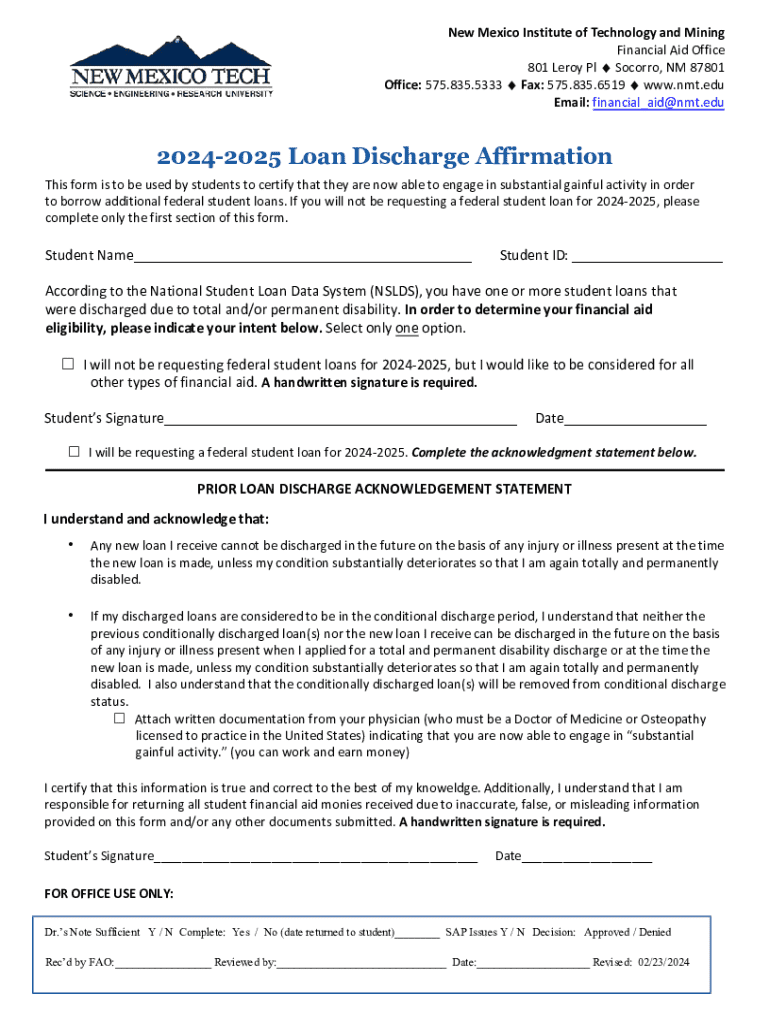

Get the free State of New Mexico Financial Aid

Get, Create, Make and Sign state of new mexico

Editing state of new mexico online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of new mexico

How to fill out state of new mexico

Who needs state of new mexico?

State of New Mexico Form: A Comprehensive Guide

Overview of the State of New Mexico forms

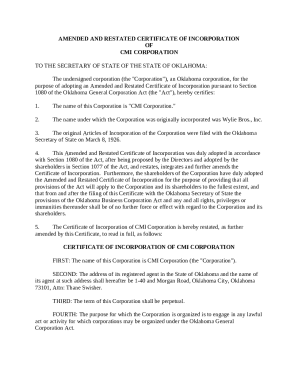

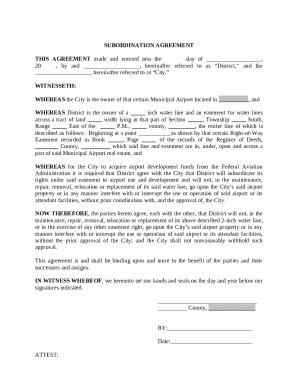

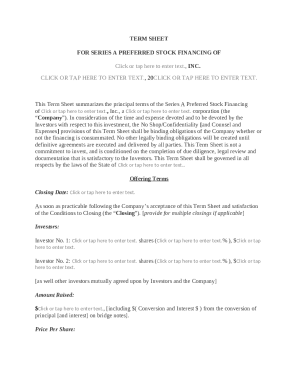

State forms in New Mexico encompass a range of official documents utilized by residents and businesses for various legal, administrative, and operational purposes. From tax to health-related forms, utilizing the correct form is crucial for compliance and efficiency. The importance of these forms cannot be overstated, as they serve as fundamental tools in navigating state services and regulations.

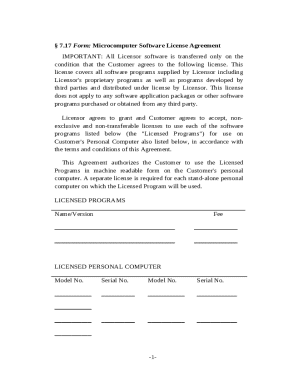

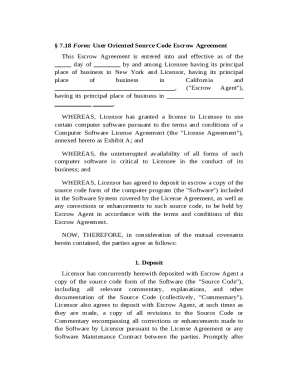

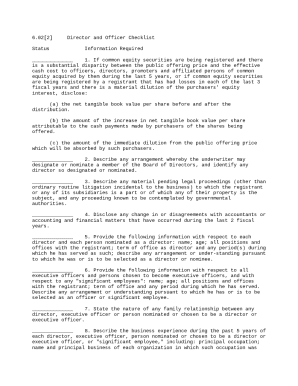

There are several types of forms used in New Mexico, including tax forms such as personal income tax returns, business-related tax filings, legal documentation such as divorce or custody forms, and health application forms like Medicaid registrations. The key features of these forms often include specific instructions, required fields, and submission guidelines that ensure they meet regulatory standards. Proper usage of the correct form is essential to avoid delays and complications.

How to access New Mexico forms

Accessing New Mexico forms is a straightforward process primarily centered around official state agency websites. These websites house comprehensive libraries of forms needed for various state functions. Local government offices may also provide hard copies or assistance in finding necessary forms, catering to residents who prefer in-person interactions.

Navigating the New Mexico Forms Library can be simplified by understanding the way it’s organized. Forms are typically categorized based on their use — such as tax, legal, health, and more. Utilizing a search function with specific keywords like 'income tax forms' or 'Medicaid applications' can significantly speed up the process of finding the right document.

Specific forms available in New Mexico

New Mexico offers a myriad of specific forms catering to diverse needs. Understanding commonly used forms can facilitate smoother interactions with state requirements. Tax-related forms stand out, including personal income tax forms and business tax returns, crucial for both individual and business financial obligations.

Legal forms, such as those required for divorce or custody arrangements, are vital tools for individuals navigating family law. Additionally, health forms like Medicaid applications play a critical role for eligible residents seeking state healthcare services. Each form serves its unique purpose and requires specific attention when filling out to ensure compliance and enhance processing speed.

Step-by-step instructions for filling out New Mexico forms

Filling out New Mexico forms can seem daunting, yet understanding the process can make it manageable. Begin by carefully reviewing the instructions provided with each form. For instance, ensure that your Tax Identification Number is entered accurately on all tax forms to facilitate correct processing and to avoid potential delays in returns.

Common mistakes include misplacing signatures or neglecting to include necessary documentation, so maintaining an organized and thorough approach greatly enhances the chance of acceptance on the first attempt. Utilizing best practices such as checking entries against official guidelines can lead to a more accurate submission.

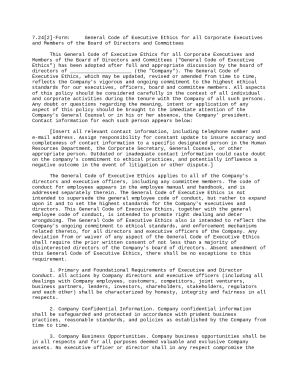

Editing and managing New Mexico forms

Document management is crucial in ensuring that all forms are accurate and up-to-date. Tools like pdfFiller provide a powerful platform for easily editing New Mexico forms. With pdfFiller, users can access existing PDF forms, make necessary edits, and ensure that all data is accurate before submission.

The collaboration features offered by pdfFiller enable teams to work together on form completion seamlessly, facilitating easy sharing and feedback. The eSigning capabilities further enhance the efficiency of document management, allowing users to expedite approvals without the need for physical signatures, which is particularly useful when submitting forms to state agencies.

Submitting New Mexico forms

Once your form is completed, the next step is submission. Depending on the type of form, submission methods can vary. Many state agencies now allow for online submissions through dedicated portals, making the process smooth and fast. For those who prefer traditional methods, mailing the forms directly to the relevant department is often acceptable. For urgent matters, in-person submissions at designated local offices can ensure immediate processing.

To track your submission status, confirm verification methods provided by the agency, such as receipt confirmation emails or dedicated tracking numbers for forms submitted online. Keeping records of submissions is crucial for follow-up communications.

FAQs about New Mexico forms

Navigating the world of New Mexico forms can bring about numerous questions. Some common inquiries revolve around regulations, usage requirements, and procedures for form completion. Understanding these aspects can greatly enhance the efficiency of submissions and the overall experience with state paperwork.

When issues arise, reaching out to the appropriate state agency is often the best course of action. Agencies tend to have dedicated customer service resources to assist with common problems, ensuring that residents can resolve any issues efficiently and maintain compliance with local regulations.

Best practices for form management

Maintaining organization is key when managing documents, particularly with the variety of forms that may be needed throughout the year. Establishing a system for keeping track of both digital and physical copies can streamline your workflow, ensuring you have quick access to relevant documents when required.

These best practices not only help prevent loss but also support timely compliance with state regulations, minimizing the stress often associated with managing various forms.

Utilizing technology for document management

The integration of technology into document management can yield substantial advantages. Platforms like pdfFiller provide cloud-based solutions for New Mexico forms, allowing users to access their documents from anywhere, at any time. This flexibility is especially beneficial for individuals and teams who need to collaborate regardless of their location.

Moreover, enhanced security features found in cloud-based systems reassure users that their sensitive form data is protected against unauthorized access. By emphasizing collaboration and efficiency, these technologies enable users to focus on completing and filing their forms accurately and punctually.

Get started with your New Mexico forms today

Exploring solutions like pdfFiller can transform the way you handle New Mexico forms. By providing a comprehensive tool for form creation and management, users can seamlessly edit, eSign, and collaborate on important documents. This integrated approach eases the administrative burden of form handling, facilitating quick and efficient processing.

Utilizing a document management system simplifies compliance with state regulations while enhancing productivity for individuals and teams alike. The benefits of leveraging such technology cannot be understated, offering powerful solutions for form management in New Mexico.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit state of new mexico from Google Drive?

How do I edit state of new mexico on an iOS device?

How do I fill out state of new mexico on an Android device?

What is state of new mexico?

Who is required to file state of new mexico?

How to fill out state of new mexico?

What is the purpose of state of new mexico?

What information must be reported on state of new mexico?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.