Get the free 2 4 i

Get, Create, Make and Sign 2 4 i

Editing 2 4 i online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2 4 i

How to fill out 2 4 i

Who needs 2 4 i?

Comprehensive Guide to the 2 4 Form

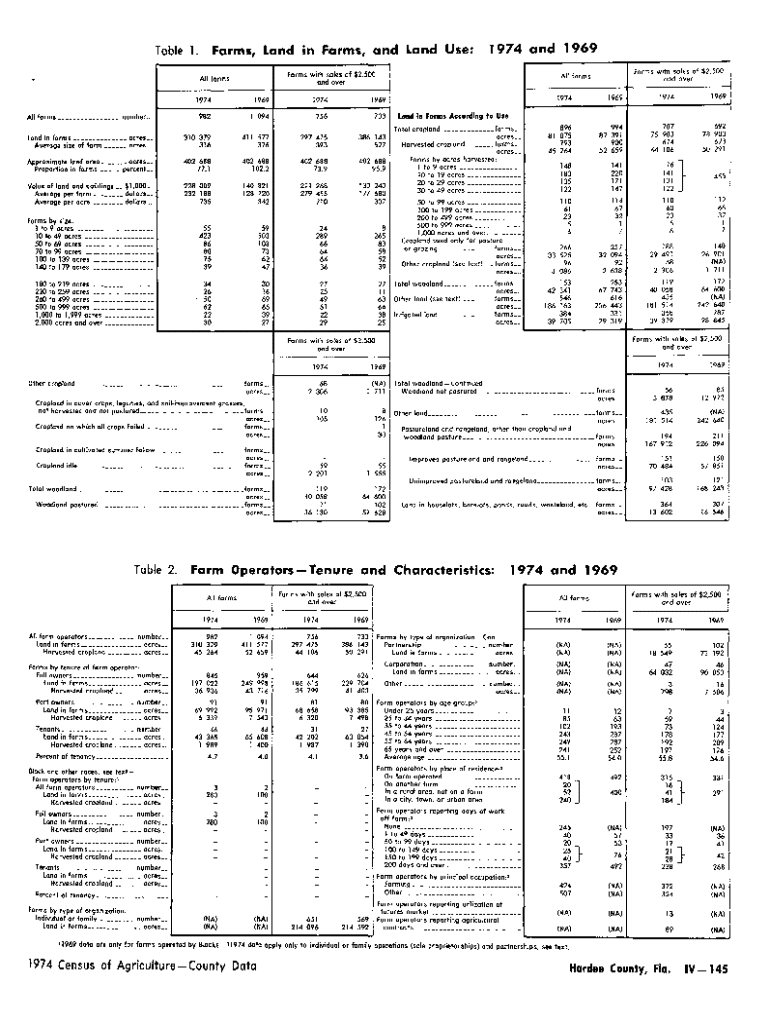

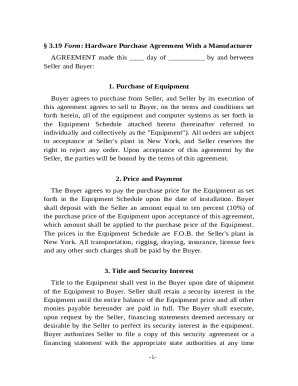

Overview of the 2 4 Form

The 2 4 i Form is essential for employees and employers alike, primarily used in the United States for managing withholding allowances. This form typically helps employers determine the correct amount of tax to withhold from an employee's paycheck based on their reported allowances and personal tax situation. The main goal of the 2 4 i Form is to ensure that employees are not overtaxed throughout the year, thereby facilitating accurate paycheck distributions.

In conjunction with other forms like the W-4, the 2 4 i Form plays a vital role in the broader context of tax reporting and compliance. Users must understand its significance, particularly how it affects their income tax and withholding amounts. Knowing the details and implications of this form can significantly enhance one’s financial management and tax planning.

Key features of the 2 4 Form

Understanding the structure of the 2 4 i Form is critical for ensuring its proper completion. The form is designed with several sections and fields that guide users in inputting essential personal and financial information. Typically, the form includes sections for personal details, declaration of withholding allowances, and a signature field acknowledging the information's validity.

When completing the 2 4 i Form, ensuring accuracy in data entry is paramount. Essential information such as employment status, withholding allowances, and additional personal details must be provided. Common mistakes include omitting critical data, calculating allowances incorrectly, or failing to sign the form, which can lead to complications in paycheck processing.

Who should use the 2 4 Form?

The 2 4 i Form is primarily targeted at employees looking to accurately report their withholding allowances to their employers. This form is also relevant for employers who need to understand their workforce’s tax filing requirements. Tax professionals and advisors would benefit from familiarity with this form for providing informed guidance to their clients, ensuring compliance and accurate tax management.

Eligibility to file the 2 4 i Form extends to anyone who receives income that is subject to federal withholding. Employees with a spouse or multiple jobs may have additional considerations, as they must accurately calculate their total withholding allowances to avoid issues later on. It's vital for specific groups, such as freelancers or part-time workers, to be aware of their obligations concerning this form.

Step-by-step instructions for filling out the 2 4 Form

Filling out the 2 4 i Form can be a straightforward process if you follow the right procedures. Part 1 involves gathering all necessary documents, such as previous pay stubs, tax returns, and other income-related documents. This preparation is crucial as it ensures that you have accurate figures ready for reporting on the form.

Part 2 focuses on accurately filling out personal details. Make sure to include your full name, address, and social security number in the designated fields. In Part 3, users should calculate their withholding allowances based on their personal and financial situation, taking into account factors like dependents and additional income sources. Lastly, Part 4 emphasizes the importance of reviewing the form before finalization. Double-check all entries to ensure accuracy, and ensure proper signing and dating of the form.

Submitting the 2 4 Form

Once you've completed the 2 4 i Form, the next step is submission. Depending on your employer’s policies, you may submit the form online, mail it to their HR department, or hand it in person. Each method has its benefits, but make sure to follow any specific instructions provided by your employer. It’s essential to keep track of submission procedures, especially if you choose to mail the form, as this could lead to delays.

Be aware of the deadlines for submission, as failing to meet these can affect your taxes and withholdings. Generally, the form should be submitted at least before the start of a new pay period or when any changes in your financial situations occur. Additionally, verifying the status of your submission can alleviate concerns; keep records of your submission method and date to confirm that your form was received.

Changes to the 2 4 Form for the upcoming tax year

As tax reform laws evolve, it’s crucial to keep an eye on changes to the 2 4 i Form, especially for the upcoming tax year. For 2026, several updates have been proposed that may impact how both employees and employers fill out the form. Adjustments could include alterations in the number of allowances, new calculations for calculating withholding amounts, and changes that address the needs of gig economy workers.

Understanding these changes is vital for current and prospective filers, as it dictates the accuracy of their withholdings for the tax year. The adjustments can influence overall tax liability, making it essential to stay informed to ensure compliance. Reaching out for assistance or consulting reliable resources can help ease the transition into next year’s filing.

Utilizing features of pdfFiller for the 2 4 Form

pdfFiller provides an intuitive platform for managing the 2 4 i Form, allowing users to access, fill out, and edit documents easily. To find and select the 2 4 i Form on pdfFiller, simply navigate to the forms section and use the search function to locate it within seconds. This easy access empowers users to tackle the form efficiently and effectively.

Once you have the form, pdfFiller's editing tools allow for seamless customization, including adding specific data, revising information, and ensuring everything is accurate. Moreover, eSigning features ensure that you can securely sign the 2 4 i Form digitally. Collaboration capabilities within pdfFiller make it easy for teams to share and manage this crucial document effectively.

Additional assistance and support

Navigating the requirements of the 2 4 i Form can be challenging, so having access to support is crucial. Help centers that specialize in tax and employment-related questions can provide clear guidance as you fill out your form. These resources often have knowledgeable personnel available for questions related to the form's completion and submission.

In addition, many official websites and forums can provide insights into the nuances of the 2 4 i Form. On pdfFiller, customers can benefit from customer support, which assists in the utilization of the form effectively. Leveraging these resources can streamline your experience, ensuring you are equipped with the necessary information and assistance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2 4 i in Gmail?

How can I send 2 4 i to be eSigned by others?

How do I edit 2 4 i straight from my smartphone?

What is 2 4 i?

Who is required to file 2 4 i?

How to fill out 2 4 i?

What is the purpose of 2 4 i?

What information must be reported on 2 4 i?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.