Get the free Maryland 2024 Nonresident Tax Forms and Instructions

Get, Create, Make and Sign maryland 2024 nonresident tax

How to edit maryland 2024 nonresident tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland 2024 nonresident tax

How to fill out maryland 2024 nonresident tax

Who needs maryland 2024 nonresident tax?

Maryland 2024 Nonresident Tax Form Guide

Understanding the Maryland nonresident tax obligation

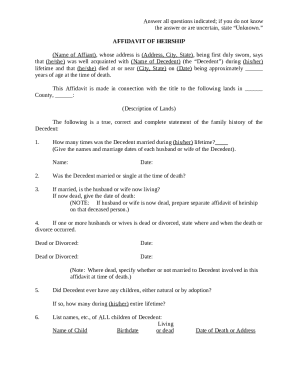

Maryland imposes a tax obligation on nonresidents who earn income in the state. The nonresident tax requirements are set to ensure that those who derive income from Maryland sources contribute fairly to the state's revenue. Understanding what constitutes nonresident status is crucial, as it determines your tax responsibilities.

A nonresident is generally an individual who does not maintain a permanent residence in Maryland but earns money there. In contrast, a resident is someone whose primary domicile is in Maryland. Filing as a nonresident is imperative for compliance with tax laws and to avoid potential penalties.

Who needs to file the Maryland 2024 nonresident tax form?

Identifying whether you need to file the Maryland 2024 nonresident tax form is essential. If you earn taxable income from Maryland sources, it's likely that you fall into the category of individuals who must file this form. Typically, nonresidents include those who work temporarily in Maryland, own rental property, or receive income from investments sourced within the state.

Certain types of income are subject to Maryland tax for nonresidents. This includes wages, salaries, rental income, and capital gains from property sold within Maryland. Even if your total income is below the filing threshold, specific situations may still require you to file to report income correctly and fulfill your tax obligations.

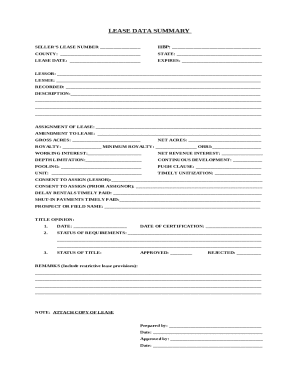

Overview of the Maryland 2024 nonresident tax form

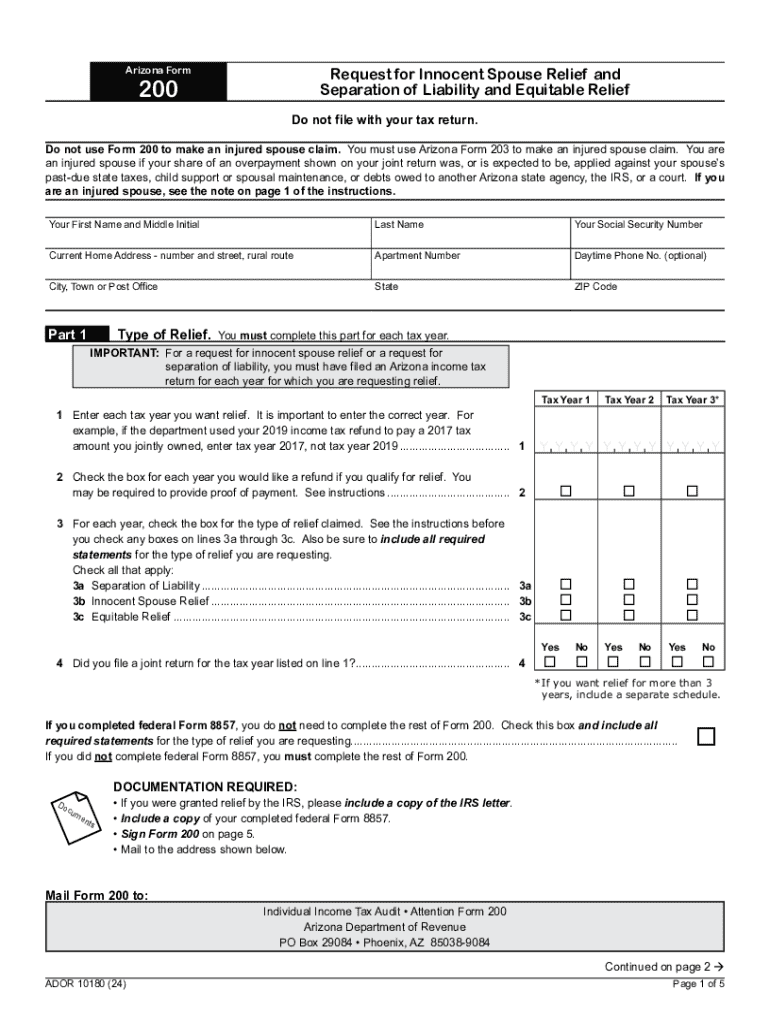

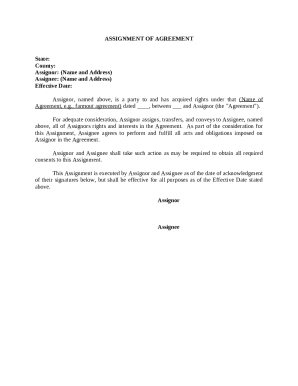

The primary form that nonresidents in Maryland must use for filing is Form 505. This form collects vital information about your income earned in Maryland, taxes withheld, and applicable deductions. Each segment of the form is designed to facilitate accurate reporting and deductions specific to nonresidents, ensuring a comprehensive tax submission.

Key sections of Form 505 include basic identification, income reporting, and deductions and credits specific to nonresidents. For 2024, notable changes include updated thresholds for various income types, as well as new deductions aimed at alleviating tax burdens for lower-income earners. Understanding each section thoroughly can streamline the process and minimize errors.

Step-by-step guide to filling out the Maryland 2024 nonresident tax form

Successfully completing the Maryland 2024 nonresident tax form requires careful attention to detail. Start by gathering all necessary documentation, such as W-2 forms, 1099s, and any additional statements that outline your income sources. Having everything in one place makes the filing process much smoother.

Next, begin the form by accurately entering your basic identification information. This includes your name, address, and Social Security number. One common mistake is transposing numbers or entering the wrong address, which can delay processing. After that, report your income from all sources, ensuring you account for wages, rental incomes, and any investment earnings.

As you move on to the deductions and credits section, carefully review which deductions you qualify for as a nonresident. This might include deductions specific to your occupation or type of income. Many filers overlook available credits, such as those for taxes paid to other states or local jurisdictions.

After completing the form, finalize your submission by checking for errors and confirming that all required schedules are included. This diligence in reviewing your work can save both time and potential penalties.

Important dates and deadlines

Being timely in your tax filing is crucial. For the Maryland 2024 nonresident tax form, the deadline for filing is typically April 15th, aligning with the federal tax deadline. However, if this date falls on a weekend or holiday, the due date may be adjusted. It's vital to stay informed about any changes that this year's calendar may present.

If you miss the filing deadline, you may face late fees or penalties. To mitigate the impact, it's advisable to file as soon as possible, even if your return is incomplete. This can help reduce penalties for lateness where applicable and keep your tax responsibilities in order.

Electronic filing vs. paper filing of the Maryland nonresident tax form

Choosing how you file your Maryland 2024 nonresident tax form can greatly affect your experience. Electronic filing is increasingly popular due to its convenience and speed. When you e-file, you receive immediate confirmation of submission, which eliminates uncertainty about whether your filing was received.

Alternatively, some taxpayers may prefer mailing in a paper submission. This traditional method requires careful attention to detail, especially regarding postage and ensuring all parts of the form are included. When opting for paper filing, always send your forms via certified mail to track when the documents were delivered.

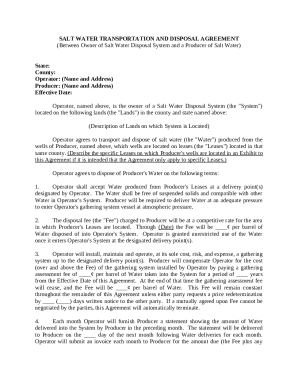

Handling estimated taxes

Nonresidents may also have estimated tax obligations throughout the year if their Maryland income is substantial. Estimated taxes are necessary for individuals who expect to owe more than a certain amount of tax when filing their returns, thus avoiding underpayment penalties.

Calculating estimated taxes requires reviewing your expected income and tax liabilities and paying quarterly estimates based on that calculation. Be mindful that failing to make these payments, or miscalculating the amounts owed, can lead to potential penalties, so careful planning is essential.

FAQs about the Maryland 2024 nonresident tax form

Navigating tax filing can lead to numerous questions, especially for nonresidents unfamiliar with Maryland's tax laws. One common query is whether a brief period of employment in Maryland necessitates filing the nonresident tax form. The short answer is yes, even if the earning is minimal, as the income generated in Maryland is still taxable.

Another frequent concern is how Maryland's tax rates compare to those of other states. Understanding these rates can help in financial planning and may influence decisions like residency status. More complex scenarios, such as part-year residency or implications for those living abroad, also frequently arise, necessitating clear and detailed responses.

Additional support and resources

For further assistance, Maryland's State Tax Assistance offers various resources to aid nonresidents in navigating their tax obligations. Their website provides direct access to forms, FAQs, and contact information for personalized help.

In addition to state resources, professional tax preparation services can provide invaluable assistance, ensuring that all aspects of your tax situation are considered. Links to official Maryland tax resources, guidelines, and possible software options may significantly simplify your filing process.

The benefits of using pdfFiller for your tax documentation

Utilizing pdfFiller streamlines the tax documentation process significantly for nonresident filers. This powerful resource allows users to easily edit, fill out, and sign the Maryland 2024 nonresident tax form and other related documents.

The platform's features, such as secure e-signing and collaborative tools for document management, ensure that you're not only compliant but also organized throughout the filing process. Convenient access from any device enhances your ability to manage the paperwork required for your Maryland taxes efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send maryland 2024 nonresident tax for eSignature?

How do I complete maryland 2024 nonresident tax online?

How do I edit maryland 2024 nonresident tax on an Android device?

What is maryland 2024 nonresident tax?

Who is required to file maryland 2024 nonresident tax?

How to fill out maryland 2024 nonresident tax?

What is the purpose of maryland 2024 nonresident tax?

What information must be reported on maryland 2024 nonresident tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.