Get the free Do you have to apply for the school allowance?

Get, Create, Make and Sign do you have to

Editing do you have to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out do you have to

How to fill out do you have to

Who needs do you have to?

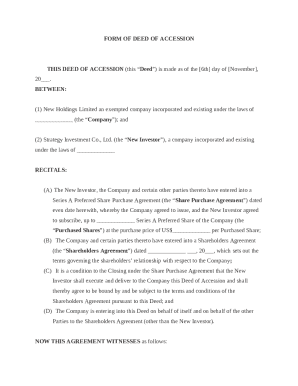

Do You Have to Form: A Comprehensive Guide to Business Entity Formation

Understanding the need to form: What it means

Forming a business entity is a fundamental step for entrepreneurs aiming to establish a legal presence. 'Forming' refers to the process of creating a structured business entity, such as an LLC, corporation, or partnership. This formal structure is essential not only for governing operations but also for addressing legal, tax, and liability-related issues. Without a formal structure, business activities may be classified as unorganized, causing complications in legal protections and operational efficiency.

Moreover, formalizing a business entity helps delineate ownership and operational roles, ensuring that everyone involved understands their responsibilities and the scope of liability. In various contexts, forming an organization could include creating nonprofits, partnerships, or sole proprietorships. Each format serves different needs, but the underlying purpose of forming is to create a legally recognized entity that can operate independently.

Step 1: Assess your requirements before forming

Before diving into the complexities of business formation, it's crucial to assess whether formalization is necessary for your specific situation. Understand your primary objectives and evaluate if creating an entity aligns with your business model. For many individuals and teams, the decision to form hinges on considerations of liability protection, tax implications, and investment needs.

If you plan to operate independently and are comfortable with personal liability—for instance, as a freelancer or a sole contractor—a sole proprietorship may suffice. However, if your operations entail higher risks or require significant investments, forming an LLC or corporation should be prioritized. Performing a thorough risk assessment and understanding your operational goals will guide you in making an informed decision concerning whether to pursue formalization.

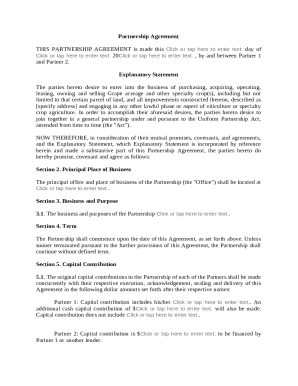

Step 2: Types of entities you can form

Business entities come in various forms, each with unique advantages and disadvantages. Understanding these types can help you select the most appropriate structure for your needs. Common entity types include:

Deciding between these entities depends largely on your intended scope of operations and risk tolerance. For example, if you're seeking a small investment and plan to minimize taxation complexities, an LLC may be the best route. In contrast, established companies aiming for large investments may prefer a corporation for its credibility and limited liability.

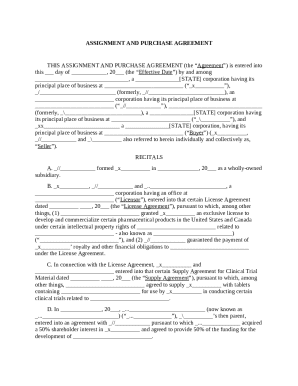

Step 3: Key documents and information needed for formation

To successfully form a business entity, various crucial documents must be prepared and submitted. These typically include:

Utilizing platforms like pdfFiller can significantly streamline this preparation process, allowing users to create, edit, and manage necessary documents efficiently. Leveraging such technology ensures that you have all pertinent information on hand, formatted correctly for submission to state authorities.

Step 4: Filing your formation documents

Once your documents are ready, the next step involves filing them with the appropriate state authorities. Each state has its specific requirements and processes, so it's essential to familiarize yourself with local regulations. The filing process generally includes the following:

Using pdfFiller not only simplifies the document preparation process but also facilitates an efficient online submission of your forms. This is particularly advantageous for ensuring timely filing and keeping track of submission confirmations from state agencies.

Step 5: Obtain necessary identification and licenses

After successfully filing your formation documents, the next step is obtaining the necessary identification and licenses. An important identifier for businesses is the Employer Identification Number (EIN). An EIN is essential for taxation purposes and is required if you plan to hire employees or operate as a corporation or partnership.

In addition to the EIN, various business licenses and permits must be obtained based on your industry and locality. Here’s an overview:

pdfFiller can assist in applying for and managing these important documents. With customizable templates and the ability to fill out forms digitally, you can ensure that your application processes are both efficient and compliant with local regulations.

Step 6: Setting up your operations

Once all formalities are taken care of and necessary licenses are acquired, it’s time to establish your business operations. This foundational work will set you up for smooth functioning and includes:

Tools like pdfFiller can significantly enhance document management—whether drafting internal policies, creating financial templates, or collaborating on agreements. The flexibility of a cloud-based solution ensures that individuals and teams can manage and adjust these documents from anywhere.

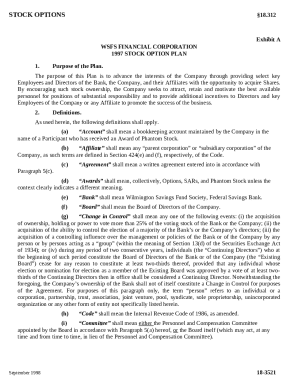

Step 7: Compliance and ongoing requirements

Maintaining compliance with state and federal regulations is crucial for the longevity of your business. After formation, ensure that you are aware of ongoing legal requirements which often include:

Utilizing pdfFiller's tracking features can help you manage these compliance deadlines effectively, providing alerts and reminders to keep your business in good standing.

Explore related topics

As you navigate the complexities of forming a business entity, explore related aspects that further define your business strategy, such as:

These topics are interlinked and not only influence your decision-making during formation but also affect your operational and strategic direction moving forward.

Related insights: Success stories and tips

Real-world examples illustrate the impact of proper formation on business success. For instance, a tech startup that formed as an LLC was able to attract investors more confidently thanks to the limited liability aspect. Conversely, a sole proprietorship in the same industry struggled to secure funding due to personal liability concerns.

During the formation process, common pitfalls include neglecting compliance requirements and failing to properly document agreements. Document management solutions like pdfFiller provide valuable tools to mitigate these risks. By employing technology to handle the complexities of documentation, businesses can focus more effectively on growth and performance management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit do you have to from Google Drive?

How do I complete do you have to online?

How do I fill out do you have to on an Android device?

What is do you have to?

Who is required to file do you have to?

How to fill out do you have to?

What is the purpose of do you have to?

What information must be reported on do you have to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.