Get the free 4 Alabama

Get, Create, Make and Sign 4 alabama

How to edit 4 alabama online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 4 alabama

How to fill out 4 alabama

Who needs 4 alabama?

A comprehensive guide to the 4 Alabama form

Understanding the 4 Alabama form

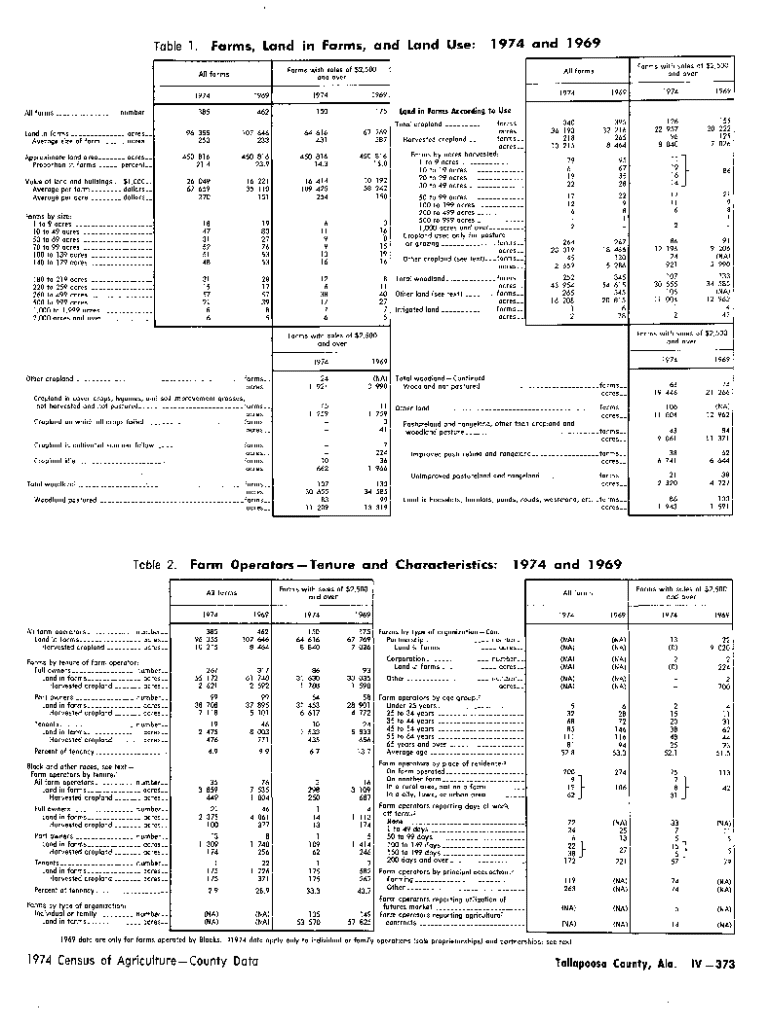

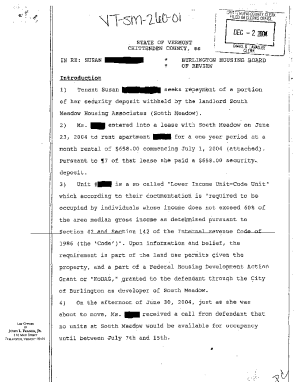

The 4 Alabama Form is a pivotal document within Alabama's administrative framework, serving essential functions in tax reporting and compliance for various entities. It primarily assists in the accurate reporting of financial information and ensures that individuals and businesses are adhering to state regulations. As one of the key forms required by the Alabama Department of Revenue, the 4 Alabama Form plays a crucial role in maintaining transparency and accountability in the financial activities of Alabama's residents and businesses.

This form is important not only for satisfying legal obligations but also for the seamless operation of various sectors within the state, including finance, real estate, and nonprofit organizations. It can be utilized for numerous purposes, from tax filings to permits, making it essential for both individuals and business entities.

Who needs the 4 Alabama form?

Understanding who requires the 4 Alabama Form is essential for effective compliance. Individuals such as tax filers and property owners in Alabama need to be informed about their responsibilities regarding this form. Tax filers must report their income accurately, while property owners may have additional requirements depending on their property valuations and taxes. Businesses, including LLCs, corporations, and nonprofits, also need to be aware of their obligations. For example, licensed professionals must ensure they are following state regulations in their practices.

For individuals, understanding the reporting requirements can help avoid potential tax violations and penalties. Likewise, for businesses, utilizing the 4 Alabama Form can aid in upholding a professional standard of compliance, leading to better operational practices and eventual growth.

Step-by-step guide to filling out the 4 Alabama form

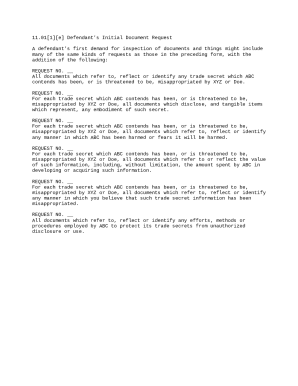

Filling out the 4 Alabama Form can be straightforward if you follow a well-structured process. Start by gathering the required documents and information to avoid wasting time. This includes your previous tax returns, identification information, and any relevant financial documents. Having a checklist can aid in ensuring that you do not miss any critical elements for a smooth filing process.

The form is typically divided into several sections, each requiring specific information. It’s crucial to understand what is needed in each section to avoid common mistakes that could delay processing. Carefully review the instructions provided with the form and ensure that all required personal and financial information is accurately reported.

Editing and reviewing your 4 Alabama form

Once you have filled out the 4 Alabama Form, it is vital to take the time to review your entries thoroughly. Common mistakes can lead to processing delays and potential issues with tax authorities. To avoid these pitfalls, check for missing information, typographical errors, and ensure that calculations are accurate.

Using tools like pdfFiller can enhance your review process by allowing you to edit directly on the document. Features such as annotation options, real-time collaboration, and easy-to-use interfaces make it simpler for teams to review collective entries effectively.

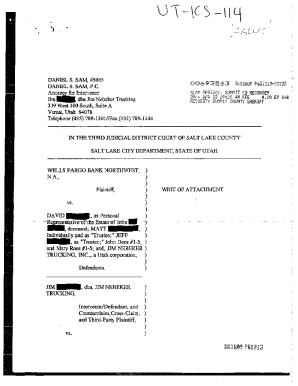

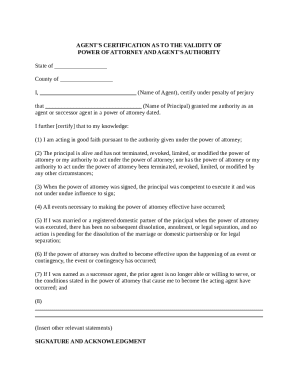

Signing the 4 Alabama form

Signing the 4 Alabama Form is a critical step in the submission process. Depending on your preference, you may opt for traditional signing methods or utilize electronic signatures, which are legally valid in Alabama. Understanding the advantages of each option plays a significant role in decision-making.

With platforms like pdfFiller, eSigning is a straightforward and secure process. You can easily sign the document directly online, even inviting additional signers if required. This flexibility facilitates efficient collaboration and quick turnaround times.

Submitting the 4 Alabama form

After signing, submitting the 4 Alabama Form is the next crucial step. You have multiple options available for submission, including online submissions through state websites or traditional mail-in options. It's imperative to be aware of applicable deadlines associated with each submission method to ensure compliance.

Once your submission has been sent, expect a confirmation from the relevant authorities. You should also familiarize yourself with how to track your form status, either through website checking or follow-ups with the Alabama Department of Revenue.

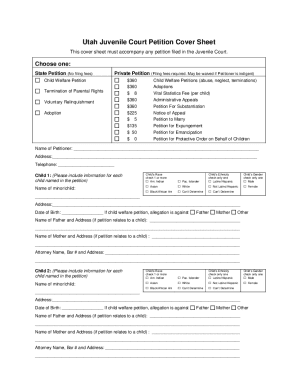

Managing your 4 Alabama form after submission

Post-submission, managing your 4 Alabama Form becomes vital for record-keeping. Properly storing a copy of your submission, whether digitally or physically, can save you time and headaches during future tax seasons or audits. Services like pdfFiller allow users to securely store documents and retrieve them easily for future reference.

In addition, if you find the need to amend your submission, understanding the process of filing an amendment is crucial. You should plan accordingly and use tools, such as pdfFiller, to facilitate quick edits and ensure that any necessary re-submissions comply with legal requirements.

FAQs about the 4 Alabama form

Frequently asked questions regarding the 4 Alabama Form often highlight concerns about navigating the filing process. Understanding common queries can demystify the experience of completing the form. For instance, questions range from filing deadlines to clarifications on what constitutes accurate reporting.

As you tackle your form, remember that resolving issues quickly will keep you in good standing with tax authorities. Having clear answers can help prevent errors and ensure you meet your legal obligations effectively.

Further support and resources

Accessing reliable support is vital when dealing with the 4 Alabama Form. Whether it's consulting a tax professional or reaching out to official government websites, having access to knowledgeable resources minimizes errors and ensures compliance with tax regulations. It's often beneficial to determine when to seek external assistance, especially for complex situations that require more than an online search.

Alabama's state resources, including their tax department hotline and online FAQs, offer essential guidance for residents and businesses alike. Familiarizing yourself with these resources can greatly enhance your understanding of your responsibilities and rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 4 alabama for eSignature?

Where do I find 4 alabama?

Can I create an eSignature for the 4 alabama in Gmail?

What is 4 alabama?

Who is required to file 4 alabama?

How to fill out 4 alabama?

What is the purpose of 4 alabama?

What information must be reported on 4 alabama?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.