Get the free " - 32 California

Get, Create, Make and Sign quot - 32 california

Editing quot - 32 california online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quot - 32 california

How to fill out quot - 32 california

Who needs quot - 32 california?

A comprehensive guide to the quot - 32 California form

Overview of the quot - 32 California form

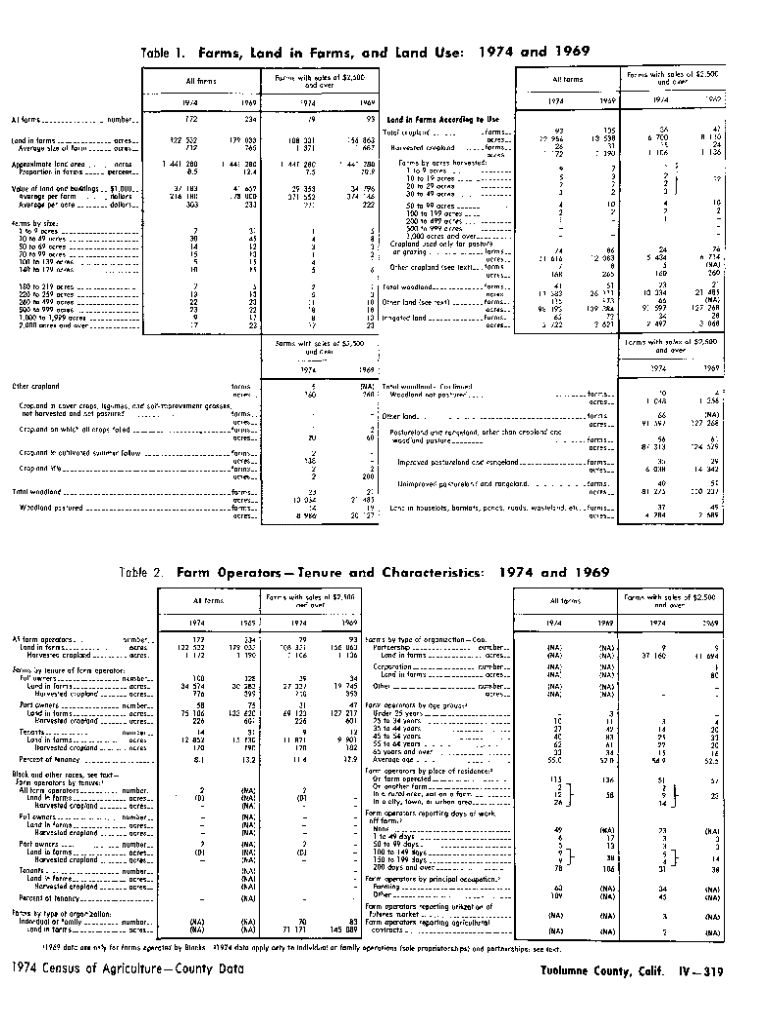

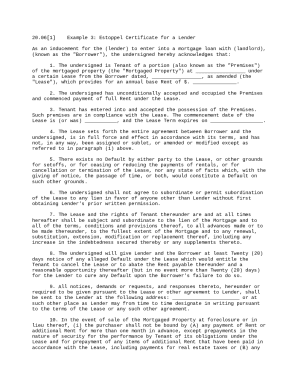

The quot - 32 California form is a vital document utilized in California's workers' compensation system. This form primarily serves to facilitate the reporting of employee wages for the purpose of determining the correct amount of benefits to be disbursed to injured workers. Employment sectors in California, especially those involving manual labor or high-risk industries like construction, frequently utilize this form to guarantee that employees receive adequate compensation should they experience job-related injuries.

Understanding the significance of the quot - 32 form is crucial for both employers and employees. For workers, it ensures that they are correctly represented in terms of wage calculations when seeking benefits such as disability, death benefits, or job displacement. For employers, proper completion of this form can mitigate risks associated with penalties or legal disputes concerning workers' compensation claims.

Understanding the components of the quot - 32 California form

The quot - 32 form consists of several key components, each designed to capture specific information necessary for the processing of claims. These sections include identification details, income information, and additional disclosures that provide context for wage calculations and benefits.

Additionally, it's essential to include supporting documents such as pay stubs, proof of employment, and any prior injury reports. These attachments reinforce the information provided on the form and help streamline the claims process.

Step-by-step instructions for filling out the quot - 32 California form

Filling out the quot - 32 form requires careful attention to detail. Follow these steps to ensure accurate and efficient completion.

Common mistakes to avoid when completing the quot - 32 California form

Even minor errors can cause significant delays in processing claims. Here are common pitfalls to watch for when filling out the quot - 32 California form.

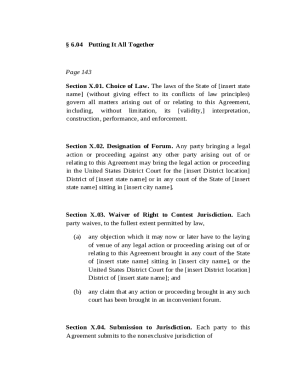

Filing the quot - 32 California form

After completing the quot - 32 form, the next step is submitting it to the appropriate workers' compensation board. This can be done electronically or through traditional methods.

What to do after filing the quot - 32 California form

Once you have submitted the quot - 32 California form, it's essential to understand the next steps in the claims process. You will receive notifications from the relevant authority regarding the status of your submission.

If adjustments are necessary, such as updating wage information or correcting errors, you can amend the information by following specific guidelines set by the California workers’ compensation board.

Frequently asked questions about the quot - 32 California form

Navigating the quot - 32 California form can raise several questions. Below are some frequently asked questions that may provide clarity.

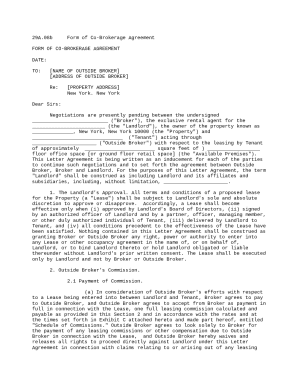

Benefits of using pdfFiller for the quot - 32 California form

Utilizing pdfFiller for your quot - 32 California form brings several advantages, especially for individuals and teams looking for a streamlined document management solution.

Tips for optimizing your experience

Maximizing your experience with the quot - 32 California form can reduce frustrations and enhance accuracy during filings.

The importance of compliance with California form requirements

Compliance with California’s form requirements is not just a matter of best practice; it carries significant legal implications. Non-compliance can lead to financial penalties or disputes concerning workers' compensation claims.

Employers should remain informed about regulatory changes affecting the quot - 32 California form and related procedures, thereby ensuring their practices align with California labor law. Keeping abreast of these regulations, including benefits related to disability and compensation insurance, ensures that employees are adequately cared for, fostering a safer and more compliant work environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit quot - 32 california straight from my smartphone?

Can I edit quot - 32 california on an iOS device?

How can I fill out quot - 32 california on an iOS device?

What is quot - 32 california?

Who is required to file quot - 32 california?

How to fill out quot - 32 california?

What is the purpose of quot - 32 california?

What information must be reported on quot - 32 california?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.