Get the free Land In farms Acconllng to Use

Get, Create, Make and Sign land in farms acconllng

Editing land in farms acconllng online

Uncompromising security for your PDF editing and eSignature needs

How to fill out land in farms acconllng

How to fill out land in farms acconllng

Who needs land in farms acconllng?

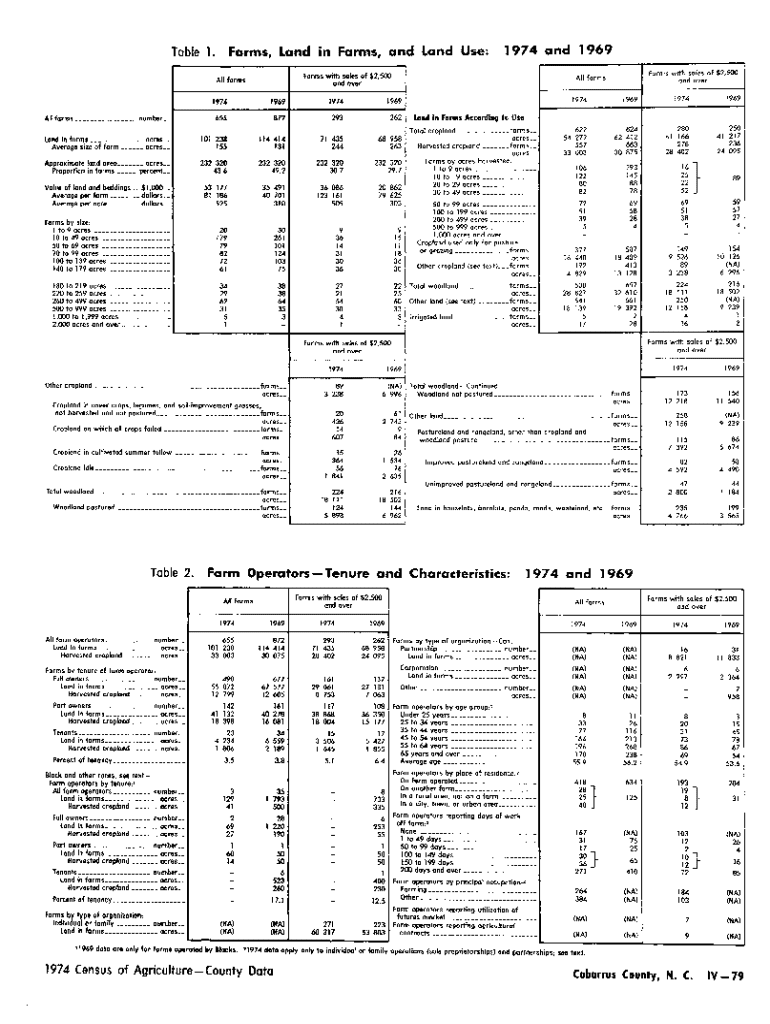

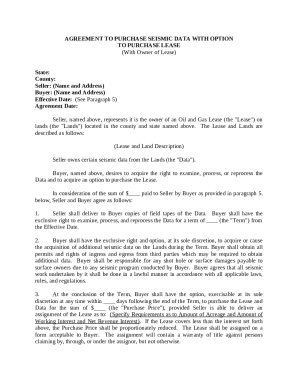

Understanding the Land in Farms Accounting Form

Understanding the importance of tracking land use in farming

Proper tracking of land use in farming is critical for several reasons. Farmers rely on accurate land records to inform their agricultural practices, optimize yield, and manage resources effectively. This practice is not merely administrative; it's a cornerstone of sustainable agriculture.

Legal implications also underscore the importance of accurate land documentation. Compiling comprehensive records can protect farmers during disputes over land use, easements, or zoning issues. Furthermore, good record-keeping can significantly impact financial planning and tax reporting, leading to more informed decisions in investments and expenditures.

What is the Land in Farms Accounting Form?

The Land in Farms Accounting Form is a specialized document used to track various aspects of land ownership and use in agricultural operations. It consolidates data regarding parcel information, land management practices, and financial data related to land, enhancing clarity and organization in farming operations.

Farmers, agricultural organizations, and even government entities engaged in the agricultural sector need this form. It helps in documenting land-use changes over time, fostering transparency that can be beneficial for seeking funding and grants.

Preparing to fill out the Land in Farms Accounting Form

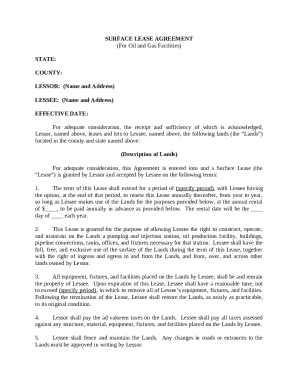

Before filling out the Land in Farms Accounting Form, it's crucial to gather all necessary information. This includes documentation of land ownership, current use, and even historical data on land yields and productivity. Having this information at hand is essential for accuracy and completeness.

Additionally, farmers can use various tools to streamline the data collection process. Software solutions like farm management systems can simplify the tracking of yields and land use over time. Consider utilizing cloud-based platforms that allow you to manage documents efficiently, making collaboration easier across different team members.

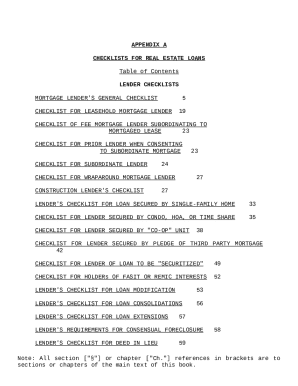

Step-by-step guide to completing the Land in Farms Accounting Form

Completing the Land in Farms Accounting Form involves several sections, each requiring specific information. Here is a breakdown:

Tips for successfully filing the Land in Farms Accounting Form

To ensure the successful filing of the Land in Farms Accounting Form, avoid common mistakes such as incorrect measurements or incomplete information. Best practices include double-checking entries for accuracy and utilizing resources like pdfFiller for editing and collaboration.

Make use of pdfFiller’s editing tools to easily fill out and sign your form. The platform aids in organizing documentation systematically, making it user-friendly for individual farmers and agricultural teams.

Leveraging technology for farm land management

pdfFiller offers powerful features that enhance the user experience when working with the Land in Farms Accounting Form. Farmers can directly edit and sign forms, making it much easier to manage records without the hassle of physical paperwork.

The benefits of cloud-based document management extend to easy access from anywhere, ensuring that critical agricultural records are always at your fingertips. Digital backups mean that you’ll never lose essential documents, further enhancing your operational efficiency.

Advanced strategies for using the Land in Farms Accounting Form for improved farm management

Analyzing land data collected through the Land in Farms Accounting Form can significantly improve decision-making in your farming operations. By integrating this data with overall farm management practices, you can utilize insights for strategic planning such as crop rotation.

Understanding soil health and its financial implications allows farmers to make informed decisions that ensure sustainability while also maximizing profitability. The combination of detailed tracking and advanced data analysis could mean the difference between stagnation and growth in the agricultural sector.

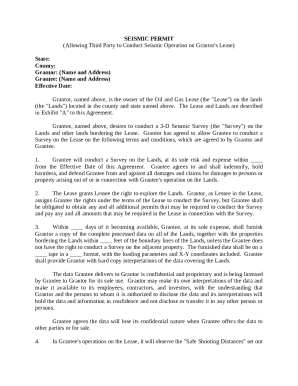

Staying compliant and up to date with agricultural regulations

Agricultural regulations continuously evolve, affecting land use accounting practices in farming. Staying compliant requires an ongoing commitment to education and training, which can be facilitated through resources provided by agricultural organizations and institutions.

It's crucial to remain informed about changes in agricultural laws that may affect land documentation and accounting. Incorporating this knowledge into your farming practices can ensure that you remain compliant while also reaping the benefits of proactive land management.

Conclusion: Transforming land accounting into a strategic asset for farm growth

Thoroughly documenting land use through the Land in Farms Accounting Form can yield long-term benefits that contribute significantly to farm sustainability and profitability. Proactive land documentation leads to better financial decisions that not only enhance agricultural productivity but also drive sustainable practices.

With tools like pdfFiller at your disposal, managing documents becomes a seamless part of your agricultural operations, ensuring that what was once a cumbersome task can now aid in strategic growth and development within farming.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify land in farms acconllng without leaving Google Drive?

How do I complete land in farms acconllng on an iOS device?

How do I edit land in farms acconllng on an Android device?

What is land in farms accounting?

Who is required to file land in farms accounting?

How to fill out land in farms accounting?

What is the purpose of land in farms accounting?

What information must be reported on land in farms accounting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.