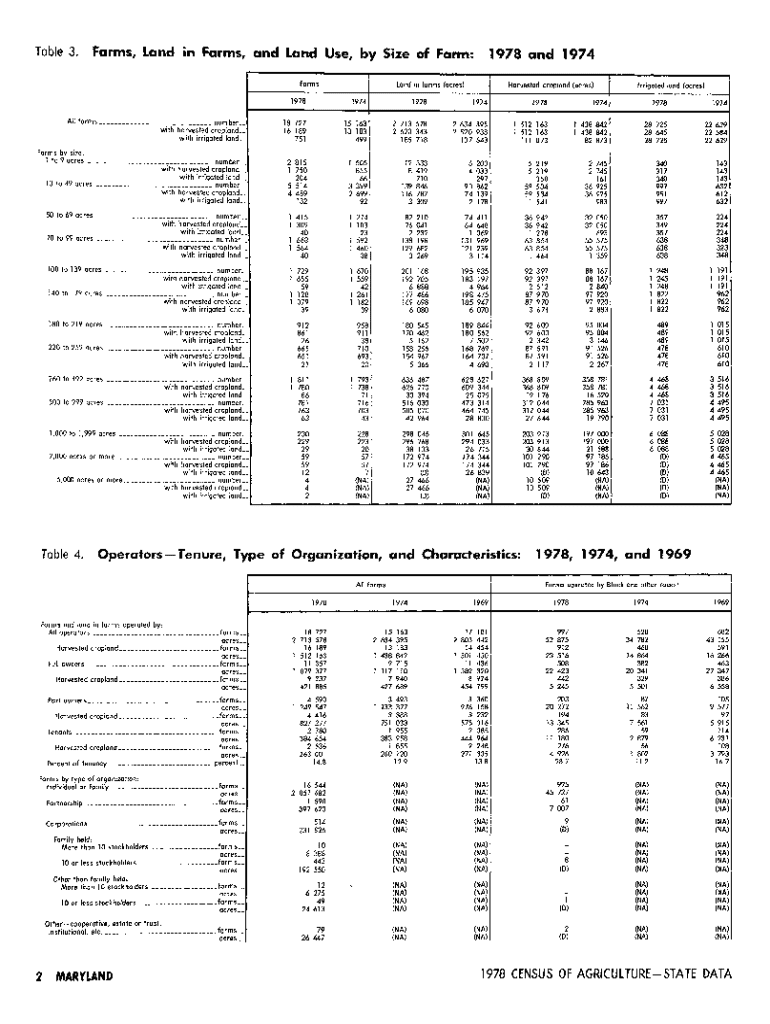

Get the free I 512 163

Get, Create, Make and Sign i 512 163

Editing i 512 163 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out i 512 163

How to fill out i 512 163

Who needs i 512 163?

A Comprehensive Guide to the 512 163 Form

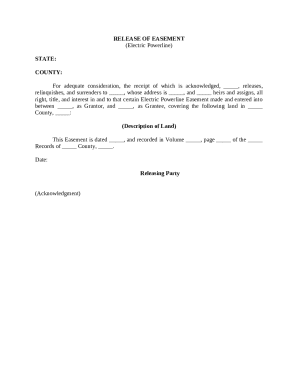

Overview of the 512 163 Form

The i 512 163 Form serves as a critical document in various organizational and administrative contexts. Specifically designed for accurate documentation, this form streamlines processes related to employee reporting and compliance. The importance of the i 512 163 Form cannot be overstated, as it aids organizations in maintaining organized records, ensuring adherence to laws and agency regulations.

Primarily, the i 512 163 Form facilitates the management of employee information systems, particularly for human resource applications. It serves various functions, including payroll tracking, tax calculations, and employee status updates. Its strategic use allows managers and teams to ensure that all pertinent employee data is captured and reported correctly, thereby preventing any legal or operational mishaps.

Who should use the 512 163 Form?

The i 512 163 Form is essential for a variety of users. Individual users, particularly HR representatives, are integral in ensuring the accurate completion of this form to maintain employee compliance with organizational policies. Additionally, teams and organizations that handle multiple employee data points can significantly benefit from utilizing this form. Situational contexts such as onboarding new hires or conducting annual reviews provide excellent opportunities for applying the i 512 163 Form.

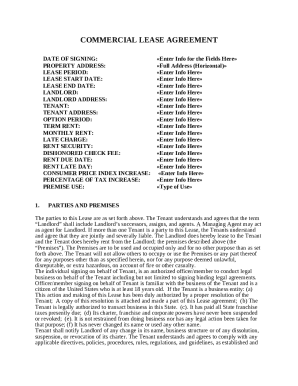

Navigating the 512 163 Form

Accessing the i 512 163 Form is straightforward through pdfFiller’s extensive resources. Users can initiate their search by heading to the pdfFiller website and using the search bar to locate the i 512 163 Form. Once found, users can click to access an interactive version that allows for easy navigation through the document.

The digital interface provided by pdfFiller is user-friendly. Upon accessing the form, users will see well-structured sections designated for various inputs. The intuitive design eliminates confusion and helps guide users through the form-filling process seamlessly, whether on desktop or mobile devices.

Filling out the 512 163 Form: Step-by-step guide

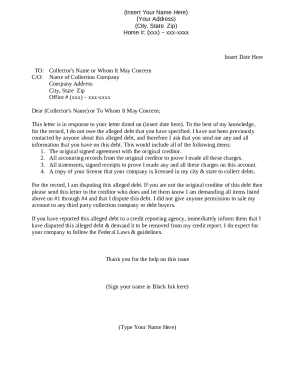

Filling out the i 512 163 Form can be simplified through a step-by-step approach. Before starting, it’s vital to gather all necessary information. This includes personal details such as full name, address, and contact information, as well as critical financial data necessary for payroll and tax purposes. Efficient gathering of this data can be accomplished by scheduling adequate time for document preparation and checking that all relevant files are at hand.

Once all information is gathered, proceed to fill out the form section by section. The first section typically requires personal information; here, you will input your basic details. The second section encompasses financial information, which may include salary details and tax withholding amounts. The third section requests any additional information which aids in creating a comprehensive employee report.

Be vigilant against common mistakes that many encounter while filling out the i 512 163 Form. Ensuring all fields are completed accurately minimizes errors. Double-checking personal and financial data helps avoid issues during processing. Best practices such as using a printed copy for preliminary information gathering before inputting data online can increase accuracy significantly.

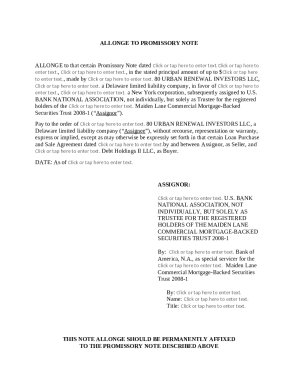

Editing the 512 163 Form: Enhancing your document

Utilizing pdfFiller's editing tools is crucial once you have filled out the i 512 163 Form. You can insert additional text, include relevant images, or add electronic signatures directly to the document. This feature is especially beneficial for teamwork, as you can customize the form based on specific agency or organizational needs.

Another powerful aspect of the pdfFiller platform is its collaboration features. Users can share the form with colleagues for feedback, ensuring that no detail is overlooked. The annotation tools allow for making comments directly on the form, facilitating an efficient review process where all interested parties can contribute.

Signing the 512 163 Form: Electronic signature guide

Understanding the importance of electronic signatures (eSignatures) in today's digital documentation landscape is key. They authenticate the identity of the signer and ensure that the document has not been altered after signing. Thus, the i 512 163 Form can be finalized securely through pdfFiller’s electronic signature process.

To sign the form digitally, navigate to the signing option on pdfFiller. Follow this step-by-step process: First, click on the 'Sign' button, then choose whether to draw your signature, upload an image, or select from pre-saved options. Place your signature appropriately on the form and save your changes. While electronic signatures streamline the signing process, it's essential to be aware of the legal considerations governing their use, ensuring compliance with applicable laws.

Managing your 512 163 Form

Effective management of your i 512 163 Form ensures that you can always access necessary information. pdfFiller offers diverse saving and storage options, especially cloud storage, allowing users to maintain their documents securely online. Best practices include organizing forms into well-labeled folders, making retrieval fast and hassle-free.

Sharing and sending your i 512 163 Form is simplified with pdfFiller as well. Options for emailing the form directly or printing physical copies are available. When dealing with sensitive data, it's paramount to ensure that secure methods of sending are employed, such as encrypted emails or secure file sharing services.

FAQs about the 512 163 Form

Addressing common inquiries related to the i 512 163 Form can alleviate confusion for new users. For instance, understanding when the form is required, such as during employee engagement and compliance reporting is essential. Moreover, clarifications on complex sections can prevent misinterpretation of required information.

To troubleshoot common issues that may arise, having a FAQ section proves invaluable. This provides practical solutions or contact details for inquiries that extend beyond the scope of the form itself. Overall, maintaining a clear line of communication regarding the form's usage can significantly enhance user experience.

Conclusion

The benefits of using pdfFiller for managing the i 512 163 Form are numerous. Convenience is heightened through easy access to digital tools, allowing users to fill out, edit, sign, and share documents all from one application. This integrated approach is crucial for individual users and teams aiming to streamline documentation and improve compliance.

By embracing such technology, organizations ensure a smoother workflow, promoting better collaboration and data management practices crucial for today’s business environments. With tools like pdfFiller, mastering the i 512 163 Form becomes not only feasible but also highly efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my i 512 163 in Gmail?

How can I get i 512 163?

Can I edit i 512 163 on an iOS device?

What is i 512 163?

Who is required to file i 512 163?

How to fill out i 512 163?

What is the purpose of i 512 163?

What information must be reported on i 512 163?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.