Get the free House Committee on Financial Services Holds Hearing,... - docs house

Get, Create, Make and Sign house committee on financial

Editing house committee on financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out house committee on financial

How to fill out house committee on financial

Who needs house committee on financial?

House Committee on Financial Form: A Complete Guide for Compliance and Transparency

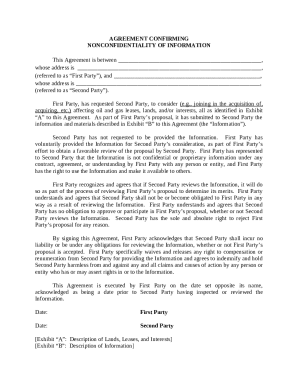

Understanding the House Committee on Financial Form

The House Committee on Financial Form plays a pivotal role in ensuring transparency and accountability among elected officials and candidates in the U.S. Congress. This committee oversees the submission and management of financial forms that assess potential conflicts of interest and promote public trust in the legislative process.

Financial forms are critical instruments for legislative transparency, enabling the public to understand the financial interests of their representatives. By mandating these disclosures, the House Committee seeks to mitigate corruption and maintain the integrity of the legislative body.

The financial forms are required to be completed by a broad range of individuals, including members of Congress, congressional candidates, and staff members within congressional offices. This broad applicability helps ensure that financial interests are disclosed at various levels of the government.

Types of financial forms managed by the House Committee

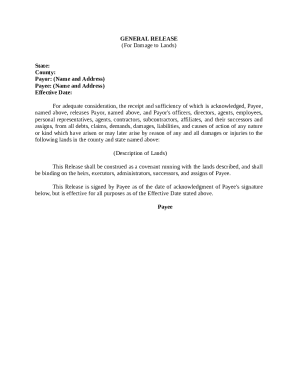

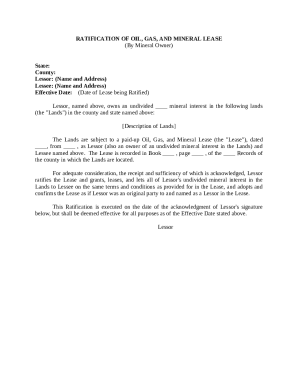

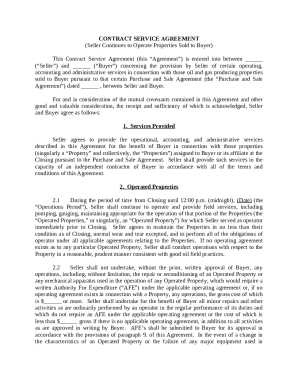

The House Committee on Financial Form handles several types of financial disclosure documents. These forms are designed to capture detailed financial information and obligations, making them essential for accountability within Congress.

Each form serves a distinct purpose and comes with specific requirements that vary depending on the role of the individual and the nature of their finances. Understanding these forms is crucial for compliance and avoiding penalties.

Who should complete these forms?

Filling out the financial forms is not exclusive to members of Congress; several other individuals are also required to ensure comprehensive transparency. This includes:

This diverse group underscores the importance of transparency at all levels of government operation, helping to build public confidence in elected and appointed officials.

Specific disclosure requirements

The financial forms require a variety of disclosures to provide a complete picture of an individual’s financial situation. Key elements that must be disclosed include assets, income sources, and more.

The relevance of reporting thresholds is also significant; these thresholds dictate the amounts and types of disclosures required based on varying incomes or asset values.

Step-by-step guide to filling out the financial forms

Completing financial forms may seem daunting, but breaking the process down into manageable steps can simplify it substantially. Here’s a concise guide for effective completion:

Following these steps can minimize errors and streamline the disclosure process, ensuring compliance and transparency.

Common oversights in financial disclosure reporting

Even with clear guidelines, it’s not uncommon for individuals to overlook critical details when filling out financial forms. Common mistakes can lead to compliance issues or reputational damage.

To combat these oversights, it is crucial to review completed forms thoroughly and check for accuracy before submission.

Tools for managing financial forms

Utilizing digital solutions can greatly enhance the experience of managing financial forms. For example, pdfFiller offers features that cater specifically to the needs of individuals engaged in financial disclosures.

Moreover, a cloud-based platform like pdfFiller provides the flexibility and accessibility needed for efficient management of these important documents.

FAQs about financial disclosure for members, officers, and employees

Understanding the obligations related to financial disclosures can be challenging. Here are some frequently asked questions to clarify common concerns:

Getting clear answers to these questions ensures that those required to file can do so effectively, supporting transparency throughout the legislative process.

FAQs about financial disclosure for candidates

Candidates navigating the financial disclosure process often have unique concerns. Addressing these inquiries can provide crucial guidance during campaigns.

Understanding these aspects of financial disclosure allows candidates to better prepare their submissions, fostering transparency and increasing public confidence.

Review of past financial disclosure forms

The historical context of financial disclosures provides significant insights into how compliance can impact public perception and legislative actions. Significant cases often highlight lapses in transparency that spurred reforms.

The lessons learned from past disclosures are invaluable, enabling contemporary lawmakers to navigate financial regulations with a better understanding of their implications.

Leveraging digital solutions for accurate reporting

Utilizing tools like pdfFiller can substantially ease the burden associated with financial form management. This platform offers numerous advantages tailored for compliance and efficiency.

Embracing digital solutions like pdfFiller can ensure compliance and make the financial disclosure process more effective and less daunting for all parties involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my house committee on financial directly from Gmail?

Where do I find house committee on financial?

Can I create an electronic signature for signing my house committee on financial in Gmail?

What is house committee on financial?

Who is required to file house committee on financial?

How to fill out house committee on financial?

What is the purpose of house committee on financial?

What information must be reported on house committee on financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.