Get the free Form 10-Q - Investor Relations - Rand Capital Corporation

Get, Create, Make and Sign form 10-q - investor

How to edit form 10-q - investor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q - investor

How to fill out form 10-q - investor

Who needs form 10-q - investor?

Comprehensive Guide to Form 10-Q for Investors

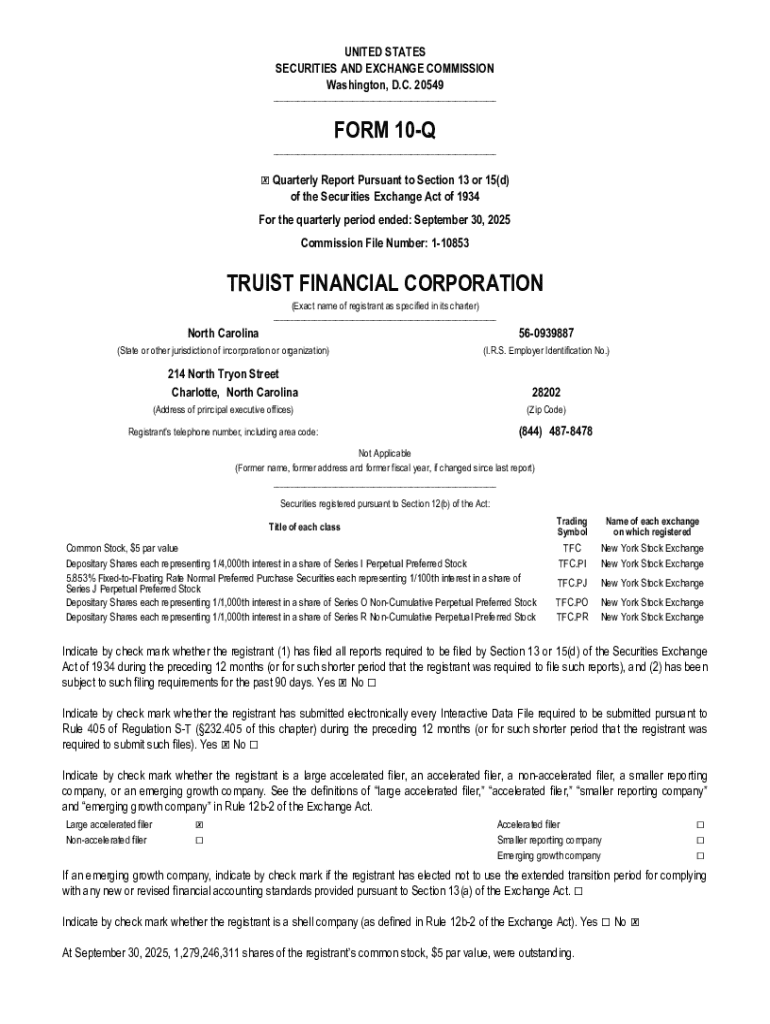

Understanding Form 10-Q

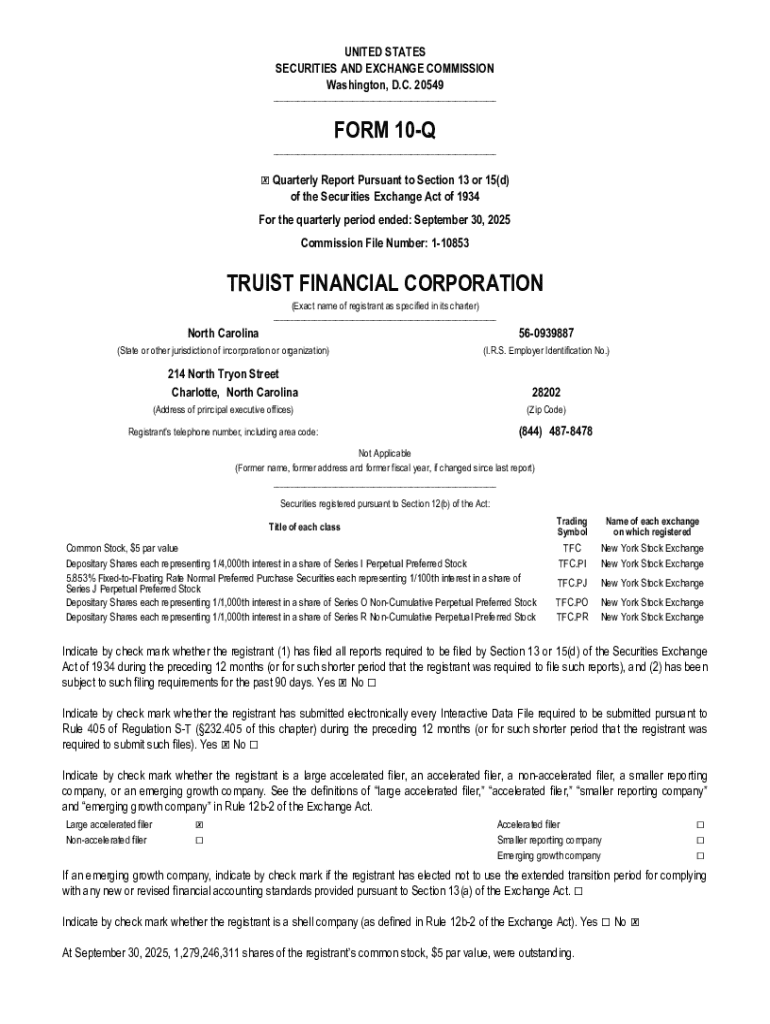

Form 10-Q is a quarterly report required by the Securities and Exchange Commission (SEC) for publicly traded companies. It provides a comprehensive overview of a company's financial performance over a fiscal quarter. Unlike the annual Form 10-K, which offers a more detailed and extensive view of a company's finances, the Form 10-Q discusses financial statements and management’s analysis, making it a crucial document for investors looking to gauge a company's ongoing health and adjust their investment strategies accordingly.

The significance of Form 10-Q in the investment landscape cannot be overstated. It offers quarterly updates that provide insights into a company’s performance, revealing trends that may not be visible in annual reports. Investors depend on these insights to make informed decisions, manage risk, and capitalize on opportunities in their portfolios.

Importance of Form 10-Q for investors

For investors, Form 10-Q plays a critical role in shaping investment strategies and decisions. Regular access to these reports allows investors to monitor the financial health of companies in real-time rather than waiting for annual summaries. This ability to quickly assess performance can lead to timely decisions, whether buying, holding, or selling stocks.

Additionally, the Form 10-Q can unveil potential red flags such as declining revenues, rising debt levels, or shifts in management strategies. By reading these reports, investors gain a deeper understanding of the risks and opportunities within their investments, leading to more informed and confident decision-making.

Structure of a Form 10-Q

A typical Form 10-Q is structured into several key sections that provide crucial information about a company’s operations and financial status. It usually includes financial statements, management discussions, market risk disclosures, and internal controls. Understanding these sections will help investors extract meaningful insights efficiently.

Key sections within a Form 10-Q

Detailed items included in Form 10-Q

Beyond the key sections outlined, the Form 10-Q includes various line items such as revenue breakdowns, operating income, net income, and earnings per share. Each of these elements is fundamental to investors as they offer insights into profitability and operational efficiency, which are critical for evaluating a company's performance over time.

Filing and accessibility of Form 10-Q

Accessing a company's Form 10-Q is relatively straightforward. Investors can retrieve these documents from the SEC's EDGAR database, which is the official repository for all public filings. This platform allows for easy navigation of different company filings, including reviewing historical documents.

Timeline for filing Form 10-Q

Companies are required to file their Form 10-Q within 40 or 45 days after the end of each fiscal quarter, depending on their reporting status. For seasoned filers, the deadline is 40 days; for smaller reporting companies, the deadline extends to 45 days. Such timeliness is crucial, as delays can affect investor perception and company legitimacy.

Consequences of delayed filings can be serious, not only leading to potential penalties from the SEC but also eroding investor confidence. When a company does not meet its filing obligations, it raises questions about transparency and trust, which can adversely impact stock performance.

Common mistakes and FAQs in Form 10-Q filings

Common mistakes in Form 10-Q filings include errors in financial reporting, inaccurate data entries, and lack of sufficient detail in management discussions. These errors can result in misinformation that may lead investors to make misguided decisions.

It's essential for companies to prioritize accuracy to avoid any potential backlash from regulatory bodies or the investing community. A well-structured Form 10-Q not only fulfills a legal obligation but also builds investor trust, as transparency is key to maintaining positive investor relations.

Filing compliance and consequences

Failing to file Form 10-Qs on time has serious implications for companies. Non-compliance can result in legal actions from the SEC, including fines, and could even lead to delistings from stock exchanges. Such penalties significantly harm a company's reputation and can diminish shareholder value.

To address 10-Q filing issues, companies should establish a robust filing schedule and compliance team to ensure timely submissions. Transparency is critical, and keeping investors informed about any delays or issues can help maintain confidence even in turbulent times.

Key highlights and trends in recent Form 10-Qs

Regulations surrounding financial reporting are constantly evolving. Recent changes emphasize the need for clarity and granularity in disclosures. Companies are now encouraged to enhance their MD&A sections with more qualitative analyses, such as potential impacts of economic outlooks, thereby enriching investor understanding.

Additionally, industry-specific trends have emerged in Form 10-Q disclosures. For instance, tech companies are increasingly reporting on cybersecurity risks, while those in the energy sector highlight regulatory changes affecting sustainability. This sectoral variation demonstrates how different industries adapt their disclosures based on their unique challenges and market conditions.

Tools for investors using Form 10-Q

Investors not only need to access Form 10-Qs but also require tools that enhance their analysis and interaction with these documents. pdfFiller provides powerful features that allow investors to edit, sign, and manage Form 10-Q documents efficiently. This platform streamlines the process for users, helping them to maintain organization and accessibility concerning their investment documentation.

Leveraging pdfFiller for your document needs

The capabilities of pdfFiller extend beyond mere access; it enables investors to collaborate with team members in real-time, ensuring all stakeholders are on the same page when analyzing Form 10-Qs. By utilizing interactive tools available on pdfFiller, users can create, edit, and track their Form 10-Q insights seamlessly from any device.

Best practices for using Form 10-Q information

To integrate insights from Form 10-Q reports effectively into investment analyses, investors should employ a structured approach. This includes establishing a checklist of essential metrics to track over time, analyzing trends within the MD&A, and comparing quarterly performances against both past results and industry benchmarks. Utilizing tools like pdfFiller for documentation and reporting ensures a consistent and organized analysis process.

Interactive components and actionable steps

Step-by-step guide to analyzing a Form 10-Q

Analyzing a Form 10-Q can initially seem overwhelming due to the volume of information it contains. Investors can follow a straightforward checklist to break down the process:

Template resources for investors

For a structured review process, investors can utilize sample formats and templates designed for tracking Form 10-Q information. These can include accounting metrics, management commentary notes, and risk assessment forms, allowing investors to compile their analyses neatly and systematically, ensuring no vital aspect is overlooked.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 10-q - investor in Gmail?

How can I modify form 10-q - investor without leaving Google Drive?

How do I edit form 10-q - investor on an Android device?

What is form 10-q - investor?

Who is required to file form 10-q - investor?

How to fill out form 10-q - investor?

What is the purpose of form 10-q - investor?

What information must be reported on form 10-q - investor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.