Get the free 4 - Basic All Road Test Papers.docx

Get, Create, Make and Sign 4 - basic all

Editing 4 - basic all online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 4 - basic all

How to fill out 4 - basic all

Who needs 4 - basic all?

Filling Out the 4–Basic All Form: A Comprehensive Guide

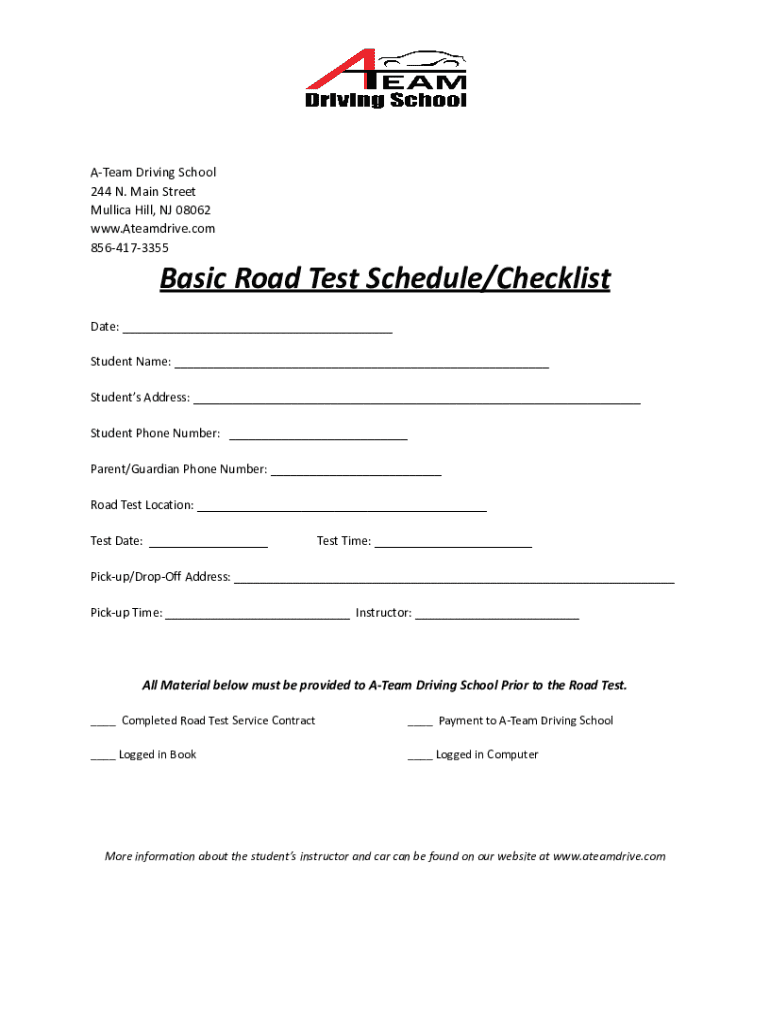

Understanding the 4–Basic All Form

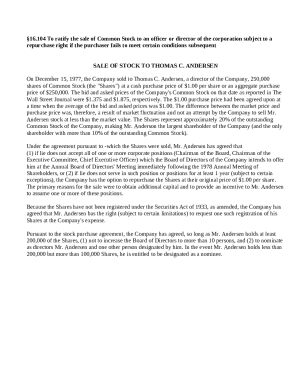

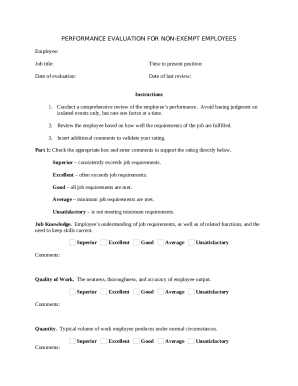

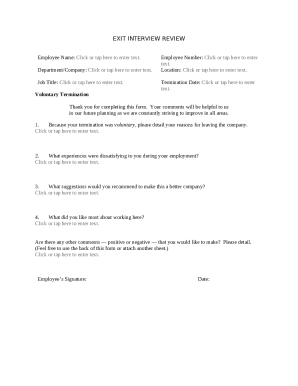

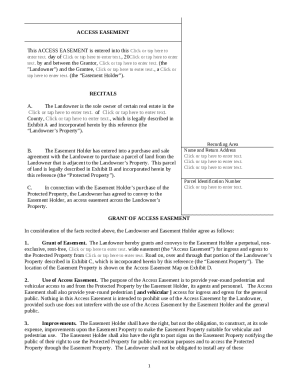

The 4–Basic All Form serves as a crucial document in various professional and personal contexts, designed to streamline data collection for reporting purposes. This form collects fundamental information that can be utilized in tax preparations, employee assessments, or financial reviews. It consolidates necessary details into a single, user-friendly format, making it easier for both employers and employees to manage essential data.

Its importance extends across multiple domains; whether you're filing your taxes, reporting compensation for partners, or collating employee information for performance reviews, correctly filling out the 4–Basic All Form is vital. This form simplifies data management, ensuring accurate records that contribute significantly to informed decision-making.

Individuals in positions requiring financial oversight—such as accountants, HR managers, and business owners—are primarily those who need to utilize the 4–Basic All Form. Understanding its purpose and functionality helps ensure compliance and efficiency in various business operations.

The basics of completing the 4–Basic All Form

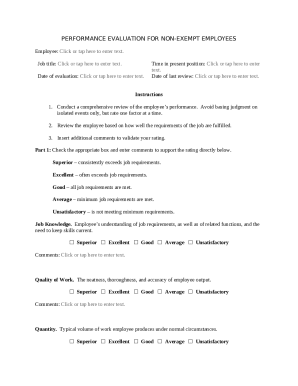

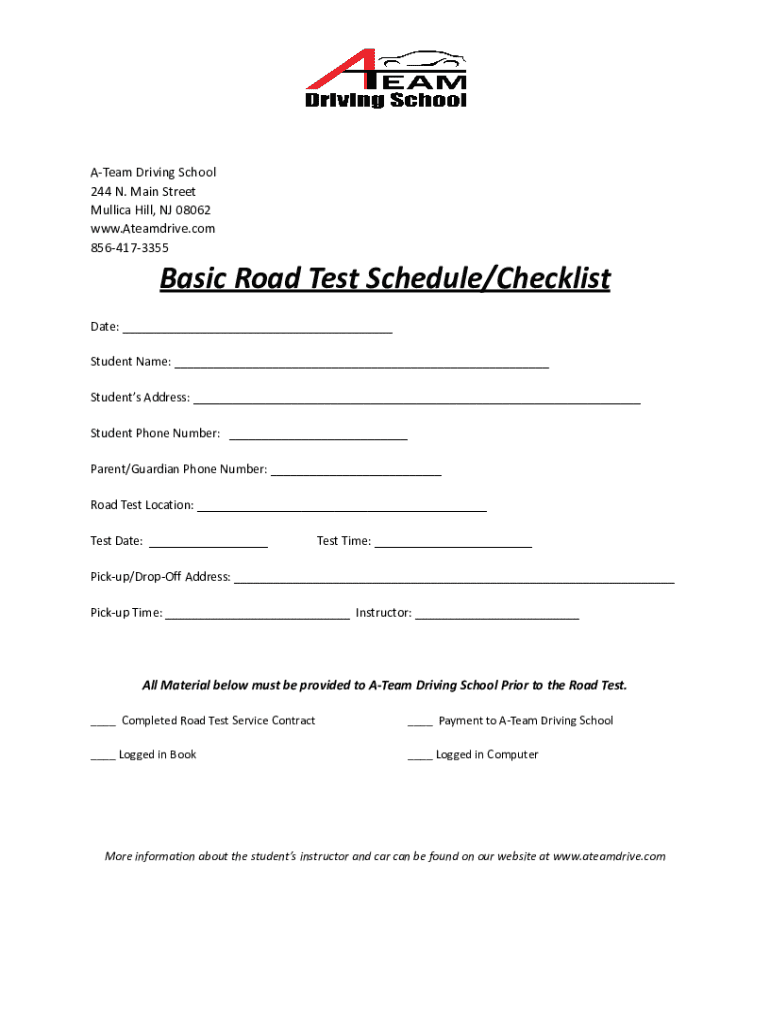

When it comes to filling out the 4–Basic All Form, familiarity with its core sections is essential. Key areas that require your attention include Personal Information, Financial Data Overview, and the Declaration and Signature section. Each segment plays a significant role in creating a comprehensive profile that is essential for accurate reporting.

In the Personal Information section, you will typically enter details such as full name, address, and contact information. It's crucial that this information is current and accurate to avoid any issues during tax filing or document verification. Moving on to the Financial Data Overview, you’ll provide information related to income sources, benefits, and partner compensation, which can tie directly to your tax filing status.

The Declaration and Signature section signify your affirmation of the information provided in the form. This step can often be overlooked, but it is significant as it attests to the authenticity of your submissions. Common mistakes that individuals make include using incorrect personal details, leaving sections incomplete, or failing to double-check financial figures, all of which can lead to delays or errors down the line.

Step-by-step instructions for filling out the 4–Basic All Form

Completing the 4–Basic All Form can be made simpler by following a structured approach. Here’s a detailed step-by-step guide to assist you in the process.

Interactive tools for filling out the 4–Basic All Form

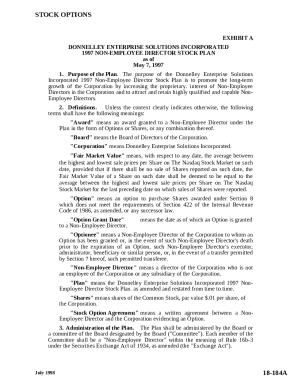

Utilizing interactive tools can enhance your experience when filling out the 4–Basic All Form significantly. pdfFiller's Interactive Form Editor allows users to engage with their documents in a dynamic manner. The platform is designed to facilitate seamless edits, enabling you to maneuver through the form while also incorporating necessary changes instantly.

Among the impressive features of the Interactive Form Editor is the capability to create and utilize templates, which can save time and reduce the complexities of filling out the form repeatedly. These templates can be customized to meet specific needs, often a significant advantage for teams handling multiple submissions.

Moreover, collaboration has never been easier with pdfFiller. This tool allows team members to work collectively in real time, providing comments and feedback as you fill out your document. Real-time editing ensures everyone is on the same page, facilitating a more efficient review process.

Managing your 4–Basic All Form after submission

Once you’ve submitted your 4–Basic All Form, it’s vital to keep track of its status. Depending on the context of submission—whether it’s for tax purposes or partnership details—understanding where your form stands will minimize the chance of future complications. It’s advisable to document confirmation receipts or take screenshots of your submissions for reference.

If you need to edit or resubmit your form, this process should be straightforward if you’ve leveraged the functionalities that pdfFiller offers. The platform allows users to amend submitted forms and resubmit them, which is a hugely beneficial feature, especially during tax season when changes are common.

Also, ensure you are storing copies of your form securely. Using cloud storage solutions provided directly through pdfFiller means you can access your documents anytime, anywhere. This flexibility is instrumental, particularly when you require copies for subsequent filings or references.

Frequently asked questions (FAQ) about the 4–Basic All Form

As with any essential document, users often have numerous questions about the 4–Basic All Form. Here’s a curated FAQ to help address common concerns.

Tips for efficiently using the 4–Basic All Form in 2023

To maximize your efficiency when working with the 4–Basic All Form in 2023, consider adopting a few best practices. First-time users should approach filling out the form with patience, ensuring each section is understood fully before entering data. Familiarize yourself with any updates or changes introduced in the current year, as these can often affect how you report information.

For teams managing multiple submissions, leveraging cloud-based document management solutions like pdfFiller remains invaluable. Organizing documents efficiently and accessing them from anywhere empowers teams to collaborate seamlessly and support efficient workflows. Moreover, the comprehensive nature of these tools can alleviate some of the stress associated with tax time, making the 4–Basic All Form manageable and ensuring compliance with relevant regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 4 - basic all directly from Gmail?

How can I send 4 - basic all for eSignature?

Can I create an electronic signature for signing my 4 - basic all in Gmail?

What is 4 - basic all?

Who is required to file 4 - basic all?

How to fill out 4 - basic all?

What is the purpose of 4 - basic all?

What information must be reported on 4 - basic all?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.