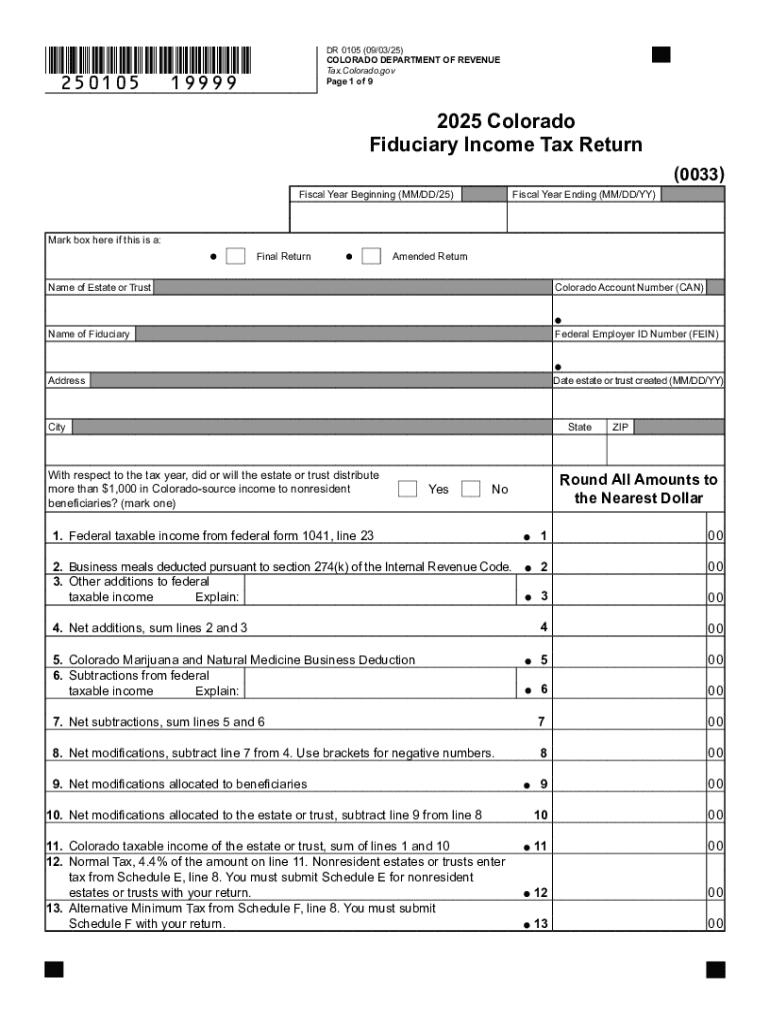

Get the free DR 0105, 2025 Colorado Fiduciary Income Tax Return. If you are using a screen reader...

Get, Create, Make and Sign dr 0105 2025 colorado

How to edit dr 0105 2025 colorado online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 0105 2025 colorado

How to fill out dr 0105 2025 colorado

Who needs dr 0105 2025 colorado?

Comprehensive Guide to the DR 0 Colorado Form

Overview of DR 0105 Colorado form

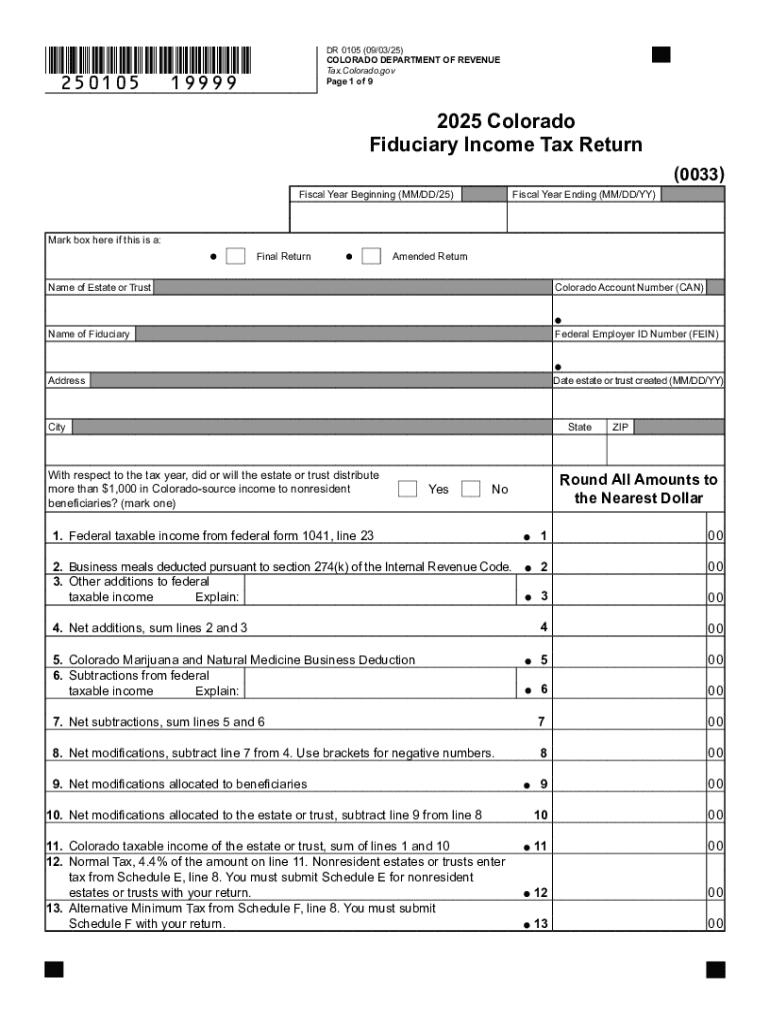

The DR 0105 Colorado form is an essential document required by the Colorado Department of Revenue for filing state taxes. This form facilitates the reporting of income and deductions, helping taxpayers determine their tax liability. For individuals and businesses alike, accurately completing the DR 0105 ensures compliance with state tax laws and helps avoid potential penalties. Especially in 2025, understanding this form and its importance in Colorado’s tax landscape is paramount due to evolving tax regulations.

Taxpayers should pay close attention to key deadlines, especially to avoid late fees associated with missed due dates. Normally, state tax returns are due by April 15, but for 2025, consult the latest guidelines for any specific extensions or updates.

Key features of the DR 0105 Colorado form

The DR 0105 structure includes specific sections that cater to various income levels and tax scenarios. Taxpayers will find sections that require details of their income sources, allowable deductions, and credits they can claim. Each part of the form is designed to guide the taxpayer through reporting their financial situation accurately.

Commonly, this form is used not only by individual taxpayers but also by partnerships and business entities, making it vital for accurate financial representation in the state.

How to access the DR 0105 Colorado form

Accessing the DR 0105 form is straightforward. The Colorado Department of Revenue website serves as the primary resource. To find the form, follow these steps: Visit the website, navigate to the Forms section, and select the appropriate year version of the DR 0105. Once located, taxpayers can easily download and print the document for completion.

Alternatively, users can access the form through platforms like pdfFiller, which not only allows for downloading but also offers various tools for editing and managing the form efficiently.

Preparing to fill out the DR 0105 form

Before diving into filling out the DR 0105 form, gather all necessary documentation. This includes personal identification details such as your social security number, tax identification number, and any information related to your filing status. Additionally, ensure you have complete financial details ready — this encompasses all income sources, tax deductions such as mortgage interest and charitable contributions, and any credits applicable to your situation.

Having all documents at your fingertips simplifies the completion process and reduces the likelihood of errors while providing a comprehensive view of your financial standing.

Step-by-step guide to filling out the DR 0105 form

Section 1: Personal information

Begin with filling out your personal details accurately. Input your full name, address, social security number, and any other requested identifiers. Ensure all names are spelled correctly and information is current to avoid any issues with processing.

Section 2: Tax information

This section dives into declaring your income and applicable deductions, which is crucial for calculating your tax liability. Carefully list all sources of income, such as wages, dividends, and any other financial earnings. Use the correct tax classifications for each income source, ensuring clarity and precision. When reporting deductions, familiarize yourself with allowable items to optimize your return.

Section 3: Review of form

After completing the form, take the time to review it meticulously. Look for common mistakes such as misentered income figures, incorrect social security numbers, or missed signatures. Thorough checks can mitigate delays in processing and prevent unnecessary follow-ups from tax authorities.

Editing and collaborating on the DR 0105 form

Utilizing pdfFiller can significantly streamline the process of editing and collaborating on the DR 0105 form. The platform's tools allow users to make modifications easily, add comments to specific sections, and streamline team reviews. This feature is particularly useful for teams who might be working together on business filings or for tax professionals assisting clients.

These collaborative features ensure that the form is accurate and conforms to all requirements before submission, enhancing overall efficiency.

Signing the DR 0105 form

When it comes to signing the DR 0105 form, pdfFiller offers convenient electronic signature options. Users can easily validate their eSignature directly within the platform, making the process quick and compliant with Colorado's legal standards for electronic signatures.

The ease of signing digitally not only saves time but also ensures that your forms are submitted complete and on time.

Managing and storing your completed DR 0105 form

Once the DR 0105 form is completed, managing and storing it securely is crucial. pdfFiller allows users to save their forms directly to the cloud, providing a convenient and secure way to access documents from anywhere. By organizing forms effectively on pdfFiller, users can easily retrieve previous filings for future reference, ensuring they maintain an accurate record for tax compliance.

This proactive approach to form management ensures you remain prepared for future filings, mitigating risks associated with lost documentation.

Troubleshooting common issues with the DR 0105 form

Like any tax form, issues may arise while completing or filing the DR 0105. Frequently asked questions often revolve around filing status, eligibility for deductions, or clarity on certain sections. When encountering difficulties, utilize the Colorado Department of Revenue's support services for reliable assistance. Their website hosts a wealth of resources designed to aid taxpayers in navigating the complexities of state tax filings.

Being informed and proactive about potential issues can lead to smoother filing experiences and fewer headaches come tax season.

Importance of timely filing and staying compliant

Timely filing of the DR 0105 is critical to avoid late fees and penalties. Failing to file on time can lead to increased tax liabilities and complications with the Colorado Department of Revenue. It is advisable to set reminders well ahead of the due date. Utilizing digital calendars, reminders through pdfFiller, or even traditional methods like post-it notes can keep taxpayers conscientious and prepare them for filing season.

Implementing best practices in tax compliance goes beyond just filling forms; it cultivates a habit of financial accountability, minimizing future tax-related complications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the dr 0105 2025 colorado in Chrome?

Can I create an electronic signature for signing my dr 0105 2025 colorado in Gmail?

Can I edit dr 0105 2025 colorado on an iOS device?

What is dr 0105 2025 colorado?

Who is required to file dr 0105 2025 colorado?

How to fill out dr 0105 2025 colorado?

What is the purpose of dr 0105 2025 colorado?

What information must be reported on dr 0105 2025 colorado?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.