Get the free FORM No. 21

Get, Create, Make and Sign form no 21

How to edit form no 21 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form no 21

How to fill out form no 21

Who needs form no 21?

Form No 21 Form: Your Comprehensive How-to Guide

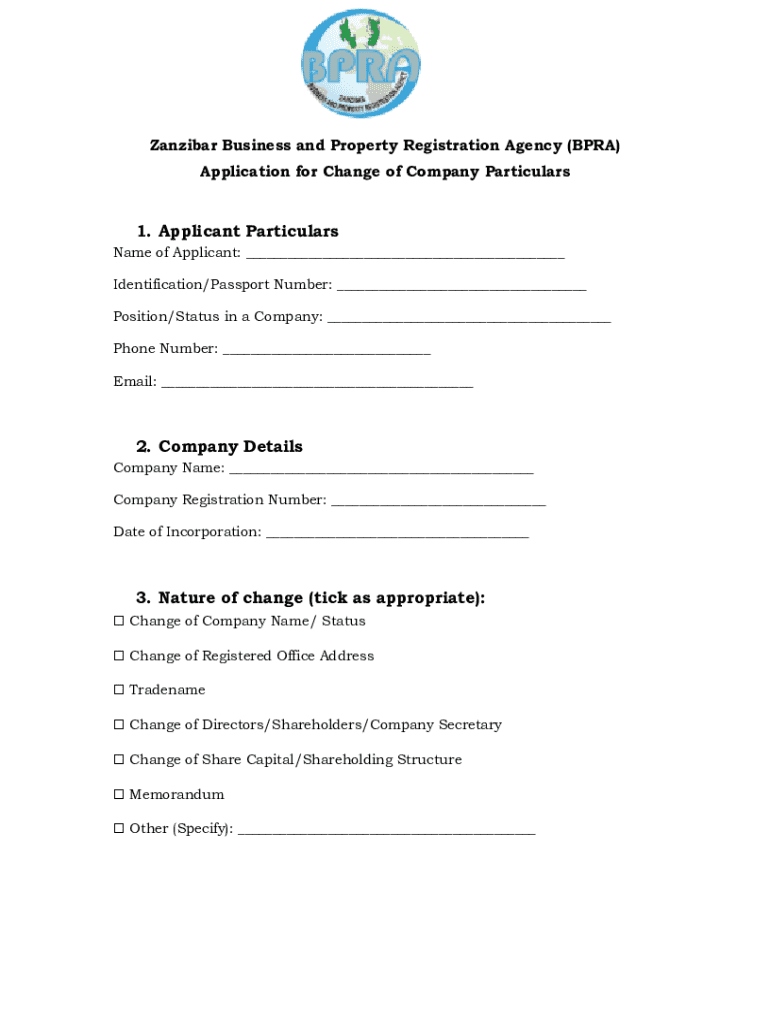

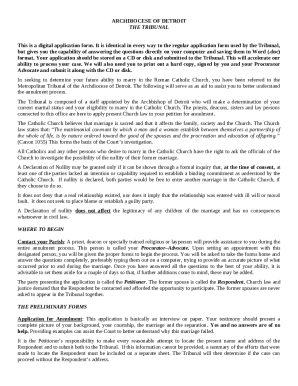

Overview of Form No 21

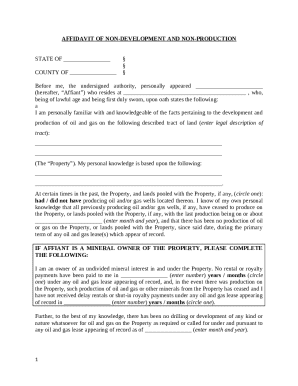

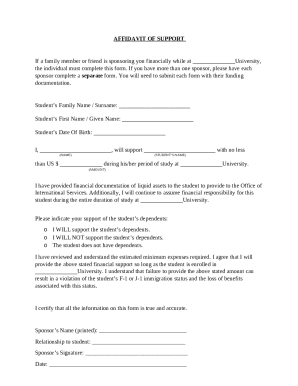

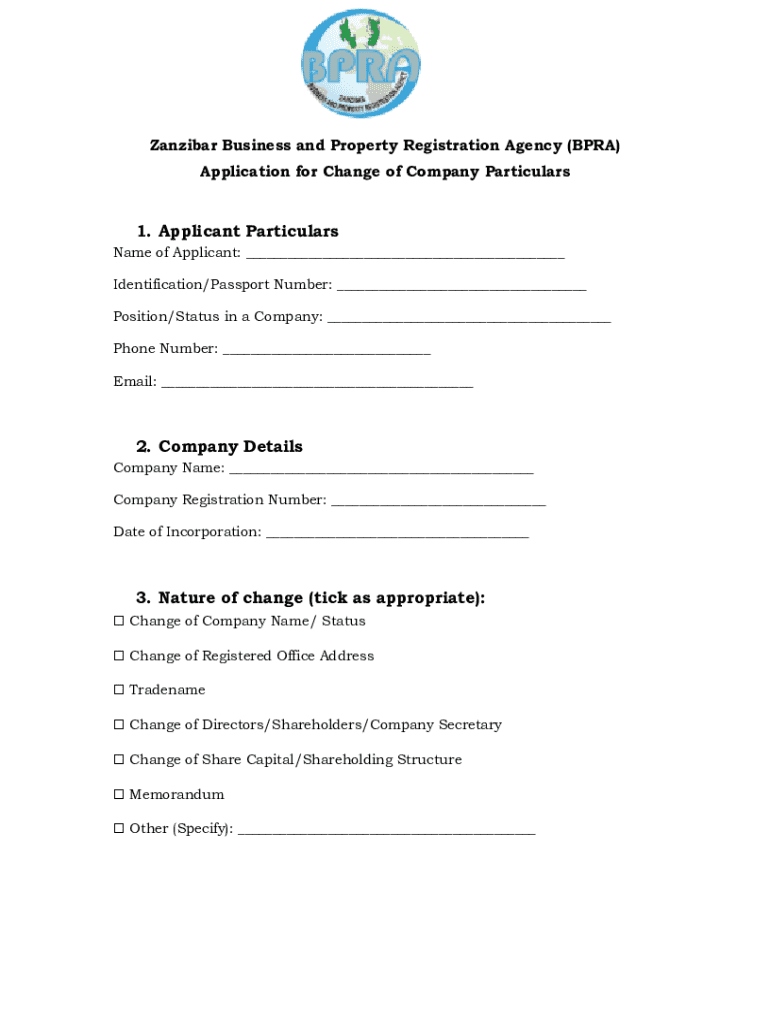

Form No 21 is a crucial document primarily used for reporting transactions and activities to the relevant authorities, such as the Department of Financial Institutions. This form serves various purposes, including compliance with state laws and fulfilling specific reporting requirements mandated by the statutes governing financial operations. Understanding the importance and function of Form No 21 is essential for anyone involved in financial transactions.

Common use cases for Form No 21 include reporting financial activities related to business or personal finances, ensuring transparency in transactions, and preventing fraudulent activity. Failing to complete this form accurately can lead to legal repercussions or unnecessary scrutiny from financial regulators. Hence, accurate and timely submission is paramount.

Preparing to fill out Form No 21

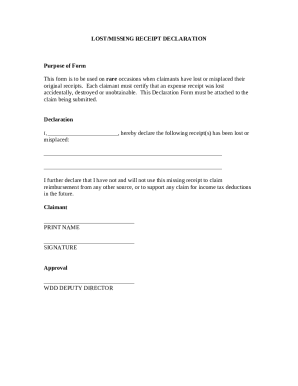

Before you start filling out Form No 21, it’s essential to understand the information required. This includes personal details such as your name, address, and identification numbers, as well as detailed financial information relevant to the transactions being reported. Knowing what supporting documents you'll need, such as proof of income or transaction receipts, can simplify the process significantly.

For effective organization, creating a checklist can be highly beneficial. This checklist should include all the personal and financial details you plan to input, along with the necessary supporting documents. Additionally, utilizing digital file management techniques can assist you in keeping everything orderly. Consider creating a dedicated folder on your computer or cloud storage system where you can save all your documents and relevant information pertaining to Form No 21.

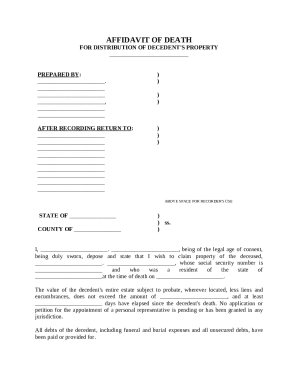

Step-by-step instructions for filling out Form No 21

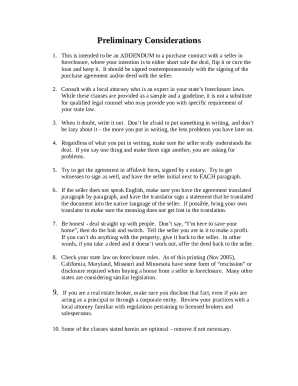

Filling out Form No 21 requires attention to detail. Begin with Section 1, where you will enter your applicant information. This typically includes your name, address, contact number, and any identification details relevant to your report. Ensure that this information is current and accurately reflects your personal data.

In Section 2, specify the purpose of your submission. Identifying the reason for filing, be it for audit purposes or monthly transaction reporting, is crucial. Section 3 requires you to delve into your financial details. Here, you will report your transactions, including amounts, dates, and types of transactions. Lastly, Section 4 involves a declaration and signature, affirming the accuracy of your submission.

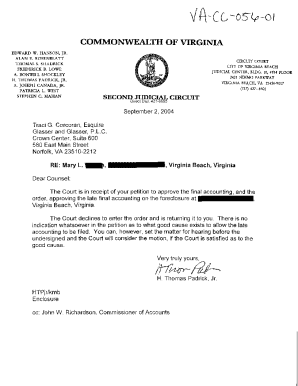

Editing and revising Form No 21

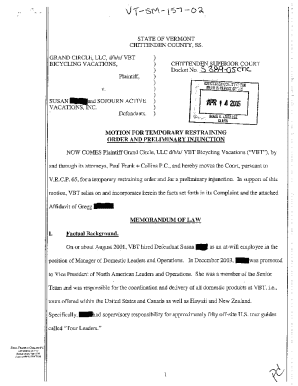

After your initial submission of Form No 21, it’s vital to be aware of common mistakes that could lead to rejections. Some frequent errors include incorrect personal details, omission of required financial information, or failing to sign the form. Should your form be rejected, promptly reaching out to the department for clarification on corrections may expedite the resubmission process.

Utilizing pdfFiller tools for editing PDFs allows you to make necessary revisions efficiently. You can add text, comments, or corrections directly on the form without needing to start from scratch, making the process straightforward and user-friendly. This capability is especially beneficial when you need to amend your initial submission quickly.

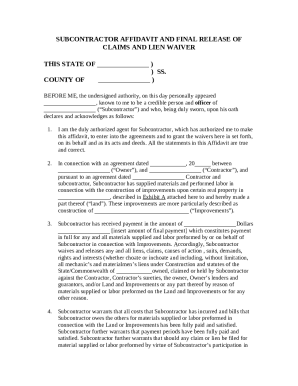

Signing and finalizing your Form No 21

Understanding the signature requirements of Form No 21 is essential. In many cases, you may need to provide an electronic signature. Fortunately, pdfFiller offers an easy way to sign documents digitally, ensuring that your form is legally binding while saving you time. As you finalize your form, consider conducting a thorough review of all sections to ensure accuracy before submission.

Following best practices involves double-checking all provided information for completeness and correctness. An initial review may reveal mistakes that need attention, thus preventing potential rejections. Engaging with the document editing features of pdfFiller can aid in ensuring all details are rigorously checked and accurately submitted.

Managing your completed Form No 21

Once Form No 21 is completed and submitted, it’s essential to focus on saving and storing your document securely. Cloud storage options, such as Google Drive or Dropbox, are excellent for ensuring that your form is easily accessible whenever needed. It's advisable to save your completed form in a clearly labeled folder that outlines what it contains, including the date of submission for reference.

If you need to share your completed form with relevant parties, pdfFiller offers an efficient email feature, allowing you to send documents directly from the platform. Additionally, collaboration tools facilitate team submissions, enabling multiple users to review or comment on the form before finalizing it. This can streamline the workflow and ensure everyone involved is informed.

FAQs about Form No 21

Understanding what to do if your Form No 21 is rejected can alleviate concerns. In such cases, contact the relevant department for guidance on rectifying the issues. Keeping track of your submission status is also vital; many departments provide online tracking or confirmation systems that allow you to verify your form’s processing status.

Moreover, staying informed about updates to Form No 21 is essential as regulations could change over time. Regular visits to the department's website or subsiding to newsletters can aid you in being aware of any modifications or enhanced reporting requirements, ensuring compliance with the law.

Additional features and resources on pdfFiller

pdfFiller not only simplifies the process of filling out Form No 21 but also offers a range of other forms and templates that can be leveraged for diverse needs. From tax-related documents to legal forms, pdfFiller empowers users to manage their documents effectively from a single, cloud-based platform. The ability to integrate with other tools such as Google Drive and Dropbox further enhances user experience and efficiency.

The benefits of using pdfFiller for document management include user-friendly editing tools, cloud access for documents, and versatile template options. This empowers individuals and teams to operate efficiently without the need for complex software, allowing for greater focus on their core tasks rather than administrative burdens.

Community engagement and support

Engaging with user help forums can provide additional insights into filling out and managing Form No 21. Participating in discussions may help you learn from the experiences of others, as well as offer tips that could expedite your submission process. Should you encounter technical issues, contacting support is swift and ensures you receive timely assistance to resolve any concerns.

Furthermore, providing feedback on Form No 21 contributes to ongoing improvements of the document, enabling authorities to respond to users' needs better. Your experiences and insights can be invaluable in creating an efficient process for all users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form no 21 in Chrome?

Can I create an eSignature for the form no 21 in Gmail?

Can I edit form no 21 on an Android device?

What is form no 21?

Who is required to file form no 21?

How to fill out form no 21?

What is the purpose of form no 21?

What information must be reported on form no 21?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.