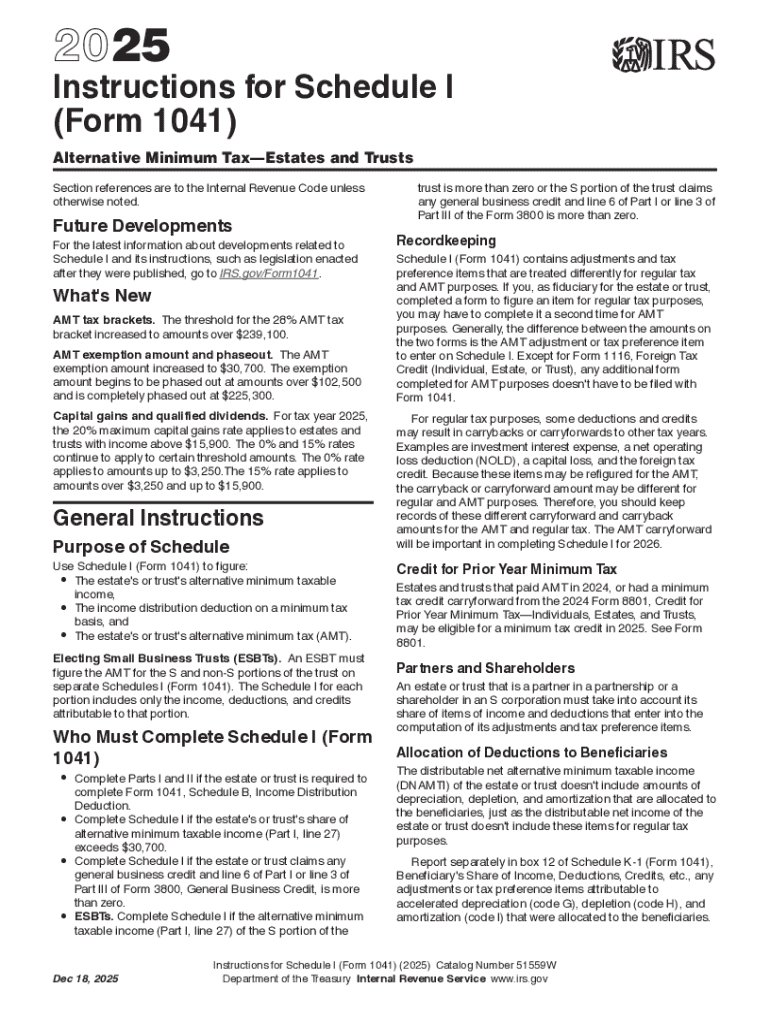

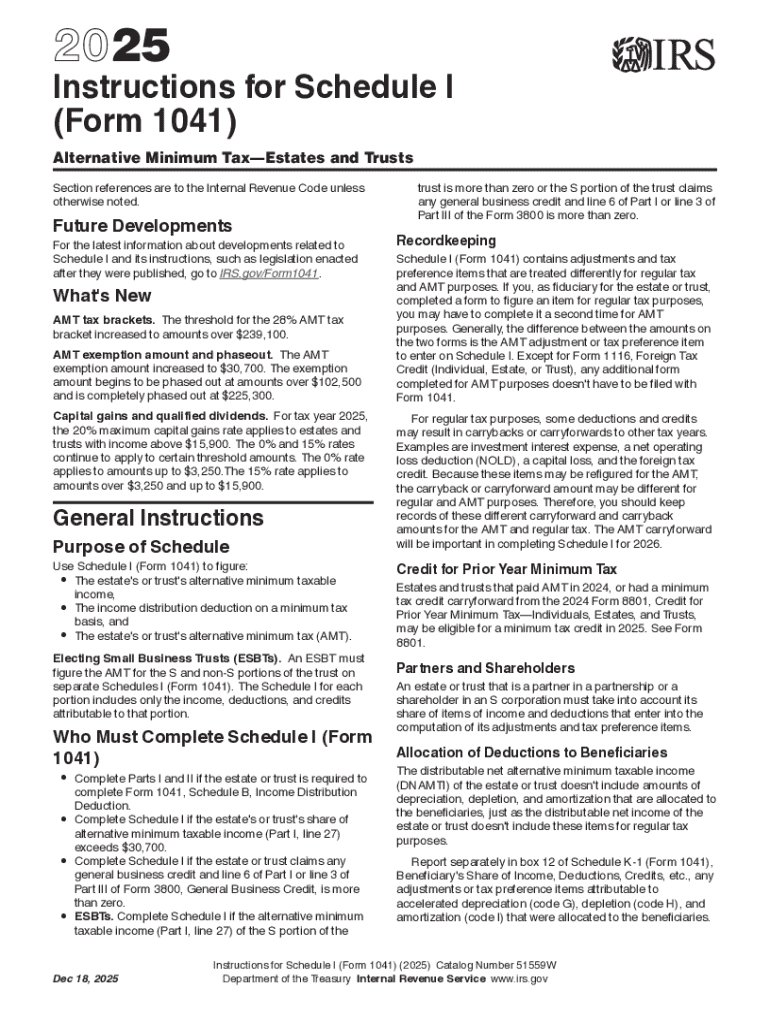

IRS Instructions 1041 - Schedule I 2025-2026 free printable template

Get, Create, Make and Sign IRS Instructions 1041 - Schedule I

How to edit IRS Instructions 1041 - Schedule I online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 1041 - Schedule I Form Versions

How to fill out IRS Instructions 1041 - Schedule I

How to fill out 2025 instructions for schedule

Who needs 2025 instructions for schedule?

2025 Instructions for Schedule Form

Understanding schedule forms in 2025

Schedule forms in 2025 serve as essential documents for reporting various financial activities, whether personal or organizational. These forms are critical for evaluating income, adjustments, and much more. Their purpose is to ensure compliance with relevant laws while providing transparency for entities involved, be it individuals reporting personal finances or businesses accounting for expenses. The significant transformation in 2025 is the simplification and enhancement of schedule forms, making them more user-friendly.

Key features of 2025 schedule forms include comprehensive digital access, real-time editing, and collaboration capabilities. Users can easily access various types of schedule forms directly online without the need for physical paperwork. Moreover, pdfFiller has emerged as a crucial tool in this regard, streamlining the creation and management of these schedules by offering intuitive interfaces and helpful functionalities.

Preparing for your schedule form submission

Before diving into filling out your schedule form, it's vital to assess your specific needs. Identifying the exact form required for your situation—be it for income reporting or adjustments—is crucial since various schedules serve different purposes. Understanding submission deadlines and guidelines will help keep you organized and ensure timely submission.

Gathering the necessary information is equally important. Essential documents often include W-2s, 1099s, and any relevant income statements or receipts for expenses. Keeping an organized record is paramount. Using tools like spreadsheets or document management software can make this process seamless, helping you maintain clarity throughout your submission efforts.

Detailed process for completing your schedule form

To successfully complete your schedule form using pdfFiller, start by accessing the correct form. Navigating the website, you can utilize the search functionalities to find the schedule form that aligns with your specific requirements. Once located, pdfFiller’s user-friendly interface allows for efficient navigation through the form's various sections.

Filling out the form necessitates breaking down its sections systematically. You’ll need to provide information related to income, tax credits, and any adjustments you're claiming. Being precise about amounts reported and entries is paramount. pdfFiller also enables users to edit, add signatures, and include comments directly onto the PDF, ensuring not just accuracy but also that all relevant information is captured.

Step-by-step instructions for specific lines of the form

When tackling your schedule form, it is beneficial to follow a line-by-line guide to ensure nothing is overlooked. Common sections typically require details on income, expenses, and adjustments. For example, Part I might require personal income reporting, while Part II could delve into deductions and allowances. Filling out complex entries can be daunting, but a precise approach coupled with pdfFiller's guidance tools will streamline this process.

FAQs often arise concerning frequently encountered issues, such as how to correct mistakes in previously completed entries or understanding the implications of data input errors. Addressing these concerns in the filling process helps minimize errors, preventing future complications with tax assessments.

Reviewing and finalizing your schedule form

Reviewing your completed schedule form before submission is crucial to ensure accuracy. A thorough checklist should include verifying all figures, ensuring required signatures are in place, and confirming that no sections are left incomplete. Recognizing common mistakes—such as entering incorrect income figures or failing to claim eligible deductions—can significantly reduce complications down the line.

pdfFiller’s collaboration tools allow you to share the form with team members for additional reviews and feedback. The incorporation of comments and suggestions within the platform leads to more cohesive and accurate submissions.

Submitting your schedule form

Once your schedule form is complete and reviewed, it’s time to submit. pdfFiller makes electronic submission straightforward. Follow the on-screen instructions for submission, which often involve confirming that all necessary fields are filled out accurately. After submitting, you will receive a confirmation, allowing you to track the status of your submission effortlessly.

However, alternative methods for submission, such as mail-in options, are also available if required. Understanding the local submission offices and their respective deadlines is key to ensuring that your form is received without complications.

Post-submission management

Managing your submitted forms post-submission is equally important. Through pdfFiller, users can easily access their submission history, a handy feature for documenting past activity and filing future forms accurately. Maintaining organized records will aid in future financial planning or changes. Document retention strategies play a significant role, especially as you may need these forms for reference down the line.

If adjustments are necessary after submission, pdfFiller provides a structured approach for amending forms. Users can follow a clear set of steps for filing amendments or corrections. Understanding this process is vital and can save time and potential headaches.

Additional tools and resources

To enhance your experience with schedule forms, pdfFiller offers various built-in help features and customer support options. Should you encounter issues, accessing these resources can provide immediate assistance and guidance. Additionally, you will find an array of related forms and templates available on pdfFiller tailored to diverse user needs.

Cross-reference relevant templates based on the specifics of your situation to streamline your efforts further. The extensive library available ensures that you find what you need efficiently, supporting your documentation process in 2025.

Engaging with the community of users

Engaging with the user community enhances learning experiences and fosters knowledge-sharing about completing schedule forms effectively. Platforms such as user forums and social media groups can be invaluable resources for where to find advice, share experiences, and seek expertise from fellow users.

Moreover, continuous improvement of your skills is crucial. Seek out webinars and guides that offer further insights into document management and editing. These resources will not only help you navigate the scheduling system with ease but also empower you to maximize the functionality of tools provided by pdfFiller in your document work.

People Also Ask about

How do I file a K-1 on my taxes?

How do I report exempt interest dividends on 1041?

Where do I report dividends paid on Form 1120?

Where does interest expense go on Form 1120?

Can I take the 199A deduction?

What is a Schedule 1 order?

Where do I enter k1 info?

Where do I enter Schedule K 1 information?

Where do I enter Section 199A dividends on Form 1041?

What is Section 199A dividends on k1?

What is a Schedule 1 offence in Scotland?

What is a Schedule 1?

What is a Schedule One offender UK?

What is reported on 1120?

What is a Schedule 1 offender?

Can I deduct Section 199A dividends?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS Instructions 1041 - Schedule I in Chrome?

How do I fill out the IRS Instructions 1041 - Schedule I form on my smartphone?

How do I edit IRS Instructions 1041 - Schedule I on an Android device?

What is 2025 instructions for schedule?

Who is required to file 2025 instructions for schedule?

How to fill out 2025 instructions for schedule?

What is the purpose of 2025 instructions for schedule?

What information must be reported on 2025 instructions for schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.