Get the free Loan Forgiveness and Cancellation

Get, Create, Make and Sign loan forgiveness and cancellation

How to edit loan forgiveness and cancellation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan forgiveness and cancellation

How to fill out loan forgiveness and cancellation

Who needs loan forgiveness and cancellation?

Comprehensive Guide to the Loan Forgiveness and Cancellation Form

Understanding loan forgiveness and cancellation

Loan forgiveness refers to the cancellation of a borrower's obligation to repay some or all of their student loans. This relief is aimed at alleviating the financial burdens faced by borrowers, particularly in public service or education sectors. Knowing the distinctions among forgiveness, cancellation, and discharge is crucial, as they each cater to different circumstances and eligibility criteria.

Loan cancellation eliminates the borrower's debt entirely, while forgiveness often requires meeting specific criteria over a set period. Loan discharge, on the other hand, typically occurs due to events like school closure or borrower disability. Understanding these options can be pivotal in managing student loan responsibilities.

Eligibility criteria for loan forgiveness programs

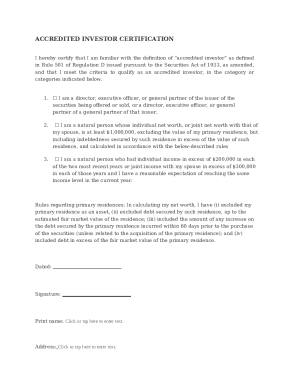

To qualify for loan forgiveness, borrowers must meet specific criteria, particularly in federal student loan programs. Common pathways include employment in public service, engaging in a teaching profession, and adhering to income-driven repayment requirements. Each of these paths has unique standards that must be evaluated thoroughly.

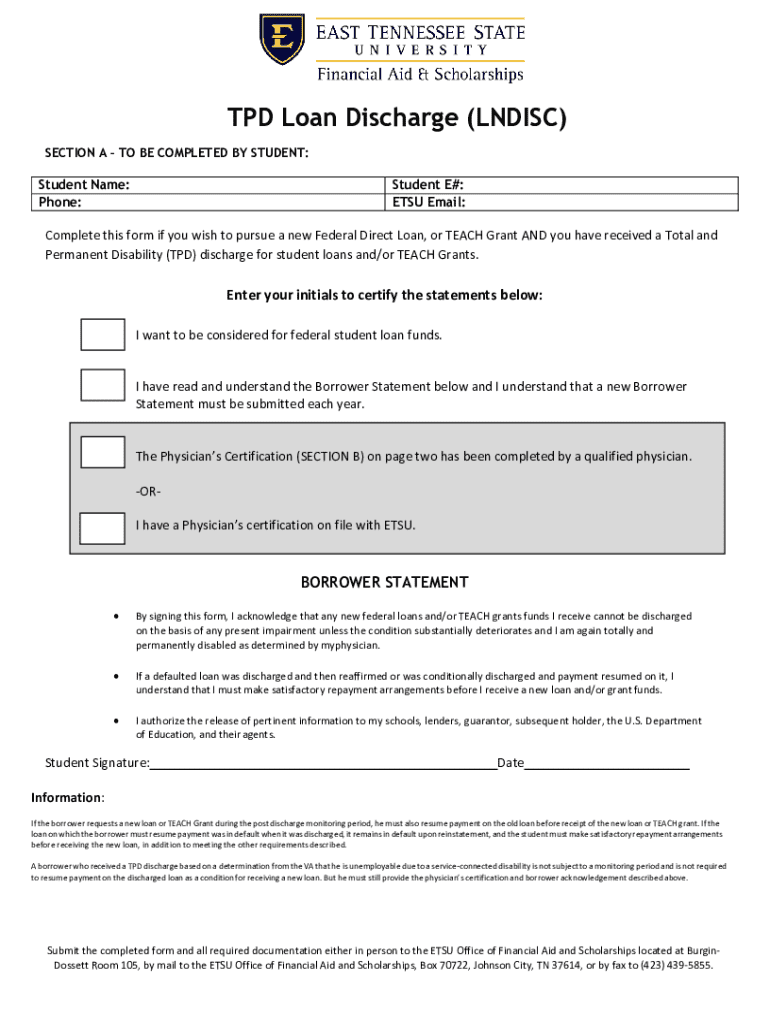

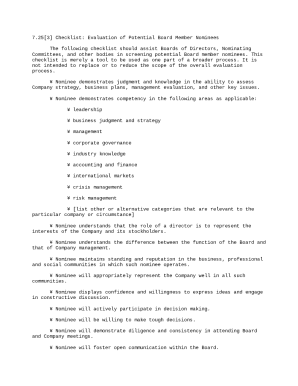

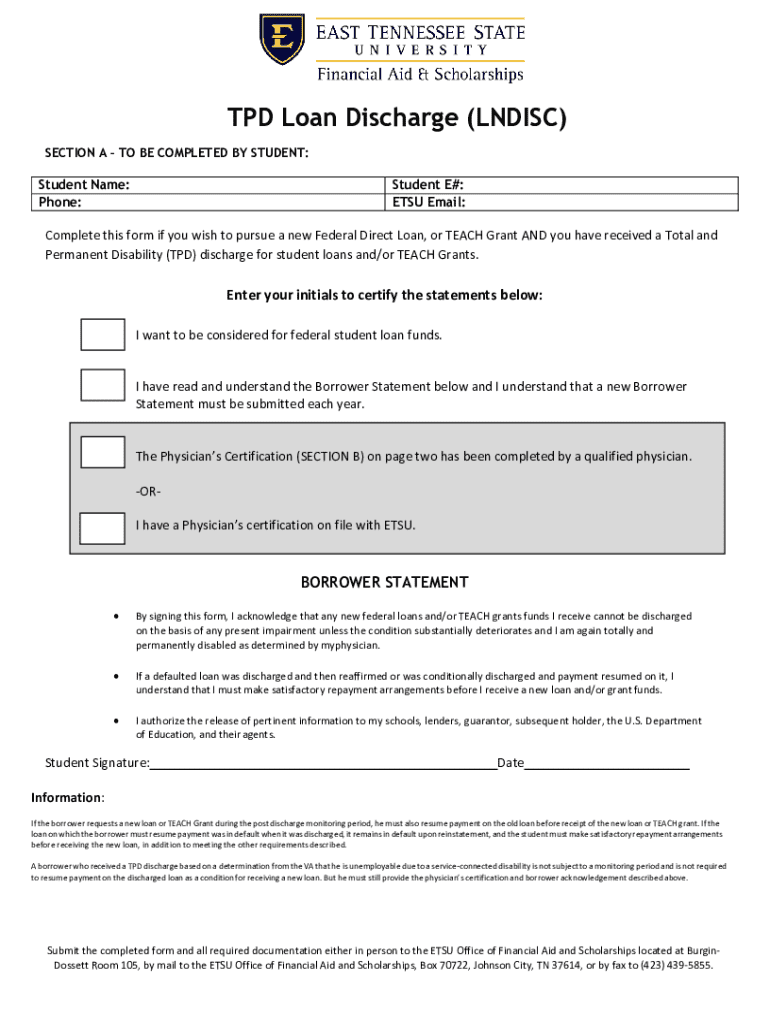

In addition, special categories exist for cancellation, such as Total and Permanent Disability (TPD) Discharge, which automatically cancels loans for those unable to maintain substantial gainful activity due to disability. Borrowers may also qualify for defense to repayment if their school engaged in misconduct.

Detailed examination of major forgiveness programs

Several key loan forgiveness programs exist, each with specific requirements and processes. The Public Service Loan Forgiveness (PSLF) program stands out by providing significant benefits to individuals dedicated to public service careers. To qualify, you must make 120 qualifying monthly payments under a qualifying repayment plan while working for a government or nonprofit organization.

Documentation is integral to your application, where you'll need to submit the PSLF form annually and any time you change employers. Similarly, the Teacher Loan Forgiveness program provides options for educators who work in low-income schools for five consecutive years, with documented proof of service. For those on Income-Driven Repayment, understanding how forgiveness is calculated based on income and family size is vital for leveraging options effectively.

Navigating the loan forgiveness and cancellation form

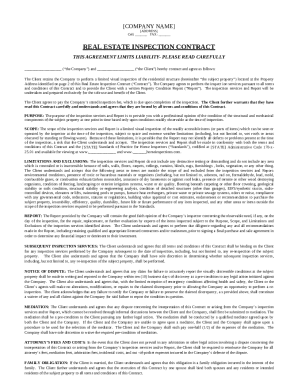

Understanding the purpose of the loan forgiveness and cancellation form is crucial as it initiates the application process for personal or public service loan aid. This form serves as a crucial tool for demonstrating eligibility for various forgiveness programs, and it is noteworthy that it can often be found conveniently on pdfFiller.

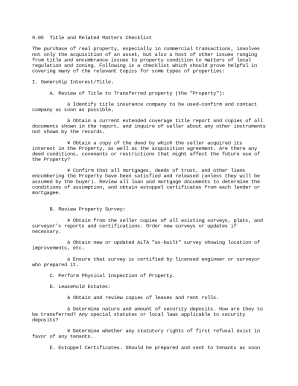

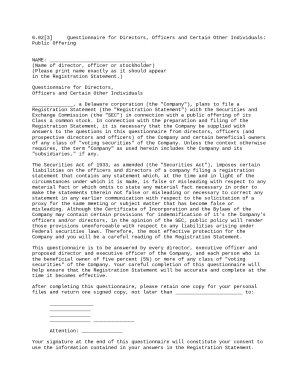

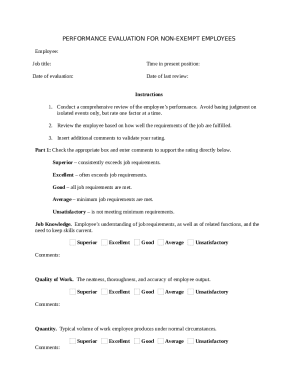

To fill out the form effectively, you'll need to provide personal information, such as your name, contact details, and Social Security number. Additionally, employment history is essential, showcasing any public service or teaching roles held. Equally important is to include comprehensive loan information, detailing the loans you’re seeking forgiveness for, ensuring all necessary fields are accurately completed.

Tips for editing and managing your documents on pdfFiller

pdfFiller streamlines the process of uploading your loan forgiveness form, enabling users to utilize interactive tools that simplify editing, signing, and revising documents. By utilizing the platform’s features, users can ensure their forms are accurate and professionally presented.

Collaboration becomes effortless with pdfFiller. You can work with team members or advisors to finalize your documents, while the platform’s saving and sharing options mean that changes can be easily tracked and updated in real-time, facilitating a smoother application process.

Common pitfalls when applying for forgiveness or cancellation

Navigating the loan forgiveness landscape can be challenging, and many borrowers encounter pitfalls when applying. A frequent issue arises from misunderstanding eligibility requirements; many applicants overlook specific terms or fail to realize the significance of qualifying employment.

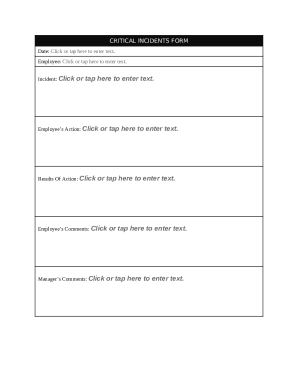

Document submission is another area where borrowers commonly falter. Failing to submit necessary documentation in a timely manner may lead to delayed application processing or outright denial. Simple application errors—such as missing signatures or incorrect loan information—can also jeopardize your chances, hence why careful attention to detail during the application process is crucial.

Real-life case studies and success stories

Hearing from borrowers who have successfully navigated the loan forgiveness and cancellation process can be enlightening. Many have shared testimonials highlighting how their persistence paid off after utilizing the loan forgiveness form effectively. For instance, an educator specializing in math and science was able to qualify for Teacher Loan Forgiveness after diligently maintaining documentation of their service.

Additionally, borrowers with total and permanent disabilities have successfully utilized the TPD discharge by ensuring comprehensive medical documentation was submitted. These narratives serve not only as testimonials of success but as guides for others seeking to understand the proper application of the loan forgiveness and cancellation form.

Frequently asked questions (FAQs)

After submitting the loan forgiveness and cancellation form, applicants often wonder what happens next. Typically, borrowers will receive notification from their loan servicer regarding the status of their application within a few weeks. If additional information is required, it's essential to respond promptly to avoid delays.

Checking the status of your application can usually be done through your loan servicer’s portal or by contacting customer support. In cases where forgiveness is denied, borrowers have the right to appeal the decision by providing further documentation or clarifying their situation with the necessary loan servicer.

Future changes and updates in loan forgiveness policies

Continuous changes and updates in loan forgiveness policies can significantly affect borrowers. Legislative changes may introduce new eligibility criteria or alter existing programs, compelling borrowers to stay informed. Recent congress discussions have focused on streamlining the forgiveness process, which could present additional opportunities for applicants.

As these updates occur, resources like pdfFiller adapt its offerings to align with evolving regulations, ensuring users can find the most relevant forms and guidance. Staying aware of such developments through reliable channels aids borrowers in making informed decisions.

Join our community

Staying connected with others navigating the loan forgiveness landscape can be incredibly beneficial. Joining our community means having access to newsletters filled with updates, insights, and strategies for successfully managing your loans. Engaging with others facing similar challenges can lead to shared experiences that enrich your understanding.

Additionally, exclusive webinars and workshops offer further education on navigating the complexities of loan forgiveness and the use of tools like pdfFiller, empowering borrowers to take decisive steps towards financial relief.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in loan forgiveness and cancellation without leaving Chrome?

How can I edit loan forgiveness and cancellation on a smartphone?

How do I edit loan forgiveness and cancellation on an iOS device?

What is loan forgiveness and cancellation?

Who is required to file loan forgiveness and cancellation?

How to fill out loan forgiveness and cancellation?

What is the purpose of loan forgiveness and cancellation?

What information must be reported on loan forgiveness and cancellation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.