Get the free 18 Printable Claim Letter Sample Forms and Templates

Get, Create, Make and Sign 18 printable claim letter

How to edit 18 printable claim letter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 18 printable claim letter

How to fill out 18 printable claim letter

Who needs 18 printable claim letter?

18 Printable Claim Letter Form: Your Comprehensive How-To Guide

Understanding claim letters

Claim letters are formal documents used to request compensation, reimbursement, or acknowledgment for a particular issue or grievance. They typically serve as a way to communicate dissatisfaction or a request for a remedy to an appropriate entity, whether it be an insurance company, a business, or a government agency. The importance of these letters cannot be overstated, as they provide a structured format for presenting claims clearly and professionally while documenting the sender's intent.

In various contexts, such as health, property, warranties, or services, claim letters play a crucial role in advocating for your rights. For example, when a service is not rendered as promised, a claim letter serves as formal communication seeking resolution. Understanding the various types of claims, like insurance claims, warranty claims, and refund claims, is essential for effectively addressing issues.

Characteristics of an effective claim letter

An effective claim letter must contain several key components. These components lay the foundation for a well-structured claim that the recipient can easily understand. Firstly, including the sender's information—such as name, address, and contact details—is crucial for establishing identity. Secondly, the recipient's information, which includes their relevant designation and address, personalizes the letter and ensures it reaches the correct department.

The subject line should be clear and to the point, summarizing the essence of the claim briefly. A clear statement of the claim follows, outlining the issue, any relevant dates, and the specifics of the request. Moreover, best practices recommend that the tone be polite and assertive, as this can significantly affect the recipient's response. Keeping the letter concise yet comprehensive, and providing supporting documentation enhances the claim’s credibility.

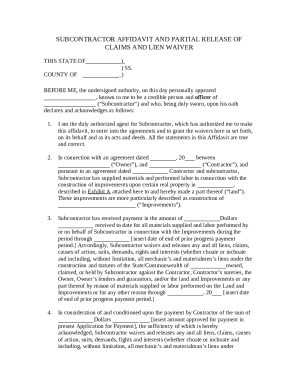

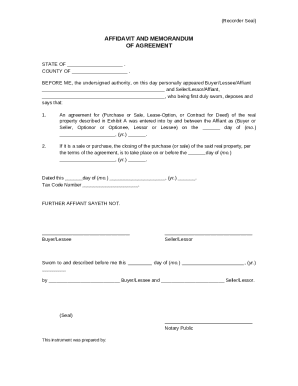

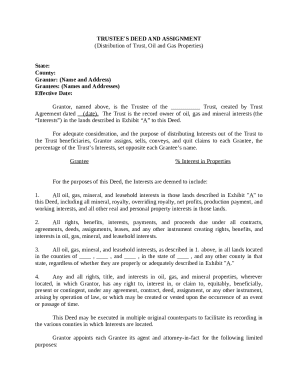

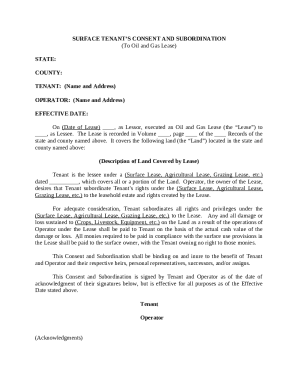

The 18 printable claim letter forms

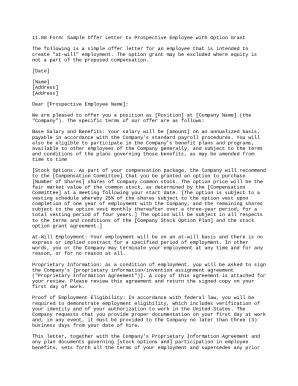

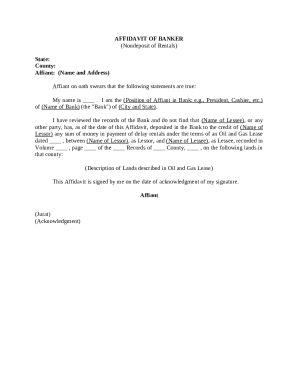

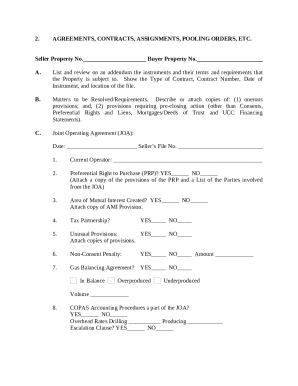

Having access to a variety of printable claim letter forms simplifies the process of addressing specific issues by providing pre-formatted templates. Each template caters to different situations, ensuring users can quickly find the appropriate format to express their claims effectively.

Below is a brief description of each template, highlighting key scenarios they are suited for:

How to use the 18 printable claim letter forms

Utilizing the 18 printable claim letter forms is straightforward, making the process of assertion simpler and more effective. Users can start by visiting the pdfFiller website to access and download the required form. Each form is designed to be easily editable, ensuring personalized details can be seamlessly integrated.

To edit these forms, pdfFiller's online editor provides a robust platform for customization. Users can type in their information directly, adjust the format as needed, and even add comments or additional notes. Once the form is customized, signing documents electronically can be done using eSignature tools available on the site. This not only saves time but also ensures that the integrity and privacy of the documents are maintained.

Completing your claim letter

When filling out each section of the claim letter form, it’s crucial to ensure that all necessary specifics are included based on the claim type. For instance, include policy numbers for insurance claims or order numbers for refund claims to facilitate faster processing. Additionally, one must avoid common errors such as misspelled names or incorrect addresses, as these can lead to delays or rejections.

It’s advisable to proofread the document multiple times after completion. Attention to detail can significantly enhance the clarity and professionalism of your letter. Final checks should also include ensuring adherence to any specific guidelines set by the recipient, and confirming that all supporting documents are attached.

Submitting your claim letter

Different submission methods exist for your claim letter, often dependent on the recipient's preferences. Common methods include mail, email, or directly online through specific portals. It's vital to choose the method that aligns best with the instructions provided by the entity to ensure prompt processing.

Following submission, understanding the expected follow-up procedure is equally important. Recipients may take several days to respond, and tracking your claim status could involve following up through customer service lines or online tools. Ensuring you maintain records of your correspondence will also help in any follow-ups.

Tips for successfully managing claims

An organized approach to managing claims can greatly reduce frustration and increase the chance of satisfactory outcomes. Keeping thorough records of all communications—emails, letters, and phone calls—provides a trail that can be essential should disputes arise. Documenting every step creates a clear picture of your attempts to resolve the issue and supports your case if a claim is denied.

If a claim is initially rejected, understanding the next steps in the appeals process can be critical. Many institutions offer a formal path for disputing denials, which may require submitting additional documentation or providing further context to your claim. Making use of your resources, including customer service contacts or legal advice if necessary, can equip you with the information needed to pursue a successful appeal.

Troubleshooting common issues with claim letters

Common errors in claim forms can lead to significant issues, including delayed responses or outright refusals. Examples include incomplete forms, incorrect policy numbers, or failures to attach supporting documents. Recognizing these frequently posed problems can save time and avoid unnecessary frustration.

Users should also have reasonable expectations regarding response times. While some claims may be processed quickly, others may take weeks or even months, especially during peak times. Awareness of typical timelines for replies can alleviate anxiety during the waiting period. Additionally, if responses are inadequate or claims are persistently denied, it may be prudent to seek legal guidance.

Benefits of using pdfFiller for claim letters

Using pdfFiller provides significant advantages in accessing and managing claim letters. The platform offers streamlined access to templates and tools necessary for creating professional and accurate documents, enhancing workflow efficiency across multiple claim types. This feature is particularly beneficial for both individuals and teams navigating various claim situations.

Moreover, pdfFiller incorporates collaboration features, allowing multiple users to work on documents simultaneously, which is particularly useful in corporate settings. Security benefits associated with cloud-based document management cannot be overlooked. Users can be assured of the integrity of their data while also maintaining control over document access and permissions, ensuring privacy throughout the document lifecycle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 18 printable claim letter without leaving Google Drive?

How do I edit 18 printable claim letter on an iOS device?

How do I complete 18 printable claim letter on an iOS device?

What is 18 printable claim letter?

Who is required to file 18 printable claim letter?

How to fill out 18 printable claim letter?

What is the purpose of 18 printable claim letter?

What information must be reported on 18 printable claim letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.