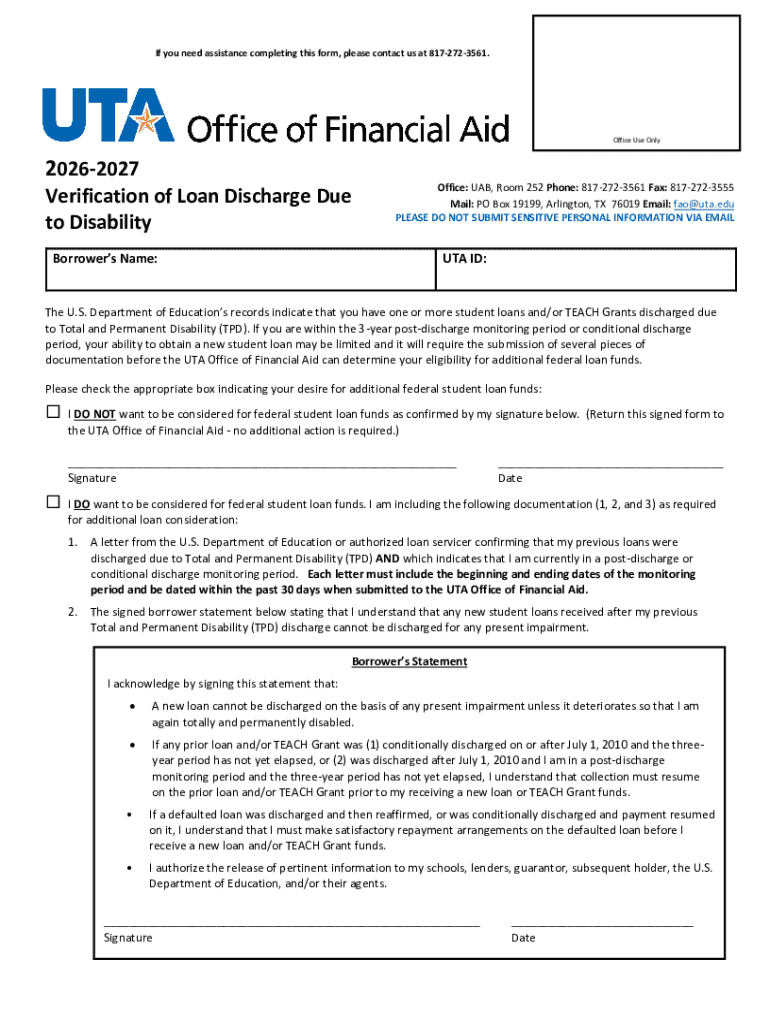

Get the free 2026-2027 Verification of Loan Discharge Due to Disability

Get, Create, Make and Sign 2026-2027 verification of loan

Editing 2026-2027 verification of loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026-2027 verification of loan

How to fill out 2026-2027 verification of loan

Who needs 2026-2027 verification of loan?

2 Verification of Loan Form: A Comprehensive Guide

Understanding the 2 verification of loan form

The 2 verification of loan form serves as a critical instrument in the loan approval process, aimed at providing financial institutions with accurate, detailed insights into an applicant's financial standing. This form acts as a bridge between the borrower and the lender, enabling essential verification of personal and financial data required for loan approval. With potential impacts on loan amounts, approval times, and interest rates, understanding this form's intricacies is fundamental for all parties involved.

For borrowers, the verification of loan form is indispensable; it not only helps in clearly presenting their financial situation to lenders but also aids in anticipating any issues that may arise during the approval process. On the lender's side, a well-completed form reduces the risk of fraudulent applications, ensuring compliance with financial regulations while expediting the decision-making process.

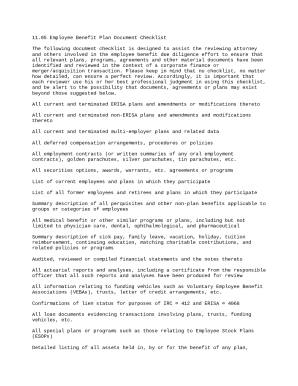

Key components of the verification of loan form

The 2 verification of loan form is structured to collect crucial data about the applicant. This includes personal details, financial information, and specific loan details. Here's a comprehensive breakdown of these components.

Verification process overview

Complying with the 2 verification of loan form requires a systematic approach. Here’s a step-by-step guide to navigate this process seamlessly.

Common reasons for loan verification rejections

Understanding potential pitfalls can help in successfully navigating the 2 verification of loan form. Here are some common reasons applications may face rejection.

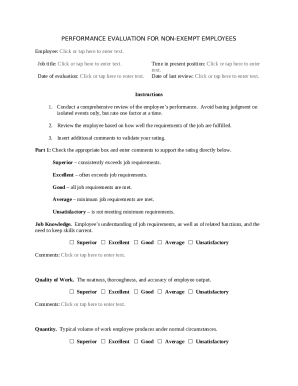

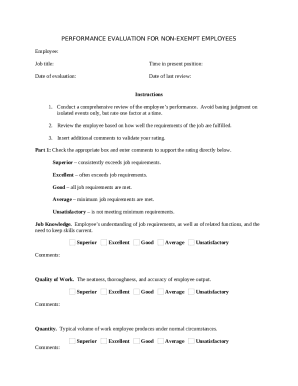

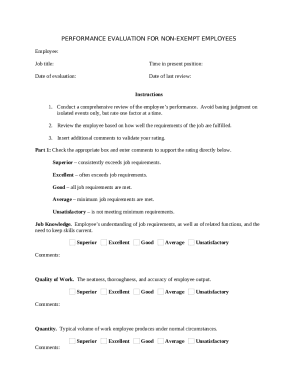

Navigating the interactive tools on pdfFiller

pdfFiller offers various tools that enhance the experience of filling out the 2 verification of loan form. These tools facilitate editing, signing, and document management directly from the cloud.

Moreover, pdfFiller enhances collaboration, allowing users to share documents with teammates for feedback and support in real time. This collaboration is invaluable for ensuring accuracy and completeness before submission.

Ensuring compliance and security

In loan verification, security and compliance are non-negotiable. The 2 verification of loan forms often involve sensitive personal data, making data privacy paramount.

Troubleshooting common issues

Despite a user-friendly design, issues may arise during the verification process. Knowing how to troubleshoot can save time and reduce frustration.

Advanced tips for a smooth verification experience

To ensure a seamless experience when completing the 2 verification of loan form, implement best practices to optimize your approach.

Comparisons with other verification methods

When evaluating verification methods, it’s key to understand how the 2 verification of loan form stands against traditional methods. In an era where digital solutions are paramount, analyzing the differences can illuminate advantages.

User testimonials and success stories

Real-life experiences highlight the effectiveness of utilizing the 2 verification of loan form through platforms like pdfFiller. Many users report significant reductions in approval times and greater confidence in the accuracy of their submissions.

For instance, one recent user shared how pdfFiller’s intuitive interface allowed them to complete the verification process in less than half the usual time it took using traditional methods. This transformation not only made the process simpler but also led to quick approvals, showcasing the tangible benefits that digital solutions bring to the table.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2026-2027 verification of loan directly from Gmail?

How do I make edits in 2026-2027 verification of loan without leaving Chrome?

How do I fill out 2026-2027 verification of loan on an Android device?

What is 2026-2027 verification of loan?

Who is required to file 2026-2027 verification of loan?

How to fill out 2026-2027 verification of loan?

What is the purpose of 2026-2027 verification of loan?

What information must be reported on 2026-2027 verification of loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.